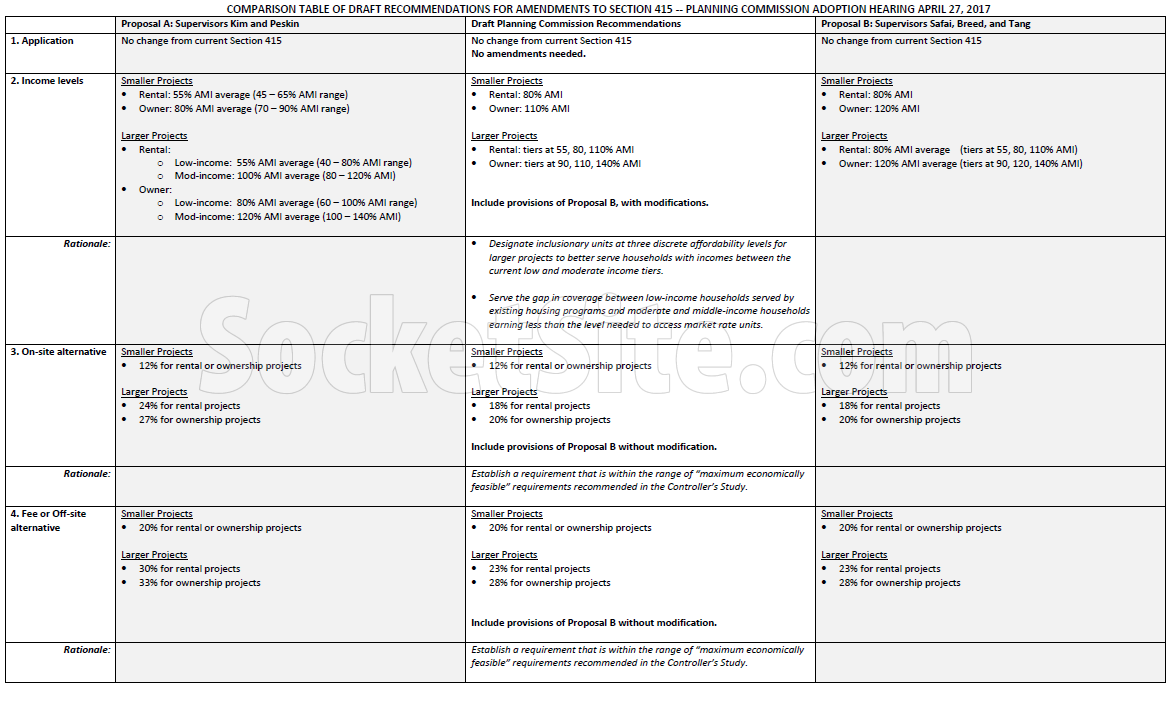

With San Francisco Supervisors having drafted two competing proposals for overhauling the percentage and mix of below market rate (BMR or “affordable”) units that developers of market rate projects are required to provide on-site or fund elsewhere in the city, in response to the passage of Proposition C and a follow-up report from the Office of the Controller, San Francisco’s Planning Department has just finalized their formal recommendations for how the City’s Inclusionary Housing Program should be changed.

As outlined in more detail and rationalized in the tables above, the key recommendations include:

Raising the allowable income limits to qualify for a below market rate unit, by which the “affordable” pricing levels are set, up to 80 percent of the Area Median Income (AMI) for rental projects and 110 percent of the AMI for condos in developments with 10 to 24 units.

Raising the allowable income limits and pricing for larger projects, with 25 units or more, up to 110 percent of the Area Median Income (AMI) for rental projects and 140 percent of the AMI for condos.

Increasing the required percentage of on-site affordable units in developments with 25 units or more to 18 percent for rental projects and 20 percent for condos to be sold; that’s up from 12 percent as originally required but down from the 25 percent as initially mandated by Proposition C.

Increasing the required percentage of affordable units to be developed off-site, or the basis for calculating a project’s in lieu fee, up to 23 percent for rental projects with 25 units or more and up to 28 percent for condos to be sold, versus 20 percent as originally required or 33 percent as initially mandated by Proposition C.

And the adoption of a bi-annual one point increase in the required on and off-site percentages, with an upper limit of 23/25 percent for on-site rental/condo projects and 28/33 percent for an off-site election.

In effect, the Planning Department’s formal recommendation, which is slated to be presented to San Francisco’s Planning Commission in two weeks time, is most closely aligned with the proposal backed by Supervisors Breed, Safai and Tang.

My question is if increased affordable housing requirements dissuade developers from building. We’ve had a building boom at 12% BMR. Does a 23% BMR requirement kill development?

The golden question! I think it will. Developers have said as much and been widely villainized as a result. However, I think it’s more of an issue with lenders being fearful of much lower returns. If developers can’t build in a certain return on investment (say 6% or more) because there are fewer market rate units, then investors and lenders will simply put their money elsewhere. Maybe it’s Seattle, Oakland or simply switching to commercial projects.

Take this with a grain of salt, it’s [only] what I’ve heard or been told. There isn’t any data to back this up right now but it looks like we’ll just have to see. Maybe a benefit would be more small projects will get jumped started that have 2-3 bedrooms instead of 1-2. More families could stay? Call it youthful optimism.

It’s all about development cost vs sale price. BMR requirements, whether it’s at 12 or 23%, increase development cost. So if it generally costs $800 per SF to build in SF, then developers won’t start building until sale prices reach $1,000 per SF. If you increase the BMR requirements, then you are simply increasing development cost and discouraging developers to build until the sale prices reach even higher levels. It’s because development costs are so high that it’s so expensive to live in SF.

“It’s because development costs are so high that it’s so expensive to live in SF.”

That is nonsense. It is expensive to live in SF because there is enough wealthy demand to pay the inflated prices. SF RE owners (including moi) are quite adept at inflated their prices to capture a maximum share of new wealth.

There are plenty of expensive places to build (due to hazmat, for example) that are relatively cheap to live in because the demand is too low. Development is discouraged there because of too few buyers/renters, not because of ‘affordability’ requirements.

Demand is very high in SF because of the concentration of high paying jobs in the CBD and the appallingly poor/limited transportation options to get to those jobs from further than 5-10 miles away.

We could reduce demand for SF housing by increasing the capacity of mass transit into SF from the suburbs faster than we construct more office space.

Development costs are high in SF. You think the buildings going up in SOMA are going up cheaply? You think it costs the same for labor in SF as Heyward? The price of construction hasn’t been flat, there isn’t an infinite amount of labor to build these projects.

yup, the high prices are largely the fault of greedy workers that expect much more pay in SF than 20 miles away in Hayward. And the greedy/wealthy companies that pay them those high wages, like Twitter, and Uber, and …. Much of it with money from greedy/wealthy investors, not from cashflow. When that gravy train runs dry, SF RE prices drop.

Meanwhile, in the real (estate) world of SF landowners, SS has a story today of a parcel in a not-so-nice location ~3 miles from the center of downtown SF asking ~$250k per buildable unit and there is a small industry in SF flipping entitled land for higher prices than that.

SF land costs are over-inflated by the miserable transportation options to get to the over-paid jobs in the over-built CBD. The supply/demand ratio of transit between where nearly 50% of the SF workers live (not in SF) and their SF jobs raises the value of residential property inside the transport choke to SF.

It isn’t just supply, it isn’t just demand; it is both.

…and much of the demand has been speculation-driven, so there’s that.

this is just not true. development costs have little to do with the price of housing.

also will too high % of BMR dissuade buyers from buying? it’s already not a very attractive proposition to buy an expensive unit knowing that your next door guy got it at 50% off.

Not that they got it cheap (though BMR only really work out for a v small demographic) – but that your neighbors are ‘cheap’ (the slob in the wife-beater).

Who wants to buy something still really expensive, with the certainty that there will be almost no appreciation – and you’re monthlies are still significant.

There are prohibitions against renting and STRs, aren’t there?

If the developer wants exclusivity (a.k.a. “not having to view downscale slob neighbors in wife beaters”) as a selling point for a particular building, well, that is what the off-site BMR construction or in-lieu fee options are there for.

In addition, keep in mind that those “slob neighbors in wife beaters” are currently earning up to $105,500 per year under the recommended guidelines for an individual.

unfortunately that is poor in SF, as most plumbers, electricians, other blue collar roles make more than that. Im not judging jsut saying that wife beater and plumbers crack generally associated with this class

well for one reason or another, most projects incorporate the BMR’s into the same building (especially for projects that are not massive with several hundred units where it might be infeasible to build separately just for BMR so you have to mix them into the same building). also it’s a little bit of buyer beware thing, the sales offices and developers official websites don’t proactively mention that there are BMR’s in the development.

@Hancock – Seattle has an aggressive 40% goal for affordable housing in the 35K – 40K new units expected to be built there by 2025. That city is booming with cranes everywhere, so its tougher affordability requirements have not impacted development.

The prices that recently dropped have certainly affected building new holes.

Yes – that is the primary reason for fewer “new holes” being built. Unfortunately, this downturn in SF RE prices coincides with a more realistic affordable requirement and the latter will be erroneously blamed for any coming big slowdown in SF construction.

This Mission project mentioned below in the blog is a perfect case in point. The developer is not going to build and it’s under the old BMR regimen as is the other project mentioned within the story that is also being put on the market instead of being built. These two are examples of falling prices stalling projects – even those with a very modest BMR requirement.

The falling prices are likely the reason new development proposals have been slowing for more than a year. Anecdotal as SS has not reported specifically on early 2017 yet, but it seems like new proposals are down so far this year compared to last year.

It seems to continue that off-site or in-lieu fees are a massive loophole. The fees ought to be tied to the inflation cost of local construction plus. And the off-site ought to have an almost concurrent clause or, again, inflation-adjusted incremental increase in the # of units produced.

The way it is now its a relatively cheap cost of doing business.

Here’s a novel idea, just let everyone build without any restrictions. To think that this city would change overnight is ridiculous. It is already pretty expensive here and it’s not like there are so many empty parcels of land everywhere in the Fab 7×7 just waiting for developers. It’s quicksand: the more you try and struggle to get out, the more you sink…

A major cause of a fear to build BMR units in SF is the planning department. Developers need to make the bottom line for their investors, it’s that simple. This article highlights a very serious problem the SF has with its planning department.

If a planner disagrees with the architecture, it can take years to even start construction. Some of the reasons why they object sometimes is the material choice, amount of glass on the façade, and sometimes you get 2 different interpretations of the same code by different plan checkers.

We need regulations and zoning, to enforce height, light and air, or bulk. However, plan checkers should not have any opinion on certain design elements like material or what they consider to be active use on a façade. The amount of input planning gives to projects is really an over reach of their authority, and because of this it slows development down.

What makes certain things worse is the departments never talk to each other DPW, Planning, SFFD, SFMTA, Caltrans all have their own agenda and most of the time they conflict. The developers then need to worry about increase in overhead costs of starting/stopping work with the team, paying property tax on an empty lot while waiting for approval, etc. At the end they need to maximize their profits due to the increase in overhead.

I’m not saying planning is the root cause to the housing crisis, but their overreach in terms of input causes a slowdown that trickles down to the buyer/renter. A conceptual example is, developments that reach 30% BMR of the initial allowed FAR can get a 1:1 increase in market rate units which will give exceptions to height/bulk limits, however won’t increase the open space requirement of the initial FAR. The increase or decrease in added market rate units can be dependent to the percentage of BMR units allocated minimum of 18%. This is a very raw concept but it rewards developers who actively work towards adding on-site BMR. This solution should also go hand-in-hand with the planning department pulling back its design input.

as a homeonwer, this is fantastic. restricting the market in this way will continue to increase the price of my home. As a mathematician, i am surprised that anyone involved with this plan has a college degree or knows anything about economics, moral hazard, law of unintended consequences. this is a terrible plan

Agree 100% on both counts.

As a homeowner, I hope there’s a 30% BMR requirement for two reasons:

1. Less inventory overall because builders will have less ROI.

2. Less inventory for regular buyers because BMR units don’t decrease overall demand – BMR units simply allows non-qualified buyers an opportunity to own.

I love this! Let’s do it!

I suspect they know what a terrible plan it is but it’s all about demagoguery and the Supervisors being able to claim they are “helping the little guy”. Most people don’t think through the economics of this, even though it should be obvious to everyone that the results will be the exact opposite of what they’re supposed to be.

I used to think the Supervisors knew better and were being cynical.

The more I talk with them the more I suspect they really are this ignorant.

Let’s Make SF More Expensive Yet Again! SF continues to find ways to limit supply by fantasizing they are being progressive and helping the little guy when they know they are only helping the few lottery winners. Landlords win again!!!

This proposal will continue to ensure that only the rich and the poor will live, and more importantly vote, in SF. It makes sure that the working class is kept out of the city and commuting to the detriment of the environment. The welfare housing people owe everything to the progressive supervisors and they vote to keep these supervisors in power. These supervisors, in turn, do everything in their power to prevent the construction of market rate housing, thereby keeping out the unassisted working class. SF will continue to be an outdoor insane asylum for the foreseeable future.

The continuance of rent control, Prop 13, and the mortgage interest deduction each have greater impact on the persistence in SF of whatever counts as ‘working class’ than any poorly funded local gov’t ‘affordable’ proposal.

FTR, ~38% of SF households earn $50k-$150k, while ~31% earn less and ~31% earn more, per US Census ACS 2015. Otherwise, I’m as shocked as you are to read such hyperbole on the Internet.