Having dropped an upwardly revised 2.4 percent in June, the seasonally adjusted pace of new single-family home sales in the U.S. slipped another 1.7 percent in July to an annual pace of 627,000 sales, which is 3.8 percent below the long-term average for this time of the year but is 12.8 percent higher versus the same time last year.

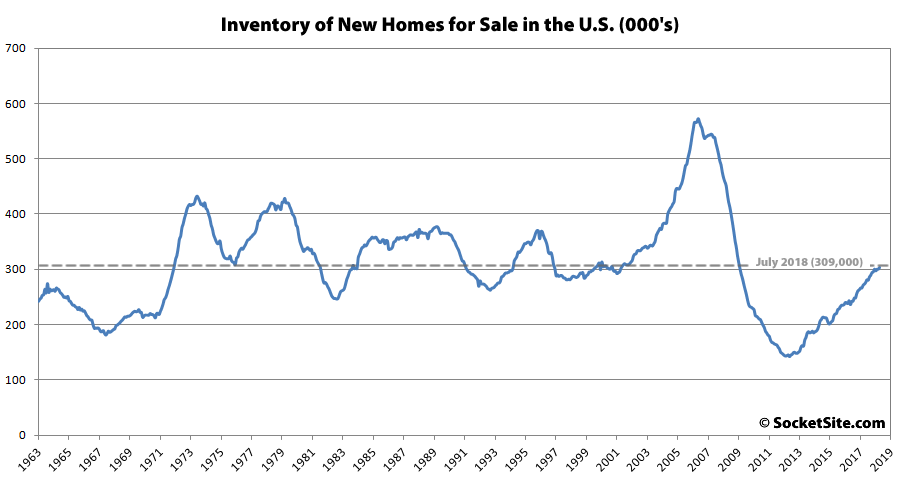

At the same time, the number of new single-family homes for sale across the county ticked up from 303,000 to 309,000, which is a new nine-year high and 12 percent higher, year-over-year.

And having inched up an upwardly revised 3.3 percent in June, the annual pace of new single-family home sales in the West jumped 10.9 percent in July to 173,000 transactions and is now running 18.5 percent above its pace at the same time last year with a sharp 52.3 percent drop in the Northeast dragging the nationwide pace of sales down.

In local news, why sell when you are locked in very low rates in an area with great jobs and after gaining 20-30% the last few years. People have the $1m tax level. Massive amounts of condos getting built and starter houses are getting flipped to even higher priced houses.

Speaking of local, Bay Area Home Sales [have dropped] to a 4-Year Low while the Inventory of Homes for Sale in SF has ticked up and the average price per square foot of the homes in contract has actually dropped.

“Massive amounts of condos getting built”

Top of the market, sales slowing, massive inventory coming online…

Being underwater is only fun if you’re SCUBA diving!

Where are these massive amounts of condos you mention? In San Francisco?

Looking at those graphs, the headline may be “true” but neither the sales rate nor the inventory looks to be way off the historic levels. I am curious how the Trump tax cuts are going to affect things as for Californians they are really tax increases.

Indeed, why sell? You have to leave the area if you do. If you stay you’re just buying another property at the same or higher price, paying large transaction costs, resetting your assessment, and if you need financing, raising your rate by a point or more.

Because the smart people are leaving the area, since the quality of life has dropped off sharply and there appears to be no political will to fix the issues. They can cash out now and live like kings in less expensive places with better quality of life, even if they take a huge pay cut.

But you are correct, a survey found 50% of people will not sell their home just because they want to keep their low rate. I think we are soon running out of willing and able buyers at these prices however. There’s enough tech funny money sloshing around SF, but in many other places they’ll have to either loosen lending or lower prices.

Looking at 50+ years of home and sales inventory, one should be reminded that the US population was 189 million in 1963 and 325 million in 2017…