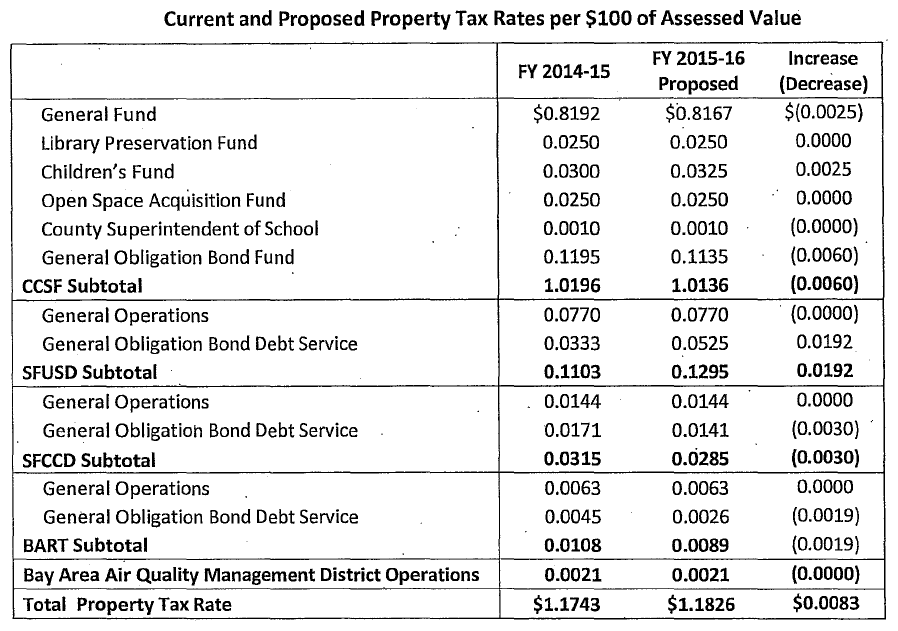

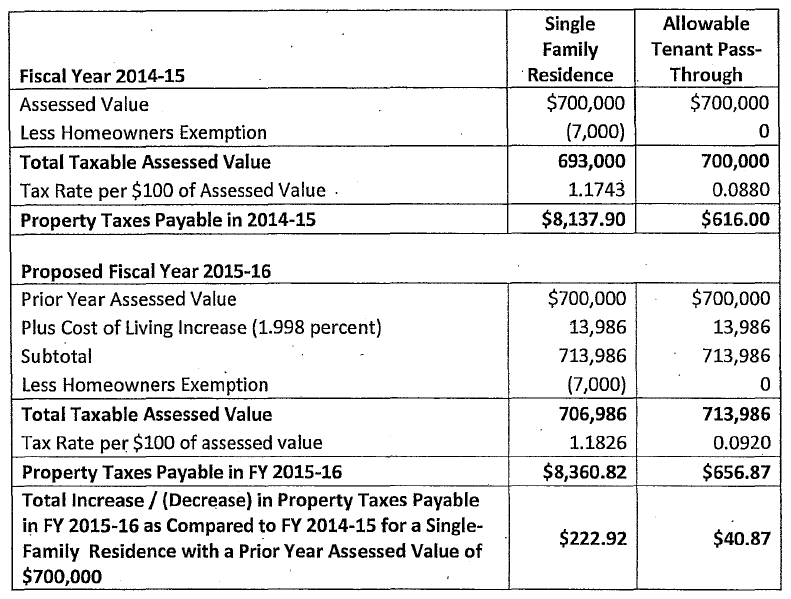

Despite rising property values, the property tax rate for the City and County of San Francisco is slated to increase from $1.1743 per $100 of assessed value in the current Fiscal Year to $1.1826 per $100 of assessed value for Fiscal Year 2015-2016, an increase of 0.71 percent.

For properties that haven’t changed hands or been improved, assessed values will increase 1.998 percent over the next year, which is 0.002 percent under the maximum allowable increase of 2 percent per year thanks to Proposition 13.

The proposed pass-through rate to residential tenants will increase to $0.092 per $100.00 of assessed value for landlords, up from $0.088 in the current fiscal year.

A breakdown of how the property tax dollars collected in San Francisco will be allocated in 2014-2015:

San Francisco’s Board of Supervisors is slated to ratify the new rates this afternoon.

What about all the money coming in from the Real Estate Transfer Tax?

Am I reading this right? $1.0136 tax dollar out of the $1.1826, or 86% of San Francisco’s property tax goes to where? CCSF? The unaccountable administration who run the institute into ground? Close CCSF now!

CCSF means “City and County of San Francisco” here.

I’m guessing that CCSF stands for City and County of San Francisco here.

CCSF: City and County of San Francisco; not City College of San Francisco. Acronym collision, though ‘unaccountable administration who run into ground’ (UAWRIG) may fairly apply to all of the above.

In this non-self-explanatory table, SFCCD is the San Francisco Community College District which includes the City College of San Francisco, aka notoriously UAWRIG.

How much goes to homeless entitlements?

$167MM per annum, the largest of any city in the U.S. according to the Business Times.

Problem with that data point is that SF is one of the few combined city/counties in the U.S. – and probably the largest city in the U.S. that is a combined city/county. A large portion of homeless services funding nationally runs through county governments – County Departments of Public Health and/or Human/Social Services. Which doesn’t show up as spending on the homeless by the local municipality.

For a true apples-to-apple comparison, you’d need to determine how much county funding for homeless services goes to provide services in those other cities. That is, how much of Cook County’s homeless spending goes for services in Chicago, how much of Suffolk County for Boston, etc.

Suffolk County, Mass. was abolished in 1999 (along with most other Mass. counties, I believe).

And of course NYC is made up of 5 counties, but I believe that its services are doled out at the NYC government level, not by the Counties of New York, Queens, Richmond [a.k.a. Staten Island], etc.

Plus policing and cleaning…plus the portion of CBD budgets going towards this scourge. Our city is a disgrace.

“policing and cleaning”. Is that what you were referring to when you mentioned *homeless entitlements*? Those lucky homeless people and all their entitlements!

I do agree with you that homelessness is a scourge and a disgrace to the city.

Policing and cleansing are byproducts of the entitlements, hence my use of the word “plus.” If the line items in the budget for the homeless population are not entitlements, what are they?

so what if they are entitlements or not? social security is an entitlement. and medicare. and veterans benefits. and the agricultural support programs. so what?

would you rather deny the homeless whatever meager benefits they receive? would you rather not have the policing and the cleansing?

@bioproducts–Exactly. The city has a total budget of $8.9 billion and homeless-related expenditures are less than 2%. A minuscule amount of the total. It astonishes me how many people fortunate enough to have nice homes in a beautiful part of the world (and time during the day to post comments online) can get so agitated about allegedly being screwed-over by “those damn homeless people who have it so easy”. Arguably, we should be spending much more and making a more serious effort at solving the problem. Nobody here seems to want to do anything about it, other than give them one-way bus tickets to Vallejo or Antioch.

San Francisco is a fantastic place. It is also an urban city with urban problems that must be dealt with. For those desiring a gated community with a uniform wealthy demographic, might I suggest Blackhawk or Atherton.

How does this relate to Prop 13? I thought it froze property taxes, but admittedly I know next to nothing about the details.

[Editor’s Note: As reported above, “For properties that haven’t changed hands or been improved, assessed values will increase 1.998 percent over the next year, which is 0.002 percent under the maximum allowable increase of 2 percent per year thanks to Proposition 13.”]

The distinction is between the rise in assessed value (limited by Prop 13) and the rise in the assessed rate (the tax rate levied on your assessed value).

And the assessed rate is also limited by Prop 13.

Base tax rate frozen at 1% – and the override factors above the Prop 13 base 1% are determined by debt service this year for voter-approved General Obligation bonds. It is the voter-approved GO Bond debt service among taxing entities that affects the added tax rate above the 1% fixed rate.

How much goes to SFPD? Jane Kim just visited our building and told us our tax money wasn’t enough for SFPD to patrol our area and tell the homeless to stop bumping and grinding in our alley all times of the day.

Just give the “bumpers and grinders” Jane Kim’s address, and tell them that they can go bump and grind at her place, and not be hassled for it the way you’re gonna hassle them.

decreasing money to BART ?!?! nooooooooooo

Another reason why rents continue to go UP, UP, UP!

Actually, no. Owners of market-rate units are already charging as much as the market will bear.

And if anyone wants to assert that that the level of property taxes here reduces the amount of new supply, they can explain why our pipeline currently has more market-rate units in various stages of development than at any time in decades. And link to an article quoting a single local developer saying that property taxes in San Francisco are killing development.

For the record, the increase in the property tax rate equates to an additional annual burden of $8.30 per $100,000 in assessed value. The price of 2 lattes at Starbucks.

Be nice if some of it went to ongoing pothole-type fixes so we didn’t have to have all of the major thoroughfares under construction at the same time because The Mayor only fixes infrastructure when a lump of federal dollars can be wheedled.

CCSF is not an acronym. It’s just initials.

“Despite rising property values”? This sentence implies that the tax rate should decrease or remain the same. Given that there is an explosion of wealth in real estate, that Prop. 13 constrains property taxes unreasonably, and that there are several legitimate needs for the funds (Pick your faves: Police, Potholes, Homeless, Cleaning up after the Homeless), is it so crazy or greedy that the government that serves all of our needs should ask a fraction more?

+1

That first sentence ruined the rest of the piece.

@daved–Yeah…despite home prices having appreciated well over 10% in the past year, the tax burden shown in the example presented in the article increased by 2.7%. The article seems to incorporate the assumption that the cost of operating the city and dealing, dealing with social issues, etc. increased by no more than 1.998%.

The only two categories receiving a higher allocated tax rate are general obligation debt for the City and County and a much smaller increase for the Children’s Fund. Both of those would have been approved by voters.

You had the chance to tax institutional growth, business, and development of high end residential

the SF Planning Commission bailed, and split it 33/66 with 66% paid for by taxpayers, 33 by business and development interests on transit… now the reality hits and people want to close CCSF ridiculous, instead shut down the expansion of the central subway project and its overruns and mis-appropriated funding by city agencies.