Purchased for $925,000 in September of 2013, 338 Spear Street #26G, a 807-square-foot, one-bedroom “with a coveted floor plan” at the Infinity resold for $1,175,000 in June of 2015, which was $20,000 under asking and roughly $1,481 per square foot.

The 2015-era sale represented total appreciation of 27 percent, or roughly 14 percent per year, for the unit on an apples-to-apples basis from 2013 to 2015, back when short-term holds and flips were somehow still paying off.

And today, 338 Spear Street #26G is back on the market and priced at $1,099,000, a sale at which certainly wouldn’t be cheap at $1,362 per foot, but it would be 6.5 percent cheaper on an apples-to-apples basis compared to mid-2015.

If you think you know the market for condos in San Francisco, now’s the time to tell.

Why do you keep posting 2015 and 2016 deals. Why don’t you show any of these purchased in 2008-14? Your agenda is getting tiring. I enjoy the pictures and data but it gets old when you hold your agenda a bit one sided. I enjoy your site and have followed since the beginning.

I think their point is that the market has peaked an is now slowly trending lower. Socketsite’s only agenda appears to be informing of trends in the marketplace. Do you want them to post about how much the market has grown since 2000? 1990?

Trending lower? The last couple Case Shiller posts indicate slightly climbing prices.

Thevis is totally on point. Both my units went up substantially this year.

That’s terrific. What neighborhood(s), price point(s) and metric(s) are you using? And based on that knowledge, what’s your expectation for where this unit will actually sell? Up 5, 10, 20 or another 27 percent versus 2015?

I appreciate any apples to apples comparisons. You have an entire industry on the other side controlling the narrative in a way that is skewed hugely the other way. I have been told crazy stuff by realtors over the years.

Whenever there is a negative apples to apples, the refrain is always: the previous buyer overpaid, don’t like the space, marginal neighborhood, there is something wrong with the place, socketsite is cherry-picking. I know there are still short-term positive appreciation apples-to-apples and would want to hear about those too.

Is there any way to guesstimate the total dollars spent in SF on renovations during a time period? I never understood looking at non apples to apples price appreciation without taking this into account.

“Purchased for $925,000 in September of 2013” This was an 2008-14 purchase. And no 2018 resale yet so call off the agenda cops.

I’ll try to say this again, and be deleted, but the headline reference is indeed to the 2015 trade price.

Do you think this will sell for less than $925K, the value in 2013?

And yet we provided the necessary data, and set the stage, for three apples-to-apples comparisons: 2013-2015, 2015-2018 and…2013-2018!

And in fact, by doing so, we can divine the components of the market’s change from 2013 to 2018 versus a smoothed (over) line which is likely to obfuscate the actual trends at hand.

I guess that plan isn’t all that coveted after all.

Big building box condos….yes peaked. Supply greater than demand. SFH < about $2 million and still much demand and appreciating still. Supply less than demand.

[Editor’s Note: With respect to supply (and demand), Key Trends of Homes for Sale in San Francisco Hold.]

Sales of single-family homes under $2 million have accounted for roughly 25 percent of the market in San Francisco over the past year versus condos which have accounted for 55 percent of all sales. And the market for condos tends to be a leading, versus lagging, indicator. Which brings us back to the topic at hand…

Big box condos — supply greater than demand leading towards downwards pressure on pricing. Assume other condos relative fall. What’s the argument against building more supply, regardless of premium tier units vs affordable, in order to drop prices?

That’s kind of what I’m seeing too. And seemingly very strong demand for $1.2M and lower.

Interestingly I just looked at 3M and up sales 4/1/18 – 8/31/18. There were 120 sales averaging $1260 per square foot.

4/1/17 through 8/31/17 showed 108 sales averaging $1197 per square foot.

So it appears that that sector, single family homes mind, is also up from the “selling season” and onward, YoY.

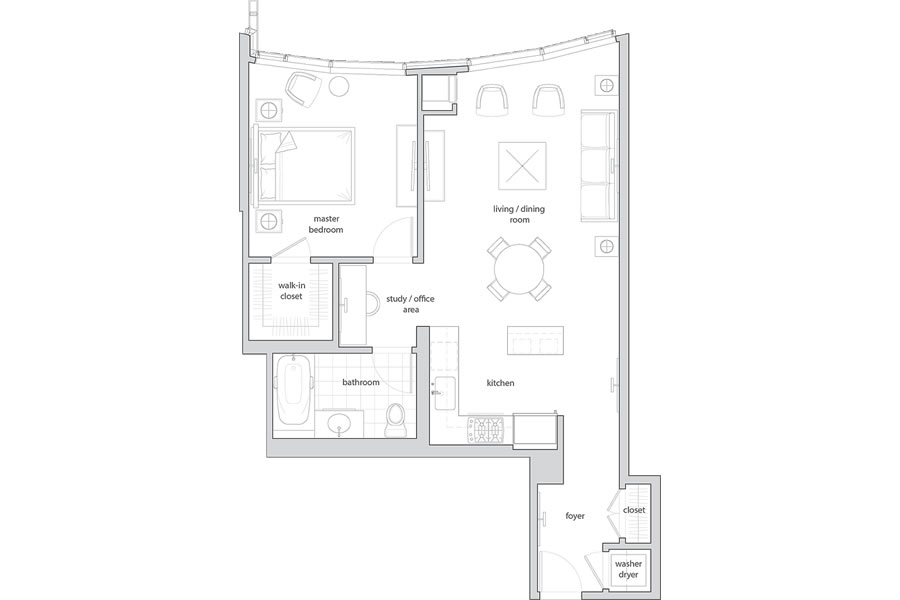

I’m guessing the floorplan is “coveted” by people in other units because it doesn’t have a giant structural column in the middle of the living space

The “G” plan is one of the best in the building. Room for both a full dining room table (rectangle works better) and living area, good sized master closet and bath and the office alcove is functional.

it doesn’t even have a balcony which other units seem to have, so it’s a real tough case to say it’s coveted.

It’s very windy in that area. An unprotected balcony is rarely useful other than for the occasional gawking.

I hate windy balconies on high floors.

At its last sale, after tax mortgage+property tax+hoa was $3485/mo when property taxes were deductible and mortgage rates were lower. That was about $350/mo under the fair market rent. If you assume you’ll need to spend $30K every ten years on updates to the kitchen, bath, floors, and paint, that sort of hits the rental price very closely, still just a bit under. Selling fees were probably expected to be paid for with appreciation. Current owner paid cash, so this analysis is not for her, but her competition would have done this analysis, and that’s what constrained the last sale price to an under-asking offer.

At its last sold price, with today’s interest rates, after tax mortgage+property tax+hoa is $4400, about $500 over the fair market rent. Therefore, the price would have to be lower. At asking, monthly after tax costs are $4175, still above the fair market rental value and no update budget.

At $1M, you’re right at the fair market rent, with no update budget, which it will probably need in the next 5 years. You’ll also be stuck holding the bag when interest rates rise further. Are buyers this rational? Probably not, but it’s not a particularly smart buy @ $1M.

As a rental, costs would exceed the fair market rent at a $1M price. So no investor will buy it.

So I’ll stick my neck out and guess 1.050, in spite of Case-Shiller telling me everything is up, up, up. That would be $125K loss plus another $75K in selling fees, transfer taxes, etc. $200K over 3 years will mean the owner paid the equivalent of $5,000 a month over renting. Because the owner paid in cash, the sale will happen at whatever the market price is, as the owner will not have to bring cash to the closing. Should be interesting to see.

The thing to do in this area is to hold if at all possible. Rent at a bit of a loss for a few years if you can stomach it, depreciate your asset, etc. Everybody has different situations, of course. But the area in question is going to in-fill with more and more amenities, near term.

The area will also fill with more supply as well. There are several rental only buildings on folsom st. that plan to go condo at some point. Prices are going to be depressed for a while until all that capacity shakes out.

Hmmmmm. Buy at the top of the market, lose money on rent for years. Pay more money to update your outdated unit to compete with brand new supply. Pay out to a realtor to stage and sell. Probably sell out at a loss. Depreciate your bank account, more like.

Maybe San Francisco real estate will turn out to be a bad long term investment. Or maybe not. Historically it’s been very, very good.

Depends when you got in or out. It’s a cyclical market. Not a buy and hold one. Certainly not at these cap rates.

San Francisco is not a buy and hold market? It has been for the last 160 years, but maybe you’re right.

I know I’m not selling.

One phrase: San Andreas Fault

It was already bought. So I only gave an opinion to hold as opposed to taking a certain loss. You’re mixing around a prospective buyer. You’re inserting a hypothetical remodel. You’re inserting then again a future sale in a near term market sans appreciation, when everyone knows this neighborhood is changing. Then you’re using one of the words I used, “depreciation,” a tax term, in order to insert some sort of snarky unearned coda.

in contract.

Sure, because everybody gets a new kitchen every ten years.

I’m thinking of renovating my forty-year-old kitchen, but ten years? Really? Sure, some people with more dollars than sense may choose to do that, but it’s not as if it’s a market requirement or that a slightly dated kitchen makes a unit unrentable or unsaleable.

You’re also failing to consider the many intangible benefits of ownership. Your analysis holds more water if you’re looking at buying strictly as a financial investment, but few SF properties make sense from that perspective, at least compared with alternatives elsewhere.

Have you seen all those empty condos? Those are all investments.

This is such deja vu. In 2007, we started hearing about the glorious ‘intangible benefits’ of home ownership. “You can paint the walls in any color you want!”

Hmmmmm. Keep my $200 thousand dollars, or paint the walls. Let me think about which one I’d rather have…

OK, I decided. I’ll take the $200,000.

According to this (https://socketsite.com/archives/2018/08/bay-area-home-sales-slow-to-a-7-year-seasonal-low.html) chart, median prices in 2007 were around $800K, median prices today are around $1.3M.

Are you positive you’d be better off keeping your money?

Suppose that Tipster had put his money into a super cheap, real-world mutual fund that invested in the S&P 500. According to this chart, such a fund at the end of August in 2007 was $136.16 per share. The closing price on Friday was $268.75, for a whopping 97% gross gain. And that’s not accounting for dividend reinvestment.

Are you positive Tipster would have been better off buying a median-priced bay area home?

Doubling one’s money in 11 years is pretty good!

Now let’s say Tipster put $200K into an $800K home in 2007. Tipster then sold that home today for $1.3M. Tipster’s $200K is now $700K, even if Tipster paid only interest on the $600K that was borrowed and did not pay any principal. Yes, there are some fees involved. But they’re not that large.

Are you positive that Tipster would have been better off buying a mutual fund?

We can make these numbers more concrete. Let’s use the Vanguard Total US Stock Market ETF.

Over the past 10 years, NAV Total Return is 183.5%, assuming dividend reinvestment. So Tipster would have nearly tripled their investment by parking it for 10 years.

Are you assuming Tipster was living for free in a van down by the river during this time period?

Houses are more than JUST investments.

I bought in 2007. Got to paint the walls and pocket 235k when I sold. If I had waited, I wouldn’t have been able to qualify for the loan.