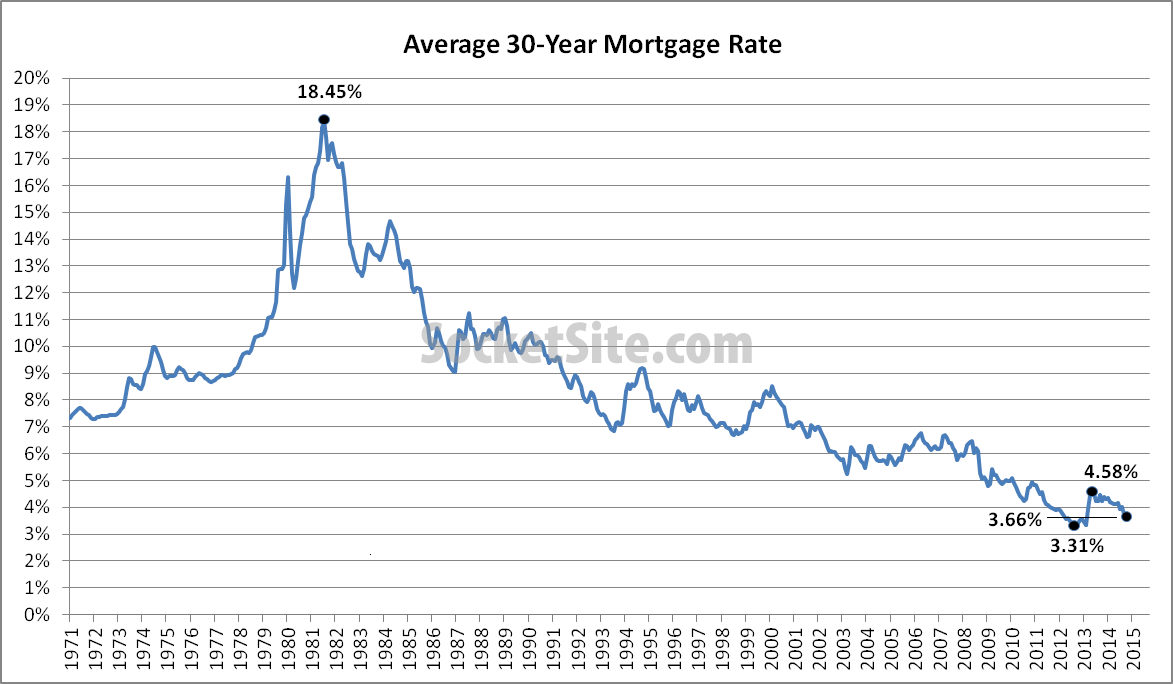

The average rate for a conforming 30-year mortgage has fallen for the third week in a row to 3.66 percent, the lowest rate since May 2013 when the rate averaged 3.59 percent and 75 basis points below the 4.41 percent average rate at the same time last year.

And while Jumbo mortgages had been cheaper than conforming loans for quite some time, the advertised 30-year rate for a Jumbo loan at Wells Fargo is currently running 3.875 percent versus 3.750 percent for a conforming loan up to $417,000.

Averaging around 6.7 percent over the past twenty years, the 30-year rate hit a three-year high of 4.58 percent in August of 2013 and an all-time low of 3.31 percent in November 2012.

i just locked in a 3.75 refi. very happy.

Might I ask with whom?

lasalle financial

Yes, I never thought I’d refi after I got such a great rate when we bought a few years ago. But we just signed all the closing docs on a 3.6% jumbo refi with Citi last night. If someone is going to lend me money at about 2.4% after tax breaks, I’ll take it as I’m pretty sure I can beat that in the market.

I am thinking of getting a 7 year arm to get an even lower rate. I’m seeing high 2s.

as well- locked a 3.75% refi this morning. will save $300/month from a 4.35% from 2011, and will be a $15,000 savings on the full term of the loan as well.

hey justin—how much did re-fi cost you?

zero dollars- I am using cashcall- sounds a bit shady but a few people I know have used them with good results.

I locked in 3.5% no points through Loan Depot today.

On a jumbo?

Conforming

How much upfront?

less than $2k

I am closing right now on a 3.375% refi.

Is that a 30 year Jumbo and with whom?

there’s no way that’s a 30 year jumbo (or even a 30 year conforming). must be adjustable.

Unless it has a ton of points.

It’s a 30 year jumbo. My mortgage broker is Navid Filsoof. I am a Veteran and this is a VA loan though, so I don’t know if you can get the same rate or not.

Wow! Congrats. JR, did you get yours through Citi private banking? Maybe I need to look into the new opportunities afforded by partner status. (Also, are you the poster formerly known as Tripp?)