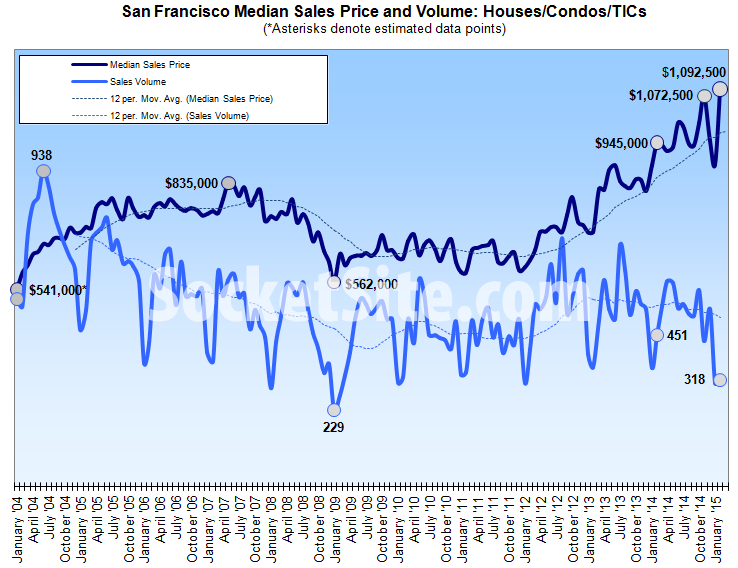

Having hit a record high of $1,072,500 this past November, the median price paid for a home in San Francisco dropped to $885,500 in January but returned to a record high $1,092,500 in February, a 23.4 percent jump over the past month and 15.6 percent higher versus the same time last year.

That being said, while the inventory of homes for sale in San Francisco is currently higher on a year-over-year basis, recorded home sales in February were the slowest since 2009 and 29.5 percent lower versus the same time last year. And while home sales did increase 3.2 percent from January to February, that’s 11 percentage points lower than average for this time of the year.

Across the greater Bay Area, homes sales dropped 1.4 percent from January to February and are down 10.9 percent year-over-year, the slowest February since 2008.

The median price paid for a Bay Area home in February dropped 1.2 percent from January to $565,000 but remains 4.6 percent higher versus the same time last year, the smallest year-over-year change in nearly three years. At the same time, the median price last month was 95 percent higher than the low-water mark of $290,000 recorded in March of 2009. The Bay Area median home price peaked at $665,000 in July of 2007.

At the extremes around the Bay Area in February, Solano was the only county to record a meaningful year-over-year increase in sales volume, up 17.3 percent with a median sale price of $318,000, up 21 percent year-over-year, the largest Bay Area gain. San Francisco’s 29.5 percent drop in sales was the largest drop by far, followed by a 17.6 percent drop in Santa Clara.

Keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) months prior but are just now closing escrow (or being recorded) and any properties that were sold “off market.”

And as always, while movements in the median sale price are a great measure of what’s in demand and selling, they’re not necessarily a great measure of appreciation or changes in value.

Ultimately, if you’re part of the percentage of people moving to the Bay Area, you might want to look into this Bay Area Movers company. Whether you’re moving your home or office, Bay Area Movers are committed to meeting all of your moving and storage needs.

There is a lot of product in the pipeline such as the 5 towers on Rincon Hill at or almost at the “topping out” stage. Perhaps buyers are waiting to see these units before making a decision.

The last SF “top” happened precisely at the time ORH and The Infinity were completed in 2008. Are we actually seeing the end of this cycle? 7 years seems a bit on the short side. I would give another 1-2 years before the pendulum starts to swing back.

The labor force bottomed out in 2005-6, and then the Magnetar Trade carried the housing market for another couple of years. Not saying you’re wrong, just watching the paint dry over here. At any rate, it will be interesting to see what happens when the VC money spigot gets shut off or we see a high profile failure. Anyone got an insiders view at Square?

Realtors blamed the calendar for low sales in January, rationalization this time? Too much rain?

Many foreign currencies have been dropping relative to the dollar. Which has made US real estate increasingly expensive to foreign buyers when measured in their local currency. This is probably driving down the number of foreign buyers.

Interest rates are going up a bit.

But on the bright side, European real estate is becoming very attractive again. Especially the South of France, with a combination of economic stagnation, lower euro, lack of buyer confidence.

My guess is most of the foreign buyers in SF are Asian mega-rich for whom the currency shifts don’t matter that much compared to the politics that has them worried. In cities like Miami where you are talking more about the upper middle class and “just sorta rich” from Latin America it may matter more.

brazilians have been driving the miami market and brazil is in a lot of trouble.

Sales have been sliding for a while. Is there any evidence this is having an impact on prices? Nothing significant that I can see at this stage.

Seems more likely that it’s the high prices having an impact on sales.

Maybe even pushing up the medium as the low end of the market has less price elasticity than the high end so generally rising prices cut out more low end sales than high.

i made a comment / reply to Denis that I think took the site down. Seems it also killed both comments regarding the penthouse?

Question for the editor .. having read SS for years now I have a meta-observation .. it seems like whenever there is mixed news about metrics, the SS headline (and content) are often presented as “Here’s something bullish .. but also something bearish.”

I want to point out that IF this is the case, the effect of using the word “but” and always “tempering” the positive afterward with the negative actually puts additional emphasis on the negative, whether it’s intended or not. There are psychological studies to this effect (Google will surely turn them up). To wit, if you compare the two statements: “It’s going to rain today, but I’ve got the day off” versus “I’ve got the day off, but it’s going to rain today” doesn’t one sound more positive and the other negative?

I point this out to ask, out of curiosity, if this is intentional, i.e. is there a slant or a desire to combat “hype” in the market (there are lots of sources of hype in the RE market ..) I’m not invested in the answer and don’t care which it is, I’m just curious if you’re aware this is creating bias the reader must consciously attempt to overcome. Also, I may have selection bias myself and not notice when the headlines read the opposite way, and am open to the possibility they do so with equal frequency. 😀

Maybe may brain is wired backwards and doesn’t track with the studies you’ve seen, but to me a headline that says “Sales Tank, But Record High Median Home Price in San Francisco” would sound more negative than the way it was posted. In any event the commentariat here seems so permanently bullish that I could understand if the editor was trying to temper the exuberance here (didn’t want to say “irrational” as that alone would probably precipitate a flame war).

I see “sales tank” and ignore the other stuff — that statement could be a trend and thus more indicative of the market than median home price. The house for sale at the end of my block still has not sold after sitting on the market for months just like my leasing agent’s overpriced rent controlled apartments.

Not sure about psychological studies but I have been taught to end on a positive note to give hope to my intended audience. But personally I want the negative news first because I need to address the situation and find a solution.

I think it’s the weather, sales seem to be picking up again.

It would be interesting to see the average unit size against this chart as well.

Price is hitting a new high. Volume is low. Low volume is generally true volume. If I saw a spike in transactions, I would have to be thinking about a capitulation high forming. However, there is NOTHING right now that tells me the trend is over. The trend is your friend.

“Low volume is generally true volume”

That makes no sense. High volume means more people validating price levels.

With very low volumes prices can easily be swayed by small numbers of people with uncommon circumstances.

That’s an observation over years. Maybe I should clarify – a spike in volume is a hallmark of trend change. It is exhaustion of smart money to dumb money. That can occur at a low or a high. I posit that the trend continues and I put my money where my mouth is.

Just basic web journalism in the tldr age. Don’t bury the lede.

People care more about price than sales and a “record” always is eye catching.

Nobody makes headlines like: Less interesting fact, but record important stat.

Kind of looking same, volume wise, YoY for March. It stands at 293 for 2014 versus 252 for 2015. And that’s at 7 a.m. on a Friday. I wouldn’t be surprised if 40 or more sales take place on a Friday as that’s kind of typical.

On a meta level, I’m surprised more older baby boomers aren’t putting their homes on the market and cashing out right now. Part of the low sales volume is the low listing volume….and it seems to me to be a really great time to sell if you’re willing to move to somewhere cheaper. Blame Prop13 I guess….staying in appreciated real estate is so damn cheap it takes a lot to dislodge anyone.

We are still in the middle of up trend. Price continues to go up, low inventory caused low sales volume and rising price.

Bay area population grows pretty fast and new home construction is pretty low still. SF has a lot of new condos under construction, hope they do not over-build. Builders always build too much at the wrong time.

“low inventory caused low sales volume and rising price.”

Well, no…

“That being said, while the inventory of homes for sale in San Francisco is currently higher on a year-over-year basis, recorded home sales in February were the slowest since 2009 and 29.5 percent lower versus the same time last year.”

can you dig down into the inventory, this year over last? what has been for sale, specifically? that’s how to make sense of YoY. If let’s say lots of condos have come to market in areas without wide appeal, how would that affect the perception of inventory?

Interesting idea, though you could ask the same thing about prices. Is the median just going up because of dropping volume in the low end of the market?

And like curmudgeon said it’s somewhat surprising that more people aren’t selling into the hot market to cash out. With the higher prices and quicker sales they’d get it seems there be more incentive for people in hot areas to add to inventory. I’m not sure what would make people in areas with lower appeal more likely to list their homes for sale.

i think the reason more people aren’t selling is the high prices. there’s no moving up. people would need to leave the area, or else size down?

Most of my neighbors are elderly ie. 70 yrs. old+ Too old to spend money on upkeep and too stuck in their ways to move. Don’t rely on the older boomers to do much unless they have some kind of life-changing medical event which forces them to move due to mobility problems.

The cognitive dissonance is amazing. 9 out of 10 posters on this site don’t even see this disastrous bubble. Nor, or course, recognize it was another massive tax payer funded subsidization.

There are three main central banks. In China, the USA, and in the EU. Since the crash of 2009, they continued the same policies of pumping the markets. We are now in the world’s biggest asset and credit bubble in history.

The USA fed, not only loaned at near zero interest rates over 12 TRILLION dollars to the same casino organizations, they also threw at least 4 Trillion of RMBS etc on the gov’t’s balance sheet. But yeah, gotta goddamn that rent control that protects some actual members of an urban community. Speculators love free markets, when centralized banking systems always back their bets. Which of course is not a free market. And speculators love the billions they get to deduct from taxes for…rampant gambling.

Indeed. The USA population, half of which claims they can’t last a crisis that will cost more than one thousand dollars, is finally waking up. You may reap, the anti social and vicious greed, that you have sowed.

The Atlanta branch of the Fed, just did a realistic number of .2% growth. That is near negative. Very close to a spiral. I only hope that all you that made millions off of flipping, have most of your money in stocks. My little hope. The big one, is that this depression coming, will lead to a real change in economics and environmental stability. And wrecks this two party corporate oligarchy. Many of ‘us’ will die and be jailed before then. We know that.

I can see obviously, that none of the posters on this site read those who predicted the 2009 crash: Yves Smith, William Black, Michael Hudson, Nomi Prins, Pam Martens, Ellen Brown, Grieder etc. But you’re experts, as long as the Fed has your back, and international capital fleeing other busts flows in. Then us the working, and middle class will get austerity, and more police….to pick up the pieces.

I agree that central bank short-term interest rate policies are historically unprecedented. That said, lending conditions do not seem to be very loose as they were in the most recent bubble. I don’t know if that is due to low money velocity or something else, but the end result is that lending is not reckless and the general housing market is hardly overheated. Clearly rock-bottom interest rates are creating a very frothy equity market, which in turn inflates the perceived wealth of many Bay Area residents. Also, one might argue that the level of venture capital funding flowing into tech companies is unwarranted. Still, I do not think that the general housing market today is similar to 2008.

Housing trends are more regional now than the last bubble too. And so is employment.

Lending is not reckless? Near one trillion dollars of junk bonds on the Fracking and oil market is not reckless? 12 trillion to goldman sachs, etc at no interest was not reckless? My god.

Actually, I was referring to mortgage lending. But I relate to what you’re suggesting, namely that other asset bubbles will spill over into the real economy and therefore housing prices.

I don’t mean to sound rude, but I believe there is some cognitive dissonance from your end of the political spectrum. Specifically, it was liberal policies which fueled the first housing boom, in particular Freddie and Fannie rewarding risky lending. Moreover, the past six years has seen a very weak recovery. In particular, the most damning figure would be the extent to which many people left the labor force. In general, I feel that the policies of the past six years have not helped the real economy. Consequently, the Federal Reserve was more inclined towards extremely loose monetary policy. This is not helped the real economy, but as you pointed out it has dramatically benefited rich people with capital at their disposal.

I would also point out that it is generally conservatives who promote more constructive economic policies (raise the retirement age, workfare rather than welfare, less regulations, etc.). At the same time, conservatives were more opposed to quantitative easing, to the extent where they incorrectly predicted dire inflationary consequences.

What is the result? Liberals lament the hardship imposed on the working and middle class. They are quick to point out how the rich benefit from extremely low interest rates. This, in itself, is totally understandable. However, since they have promoted poor economic policies of the past six years, it is akin to the doctor poisoning the patient, then pointing fingers at greedy Wall Street bankers (who probably vote Democratic, for obvious reasons).

Thanks for your friendly response. I urge you to really read who all the players have been from Clinton through Bush through Obama. This is a bi partisan monetary policy. There is NO difference between the two parties. Griftopia is a great read, as is Shock Doctrine, It Takes a Pillage, Ecconned, and any William Black article, who was the lead prosecutor during the SnL crisis and helped put a thousand people in prison.

you forgot the necessary “/rant”

You call it a bubble, but isn’t this how our grand fathers built the world we live in? Create debt today to put people to work and build and generate growth tomorrow. This has been going on for what? 120, 150 years? And the “greatest asset bubble and credit bubble in history”? Did I wake up in 2007?

Are there excesses? Absolutely. There are outrageous abuses, massive inequalities, scandalous wastes. But do not forget the long term benefits…

Have you been asleep since 1990? In the past 25 years, more than 2B people have gained access to a better quality of life, infrastructure and economical prospects have also improved greatly. Africa is doing better despite a doubling of their population. Asia is roaring, Eastern Europe has fully caught up the West, South America has mostly broken the cycle of dictatorships. America is growing and picking up some of the slack these days but doesn’t need to as much as before.

Nothing of this was possible without “speculation” aka risking something today in the hope to make a profit tomorrow. Yes some of this speculation is not productive, but the end result is quite amazing.

Just enjoy the good times, they will be gone soon enough. Then there will be the next cycle. Of course if you’re locked up in a rent controlled apartment clinging to an obsolete entitlement you can’t ever be part of this.

If you know of any articles/analysis arguing in support of the bubble theory, please provide a link.

all of those names Ilisted, have ample links, as well as five years or so of documentation. As well as ten years of cogent analysis. Pick one name. Or go to Naked capitalism. These are people that ‘use’ to be middle of the road liberal finance experts. Now, are aghast.

Is that a Patrick.net revival festival? Did I miss the invitation?

I was a big fan, but in 2011 they failed to see the wind had changed. Now they’re more like a broken clock, pointing at things that were very true in 2007 but are now only marginally relevant.

“This is not helped the real economy, but as you pointed out it has dramatically benefited rich people with capital at their disposal.”

Has it?

Sure, pumping up the value of stocks and houses increases the current paper wealth of people who own these assets. But history tells us that when assets are richly valued, their future returns are poor. Plus with high prices, buyers get fewer assets for a given amount of cash.

What if we had the reverse situation with collapsed home and stock prices? Then the truly rich could scoop up assets at fire sale prices. And assuming an eventual return to normalcy, these assets would have great forward looking returns.

People with plenty of cash in 2008-2012 made out like bandits if they put their money in stocks or real estate (especially SF).

I did 2 purchases within 3 years during that period. I agree my paper wealth has skyrocketed, and you are correct that the returns are smaller when you look at the current value. But if you look at the original purchase price, the rental ROI is phenomenal, especially for SF.

Say you buy a 2-unit building in a decent neighborhood in 2011. There were deals in Noe where you could get each 2BR for under 500K. At the crossing of Castro and Elizabeth there were 2 such deals sold by the same owner in late 2011. Great location, nice views and exposure.

With all costs, one building was sold for a bit under 1M for 2 pretty large 2Bedrooms on a decent corner lot.

Today each of these units could be sold 750K to 800K as TICs, or rented for 4500 each. That’s a tremendous appreciation (60% in 40 months!), and that’s also very good rental ROI. It would be cash-flow positive at the December 2011 sale price. With today’s price, we’d be almost doubling the mortgage payment and add an extra 60% on property taxes. You’d be marginally in negative cash-flow but it could still work, in a way.

Now my point is that people who bought at that time are doing really well. Some are doubling up, and some are staying put, rebuilding a stash…

“People with plenty of cash in 2008-2012 made out like bandits if they put their money in stocks or real estate (especially SF).”

But that was in a time period where prices were depressed not propped up. Which illustrates my point.

Pumping up assets certainly is of no benefit to buyers, since they end up getting less for their money. It helps owners on paper, but would require some market timing to turn this into a real gain. And we certainly haven’t seen any housing inventory surge indicating a rush to monetize recent housing price gains.

Who this really benefits is asset producers, Builders of homes and companies. And they respond by increasing production. Building more homes and starting more companies. And in doing so hire and employ more workers.

So the point is that, contrary to what Mr. Strange & SOMA seem to agree on, pumping up the economy with monetary policy primarily helps labor by reducing unemployment.

Now as to if this creates a bubble as a side effect, that depends entirely on if all the excess creation goes to fundamentally useless or useful purposes.

SF is its own very specific market. It is motivated not by speculators but by actual wealth and income.

Now if you look at more standard markets, investors are steadily withdrawing from the market and are being replaced by real buyers.

At the other end of the spectrum, let’s take Las Vegas: Prices lost 70% from 2006 to 2012. A buying binge from speculators made prices almost double until early/mid 2014. Since that time, price increases have been very subdued. Buyers are regular folks, and there’s much less sign of rampant speculation. Many sellers are the bargain hunters of 2011-2012.

The real economy is moving RE, and not the other way around. Are there possible regional bubbles or overshoots? Absolutely. But systemic? I don’t think so.