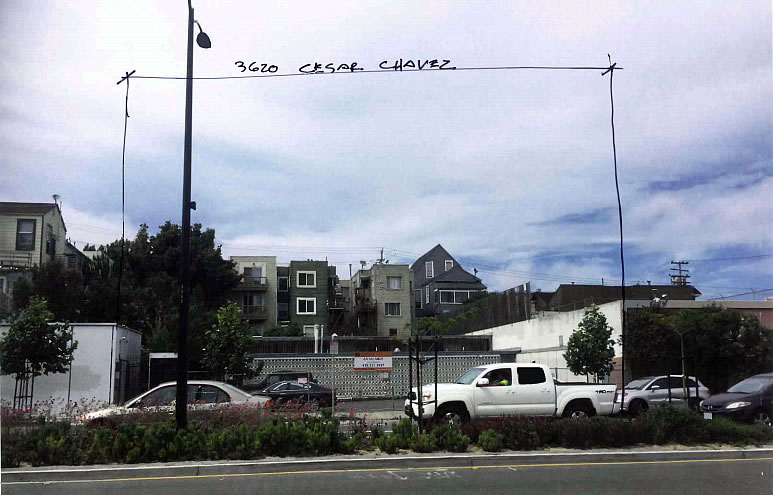

Approved for a 24-unit development to rise up to six stories in height on the Mission District site, with 20 two-bedrooms and 4 one-bedrooms over a 761 square foot retail space and a garage for six cars, the 3620 Cesar Chavez Street parcel and plans are now on the market with an $8 million price tag.

Not including the commercial space, the asking price works out to roughly $333K per buildable unit, a sale at which would be a near-record-setting price (for the neighborhood) and significantly above the going average rate while new construction pricing and sales are on the decline.

We’ll note that the paperwork to request the required building permits for the project was filed last July.

Why build if you can make all the profits on a Hail Mary?

Kinda wish they were taking out the awkward pharmacy building next door in the same swoop

Well, we can all rejoice in the fact that this will be a parking lot for the foreseeable future.

This site has been empty – and the adjacent pharmacy little-used and dilapidated – for at least the last 15 years. Oh well, what’s another few, or 5, or 10…

Another entitled and, in this case, building permit in hand, project put up for sale. Given the area and the slide in new condo prices the asking price seems totally unrealistic. Most likely the owner knows they will have to settle for a lot less than this near-record price.

At 333K/unit just for the entitled land, any idea what it would cost to build the proposed structure? What that would bring the cost/unit to? How much above that base cost can the units be priced for in a declining market is the question.

The current owner’s cost basis (land) would be less, but even at that, the final ROI was apparently not good enough. Good luck in finding a buyer short a steep price discount.

Editor, what was the price paid by KB for the Bush and Divisadero project? As I recall, the price per door was higher than the “record” (plus it was partially entitled, unlike recordholder)

On Bush and Divisadero, I believe KB Home spent $38.5 million for 81-83 units entitled which works out to $463,000 per unit. I live/develop in that area so know the market well in these parts. I think TMG sold it to them and had paid $8.5 million for the lot, knocked down the old hospice (where I used to park one of my cars) and promptly flipped it for a HUUGE return. Sell out was probably around $1200/sqft blended and average unit is around 900 sqft so, if you do the math, not such a great return for KB given it took 5 years to complete…