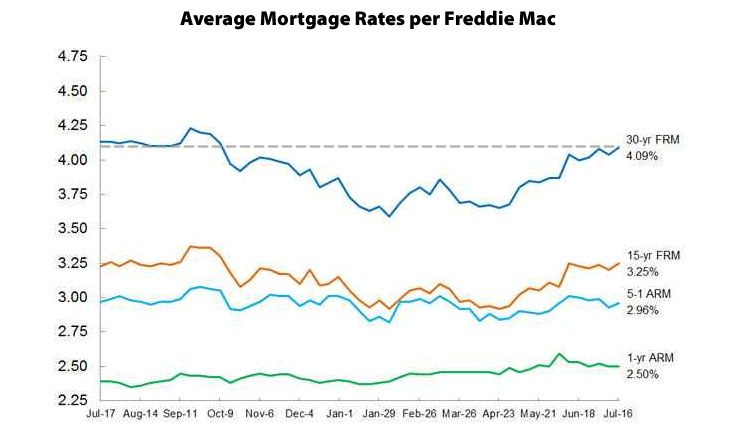

Having crossed the 4 percent mark for the first time since the fourth quarter of 2014 last month, the average rate for a 30-year fixed mortgage has ticked up to 4.09 percent, the highest rate this year and within 4 basis points of the 4.13 percent average rate recorded at the same time last year according to Freddie Mac’s latest Primary Mortgage Market Survey.

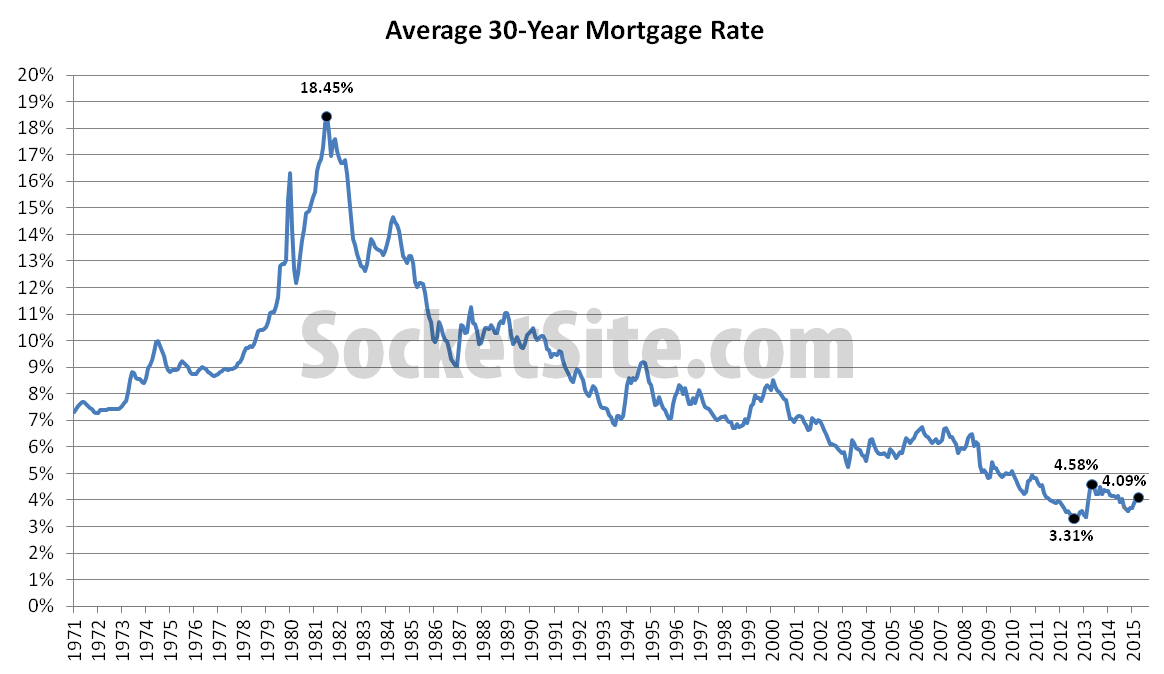

The 30-year rate, which hit an all-time low of 3.31 percent in November 2012, and a three-year high of 4.58 percent in August 2013, has averaged roughly 6.7 percent over the past twenty years.

Probably will bring a rush of buyers to the market as there is this fear of missing out. It’s unlikely interest rates will go much higher from here though.

We are in the perfect scenario for rising home prices in SF for the next 5 years.

[Editor’s Note: Median S.F. Home Price Hits A Record $1.15M And Sales Slip (Again).]

They should cool off the market and push rates higher. Give people a taste of reality. I’d love to see 5% and have the markets remain stable. It would be a good long term economic signal. Also, high rates spurs a lot of refi activity when the market drops. It’s all a very complex game at this point.

I personally never saw interest rates going below 5% and they did!!