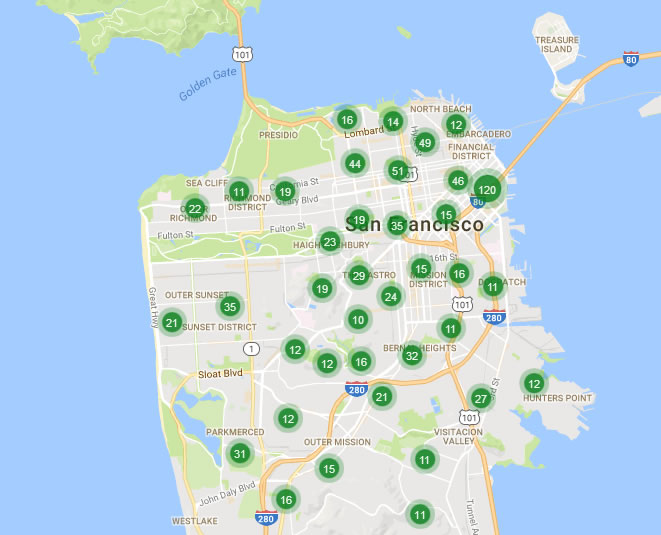

While recorded sales activity in San Francisco ticked up last month, the pace of new listings has ticked up even more. And the number of single-family homes and condos listed for sale in San Francisco now totals 885, which is most at any point in time since the end of 2011 and 31 percent higher versus the same time last year.

Keep in mind that our count above doesn’t include homes that are for sale but currently unlisted, such at the Mrs. Doubtfire home at 2640 Steiner Street, nor the vast majority of new construction condos available for sale across the city (the number of which has been hovering around 1,100 and over 50 percent higher, year-over-year).

At a more granular level, the number of single-family homes currently listed for sale in the city (350) is running 28 percent higher versus the same time last year while the number of listed condominiums (535) is running 33 percent higher.

And in terms of pricing and expectations, 18 percent of active listings on the market have undergone at least one price reduction versus 10 percent at the end of September last year. Of course, that doesn’t include an accounting for homes like 50 Oakwood, the asking price for which has been reduced a million dollars but the listing for which was withdrawn from the MLS and then relisted anew.

Expect inventory levels to continue to tick up through October and then to start dropping through the end of the year while the number of listings for which the asking price has been reduced (155 versus 65 at this time last year) should continue to rise.

“Homeowners making moves out of state are increasingly selling out of expensive markets like California, where price escalation is steep, and buying into lower-cost markets such as Texas and Arizona, according to an analysis by data company CoreLogic.

Overall between 2000 and 2015, 2½ home sellers left California for every out-of-state buyer coming into the state, the study found…”

Goodbye California.

It has always been that way. California (SF and LA in particular) attracts people, shapes them, then ships a few out. It works as a heart of some sorts that spreads energy around. The same applies to NYC, London, Paris, etc…

Some times it will take more people in than it gives out, and other times it will be the other way around.

The heart analogy is an astute observation. World class locations are in the consciousness of many of the 6+ billion inhabitants of this earth. These destinations are a continuous draw to the ambitious, the worldly, the creatives, etc., etc. etc. Basically the best and brightest seek top locations.

I’m from podunk and did 2 tours in the big city in my 20’s. Three years in Manhattan, two in Chicago. Expanded my mind, I tell you. Expanded my mind. Living proof.

O noes, the bubble is burst? And I’m stuck in Brooklyn. I mean Oakland. Thanks techies!

The sky is not falling. In the medium and long term, SF real estate is a better bet than almost anywhere else in the USA and the western world. A correction perhaps. Remember when they said Paris could not go down? Well, it did, but just a little, and it is stable. That may happen here, but nothing worse.

I’m going to start clipping these comments for the crash.

Is this 2007 again? Maybe. Probably.

We’ve been hearing the crash is around the corner since, what 2011?

It would have crashed if it weren’t for QE. You heard Trump, the Fed blew another bubble, and they’re just waiting for the new president until they pop it. Hillary didn’t deny or even respond.

you’re quoting trump now?

I’ve said the same thing before, right here, and plenty of others are saying it too. But this time we heard it on national TV. I’m no Trump fan, but he has been in real estate business since 71, so this is not his first rodeo.

Note: the Fed is an independent entity. Hillary does not “defend” it’s decision making.

It’s so independent that Obama and Yellen had a closed doors meeting in April and we don’t get to know what was discussed.

So the President meets with the Chair of the Fed?? This is unprecedented! It must be a conspiracy!

UBS came out with a housing report today saying “excessively low interest rates that are inconsistent with the performance of the real economy are keeping home prices high around the world” and “a change in macroeconomic momentum, a shift in investor sentiment, or a major supply increase could trigger a rapid decline”. They listed the most bubblicious cities, and San Francisco was ranked #7 globally and #1 in the USA. But it’s probably just a conspiracy theory.

[Editor’s Note: San Francisco Market Approaching Bubble Territory per UBS.]

I like it when James Grant criticizes low interest rates and calls for a bond selloff. He’s been doing it cleverly, with good writing for the past 20 years…

I think I saw this same article in 2002. And 2008.

It’s cyclical and I’m ready for a pullback / pause. A rebalance is in order.

Long term prospects here remain outstanding. Maybe those who don’t own yet but are on the cusp of being able to buy will finally get a chance when the overheated tech boom here cools and the easy money flushes out further.

Trump did nail it when he aptly painted the Fed as creating asset distortion through easy monetary policy. Absolutely nailed it. It is undeniable unless you have no grasp of basic economics. Very few politicians would ever commit such blasphemy against the Fed on live television. Maybe only Bernie and Donald, stops there.