Seeking to rationalize the recent drops in recorded home sales in San Francisco, a lack of inventory, seasonality and changes in the mortgage market which shifted sales at the end of 2015 have all been invoked to explain it away with the wave of a hand. So let’s take a harder look at the data.

Comparing three months of sales data, spanning November to January, should eliminate the impact of any shift in sales from November to December. And by comparing the three-month period, year-over-year, we’ll account for seasonality.

From November 2015 to January 2016, roughly 1,500 homes traded hands in San Francisco. And from November 2016 to January 2017, the total was closer to 1,400, down 7 percent on a year-over-year basis.

At the same time, both listed and unlisted inventory levels were running between 40 and 70 percent higher, so it’s not a lack of homes or choice which is to blame.

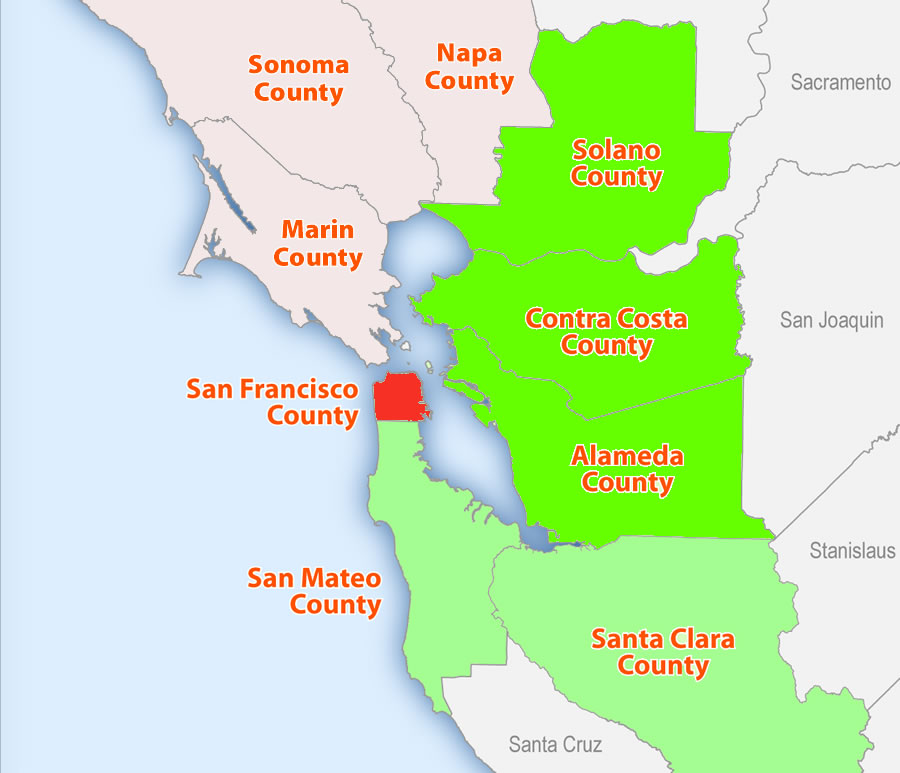

And with respect to the argument that it’s a systemic shift in the mortgage market which has led to a drop in local sales? Well, on the same quarter-over-quarter basis, total sales in the eight Bay Area Counties surrounding San Francisco ticked up 3 percent versus San Francisco’s 7 percent decline.

If we isolate the sales in the high-cost Silicon Valley counties of San Mateo and Santa Clara, transaction volume still ticked up 2 percent on a quarter-over-quarter basis versus San Francisco’s decline. And sales were up 5 percent across the lower-cost East Bay counties of Alameda, Contra Costa and Solano, the performance of which is helping to drive the performance of the Case-Shiller Index for San Francisco.

It was basically a push (down less than a percent) for the northern counties of Marin, Napa and Sonoma.

I think more posts, articles and discussion on this point would be appreciated and helpful. Oakland in particular may be finally turning a corner, permanently.

Anecdotally, while I hear about a flat or declining market in SF, I regularly see and hear strong indications in the east bay, of course in all of the traditionally strong locations (piedmont, berkeley, rockridge) but also now in places that may be irrevocably gentrifying (west oakland, uptown, etc.).

For people in my demographic (30s, no kids yet, professionals working in SF/tech), I am finding most people looking for and even preferring the east bay. a cultural shift is happening, on top of the economic one, and there will be major long term implications for bay area real estate.

Oakland may strengthen permanently with the childless buyers, but I doubt growth will continue on this pace after pent-up demand is exhausted. I have a good friend, an Oakland lover, getting set to move out of Oakland because the public schools are so bad, far below even SF. He bought when he was childless…but now he is on his way out. He is not alone…he has friends moving to Castro Valley and San Leandro, which have schools significantly better, even thou SL’s aren’t even that good yet. Point is, even SF has some public school choices if you win the lottery. In Oakland, that is much more chancey.

This is why most move. With houses beyond the ability of even 6 figure tech salaries and chinese investors pulling out the market is adjusting to the realities that up until now sheer greed drove up prices. Add tech kids finding love and wanting families the inevitable exodus (white flight) is occuring. With poor academics, higher taxes, over inflated housing prices, and lack luster foreign investment we are seeing a cooling in the SF market.

I agree with this; as young tech people start to have kids, living in oakland is not really a viable option. long term that will indeed put a damper on things. but for the tech set in the 25-35 range, oakland is a very attractive market to buy a starter home or condo.

Oakland schools have open enrollment.

Oakland has some great public elementary schools in the pricier neighborhoods. Even Oakland Tech is also now a pretty good high school. Keep in mind that many kids in Oakland go to charter schools or private schools.

Oakland has a several top rated public elementary schools, even some moderately good ones in East Oakland. Middle and high schools are not so great, but American Indian and OSA charter schools are pretty good. There are a number of highly rated private schools here… The College Preparatory School, Head-Royce, Bishop O’Dowd, etc.

Most young people I know who move to the east bay do so for affordability reasons.

its more than that. you could move to daly city for affordability reasons, but daly city is not cool. people *want* to move to oakland for reasons beyond just pure affordability.

i personally think Daly City is cooler than Oakland. UNfortunately it is more expensive than Oakland

In what way is Daly City cooler than Oakland?

I think you mean colder.

Oh yeah, Daly City is cooler, it’s freezing cold.

Oakland is the future. I expect prices in Oakland and SF too become much closer in the next three to five years.

Oakland has the better climate, more central location, more space, varying topography, along with the great restaurants, cool bars and art galleries. You throw in the 9 BART stops, great freeway access, the charming neighborhood shopping districts, and it really is a no brainer.

Downtown Oakland is booming and just about every surface parking lot is either under construction or in the development pipeline. San Francisco on the other hand, is way overbuilt with more supply still under construction as evident by all the construction cranes.

Oakland is where it’s at and everyone knows it.

Just yesterday I was startled to see that a townhouse on 51st Street, right on the Temescal Rockridge border, sold recently for 1.3 million. Another home just above College Avenue is on the market for 1.6 million and will probably go for closer to 1.8 million.

SF is not overbuilt. There’s still plenty of pent up demand. If SF’s housing supply were to suddenly jump by 10%, it would be quickly gobbled up. Prices would drop for sure, but those units would find occupants/

I meant over built as far as sustaining current prices. I expect SF’s median home price to come down to about $1,000,000 in the next three years while Oakland’s climbs to around $800,000.

Why are you equating today’s obscene equilibrium with “overbuilt”? We are laughably underbuilt, hence the ridiculous prices.

This is possible but couple things need to happen first:

1) Second BART tunnel, 24 hr BART access to SF

2) Oakland must embrace density and built more, way more

3) Removal of highway 980

I think #2 is starting to happen. a 24 hour linkage between SF & OAK would be a great thing and could easily happen. The 980 freeway coming down and a second Bay crossing would cost too much to make it a reality.

Oakland still has plenty of available and underutilized land. There are currently over 2300 units of housing under construction and over 14,000 more units in the pipeline.

The greater density is coming to Brooklyn Basin, Uptown, Jack London Square, Old Oakland, Lake Merritt BART area, Auto Row, and Temescal.

SF Business Times reports that a developer wants to build 1.4k micro unit complex in West Oakland 5 minutes away from a BART station. Well that’s what i call embracing density! Go Oakland! I hope that development gets approved and sets a precedent. Is there available land to build 2-3 more projects of this size in W. Oakland?

Only people with chronic SF syndrome think #1 is important. I live in Oakland and I go to SF about annually, to see my dentist. There are more than sufficient services, culture, and entertainment on this side of the Bay to keep people happy and healthy without having to leave.

Strongly agree on #2 and #3 of course.

Actually, I disagree with you re: #1. It’s insane that there is not better late night access between Oakland and SF. If there were, Oakland would immediately get a huge boost, particularly for the residential real estate market. I love Oakland and everything that is happening, but SF remains a great entertainment/dining/cultural draw and the lack of convenient transit access between the second and third most populous cities in the Bay Area (Hey, San Jose!) hurts both.

I moved to SF from New York people are super worried about potential closure of the L train.. Its just a net positive to have the option to go to Oakland from SF whenever you want within 15-20 mins and visa versa.

So you aren’t an opera, symphony or (soon) basketball fan.

Oakland has a symphony as well as three beautiful theaters in and around downtown. The Fox and Paramount draw people from San Francisco who rely on BART & the 19th Street BART station. With all the bars and clubs in Uptown it makes no sense that BART stops running at midnight. Why can’t BART keep a train running between DTO and Downtown SF?

@BTinSF I’ve seen more choral music in ten years of living in the East Bay, thanks to BCCO, than I ever did in two decades of living in San Francisco, because attending the San Francisco the Opera costs $400 and is the same experience as visiting a mausoleum, where all the patrons are 120 years old. Also we have college football.

You’ll find there are things on either side of the bay, and that being unable to get to them from the other side at 2AM because BART is closed is not a very big impediment in practice.

An Uber from SF to Oakland is pretty cheap, and unlike BART, takes you right to your doorstep. This seems like not a big deal at all. If we were stuck back in 2005, with the Bay Area’s rock-bottom cab situation, then I’d get it.

Have you ever ridden BART on New Year’s Eve? People barfing everywhere, acting crazy. I know it’s NYE but still, the type of riders that would use BART at 2am probably cause a lot of trouble for them. Passing out, peeing on the seats, starting fights etc.

Are you aware that people take BART to work? Are you aware that some people’s work hours include late nights and early mornings?

@SFRealist I am sure you aren’t suggesting that people who are obligated to ride public transit at 2AM because of their jobs can afford to live in SF in the first place. That seems like a really bizarre suggestion.

I’m not. But their lives would be greatly improved with 24 hour BART.

I was responding to Sabbie’s comment that seemed to say that the people who need late night BART are a bunch of drunks

Hurray! An actual barf report on the night life in Oakland 🙂 can we get real here? Will you allow your teenage daughter to go out ALONE at night in downtown Oakland or the Tenderloin? Of course not, so then why are you pro-Oakland [people] trying to profess that the capital city of MURDER aka Oakland is such a hot real estate market? foolish. Take away the fleeting temp tech jobs and you have a dangerous [city] with techies trying to move in for employment convenience. NOT to raise a family. Get real ok?

Jay: Young people by the thousands regularly come to downtown Oakland at night. Have you heard of First Friday’s? Also, why do you equate Downtown Oakland with the Tenderloin in San Francisco? It’s obvious you know nothing about Oakland.

BART extensions is happening. But not.a tunnel but Santa Clara residents passing a transportation tax will get BART Indo downtown San Jose which is a big win for Oakland A’s well..

This is the first time I’ve ever read someone claim SF is “overbuilt” with housing.

Having watched the market for 35 years, I think SF prices are weakening because we have a temporary slew of new condos available at the same time the segment of tech that dominates in SF has passed its peak for this cycle. I think some techies are beginning to feel insecure in their 6 figure incomes and holding off buying for that reason–maybe next year they’ll have to move to Austin or Portland.

But in the long run, SF still has a housing shortage.

SF has plenty of space to add 50,000 units

San Francisco is wildly underbuilt. Oakland is somewhat underbuilt.

The weakening of prices in San Francisco along with the glut of expensive condos on the market and under construction indicates that there is too much over priced inventory in San Francisco.

Oakland on the other hand is still experiencing price appreciation due to more demand than inventory. Oakland is probably the hottest real estate market in the country right now. Oakland has gone beyond being just spill over from San Francisco and now is desirable on its own amenities and advantages.

I love Oakland, actually, don’t live there due to family. but your constant boosterism is just silly. Nothing is wrong, nothing can go wrong, and things are getting insanely better every day.

Schools are a giant problem, and will be for probably 15 more years. Even in the *best* elementary districts. I had another friend move out due to one of these ‘best’ elementary schools, after sending child there for a couple of years.

Yes, some people prefer Oakland. But that has nothing to do with San Francisco being overbuilt. SF is so expensive in part because we spent decades not building housing. In the last few years we have built some, but there is lots of catching up to do

This is the new reality. Oakland is not perfect just like SF has its problems, but the reality is that Oakland is now seen as a cool and desirable city.

You mean prices in Oakland will come much closer to SF in the next thirteen to fifteen years. Excess demand always comes back to SF; there’s only the overflow demand that goes to Oakland. It’s very hard imagine West Oakland stacking up in pricing anytime soon against even neighborhoods such as Western Addition or the Tendernob.

Have you seen the prices of new construction in West Oakland? It’s incredible how much people are now paying to live in West Oakland.

You sound like Trump: “everyone knows it”.

I didn’t.

You are right. I should have stated differently. Definitely don’t want to sound like Trump.

“….So let’s take a harder look at the data.” [by not actually presenting any data beyond a couple of rough approximations and just putting up a map with some bright colors, and no legend, and saying a lot of stuff. Also, let’s equate the intersection of supply and demand as merely, ‘demand.’]

The percentages presented aren’t approximations and are based on the recorded sales data over the time period discussed. Our apologies that you have to read and understand stuff in order to make sense of the graphic. And yes, demand.

Pure anecdote but an acquaintance is looking for a house in Berkeley and reports 20+ offers on anything decent, even in a rougher neighborhood. Minimum price of entry for something immediately livable that isn’t a tiny shack is over $800K now.

Berkeley has ultra-hard-core NIMBYs.

Keeps the prices up!

Most buyers tend to buy what they can afford closest to their place of work. I, for one, would hate to commute for work daily from the East Bay to SF, unless it is some kind of reverse commute. That is the trade-off. Less money for homes buys you a longer commute.

However, East Bay pricing is at its peak now so folks are buying at the top of the market. Not sure how far it will fall when the rest of SF/Bay Area falls. If the East Bay wants to sustain its peak levels, it needs to generate many more jobs to support its residents as opposed to having commuter type homeowners.

As for Berkeley, the old adage remains: easy to buy, difficult to sell.

Easy to buy, difficult to sell – do you mean it is an easy choice to make to live there but very hard to leave?

It is so easy to sell. We own two houses there and I could sell either as is in 5 days without any staging, and have a choice of 20 offers on each. There was a period from around 2009-2010 where that was not the case. It’s been the case for about 20 years.

No, it means that when prices are falling, the less desirable areas, like those requiring a cross-bay commute, but hit first and hardest. So much east bay demand is driven by people priced out of SF…if those folks aren’t priced out anymore, the east bay gets hit hard.

I think Berkeley prices declined 15% in the housing crash while Fairfield declined 60%. There’s a difference between 26 minutes on BART to SF vs. 1.5 hours in a car.

The commute question is a bit more nuanced than “East Bay” versus “SF.” My commute to SF FiDi became significantly shorter when we moved from Bernal Heights across the bay to Piedmont. It would have been even more so if we had been living in the outer sunset or down by the zoo; it would have been less so if we had moved to Orinda (or Marin) instead of Piedmont.

People who haven’t tried it don’t appreciate how much closer Oakland is to downtown SF, compared to many parts of SF itself.

Commute from east bay entirely depends on how you commute and how far you are going. Many intra-SF commutes can actually be longer than near-east bay commutes. But commute from east bay north of the maze to anywhere other than downtown SF is a bit tough, so if your job changes away from downtown, not a great place to be.

Oakland’s median home value is around $670,000 while SF’s is around 1.1 million.

There is just much more value in Oakland. What is a San Franciscan really giving up by moving to Rockridge, Piedmont Avenue, Temescal, Uptown, Old Oakland or Jack London Square. For a million dollars you can still get a very nice property in these neighborhoods with the exception of very expensive Rockridge.

Oakland has the great location and many of the same amenities. Many San Franciscans see the value in Oakland and are making the choice to move there while at the same time getting a nicer home and possibly a bettter quality of life for themselves and their families.

What are they giving up? Are you high? Do you understand the concept of “prestige,” as if that is not a huge factor in many people’s desires for a home?

They are giving up “image” of “San Francisco.” Isn’t Oakland considered a cool place to live much like Portland, Austin, or Nashville? Is there really a whole lot of “prestige” in saying that you live in San Francisco? I guess it depends on the crowd.

the price of being murdered or raped is pretty high, so increasing that by 4 fold to live in a cheaper place will not appeal to people who can afford SF.

The old bash and fear monger Oakland routine stopped working back in 1999. I guess you don’t realize that Oakland real estate is appreciating at a far greater rate than SF real estate. There goes your fear mongering theory. Also, much more crime in SF than in Oakland. In 2015 there were 55,000 crimes in SF and 32,000 crimes in Oakland. SF also recorded 700 more violent crimes than Oakland. As far as auto burglaries there were 26,000 in SF and 7,000 in Oakland. One more thing, SF has the most crime per square mile of any large city in the United States. That would be 55,000 crimes divided by 49 square miles.

yes, plenty of fearsome violent crime going around. Like the legal labor force, San Francisco imports (un)healthy share of criminals from the east bay. Probably due to the large income discrepancy. That’s what we get for dropping the (draw) bridge across the moat.

Mean while, Oakland’s population declined between the 2000 Census and the 2010 Census, unlike Berkeley, San Leandro, Emeryville, Alameda, Fremont, Pleasanton, Hayward,…, and of course San Francisco. Some people would call that a pattern needed an explanation. And FTR, San Francisco’s population has grown about 250% faster than Oakland since 2000, measured as a percentage of population. Must be all the non-bashful press.

Even San Francisco companies are now flocking to Oakland’s shiny downtown.

yup, classic overflow of SF boom into Oakland, as I pointed out yesterday when notcom posted that BS was moving downwind to save money (eastbay times article), as the President of Blue Shield mentioned in the article that you referenced. Lots of people and businesses are priced out of SF and SV. Happens every boom going way back. The eastbay is a relatively easy step away from these more preferred and more expensive locations.

What is really happening is that the concentration of high and mostly computer tech is expanding from the huge center in SV and the modest center in SF and the tiny centers in the east and north bay to displace businesses that don’t need access to this talent pool and can get along ok in less expensive areas.

And yes, Oakland is a beneficiary of the SV and SF boom, as are many other locales on the Jersey side of the bay.

Blue Shield is just coming back home to Oakland. How can they not be impressed by that beautiful new building in shiny vibrant downtown Oakland.

Also, 2/3 of their workforce live in or around the Oakland mainland. Uber also understands that Oakland is a better location and will be relocating another 3,000 employees from San Francisco. That’s 1,200 employees from Blue Shield and as many as 3,000 from Uber relocating from SF to Oakland.

The only thing preventing further defections to Oakland is the extremely low vacancy rate in DTO. With the 600,000 sq. ft. 601 City Center breaking ground this year and 1100 Broadway also breaking ground soon, more SF companies will surely follow to beautiful, clean, shiny, downtown Oakland.

Blue Shield said they were moving to Oakland to save money, not because they wanted to be downwind of a container port, simple as that. And Uber is, well, Uber is in need of adult supervision at the highest level.

SF’s Prop M and rent control are more drivers of the low commercial vacancy rates and rising housing prices in Oakland than the (moon)shine you’ve been serving us all.

Blue Shield and Uber are smart enough to recognize that Oakland is a much better value for their companies and for their employees.

yeah, sure, which is why Uber is keeping most of their company HQed in San Francisco. You may not keep up with the news so well, but Uber is not renown for their concern about the welfare of their employees. Most companies, both old economy style like BS and new economy style like Uber, are in the business of maximizing their stock holder’s value above all else. And if that means some of their employees have to endure a worse work location to “lower our administrative costs,” as the president of Blue Shield said, then so be it. Nothin personal, just business.

I’m sure the vast majority of Blue Shield and Uber employees are thrilled that they will soon be working in beautiful, clean, historic, downtown Oakland and much closer to their homes. This is great for these workers, for Oakland, and for the entire region. This will be a total upgrade in everyone’s quality of life. No more sitting at the Bay Bridge toll plaza for 30 minutes to then crawl along the Bay Bridge and into a congested over priced city.

The vast majority of Blue Shield and Uber employees will never ever work in Oakland. Even years from now when BS has completely moved their HQ to Oakland, that will only be less than 20% of their employees. Uber has been clear that they intend to have more employees in SF than in Oakland. But then you are “sure” of many things that aren’t true and don’t even make sense. Really got your head stuck in a congestion of over-hyped alt-factoids.

The vast majority of those relocating to Oakland will be thrilled with the move.

of course they will, just because you assert it. “Prediction is very difficult, especially about the future,” Neils Bohr and later variant by Yogi Berra. Bohr also said that “if an idea does not appear bizarre, there is no hope for it.” So maybe there is a slight hope for your many bizarre postings, but hard to predict.

West Oakland, uptown and lake merritt are 30 mins to downtown SF – door to door. Far closer to comparably priced inner/outer sunset/richmond locations – far better weather too.

there are costs not measured in rent or commute time or weather. Evidently, from your example, those costs are more onerous in DTO than in the sunset/richmond of SF.

My examples were directed at dude’s comment about the length of the commute and people buying closest to their work.

yes, you responded to “dude”, adding a little to the conversation, and I responded to you, adding a little to the conversation, then you responded to me, not adding (much) to the conversation. I think most of us get that.

regardless, except for those living in a very narrow slice of Oakland neighborhoods (Census tracts) within about a 10 minute walk of a DTO BART station, most employed Oakland residents drive to work. As do most employed residents of the SF Sunset and Richmond. And that makes the range of work destinations rather larger than those within a short walk of an SF CBD BART station. In particular, about 80,000 San Franciscans commute to work in San Mateo and Santa Clara Counties, as do many thousands of Oaklanders. The drive from the SF Sunset to the Silicon Valley is quite a bit quicker than from Oakland, for most AM commutes. And even the drive to places like Levis Plaza and Showplace Sq is quite a bit quicker and more predictable than being stuck on the Bay Bridge.

Anyway, wider world of doorways. And Oakland is an increasingly cool and vital place for reasons that should be obvious if not for the garish overstatements of boosters that give it the mystique and aura of the Paris Hilton of the Jersey side of the Bay.

Thanks, informative, dude (not sarcasm). Settle yourself, though, friend.

This reported trend doesn’t make sense and will clear itself out over time. There is no rational way that home sales market in say menlo and palo alto would have uplift where home sales in Sf would not. are slight differences i know but main factors are in common and interlinked. wait a few months and submarket trends will converge one way or the other.

Disagree totally; there is separation between SF and these cities. Menlo and PA also attract foreign and US investors who want the prestige of being near Stanford. It’s a huge draw. Also that little internet company, Face-something? In Menlo. They’re kind of successful and have a ton of employees. And that Googley thing, in Mountain View, next to PA. Many well paid employees, over 300, 400k, household, who want to live nearby. Plus Tesla, etc and other non-household names. All very close to Menlo and PA. All do not depend on SF employees, even though there’s a strong cohort who want to live in SF. Notice how even today, Google and FB have not substantially increased SF operations.

Google and Facebook must explain the even bigger relative boom in Solano County too. Googlers want to be close to the Vacaville factory outlets, perhaps?

No. But perhaps the “lower-cost” aspect of Solano County might ring a bell. (Which brings us back to what’s driving the Case-Shiller index.)

I’ve been trying to tell you, SF is a victim of its own success. Lots of the things that made it such an awesome place have disappeared as it has become so expensive and crowded. People here tend to live in a bubble, but if you spend any time in Oakland or other second tier cities like Portland, Denver, Austin, etc then you realize SF is not as vibrant anymore, and is mostly just fun if you are super loaded. Living in SF is almost like conspicuous consumption nowadays. Even then you’re probably working some really long hours and may not have much time to enjoy it.

With a small sample size, only two short periods covered, pretty slim differences (7%, 2%, 3%, 5%), big differences in the house versus condo mix in the various counties, and a period just before and after a monumental election with a lot of uncertainty and crazy stock and bond market swings, you can’t reach any conclusions from these numbers.

But this is the kind of thing to keep an eye on for longer term, meaningful numbers. So keep it up.

There isn’t a “sample size” nor any implied sampling error as the analysis is based on 100 percent of the data. A quarter-over-quarter comparison is far from insignificant and includes data on over 38,000 transactions. And the swing is from -7 to +5 percent, a span of 12 points.

…big differences in the house versus condo mix in the various counties…

That’s true and meaningful. But again, not in the way you seem to suggest.

…and a period just before and after a monumental election with a lot of uncertainty and crazy stock and bond market swings…

Also true but in play across the board and Bay, apples-to-apples style.

“nor any implied sampling error as the analysis is based on 100 percent of the transactions.”

To illustrate the problem, there were 2 single family home sales in District 8 in January 2016, and 1 such sale in January 2017. A meaningful conclusion that demand is off 50% because the analysis was based on 100% of the transactions? Of course not. The problem is not the percentage of transactions analyzed. The problem is the short periods of time (3 months during a traditionally slow period) and the small number of periods compared.

The point about the chaotic election was that the whole market was affected so as not to be representative of anything, so it doesn’t matter if the whole market was affected equally.

As I said, this will be useful once there is more data to be meaningful. Accept a compliment.

Again, the dataset includes a total of over 38,000 transactions, with nearly 3,000 in San Francisco alone. This isn’t a case of one versus two.

You’re confusing the sample size (which is small) with the numbers of transactions (which are large in every single period). Again, to illustrate the problem with that:

The last two Dept. of Labor initial jobless claims by week were: 242,000 and 223,000. That’s down 8.5%!!! But you can’t draw anything at all meaningful from such a small sample (just two periods). And it doesn’t make it significant to say “but there were 665,000 transactions.” Such a small sample confuses the signal with the noise.

Damn! We were just about to run the year-over-year analysis but didn’t realize those results would be equally as meaningless with another sample size of two! Instead, we’ll follow your lead and spend our time slicing the January data into 31 day-over-day periods to obtain significantly more meaningful results!

That won’t be much better, but you’re starting to get the idea. You need more data with more meaningful distinctions before you could draw the conclusions you’re trying to draw. Just noise from too few data points and differences that are insignificant from what you’ve compiled so far.

Several factors at play here.

At the more macro level, other markets such as Seattle, Charlotte and Raleigh are experiencing very strong job and population growth. Potentially drawing folks and jobs from SF. Exerting downward pressure on demand and prices.

At the less macro Bay Area level, prices in SF have gotten so high and one gets so little in terms of quality of homes/condos that people are voting with their wallet and choosing other counties in which to buy a home..

The views in the Oakland/East Bay Hills can be spectacular. 3 bridge views not uncommon. Spectacular prices too – much less than the equivalent home in SF. If you could even find it.

The hills above San Mateo, Belmont and San Carlos offer great views and quality homes too. At prices less than SF.

If an Arts and Craft home is what you want, many areas along El Camino from San Bruno south offer that. With streets uncluttered by cars, beautiful mature trees and a bit of backyard space – and space between you and the next door neighbors. Downtown Burlingame has all the charm of Union Street without the pretentiousness of Union Street.

Many of these areas have reasonable commutes to SF that are more and more attractive – especially when a great Arts and Craft home can be had on the Peninsula for the price one might pay for a Sunset special.

Of course there is the family situation. In my area quite a few young couples have moved recently with the arrival of their second child. Looking for a bigger house, good schools you don’t need the luck of a lottery winner to get into and safer streets. The West of Twin Peaks area has seen a worsening traffic and parking situation. Dangerous for young kids and for pedestrians in general. One solution tried in my neighborhood was bulb-outs. Make street crossing safer right? Only problem is these areas are now being used as more street-curb parking spaces and there are a number of “blind intersections” now. Less safe – its crazy, only in SF. The city is planning on painting the bulb-outs red to try to fix this new problem.

This will likely be a long term trend and may mitigate predictions of significantly more SF population growth. It has big implications for the 64K units of hosuing in the pipeline. If prices remain flat for an extended period and more and more people choose to liv in the East Bay or on the Peninsula will all those units actually be built?

On the peninsula, suburbs with homes less than $1.2 are usually in sadly under-treed neighborhoods, usually east of El Camino. I think you may be overstating the value of the peninsula.

“Downtown Burlingame has all the charm of Union Street without the pretentiousness of Union Street. ”

Burlingame Avenue is just as pretentious as Union Street and more expensive, and has been for years. Broadway in Burlingame is more modest.

“At the less macro Bay Area level, prices in SF have gotten so high and one gets so little in terms of quality of homes/condos that people are voting with their wallet and choosing other counties in which to buy a home..”

Yes, that is a likely cause – and the one that would explain fewer transactions in SF vs more transactions in surrounding counties. Will it eliminate the population growth? Perhaps in the short term, but IMO the outcome will be a narrowing of the price gap between SF and surroundings, leading to a slight deflation of land prices and construction cost, which will then lead to similar growth rates again…

“a slight deflation of land prices and construction cost, which will then lead to similar growth rates again…”

The catch is that price changes are a key factor in real world affordability. Buy a $1.5M house that quickly zips up to $1.7M and you’re doing fine no matter what life throws at you. But far far fewer people can afford to buy that place at $1.7M and pay down the note and taxes while the value limps along for years and years. And fewer still if the price actually declines.

True – but how many of these people can afford a home on the peninsula, In San Jose or elsewhere in the Bay Area under those circumstances? Who will buy investment homes in Berkeley if the year over year price change is a 2% decrease a couple of years in a row?

I think that SNAP is going to precipitate a watershed moment. The open secret of many of these recent “tech” companies is that they in fact have no real technology.

Silicon Valley is truly a special place and if you look at what the commercialization of the microprocessor entailed, the combination of financing, hardware, software, chemical, mechanical and optical engineering talent, you can see how hard it would be to replicate this confluence of talent.

But the products of some of these recent tech unicorns require nothing of the sort. Massive scaleability, which would seem to be a true technical problem these companies need solving is in fact usually effectively outsourced to the Amazons, Microsofts or Googles of the world.

I’m not holding my breath for Silicon Valley to be replicated elsewhere, but you really don’t need Silicon Valley or SF level talent to make an app with disappearing messages, 140 character tweets or virtual farmland . And why pay SF/SV prices if you don’t need to.

This is spot on. Silicon Valley will remain the center of tech, but the disproportionate number of tech jobs it has relative to other metros will decline in the coming years. As it is, many of the younger tech workers are trying to score tech jobs in less expensive areas – so that they can purchase a home. Not all tech workers are flush with IPO cash nor are they trust babies.

Its bad when Google and UCSF have to build housing to attract workers as both plan to do.

I have friends at LinkedIn and many are hoping, as Microsoft owns them now, that their jobs gets shifted to the Northwest.

All the talent pool – the lower level talent – does not need to be in the Bay Area. Reno/Sparks is building Switch to connect them and LV with with LA and the Bay Area in the hopes of attracting some of that “lower” level talent. .

“The open secret of many of these recent “tech” companies is that they in fact have no real technology.”

So true. Many of the latest wave are basically internet hosted business and/or media platforms. Tech is not their core competency. Their talent pool is distributed much wider than the traditional tech hubs.

It kind of reminds me of web 1.0 when many people with business and liberal arts backgrounds dropped their jobs and started coding web pages in HTML because that’s where the money was. That didn’t last long.

IMO you can separate the tech boom into two groups:

Companies with product/market fit and/or strong network effects:

– The Googles, Facebooks, Ubers, Airbnbs, Salesforces of this world. They are built on real technology and/or are entrenched through strong network effects. They will continue to be very profitable and employ armies of well-paid engineers and MBAs that can afford Bay Area housing.

– Firms without product/market fit and strong network effects:

Food delivery services, some FinTech (Lending Marketplaces), Online Advertisers (other then Google, Facebook), Uber for X knock-offs (e.g. cleaning, dry-cleaning, parking etc.). They often lack clear technological advantages and network effects. They will come under pressure to demonstrate strong growth and/or profitability in 2017 and 2018. VC that funded them generously in 2014, 2015 will want to see results in 2017/2018. If growth and/or profitability is weak, we could see some layoffs.

Bottom line, there wont be a Dotcom 2.0 bust, but a mixed picture of some very strong firm and some highly publicized blow-ups. I doubt the blow-ups will have a strong effect on SF real-estate as they still remain relatively small (<100 employees).

And why, exactly, is Uber in the first group and not the second?

They loose boatloads of money – we think, but they’re privately held, don’t have to tell and pretty much follow thru on this non-obligation, don’t have any particular assets in the way of patents, employees or physical plant, have mostly made a name for themselves alienating ever conceivable interest group from governments round the world right thru to their own contractors (to the extent that the contractors can be called “their,” that pesky lack of assets thing, again).

Mostly they seem to be in that rare universe of Too-Hyped-to-Fail.

Naked Capitalism did an amazing series of articles on Uber. It’s basically a play by billionaires to scam their drivers and ignore local law to develop a monopoly situation. Thing is, their financials are actually declining…they are not winning from a numbers standpoint. If they try to shiv their “contractors”, I can see their supply of workers dry up until, perhaps, self-driving tech takes over.

1) As I mentioned above, Uber belongs into the group of companies that have strong network effects. The more riders and customers they have, the more data they gather, the more efficient and less expensive their service gets. Now, I’m not an Uber fan. Of course they have challenges ahead and their management has been more than boneheaded recently, but we’re not going back to standing on the curb, waving for cabs, are we?

2) If you don’t believe Uber belongs into Group 1, swap it for Salesforce, Apple or even Dropbox. I think my overall point about the ‘two groups’ of companies still persists. Group 1 has considerable tech or network advantages. Group 2 has neither. While nobody can tell the future, this is what I would pay attention to when thinking of who will go belly up over the next 2-3 years.

“As I mentioned above, Uber belongs into the group of companies that have strong network effects.”

Does it really?

As a user, I find I can switch from Uber to Lyft effortlessly. While traveling, I’ve even used 3rd and 4th tier local ride sharing services I’ve seen advertised on bus stops. I use the promo code, install the app, input my destination and get a ride. I see no lock in or network effects as a user. In fact in SF and many cities, I’ve noticed that increasingly even the drivers I get have both Uber and Lyft equipment in their cars, so even the service I get is commoditzed.

The drivers hardly seem tied into or loyal to Uber. Google maps and Waze have routed me very well to many of my destinations for years, so I’m not sure what they’re getting out of their “data”.

“Salesforce, Apple or even Dropbox”

Apple has clear network effects. Dropbox is nice, but I also use google drive and have friends that use iCloud drive, Box and a few of the 3rd tier services. If Dropbox shut down tomorrow, I’d just move my files and be done.

That’s why I think that some of these are tech-less “tech” companies. So many other companies have essentially equivalent products. They’re all trying to achieve network effects, which I think is an important distinction from trying for a technical advantage, but not all of them really do have network effects.

Facebook would be useless if your friends weren’t on it. The gap is shrinking, but it’s still a pain to move all your media, apps and data from Apple devices to another platform. A Twitter clone that no one followed would be useless. These are clear network effects. But the others? Not so much.

At least Uber was first to market in their category, and much better known in wide circles than any of the other “app taxis”. And with the lack of quality in the Taxi services in most of the world there is a market for their product, but of course it will be met with a lot of criticism from traditional taxi services.

Now Twitter on the other hand does not have a unique product, do not make a profit and the only reason we know about them is because they poured millions into advertising by celebrities from all walks of life.

anon2, those are fair points that you bring up. While I agree that there are no major costs of downloading a new ride-sharing app, the real network effect comes with routing. This applies mostly to Uber Pool, when the system has to link riders and drivers in split seconds and calculate the optimal route. While a Lyft is a solid alternative, it will be very costly for new market entrants to build up that experience from scratch. Secondly, self-driving cars will increase the network effect of routing systems, as they increase the complexity and reward the largest providers with lower operational costs. I personally believe Google will be best positioned to rival Uber here (but that’s another story).

Dropbox has lock-in effects when it comes to small businesses. More and more start-ups are hosting all their files on Dropbox folders. Once all your files are on it, you are unlikely to changes providers and migrate all your files just to save a few $ here and there. Also, once your team is familiar with the OS, you are unlikely to switch for no reason (this is why we’re still seeing Windows everywhere). They also have strong rivals (Box, AWS) and the winner of cloud hosting services is still to be determined. But Dropbox has some network effects for it’s users and solid cash flows (from what I’m reading).

Also, if you think Dropbox has no tech, then you don’t know much about Dropbox. Their tech is outstanding.

“Also, if you think Dropbox has no tech, then you don’t know much about Dropbox.”

I talking about tech from an investment point of view.

The pitch of many of these new wave tech companies is that while they are currently losing money now, they have these intangible technological assets which will make money later. So if you’re being asked to pay top dollar for some black box which will supposedly spit out lots of money sometime in the future, it’s worth thinking hard about just how valuable that black box is.

And as I pointed out in the app example, the economic question isn’t how hard it would be to produce something starting from scratch, but how many other could produce something (an app or service) vs what the demand for that is. Now with an app trying to get a $1 price point the bar is much lower than a company trying to hit a $10B valuation, maybe ten billions times lower!

From a customer facing POV what they have, file synchronization, is now almost a commodity to non technical users. Microsoft, Apple, Google, Amazon,Box and many 3rd tier competitors provide much the same service.

From a backend POV, for most of Dropbox’s existence they used Amazon as their backend. Recently dropbox has been developing their own cloud backend to replace amazon. But building out a cloud server farm in the mid 90’s when Amazon got going was cutting edge, builfing out a cloud server farm now to cut out Amazon’s margin is reactionary.

And Amazon here is the exception that proves the rule. If I run a store that loses money because I sell every item for less than my cost, then all I have is a terrible business. But if you lose money because you are developing automated warehouses, logistic technology and a scaleable cloud infrastructure that will give you a strong advantage in the future, then you actually have produced a money making “black box”.

Is it possible to buy into Dropbox as a regular investor? Which stock exchange are they on?

The key point is that with technology, like art, the skill and effort it takes to produce it and it’s economic value are two very different things. And if you’re arguing that the bay area will forever keep it’s high economic moat, you need to show both that things get built here that can’t be built anywhere else and that these things have high economic value.

Now to your specific question. Dropbox isn’t public yet, but there are secondary markets. I believe that EquityZen ran/runs one and people make private deals. But keep in mind that in addition to the business risks of the company you’re investing in you’d have all these additional risks of pricing transparency, counterparty risk, legal issues (many employee agreements prohibit these types of transactions, whether companies waive or ignore these clauses can vary) and risks of ownership structure ( these transactions may not technically involve you buying and owning a share, but rather owning a share of a fund that has the economic interest equivalent to a share or being party to an options contract giving you the economic value of a share).

Caveat emptor!!

I agree that I would expect better disclosures before investing in Dropbox, but they are making a product that many companies are using and benefiting from. I don’t know if they are making a profit, but I would expect that they are since they are more substance than hype. They have competition, but that doesn’t mean that they can’t be the market leader.

There are definitely tech companies that does not fit this category, I just think that you chose the wrong one to pick on!

Some wishful thinking and/or denial here I think. My large worldwide company is very solidly in your first group. We have not brought any new-hire engineers into our original bay area complex for at least the last 4-5 years. We hire from top level schools into 2 other campuses in very desirable US locations and one Asian campus. I posted this in another thread here a while back and was ridiculed by a number of other posters who seem to refuse to believe it. I simply won’t give any more information than that. But it is true and I am sure we ares not the only ones.

It was increasingly difficult to get good talent due to the cost of living and this way the company saves money too. Win-win as they say. No judgement from me about what kind of trend this may be or what impacts, if any, such a trend might have on real estate. It’s just a fact. I was hired as an engineer in 1999, now in management. It works really well. With today’s tools there is no reason to be in the same location. We lose nothing in collaboration. And with the large Asian center to compliment the US, we gain in having basically 24 hour development and QA.

Nothing new in what your company has been doing. I knew SV companies in the 1980s that were doing that. Folks have been complaining that the costs in SV were too high to get talent for generations. Cheap and lazy argument.

Of course it makes sense to grow in other geo areas if you are big enough or the economics are favorable. Google is growing in LA. Snap has a small office in SF….And there is this little company named IBM that has run their development from widely scattered facilities for 40 years or so. Not to mention that has been common in the defense aerospace industries since WWII. It’s a strategery.

While your company was not hiring engineers in the Bay Area, other companies were hiring all they could get. The population of Santa Clara County, San Mateo County, and SF have grown by something like 200,000 in that time.

FWIW, half of the population growth of the Bay Area for the past ~50 years is immigrants. How many of your Bay Area located engineers were not born in the USA?

Building large scale software is still incredibly complex, and complexity exponentially increases with the amount of people contributing to it. “When someone says “I could build that app in a weekend!” I think of this chart of how Slack decides to send a notification”

Exactly.

Slack is a great example! It looks pretty simple. Hint: it’s not simple.

so, a tree of ‘if “x” then {y}, else {z};’ operations? unsolvable! You’d probably have to spend at least two hours at your local elementary school before you found someone who could code that.

in this case the work is not in the encoding of the algorithm, it is in finding an algorithm that fits millions of users with potentially billions of usage patterns within the constraints of platforms (mostly mobile) that run big piles of buggy code from other vendors. And making your wee little algorithm work within the code of a product which is changing daily and can never ever be exhaustively tested. Fun work if you can get it and keep up with it.

If Slack was so easy to build, why didn’t someone do it sooner? And why wasn’t it done by an elementary school aged child?

yeah, good point. And that chart is actually fairly simple compared to many comm protocols. Too bad [President Trump] doesn’t have such a decision flow for his twitterdämmerung.

Slack is total BS

But people can and do build apps in a weekend.

And that’s not because it wouldn’t be incredibly complex to build an app from scratch, but it’s because people don’t build apps from scratch. Apple has done a huge amount of complex work to provide a platform, OS, IDE, Interface Builder and code libraries which encapsulates much of that incredible complexity. But the downside to having someone else do all the ground work so that anyone can build an app over the weekend, is that your competition becomes anyone who has a free weekend. And then supply and demand kicks in.

And thus you get the economics of the app economy where Apple reaps much of the profit and the app developers struggle to maintain a 99¢ price point.

Trying to build a large scale web site with just a copy of K&R in your hand and gcc on your laptop would be a herculean task, but that’s not how things are done. But the harsh economic reality is that if it’s easy for you to outsource the complex scaleable backend tasks to Amazon’s cloud then it’s just as easy for any wanabe competitors to do so.

I’m not trying to denigrate large scale software engineering. Many open source projects have achieved incredible things from teams distributed all over the world with members who probably have never met face to face.

But the flip side of this is that if you can achieve this with people distributed all over the world, then what’s the economic value of trying to corral all these people in an area with an extremely high cost of living?

“many of these recent “tech” companies is that they in fact have no real technology.”

I think this is quite false. It’s true that some companies have no real technology. Most of those companies will stay small and aren’t consequential anyway. The more valuable companies have very valuable technology.

Which of the unicorns have no real technology?

The irony is that Snapchat, the only one of these companies that was able to go public recently, is not even located in the SF Bay Area. And the stock erased all of yesterday’s gains today. I’d say it’s a no brainer short, except for possible buyout rumors.

That’s my point here. I do think that the valley is uniquely situated to foster certain types of multidisciplinary tech companies. But for many of the recent tech companies, their real product is actually their shares. And the main benefit of situating these companies in the bay area was the cachet of silicon valley. Kind of like making a bad wine in Napa and having it sell well across the Midwest merely due to the Napa appellation.

But SNAP has shown that these tech-less tech companies can be both built and sold off to the public in places other than the Bay Area.

As an aside, that’s why it’s such a shame that Theranos was a sham. If you truly had a breadbox sized device that could run a battery of tests on a drop of blood. That would be technology that required the interplay of software, hardware, statistical, medical, analytical chemistry and operations skill.

Love it that Saddie is giving tech business investment advice. Everyone: it’s a great bet to do the opposite of what he says. A stopped clock though….he’s right about Snap.

If we want to really understand the dynamic, the next step would be to:

1) Split the data by condo vs SFH

2) Split the data into 3 (or more) price tiers.

3) See how demand and supply have changed for all these sub-segments.

My hypothesis:

1) Rents and condo prices have started to decline. Tons of new condos in SF will hit the market in 2017. Some condo buyers are delaying purchases to see how far prices will fall.

2) More and more SFH have been remodeled to cater to luxury segment. Inventory of luxury SFH (+2.0M) has increased significantly, outstripping demand. On the other hand, demand for SFH for less than 1.0MM is still very strong in Southern neighborhoods of SF and East Bay.

I’d love it if Socketsite would look into these data segments further

i would love to see a further breakdown of condos. studios and 1 bdr vs, 2bdr vs. 3or more bdr

As well as location.

Shot in the dark: people finally got sick of the homeless people crapping and throwing garbage everywhere.

Or having the windows of there car broken out constantly? Maybe. But Oakland has lots more homeless living under freeways, tons of petty crime, and its sales do not appear to be down. So probably something else…

Oakland real estate prices are up 10% over the last 12 months while SF home prices have gone up just 1% in the last year according to Zillow. Also, San Francisco still has many more homeless people than Oakland although Oakland’s numbers have increased in the last two years. There is more demand for housing in Oakland and very little new inventory. That’s why there’s been a 10% appreciation in the last 12 months.

The curious situation of SNAP is that in the unlikely event if it takes off (i.e. it generates real earnings wrt price, instead of being a fraud-based enterprise like some notorious local companies), SoCal and points beyond become stronger draws away from Silly Valley. And if SNAP tanks, it takes down a lot of overvalued tech along with it.

oddly, Snap positions themselves as a camera company. I wonder if they will go through a similar rise and decline as another socal social camera company, Go Pro. From snap.com: “Snap Inc. is a camera company. We believe that reinventing the camera represents our greatest opportunity to improve the way people live and communicate. Our products empower people to express themselves, live in the moment, learn about the world, and have fun together.”

It would seem to me that Apple, Google, Samsung, and Facebook might have some influence on how people use cameras.

Just because SNAP IPO-ed recently, is it really the poster child for a ‘successful’ tech company outside of Bay Area? The big elephant in the room is Amazon. They are the living example that you can build a world class tech company outside the Bay Area. With the moderate living costs and vibrant tech sector, Seattle will keep on growing at (probably) higher rates than Silicon Valley.

Exactly. Don’t forget Microsoft. Founded in the SV, its home has been the Northwest for a long time now. Seattle is experiencing huge population and job growth that even 5K new units of housing/year can’t keep up with. As a RE investor that is where I placed my bet a number of years ago.

The assumption that SV is immune from significant job relocation or simply jobs being established in other tech sectors is dubious.

SF is experiencing a drop-off in demand for homes and condos relative to other BA counties but, beyond that, the BA is lagging other emerging metro areas in job and population growth and price appreciation. There is no sign that will change in the medium term future.

Microsoft was founded in Albuquerque, NM by way of Harvard. They famously avoided opening a SV office for many years even while they were pilfering key talent from their Bay Area rivals. Aside from a small research group in SF, I don’t recall them having a significant SV presence until they bought webtv in the dotcom, but they may have as they bought many key technologies from our warmer climes.

For all the population growth Seattle way, the SF Bay Area has more population than the entire state of Washington and the Santa Clara valley has more computerish engineers than the states of WA and OR and the province of BC combined. But yeah, there are sw and hw elves toiling in communities around the globe. A very outsized percentage of the profit is made by Bay Area companies, though. Consequently, a disproportion of the VC investment is in the bay area, all of which makes SV ride the tiger of the computerized marketplace more than any other major population center in the USA.

SV loses jobs whenever the tech industry has a recession, which has been about once a decade for the past 50 years. You can look it up.

genius, so lose-lose game for SF Bay area?