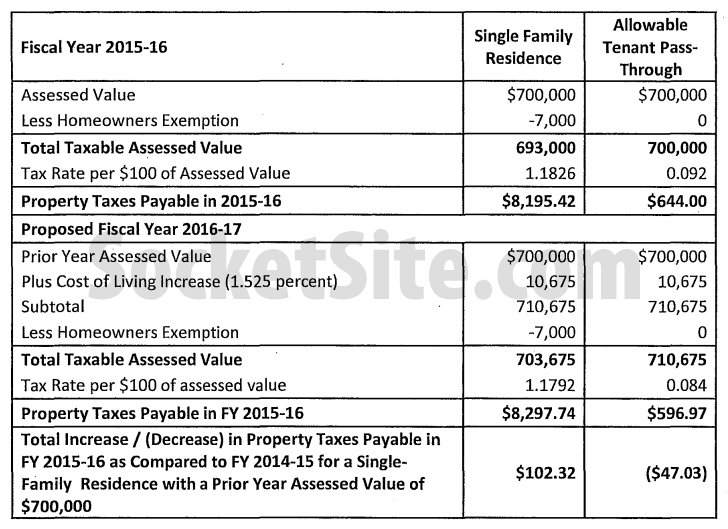

Aided by rising property values and assessments, the property tax rate for the City and County of San Francisco is slated to drop from $1.1826 per $100 of assessed value in the current Fiscal Year to $1.1792 per $100 of assessed value for Fiscal Year 2016-2017, a decrease of 0.29 percent.

For properties that haven’t changed hands or been improved, assessed values will increase 1.525 percent over the next year, which is 0.475 percent under the maximum allowable increase of 2 percent per year thanks to Proposition 13.

And the proposed pass-through rate to residential tenants will drop to $0.084 per $100.00 of assessed value for landlords, down from $0.092 in the current fiscal year.

A breakdown of how the property tax dollars collected in San Francisco will be allocated in 2016-2017:

Huh? Is it really possible that 1.0136/1.1826 – a whooping 85% – of the dollars go to CCSF, or is maybe the “General Fund” what its name suggests and not a part of CCSF?

The General Fund is for the City and County of San Francisco, as indicated in the table.

OK got it, thanks…I was reading it as City College of San Francisco (which I will assume is indicated as SFCCD instead)

They fail to mention the parcel tax increase that won this past election to “save the Bay” and the coming parcel tax increase for the Bart Bond. Rediculous, IMO.

So the tax rate is going down but the assessed values will be going up, resulting in higher payments? Thanks for nothing.

Yeah, damn that inflation! Damn those rising property values too! We shouldn’t have to pay to get government services!

I’m guessing you don’t own any property in SF or you’d realize people who do pay plenty and may think it’s enough.

Yes, exactly what I said – I don’t want to pay for ANY government services – nice intelligent reply, taking a comment to the illogical extreme and completely missing the point. The point is the City collects more than enough taxes for its budget, which it mismanages. Dumping more into that hole at the expense of the middle class families who managed to buy a home in SF and are trying to raise kids here helps the salaried bureaucrats and no one else.

I simply, utterly don’t understand. Given the continued underfunding of certain budget items – transit, Recs & Parks (just look at the shoddy state of GG Park and other areas under the city’s control), streets (I’ve been on gravel roads that are a smoother drive that many city streets, esp. Geary west of Divisadero) – why would the city *not* take full advantage of the allowed 2% increase under Prop 13? And why would it reduce the assessed rate? Not that I want to bilk every dime from every home owner; but the fact is that we have a lot of underfunded services here, and it’s not like the city can bank the delta on the Prop 13 2% increase for future years.

Prop 13 limits the annual assessment increase to the rate of inflation, or 2%, whichever is lower. The inflation rate this year was under 2% so the rate was limited to inflation.

This city has tons of money. If they stopped overcompensating their workforce we might actually have some money leftover for the citizens.

Are you saying Ed Lee doesn’t deserve $400k per year?

I think (s)he’s saying Joe or Qinang Whoski doesn’t deserve $300K (PLUS a 50% pension and free med for life)

Even if 100 employees make an extra $100,000, that’s still “only” $10,000,000 – which while a lot to you or me, is a drop in the bucket compared to the city’s overall budget, and also insufficient to explain or offset the big funding gaps in transit, Rec & Parks, and other non-homeless-outreach aspects of the City’s budget.

10mm of extra payroll for mid-career functionaries as a financial liability for the city can be considered a perpetuity.

Perpetuity math is simple: the annual cashflow divided by the relevant interest rate.

What does SF pay in the muni bond market? 3%? 2.5% $10mm/.03 = $333mm as “balance sheet” item. So, $100K for “only” 100 people, is indeed pretty significant as a liability the city has to fund forever more.

And who says it’s only 100, perhaps it’s more like 5,000-10,000 > $500M-$1B. Obviously a lot of arguing can go into deciding what is/isn’t “extra” but methinks you’re lowballing the number greatly.

Excuse me while I go to the window to watch 4 or 5 City/County employees stand around doing nothing most of the day at a street/sidewalk project.

Don’t worry guys. The tenants’ pass-through tax rate decreased by almost 9% so voters will love this.

thank Jarvis for Tax Control

A little bit of tax relief is always welcome in this city & state.

What I could never, can never and will never understand is why, in a fast-growing economy, the government absolutely *needs* tax RATES to go up.

Tax revenues will increase anyway as the economy grows.

Why on earth do tax RATES also have to continuously rise?

At least tax rates are discussed in percent per $100 assessed value instead of “mills” per whatever. The old mill rate game… Then there’s the old ploy of starting out at 25% of value and proceeding from there. Just layer upon layer of smoke and mirrors to keep it confusing so people won’t pay attention.

Huh. A rate of 1.1826% doesn’t seem so bad, compared to other comps around the country (see below). As a native Californian who voted for Regan, I find myself rolling my eyes at the recent spate of neo-libertarian talking points being righteously and indignantly bandied about on various media sites re: California property taxes and services. Different decade, same old spiel.

Hartford, CT – 2.038%

Burlington, VT – 1.686%

Atlanta, GA – 1.144%

Portland, OR – 1.162%

Seattle, WA – 1.025%

And the property tax rate wouldn’t be bad if property taxes were based on the market values of those cities. The problem is that we have market values that are much higher along with a protected class of property owner that pays taxes on a historic valuation. Great for older folks (and companies), not so great for younger folks and people who like to move.

Wikipedia has a good overview of Prop. 13 and the conditions at the time that brought the measure into being. It also has an analysis section, of which its interesting to note the ‘Negative Effects’ section related to higher housing costs and decreased mobility was heavily edited – without proper citations – in October 2015.

Does anybody know the increase in assessed value for FY 2017-2018? Is it the full 2%?