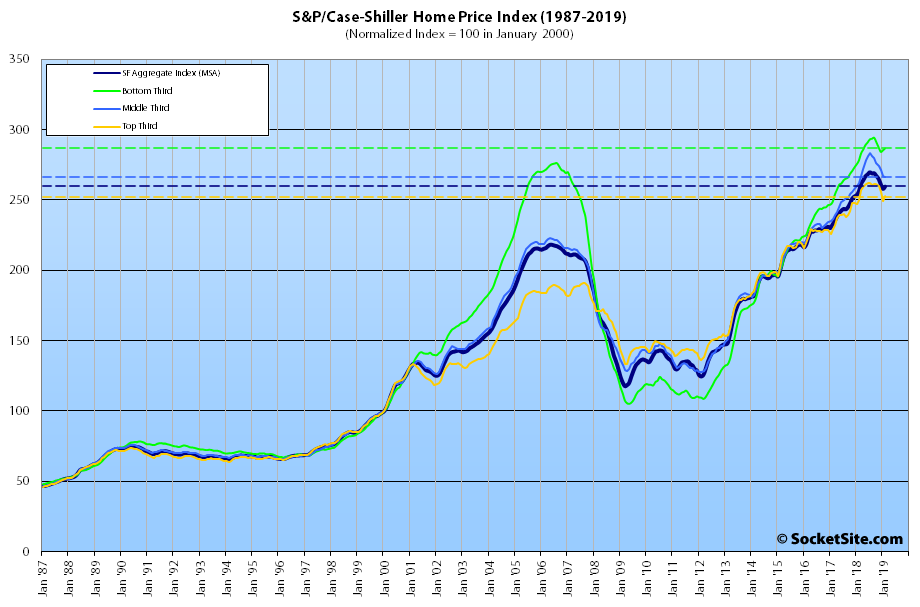

Having dropped 1.3 percent in January, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area (which includes the East Bay, North Bay and Peninsula) inched up 0.6 percent in February.

That being said, the index has still dropped 3.7 percent since the third quarter of 2018. And the year-over-year gain for the index dropped to 1.4 percent in February, representing the smallest year-over-year gain for the index since the second quarter of 2012.

While the index for the bottom third of the Bay Area market inched up 0.5 percent in February its year-over-year gain dropped to from 3.6 to 3.1 percent (versus a year-over-year gain of 11.8 percent at the same time last year). The index for the middle third of the market slipped 0.2 percent in February and its year-over-year gain dropped from 2.8 to 1.7 percent (versus a year-over-year gain of 10.9 percent at the same time last year). And with the index for the top third of the market having ticked up 1.4 percent in February, it avoided a year-over-year drop, eking out a 1.2 percent year-over-year gain (versus an 8.9 percent gain in February of 2018).

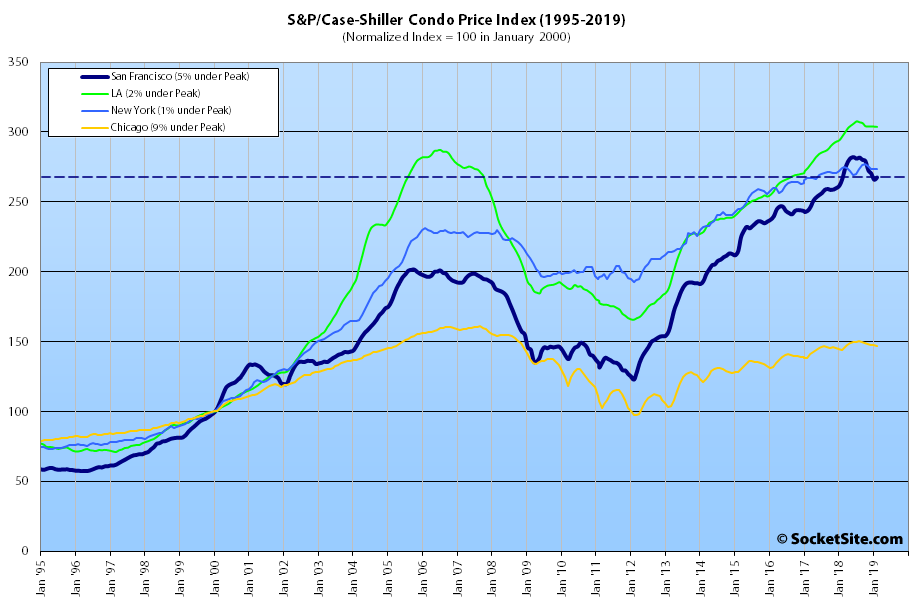

At the same time, while the index for Bay Area condo values has dropped 5.1 percent since the second quarter of last year, it inched up 0.6 percent in February and eked out a year-over-year gain of 0.3 percent.

And as we first noted in the third quarter of last year, Las Vegas is still leading the nation in terms of home price gains, up 9.7 percent on a year-over-year basis, versus a national average of 4.0 percent, followed by Phoenix (up 6.7 percent) and now Tampa (up 5.4 percent).

At 1.4 percent, San Francisco ranked second to last in terms of year-over-year gains across the county, trailed only by San Diego (up 1.1 percent).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

The long-term data in the charts is great for context!

We’d suggest paying particular attention to the periods in which the tiers aren’t moving in lockstep and the subsequent patterns that emerge.

So are you calling for SF to catch down to Chicago? Bay Area market top?