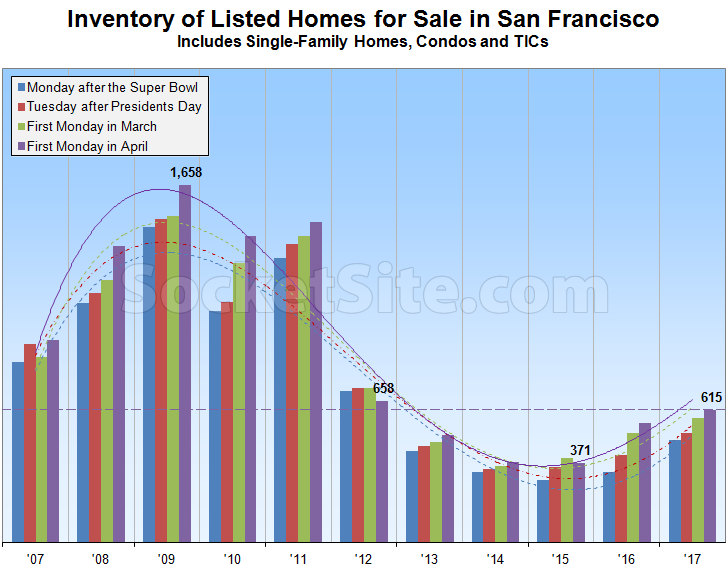

Having ticked up another 6 percent over the past four weeks, the number of single-family homes and condos currently listed for sale in San Francisco now totals 615, the highest total at the beginning of April since 2012, at which point there were 658, and 10 percent higher versus the same time last year.

At a more granular level, the number of single-family homes currently listed for sale in the city (225) is now running 12 percent higher versus the same time last year while the number of listed condominiums (390) is 10 percent higher, not including the vast majority of unlisted new construction condos for sale across the city, the inventory of which currently totals over 1,000, which is 60 percent higher versus the same time last year.

In terms of pricing and expectations, 15 percent of the active listings in San Francisco have undergone at least one price reduction (versus 12 percent at the same time last year) and 34 percent of the homes on the market are currently listed for under a million dollars (versus 39 percent at the same time last year).

Expect inventory levels in San Francisco, which are on track to soon hit a six-year high, to continue to climb through June or July.

Shouldn’t the highest inventory since 2012 mean we’re nearing a five-year high, not six? Or am I missing something…

We’re at a five-year high and on pace to surpass 2012.

though we are at at 5 year high, isnt this more normal? the market was so skewed from 2004 – 2012 or so with the mega boom bust….

Then you have some sort of population adjustment you would need to work in over such a long timeframe.

Somthing like a ratio that divides total population in the bay area in 30-50 yr old range (main ages that buy homes) by number of homes for sale, over time.

Im mostly just thinking out load but wouldnt that be a better normalizer of the data, or something like that?

Bring it on

Man these aggregate statistics that combine condos and sfh seem to mask the stark dichotomy. Anecdotally, I really only see appreciation in Sfhs. Frustrating.

Actually, i see depreciation at the way high end of the sfh market but thats about it.

Then it’s a good thing we break out the year-over-year stats for single-family homes – the inventory of which is at a five-year high as well – and condos above.

i see the break out and i appreciate it. But unlike the condo market, i’ve also seen the supply of sfhs increase with no or little corresponding decrease in prices.*

*anecdotally. Calm down i don’t have a peer reviewed paper with pvalues <.05

That’s a perfectly valid observation. Any thoughts on why that’s actually not unusual, there’s less volatility in the single-family home market, and condo trends tend to be a leading indicator of the market as a whole?

Less volatility = less likely to be a major correction? I hope not. But that’s part of my lament.

But i would say that while there is more sfh supply on the market (shifting hands) there is not more sfh supply being created (being built) unlike the condo market where both are occurring.

But i hope a falling condo market is a harbinger for the sfh market but i have my doubts, which are completely the opposite of my hopes.

I make this comment every month. 225 SFHs for sale. That ain’t much folks, even if it is up “12%” Condos I expect to explode when we constantly read that 50,000 are in the pipeline…but they ain’t making many more SFHs unless you count those horrible ones on Brotherhood Way.

Yeah very small denominator issue going on here. While i am happy there are more than last year, 12% is what 25 sfhs? So that means places that had 20 bids last year now are getting 18 or 15 or even 10?

So we have about 1 month’s inventory of houses and 2 months’ inventory of condos. Indicates a strong sellers market, no? Very strong for houses. Maybe a little less strong than a year ago, but strong nevertheless.

Months of inventory is a terrible statistic and typically misquoted and contextualized for the local market (hint: based on historical data, “six months” would represent a extreme buyer’s market in San Francisco, not one that is “balanced”).

Regardless, if you want to go down that path, “months of inventory” is currently running 70 percent higher in San Francisco versus the same time in 2015 and 50 percent higher versus the same time last year.

Looks like the highest drop in inventory is between 2011 and 2012. It would be nice if the same magnitude jump happened between 2017 and 2018…

Yes, fair to say we are no longer in a white hot sellers’ market and are now in a strong sellers’ market. These numbers support that.

These numbers support the notion that the market has weakened, as compared to last year and the year before. But they don’t actually support the notion of “a strong seller’s market.”

The Warriors have weakened, as compared to last year and the year before. Very different from saying they are weak.

Why not? You’re putting a fine point on something subjective seems like. Where’s the line, then?

So, 2.7 times as many homes were for sale in 2009 as are for sale now?

Market is rife with sellers with unrealistic expectations. Lake District observations:

Rick and Butch are struggling to sell 157 28th Ave because they are way ahead of the market for the location. $1mm too pricey.

Original condition fixer needing full rehab wants almost $1K ppsf at 136 27th. SAD!

Metallica guy can’t sell either of his Sea Cliff homes. OVERPRICED!

And the Brugnara home at 224 Seacliff won’t go anywhere near list! TERRIBLE NEGOTIATORS!

266 32nd avenue at 3.38mm with the iridescent pink paint! Iridescent pink paint! Tax roll says 2,487 sf. Tried FSBO, failed. On the second real estate agent. (But it’s those unscrupulous agents!!!)

Essentially, nearly all of the top third of single family homes in the 94121 are overpriced by 10-50%. So, yeah, baloney inventory is building.

Your examples just show the sellers do not really need to sell and can afford to wait. If they needed to sell, they would price it accordingly.

Of course, and yet inventory still builds, much to the fascination of some observers.

This is why condo sales, particularly new condo sales, can be looked at as a leading indicator. A developer selling off their new condos is ROI focused and will sell at what the market will or won’t bear. With individual owners there’s more emotion involved and people can fixate on a price they “feel” is appropriate. SFRs are more unique and the differences between properties provides more wiggle room to rationalize comparable sales. Resales of cookie cutter condos provide more of a reality check.

And as far as waiting, during a market upswing you essentially get paid to wait which encourages waiting for your price and restricts supply. But when the market turns and prices slide, this effect reverses and waiting becomes costly which drives more supply into a declining market.

I hope you are right about condos as a leading indicator. But as i mentioned above, i have my doubts about condos as an indicator for sfhs because sfhs are not being built at the rate that condos are. It maybe that comdos are a leading indicator for the condo market and rentals, not sfhs. That being said, i hope i am wrong.

Some people might have an absolute preference for SFR vs a condo or vice versa. But for most people there’s substitution between the two types with price differential being one the factors people consider.

But most importantly, if the issue with the condo market was simply a supply glut wouldn’t you expect volume to go up? But instead we see volume dropping on lower prices. Which is more in line with a change in buyer behavior and expectations than with a simple oversupply.

I think a lot people, like me for instance, have an absoute preference for sfh over a condo. So your options are really limited if you are in that boat. And i think that price deferential is what we are seeing right now as sfhs for the most part are still increasing while condos are not. But again, i hope i am wrong and we will start seeing a decline in sfh prices too.

I dont understand your second point about the condo market but i just see it as such a different market than sfhs and therefore more of a harbinger for the condo market itself, not necc sfhs and or sf real estate as a whole.

It seems like you can buy a condo or SFH for same price – $/sq ft almost half or at least 3/4 of that of an apartment in many cases.

I think that there are enough people with flexible preferences to produce a linkage between the condo and SFR markets. Starting a family tends to raise the preference for a SFR, but SF has the lowest proportion of children of any major city. And it’s not uncommon for people to start off thinking that they absolutely want to stay in SF to raise a family in a SFR, but then change their minds when the time comes either by moving away or choosing a condo.

To the second point, instead of looking at condo’s vs SFRs, the real question is if there are buyers queued up willing and able to buy into SF at these prices or was the expectation of appreciation a big driver of demand these past years?

I dont know if i’d call that the real question. But i do get your point that the assumption is that the value will go up. And again, i think that assumption is not true so much for condos as the supply of new units built has been increasing whereas that is not as much the case for sfhs. The pertinent question for me is does the supply of condos have a large impact on the priceof sfhs. My hunch is that it may have a small impact but not a large one. I also hope i am wrong.

I call it the real question because if this is simply a supply issue with new condos then the main connection to the SFR market will just be via the substitution effect. i.e. if condo prices drop some demand gets pulled away from the SFR market into the condo market.

But if this is a issue with slackening demand that’s going to hit both markets directly. Too soon to say, but notice that the SFR inventory is up 12% YoY with condo’s up 10% so there’s something happening in both markets there. And the fact that the south bay has seen outmigration and SF’s inmigration is slowing portends demand issues.

I think there is a lot of investor demand taking up the slack for SFH right now esp in D2, D3, and D10. I’ve seen so many homes with two or more inlaw units lately. They are just divvying up these little houses into multiple sketchy rental spaces and cashing in. College students, relatives, furnished Airbnb… even with these insane prices and dropping rents it’s still a cash cow. We’ll see how long it lasts.