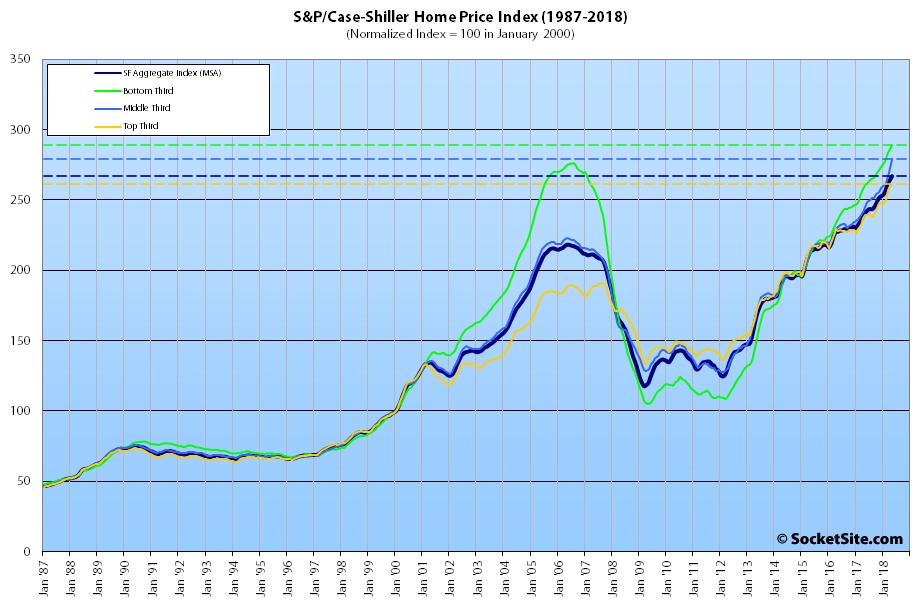

Having ticked up a percent in April, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked up another 1.1 percent in May to a new record high and is now running 10.9 percent higher versus the same time last year with uneven gains across the overall market.

While the index for the bottom third of the Bay Area market ticked up 1.1 percent and is now running 10.8 percent higher versus the same time last year, the index for the middle third of the market jumped 2.4 percent and is running 13.9 percent higher, year-over-year. The index for the top third of the market inched up 0.7 percent for a total gain of 9.3 percent over the past year.

As such, the index for the top third of the market is now 36.6 percent above its previous peak, which was reached in third quarter of 2007, the middle tier is running 25.2 percent above its previous peak set in the second quarter of 2006, and the index for the bottom third of the market, which had dropped over 60 percent from 2006 to 2012, is now 4.7 percent above its previous record high.

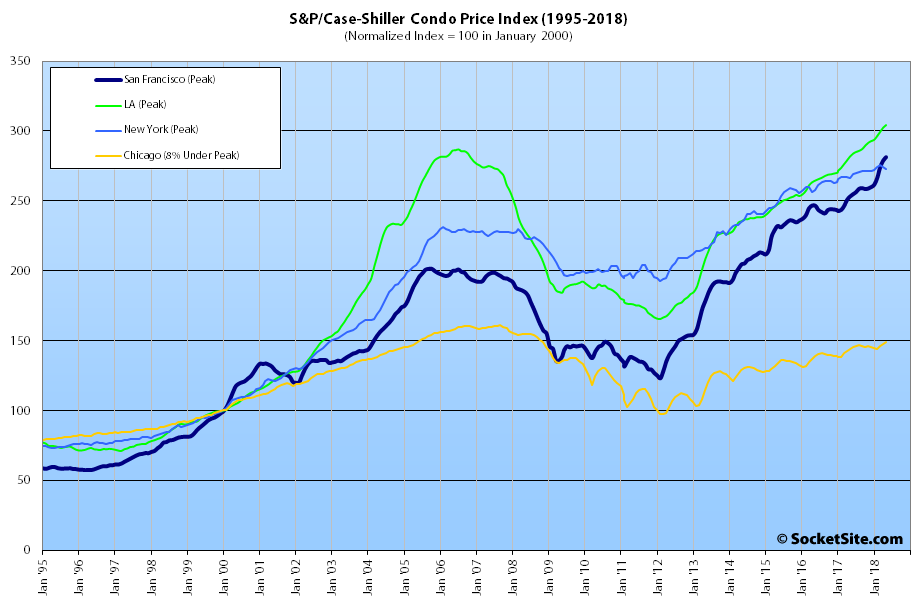

And having inched up 0.9 percent in May, the index for Bay Area condo values is now running 11.1 percent higher on a year-over-year basis and 39.5 percent above its previous cycle peak in the fourth quarter of 2005.

For context, across the 20 major cities tracked by the home price index, Seattle, Las Vegas and San Francisco recorded the highest year-over-year gains in March, up 13.6 percent, 12.6 percent and 10.9 percent respectively versus a national average of 6.4 percent.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

All time high. Ho hum.

I recently had the good fortune to buy a $1.5m SFH on the peninsula that we were renting. We got a great rate, borrowed heavily from family for the down, and now don’t worry about getting kicked out and relocating our kids. I have thought of this curve many times over the last 12 years, and I’m pretty sure a correction or flattening is near. Yet if I had to buy my home again right now, I would, because we need stability.

So I could imagine a return to the 200 level (y axis) of the curve. But lower than that? Not for more than a few months, and not as long as the regional professional job market is as it is right now. Will be interesting if rent control changes investor behavior and leads to a marginally higher level of supply (that’s about the only good outcome I could imagine from rent control)

With all these expensive rental condos eventually the tenants grow up and either move away or look for SFH. They are building tons of small aware footage condos which are bringing in high earning future bidders to bid up the stagnant supply as the bidder supply continually grows. Though most of my SFH neighborhood is handed down from grandma and rarely hits the market. Interest rates up, tax deductions down yet home prices are still getting overdid in nice starter neighborhoods.

back in spring of 2009, Socketsite posters were so loud, so insistent that the market was headed lower. Anyone who suggested otherwise was treated like a guy wearing a maga hat at a Bernie rally.

And considering the market in San Francisco proper didn’t bottom until late 2011, early 2012…

They were also loudly insistent that the market would go lower in 2011 and 2012.

Some were, others weren’t. And now back to the market at hand…

Wait for Uber, Lyft, Airbnb and Pinterest IPOs. Then prices will get really crazy!

With IPO’s now, only the first 20 to 50 employees will really make big money, unless it’s a Google sized IPO (which is nowhere in sight for any company extant today). Look up “liquidity preferences” and “ratchets”. There will be a proportionately far, far smaller number of new millionaires compared to FB and Google with all of the above IPOs.

Does it need to be millions though? That’s the first thing I’d say. Secondly, when it come to more mature companies such as Uber, Lyft, Airbnb and Pinterest I’d think that there will have been a great many rank and file employees who have accrued more and more shares over a not inappreciable amount of time.

No, 100 or 200k can help a lot. But aside from ‘exit money’, I think there’s just as many, if not more (I’d guess many more), children of upper middle class parents who can get six figure checks from parents. We’re in that category. We are just lucky, and it’s a shame that that’s what it takes. I think about it all the time. So I’m contending that tech IPO’s are overrated. Not overrated: 2 income couples who have no exits, but earn 250, 350, 400k+, possibly with parental help, who can play in bidding wars.

I agree. But I’d also say that they are not mutually exclusive either. The children of upper middle class parents not only have the banks of mom and dad, but they also have the chance to make an options windfall. And because SF RE is predicated upon the small margin of actual trades, these things can have legs for several quarters.

It’s all about selling out early to the greater fool. At least the losses won’t be systemic as with mortgages. They’ll call it “The Great Disappointment”.