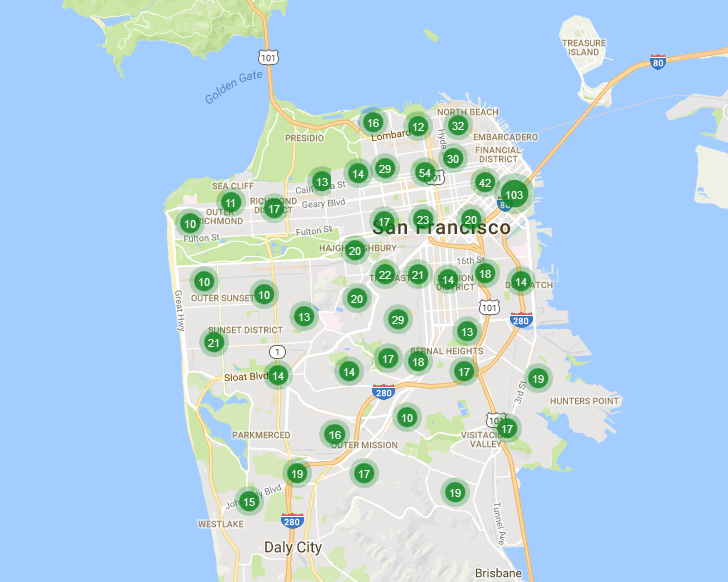

With the number of single-family homes and condos listed for sale in San Francisco having ticked up slightly over the past two weeks and now holding at around 900, which is the most active inventory since the end of 2011 and 27 percent higher versus the same time last year, the inventory level has likely peaked for the year.

But both the number (190) and percentage of listings for which the asking price has been reduced at least once should continue to rise through November.

At a more granular level, the number of single-family homes currently listed for sale in the city (350) is currently running 25 percent higher versus the same time last year while the number of listed condominiums (550) is 29 percent higher, year-over-year, goosed by teaser listings for new construction units, the vast majority of which are not included in the aforementioned counts and the inventory of which has ticked up to 1,200, which is 80 percent higher versus the same time last year, while the pace of sales has slowed.

In terms of pricing and expectations, 21 percent of the active listings in San Francisco have undergone at least one price reduction versus 17 percent last week and 16 percent at the same time last year. And of all the homes currently listed for sale in San Francisco, 40 percent are currently listed for under a million dollars (versus 42 percent at the same time last year).

Expect listed inventory levels in the city to drop through December and begin climbing anew in January.

With inventory having been so tight for so many years, what is motivating sellers to part with their properties all of a sudden?

don’t know about “all of a sudden” but…

there have been a few sales on my block this year, 3 by owners cashing out for early retirement, 2 of 3 moved to europe and were in their later 50’s. 2 others appear to be job transfers. a higher end developer construction sits on the market and a multi-unit building is attempting to trade hands again for the 3rd (?) time in 6 years at what seems like an aggressive gain.

It’s more likely that purchasers are more trepidatious with the looming bubble….

September MLS sales were up YOY, so that does not appear to be it. More sellers, but also more buyers. My guess is some sellers have decided to pull the trigger to cash out given prevailing really high prices and indications they aren’t going to go up a lot more in the near future. A good time to sell.

Saying that inventory is peaked is a bit presumptuous. Although one cannot specifically call where we are in the market cycle, it is not the beginning. This is a bubble my friends. By any definition prices have risen because of asset inflation alone, not fundamentals. Inventory will keep going up a lot.

Miyagi…dude… Let it go. You’re like a dog with a bone. Everything you post on here is bearish about SF real estate. It’s fine for you to have this pov, but why in God’s name do you camp on this site to post your negative views constantly?

I think Miyagi balances out the perspectives…there are others on here that are so bullish or seem to be seeking any type of data that proves the market is holding steady.