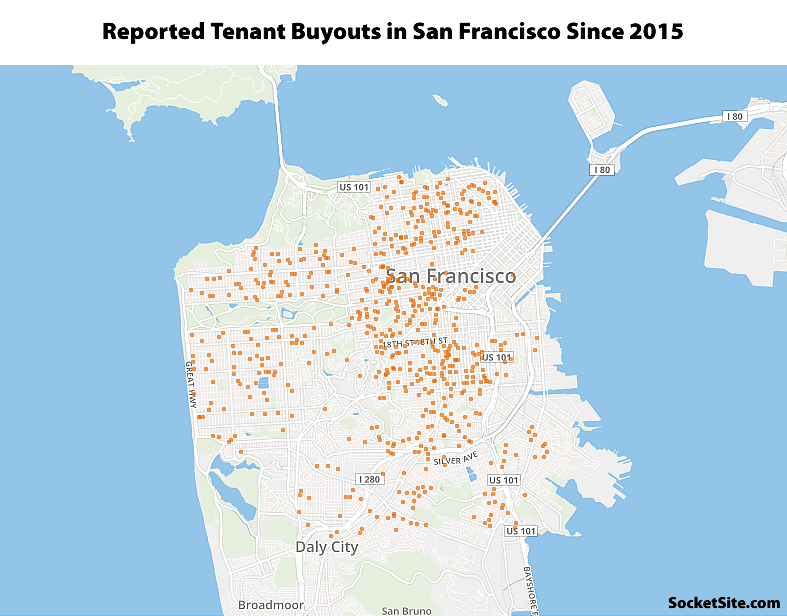

Since March of 2015, when San Francisco started regulating “buyout agreements” between landlords and their tenants, a total of 772 buyout agreements have been inked and reported, as mapped above.

While the highest reported buyout totaled $310,000 for three tenants in the Mission back in July of 2015, the highest reported buyout for a single tenant was $250,000 for a unit on 21st Avenue in the Lake District last year.

And while the total number of reported buyouts has dropped from 319 in 2016 to 258 in 2017, as of November this year, the average buyout amount has increased from $36,839 per building in 2016 to $42,806 in 2017; or on a per tenant basis, from $22,698 in 2015, to $23,504 last year and $27,495 in 2017 to date.

The smallest reported buyouts per year were for $1,750 in the Excelsior in 2015; $500 in Potrero Hill last year; and $1,000 in the Inner Richmond in 2017.

The maximum buyout offer voluntarily reported to the San Francisco Tenants Union from 2008 to mid-2014, prior to San Francisco regulating said buyout agreements and requiring the disclosure of all offers, was $80,000 with an average offer of $20,823.

Just wondering – though 772 units effectively taken out of rent control in the last 3 years is a small number and I assume the prior numbers were similar, the proportion of rent controlled units is shrinking in SF. Especially when one adds in the new construction rentals of the past 20 or so years. I assume the largest share of rental units is under rent control but as this number wanes one wonders what the future holds for rent control in SF. Will there be a new push for blanket rent control as more and more renters in SF pay ridiculous amounts for less than impressive housing – starting with a repeal of Costa?

I realize these units are still under rent control but vacancy decontrol allows the landlord to ask market rate or whatever they can get. Effectively their new baseline is a figure many SF residents could not afford. Plus, there will be far more turnover on rent controlled units whose baseline is 2017 as opposed to units tenants have been in for decades.

This seems like a natural progression to me unless they make it illegal to demo rent control units, or make it so new construction has to have rent control units folded into the mark rate units as well.

Seems like the local rent control types have given up on indirect subsidy aka housing still partially subject to market forces, because the pressure is just too strong, and have turned their attention to direct subsidy aka government mandated “affordable housing”? Personally I am surprised that any working and middle class people are still choosing “fight” over “flight” when it comes to living in San Francisco, the cost has gotten so far beyond ridiculous.

Trouble is affordable housing is not that affordable for many working individuals and the number of units built is so low it is not a practical solution. I’d rather see the money spent on building the affordable units put into a rent subsidy fund. Then the truly needy in this regard would have a better shot at getting help. And there would not be the abuse of the system – rent subsidy would be based on income. As it is high paid individuals are in rent controlled units which more rightly should be allocated to the truly in need. Plus the small abuse of rent control would be eliminated. Those who have been in the units for years and years and no longer live here but in a cheaper area but keep the rent controlled unit. I know of several such.

No easy answers to creating subsidized housing options in SF. That said, the current affordable housing regime is too small and too nascent to really judge its effectiveness. The rent control regime on the other hand we can judge. It has done its job to help residents who want to build a life in the city but can’t keep pace with market rents do that. Of course there is abuse and market distorting effects. Means testing would be great, but there’s no political will for it. I know a couple that pays $2k a month for a two bed room two bath in inner sunset. Their combined income is close to 500k a year. The good news is such extreme examples are usually temporary. At some point soon, the couple will decide they have outgrown the subsidized housing and move up.

Subsidized housing is important to the self-interest of even wealthier residents who can afford market rents. The fact of the matter is all aspects of cost of living are rising in SF in part because domestic workers, restaurant workers, nannies, day care workers, you name it, can’t afford to live here and would have to earn a lot more to justify a 1 hour or 1.5 hour commute each way from outside the city.

It would be interesting to know how common that kind of situation is. I also know a very high income couple paying under $2k/month. I wonder if they will ever leave.

Subsidized housing is important even to the self-interest of even national or international employers, who don’t want to pay employees the salaries that are necessary for those employees to in turn pay market rates for housing in the Bay Area. One law firm headquartered in Houston bought a private jet to ferry their Texas-based attorneys to visit clients in the Bay Area rather than hiring local lawyers or relocating the Texas lawyers with business in Silicon Valley to this area.

Very common. I know a couple living in a Russian Hill 1BR, I’m guessing they make $300-500k annually combined, still milking rent control from the late 90s even now that they have a child.

Subsidizing rents is a big fat waste of money. Why should taxpayers give someone an extra $500/mo to make SF affordable for them, when that person could just move to Emeryville and save the $500, and possible even have a shorter commute. Living in SF city limits is not a basic human right sorry. Pandering for votes is the only reason I can think of. Instead of providing a social safety net to the truly down and out we keep wasting money on frivolous handouts in exchange for votes.

That’s really the question. I suspect it is common, but I don’t really know. Is there any real data?

@SFRealist Two people I work with are in rent controlled units and have been for a decade or more. Each makes around 180K. Each has purchased investment real estate instead of buying a home because it works out tax-wise better for them. Once the new tax bill passes rental property will be even more tax-advantaged than owner occupied units. I don’t know how common it is but I think it is more than rare.

@Dave I agree. I would be interested in real statistical data, though. Who knows if our experiences are typical?

However often it happens it’s too much. It’s pure abuse/misuse of rent control to “help” moderate income people. Plus I bet it’s happening a lot. i.e. basically any tech person who rented in SF before 2014 is now getting a sweet deal. I’d venture to say that most people renting RC units are under market rent, unless they started renting after 2014. Totally broken system, and the desire of some in state legislature to overturn costa-Hawkins just shows how twisted these politicians are to score political favor. If that measure comes to the ballot in 2018 or 2020, it needs to be aggressively fought. It would also open the floodgates to introduce vacancy control, and you know this city is foolish enough to do that.

i know 3 couples renting in SF under rent control who own lake houses in Tahoe.

i rented a large 2bdr 2ba in pac heights for under $2K for 10+ years making 200K at beginning and nearly 300K at end of that. we decided to buy in 2012 when market hit bottom.

i dont know of stats, but my guess is at least 25% of rent control households make over $150K and at least 10% over 250K

“my guess is at least 25% of rent control households make over $150K and at least 10% over 250K”

That is an utterly absurd “guess”.

I worked with a hedge fund guy who made over $100 million a year who lived in Marin, but paid less than 10% in income taxes due to clever use of foreign “domiciles” for his business and residence. All these purported people saving relatively insignificant sums by taking advantage of rent control laws are amateurs. Rent control isn’t going anywhere, and made up “guesses” and anecdotes aren’t going to change that. All these poor SF landlords, with their extremely high property appreciation, just got yet another huge gift in the republican tax package. No sympathy here.

“All these poor SF landlords, with their extremely high property appreciation, just got yet another huge gift in the republican tax package”

How so?

“All these poor SF landlords, with their extremely high property appreciation, just got yet another huge gift in the republican tax package”

That’s crazy. SF is going to get clobbered by the tax package.

The rental market seem to be distorted in many ways. New construction is massively expensive in San Francisco, typical of infill construction or on reclaimed land. It will be difficult to build, say, a two bedroom apartment for less than a monthly rate of 4 – 5k, including capital cost. If we want anything less than that it has to be subsidized. While rent control has the safety valve of getting back to market level when tenants move on I am not sure if developers would trust this. We’d probably need a better mechanism to determine the annual raise. Less than consumer inflation dis-incentivizes new rental construction. Inflation + GDP growth would be something some developers might be willing to take.

New construction is not rent controlled. Problem solved!

just wait til ’18 and the voter revolt vs Costa Hawkins

It’ll fail at the vote. 1- homeownership in CA is > 60%. 2- homeowners will turn out in droves to vote against this crap. Tenants (outside of activist) not so much. It’ll really screw up future homeownership in CA if it does pass, as there will be even less incentive to build new housing w/o costa Hawkins. Really. Going. Backwards.

@SFrentier Home ownership is at 54% in California and falling. It peaked at 60% in 2006. I’d guess a measure to repeal Hawkins-Costa would fail, but this is California and one never knows. The potential for a change is another unknown/risk to owning investment property in California and especially SF. With my Northwest rentals this is not an issue and the strong adversarial tenant/landlord relationship one has in SF is not something one has to deal with there.

Yes, homeownership is around 50% and falling. And with the new tax give-away, that is sure to accelerate the decline.

Maybe its just the Chron, but media seem to luv the ‘massive rent hike’ story ark, so that while current homeowners may feel steady in place (Prop 13), if they think of moving, it looks less and less possible (with skyrocketing prices). The only alt is renting something; so that increased sensitivity, if not compassion, could translate into votes.

And even if a ballot prop fails, the Dem legislature is going to feel increased pressure to cave on Costa Hawkins (or aspects of it at least, along with Ellis “reform”; could see changes like “all bldgs built before 201X”, instead of “1995”, in an effort to ‘control’ more units but still keep the illusion that new construction will be unaffected – thus ‘incentiving’ production).

Folderpete- I agree with your sentiments, and yes there is risk to costa Hawkins. But it’s getting mitigated given that rents have been dropping the last year, and the housing market has stabilized price wise. Even the media started reporting on that, so the hype of the crazy rents story is starting to change. Also, if a ballot measure is introduced, and fails, it will put this issue to bed for the foreseeable future. I don’t think the legislature has the votes to pass a repeal, and they certainly won’t if a ballot measure fails. And I still think it will fail, although it will be close (and scary for prop owners.)

Dave- I still think owning in SF is better than Seattle. SF is basically almost all blue chip quality. Plus owning out of state is a major negative, as you never know the details as well as in your back yard. Now if you move to Seattle, that’s a different story. But who would want to if they have already made it in SF. (Made in the shade sure beats made in the rain 😉

RS heh…heh

Rent controlled units ARE being created – Trinity Towers for one; the ADU legislation for another. Albeit there are not that many (hundreds), with the claimed thousands that are lost to AirBnB/TIC/vacant_units etc. But they are being created. Look for more ways that the politicians will use to increase those numbers; giving false hope to tenant voters everywhere.

I think this adding-rent-controlled-stock dynamic is probably not widely-understood: The city has on one hand increased the flexibility of planning code with respect to additional units (Accessory Dwelling Units- ADUs), but also requires an owner who wants to build a new housing unit (that under “normal circumstances” would be exempt from rent control thanks to Costa Hawkins) to waive the Costa Hawkins rights in order to receive approval. The new unit becomes rent controlled from day 0.

How many ADU’s are truly new? Aren’t most just a legalization of existing illegal units. Which were under RC even when they were illegal.

I don’t have the numbers, but existing ADU’s that didn’t conform to building codes before don’t now either. The seismic upgrade ordinance allows both mandated and voluntarily-updating building owner to add new ADU’s without regard to parking requirements. These are new units though yes, probably few. An owner is likely taking away parking to add new ground floor units, and the tenant and his once-weekly-used 1992 Sentra have claim to the space where an ADU could be built as strongly as they have to a bedroom under rental law.

The ADU legislation is brilliant and is being taken advantage of by owners of larger properties who can convert storage rooms and garages to legal dwelling units (as long as they meet code, obviously). It’s actually not so horrible adding rent control units because these units are generally very small.

Although SOMEBODY may live in a studio for 40 years, in general they have much higher turnover than multi-bedroom units, so landlords like them.

I have a small landlord friend who said the smartest thing he ever did was buy a small crappy building in the Mission in the 90’s that was a mix of tiny one br and studios. Currently his young tech tenants usually stay for a couple of years and move on. On balance he’s able to keep up with market rents.

Just insane. Legislated blackmail.

And nothing more.

“…single tenant was $250,000 for a unit on 21st Street in the Outer Richmond last year.”

There’s a 21st Avenue in the Richmond (wouldn’t classify as Outer) and I highly doubt there is an unit on 21st Ave where an owner would pony up a quarter mil. I could see it happening on 21st street, though.

Since corrected to (the 100 block of) 21st Avenue and the Lake District (versus ‘Outer Richmond’ as recorded in the city’s database of buyout agreements).

Those low-end buyout amounts (“$1,750 in the Excelsior in 2015; $500 in Potrero Hill last year; and $1,000 in the Inner Richmond in 2017”) make no sense from the tenants’ perspective, because if the unit is covered by the Rent Ordinance, the tenants will get a LOT more money in relocation expenses for no-fault evictions like OMI, Ellis Act, Demolition of Unit, etc. It’s $6,281 per authorized occupant, up to a household max of $18,843, plus a bonus $4,188 for each occupant who’s 60+ or disabled, or for each household with children. Those dollar amounts should be the floor for any Buyout amount involving a tenant with Just Cause protection.

Maybe the buyouts were for unauthorized occupants

There was only 1 buyout in SOMA (except for the westernmost part). Dogpatch is also newer construction but had 4 buyouts.

I found my house where I did a buyout and there was another buyout very nearby. Generally appears that buyouts “cluster” rather than spread evenly. I wonder if one buyout begets another nearby as both parties seek a win/win outcome.

It’s interesting to me that buyouts are actually being recorded in substantial numbers. I had heard that there was an exception for buyouts negotiated as part of a legal settlement, and that many landlords were end-running the recordation requirement (which I believe limits condo conversion) via collusive suits.

If an unrecorded buyout is worth more than a recorded buyout to the landlord, then the tenant has a clear incentive to cooperate in a collusive lawsuit. I’d like to hear from anyone who may know if this is actually happening. (I have noticed, in my neighborhood, a couple of buildings which sold with protected tenants in place after the buyout legislation took effect, and then resold a year or two later sans tenants–and with no mention of any recorded buyout.)

A friend of mine (Outer Richmond) was offered an unrecorded buyout ($50k) with the warning that if she refused, they’d Ellis the bldg and she’d get half of that. She insisted on $100k, but they wouldn’t budge; said they wanted the bldg for family members, so she felt she had no leverage; SFTU was no help. If they were likely to TIC or re-rent, then she’d be in a better position. She happily took the $$ and is moving elsewhere.

And yeah, its illegal. But probably a better solution all around.

For those looking for actual stats upon which to make a sound argument as to how common it is for tenants to occupy an apartment in San Francisco proper for over a decade, the average tenancy for a rent controlled apartment in the city was 9 years circa 2015 versus 6 years for a non-rent controlled unit.

For evaluating rent control tenancies, wouldn’t the median tenancy be more relevant than the average? You may have plenty of people moving in the 1-3 year time frame when their rent is relatively close to market. This would skew the average higher.

Interesting. We all know somebody who has a $400 a month apartment they have been living in for 40 years, but that’s actually fairly uncommon.

As I said above, I’d love to see real statistics on this.

I know many, many people in San Francisco who are paying 1990s – early 2000s type rents. So I actually take the opposite view of the demographic being a purported relatively few. My thought is, “Well, if that’s just my own extended social network how many more must there be? Probably lots.”

6,000+ people living under freeways, the City tickets the hell out of people sleeping in their cars, and then this. We have a really crazy housing situation.

Mom and Pop should not buy rental property in SF. They should leave it to companies with access to expert lawyers and advisers.

Rent control should be means-tested. There is a wonderful article online by the author Nora Ephron about her life in a rent stabilized apartment in New York City. When NYC began means-testing, she had to leave it and buy her own apartment.

It is possible that there is no government intervention that can solve the current conundrum in San Francisco. Most of the “affordable” efforts are small tinkerings at the edges of a major change in the world economy, centered in the Bay Area, with satellite tech centers elsewhere in the country and abroad. The value of money is now changed here in SF, and a re-equilibrium may take more time than most of us have.

“Mom and Pop should not buy rental property in SF. They should leave it to companies with access to expert lawyers and advisers.”

Very true. Unfortunately, the City has an abundance of two and three unit buildings that are not attractive to corporate landlords. The original rent control ordinance that exempted owner occupied smaller buildings made quite a bit of sense in that it allowed those of more modest means to afford to buy aided by the rental payments received. Now, small building owners are forced to comply with a byzantine set of rules and regs and judging from my block, many are choosing not to re-rent their units when a tenant leaves. This is in spite of the hefty potential rent that may be received.