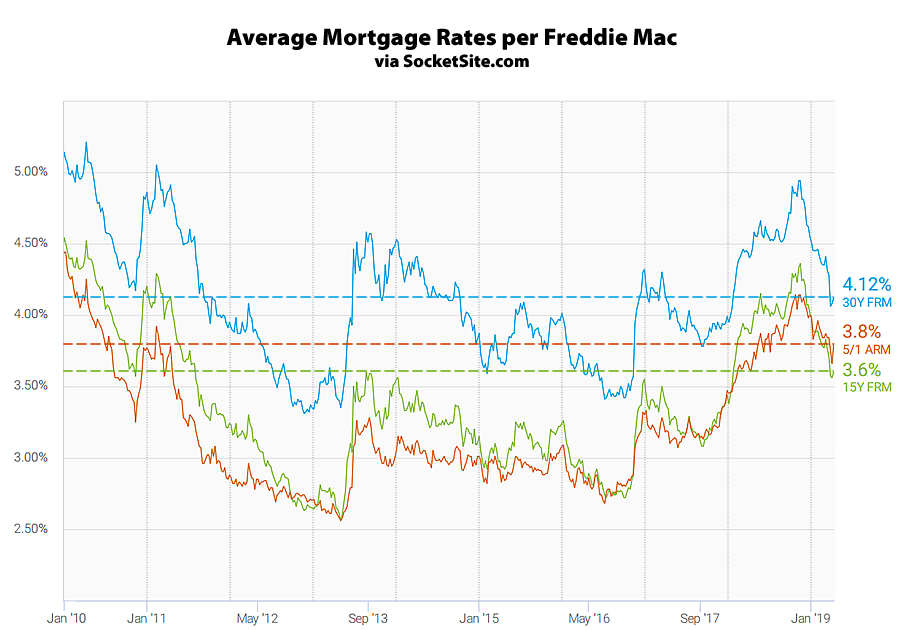

Having dropped 35 basis points in March, including the biggest one week drop in over a decade, the average rate for a 30-year mortgage has ticked up 6 basis points over the past two weeks to 4.12 percent but remains 30 basis points below its average rate at the same time last year (4.42 percent), according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has inched up 3 basis points over the past two weeks to 3.60 percent, which is 27 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable has inched up 5 basis points to 3.80 percent and is now 19 basis points above its mark at the same time last year and an inverted 20 basis points above the 15-year rate.

And while the probability of the Fed instituting another rate hike by the end of the year remains at zero, which shouldn’t catch any plugged-in readers by surprise, the odds of an easing are currently even (50/50), according to an analysis of the futures market.