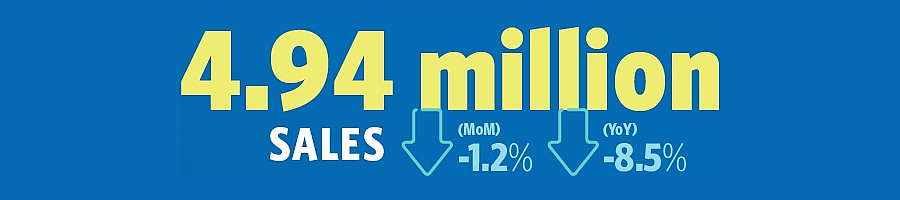

The seasonally adjusted pace of existing-home sales across the U.S. dropped another 1.2 percent last month to an annual rate of 4.94 million sales, which is 8.5 percent lower versus the same time last year, the third consecutive month-over-month decline and the slowest overall pace of sales since the third quarter of 2015, according to the National Association of Realtors.

At the same time, the inventory of existing homes on the market increased 3.9 percent to 1.59 million homes, which is 4.6 percent higher on a year-over-year basis (versus around 30 percent higher in San Francisco).

And out West, the pace of existing-home sales dropped 2.9 percent in January to an annual rate of 1.00 million sales, which was 13.8 percent lower versus the same time last year with a median sale price of $374,600, down 1.6 percent from December but 2.9 percent above its mark at the beginning of 2018.

You can almost hear the RE gang clutching their rosaries, praying for lower interest rates and a prompt end to quantitative tightening. However, the Fed has only managed a few meager rate raises and has made barely a dent in the MBS “assets” it has been trying to shed, so it will have very little “ammo” in the past-due cyclical downturn that keeps popping its head up above the horizon.

This portends that the next downturn will likely be more resistant to counter-cyclical monetary policy than in the past (precisely because it wasted all its counter-cyclical ammo in the boom).

Catch-22: I’m sure a sluggish or dissipating economy, exacerbated by the marginal room the Fed will have to operate due to its obsession with propping up RE and financial asset markets to infinity, will be hospitable to those same assets markets…

While I agree with the thrust of the above post, I have to object to the phrase “past-due cyclical downturn”. There is no due date for downturns, and similarly, economic expansions don’t die of old age. People have been expecting a cyclical downturn since 2015, if not before, and here we are.

Notice though the quote from your link: “While before World War Two it actually was true that the longer expansions lasted the more likely they were to end, the same is not true of postwar expansions, Rudebusch found. One reason, he said, could be that postwar recoveries are driven less by the production of goods than by the production of services; in addition, he wrote, the federal government including the Fed is now more focused on stabilizing the economy than it had been before the war.”

The graph from the source study shows a dramatic difference.

As he implies it’s possible that expansions used to die of old age, but something changed in the economy and the no longer do. Or it’s possible that expansions would still naturally die of old age, but increased government intervention in the economy has resulted in expansion/recessions more driven by fiscal and monetary policy and less by natural causes.