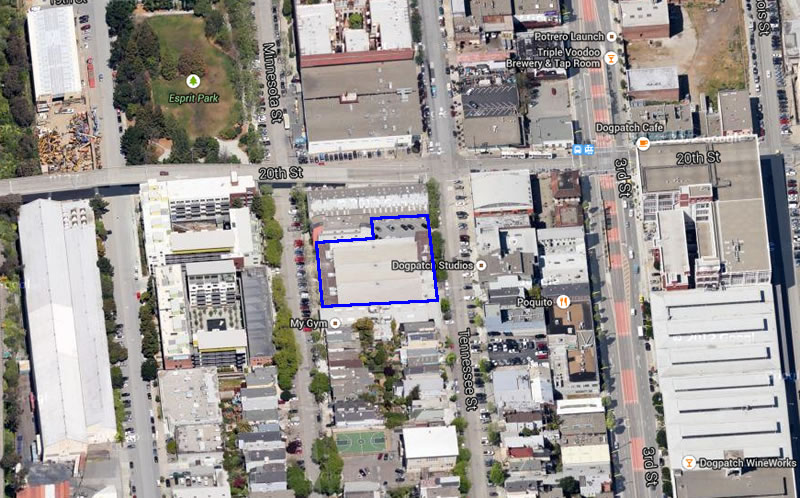

The two-story industrial building at 950 Tennessee Street, across the Street from Esprit Park, is currently home to Watermark Press, a printing company owned by RR Donnelley, which employs “a group of highly skilled craftsmen within the city limits of San Francisco [which] gives [their] clients the advantage of producing work locally with minimal time-to-market and freight costs.”

And while the project has yet to be approved, plans to demolish Watermark Press’ Dogpatch building and develop a four-story building with up to 129 condos on the site have been quietly submitted to Planning for review.

“plans […] have been quietly submitted to Planning for review”

Is there some sort of noisy process they should have gone through?

RR Donnelly is a huge corporation with more than enough money to get another place here.

This sounds distressingly similar to the pleas about the 12 laid off laundresses at Laguna Honda Hospital certain plos were constantly harping on, and which delayed the rebuilding project over there.

The City is trying to “develop” PDR. It may be “quiet” because of so many contradictions and so much capriciousness in planning policy under Mayor Lee’s administration. At some point they are going to have to really point out to citizens and the Planning Commission that there is more than enough market rate housing to meet the demand for that type of housing and the market is not reacting quickly enough to solve the problem of housing that matches the worker bees that help to make the City tick, not just the high end finance and tech folks.

There’s no magic here to getting cheaper housing. It’s priced as it is not because it’s “luxury” but because of the underlying costs of land, labor, materials, and the uncertainty and time required to get through planning. And it’s selling at the high prices required to get it built because there’s so little supply.

If we’re serious about cheaper housing — and we should be — then we need to make it cheaper to build and encourage a lot more building. The city will have to build units itself or encourage developers to do so by expediting approvals and increasing zoning heights. Anything less won’t address the underlying costs of development or demand.

I think it is a matter or rental vs. condos. SInce most of what the City is approving is housing that is only condos then it will never really allow the “fact” of the market to kick in. If all this housing that was being built was required to be rental housing then maybe the supply and demand will kick in. I think as long as it is housing that is bought, whether it is all cash or with a mortgage, and right now it is probably mostly cash, the prices will never come down. There is too much cash floating around the world, legal and illegal, to have supply and demand really won’t work as it supposedly should under all the wonderful theories. But maybe if it was all rental or mostly rental it would work. But I doubt if the City could require developers to build all the projects as rental housing because that would probably be considered a taking. “The market” (and I mean that sarcastically) is determining that it is condos, so no matter how much housing or how much of an increase in zoning, it won’t really do anything about affordability or cheaper.

If you look at the Planning website, where they discuss housing, they admit they are basically meeting all the demand for “market rate” housing. With a few exceptions, maybe it is just that Nema on Market or whatever it is called , it is all primarily condos that are being built.

But San Francisco has far more rental housing than most cities as it is. People with cash can drive up the price of rentals just as well as the price of purchases. If the City was serious about rental housing, it would look at rent control and figure out who is benefiting from it and whether it is good policy to be subsidizing their housing.

I assume you’re referring to looking at rent control as a means of getting rid of it partially, or all together?

What is being built in SF these past couple of years has been almost entirely rental units. Finally some lenders are willing to finance condos so there will be a small but increasing new units on the market.

Apartments are probably better because in a year or two most of these pampered, overpaid, simpering Millennial techies are going to be living with mom and dad back in Wisconsin.