San Francisco’s Transbay Redevelopment Plan requires any new development within the redevelopment area with a residential component to offer at least 15 percent of its units at below market rates, a key component of the Mayor’s “Housing For All” initiative and for which there is no option to pay a fee or build a greater number of affordable units off-site instead.

The developer of the mixed-use tower rising at 181 Fremont Street has managed to quietly negotiate a one-off variance from the plan, however, a variance which will obviate the need to include any affordable housing within the development and allow it to be “poor door” free.

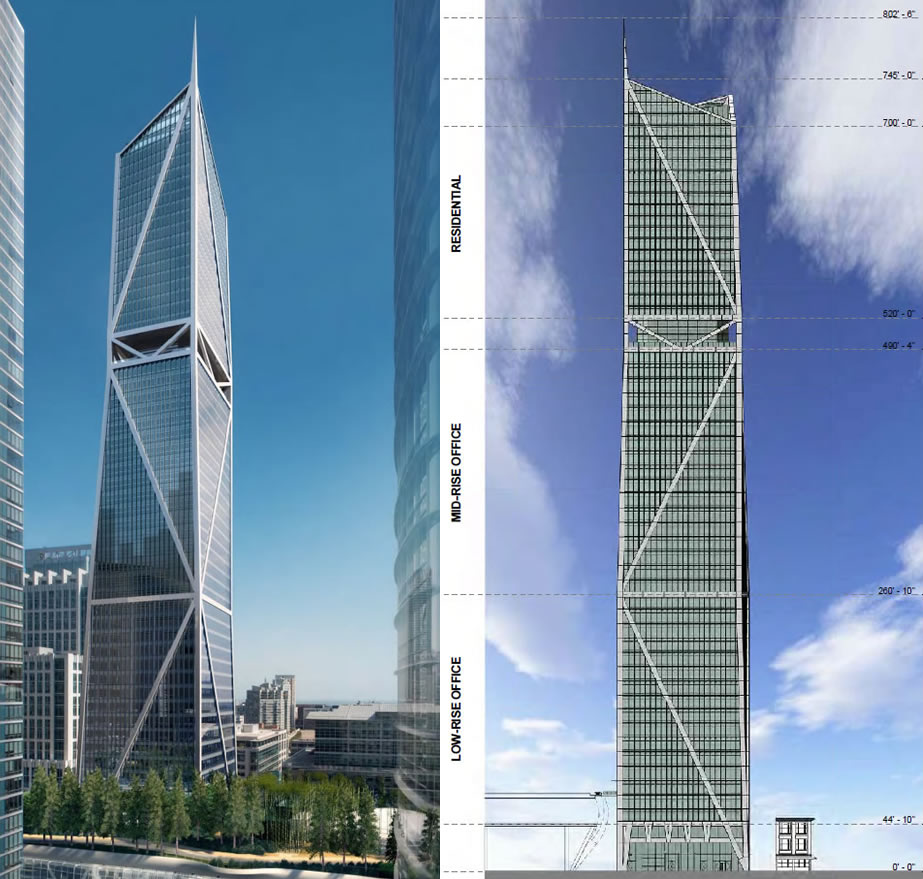

In exchange for the variance, the Jay Paul Company has agreed to pay $13.85 million into an affordable housing fund, roughly $1.26 million for each of the eleven units which would have had to have been offered at below market rates per the plan. And if approved, all 74 units to be built atop the 800-foot-tall Fremont Street tower will be sold to the highest bidders (quite literally) and with prices which are likely to start at well over $2,000 per square foot.

A late addition to the agenda for the Transbay Citizens Advisory Committee this week, San Francisco’s Board of Supervisors will have the final say on whether or not this one-off variance will be approved.

Am I missing something here? 15% of 74 units is 11.1 units. At $1.26 million per 11 units how do you end up with a $13.85 million payment?

[Editor’s Note: By multiplying 11 x $1.26M?]

I apologize. I missed the “each of the 11 units”.

This is going to be a great addition to the skyline.

San Francisco is very expensive. I think the “Poor Door” concept is brilliant and should be implemented.

Part of the problem is the wanton subjectivity – what is “below market rate” when the property in question is destined to be hold of the most expensive condos in the City? i.e., if the condos would otherwise sell for $5,000,000, would it be “below market rate” to subsidize them and sell them at “only” $4,000,000? I don’t think that’s the meaning of the mayor’s program – but neither does it make sense to say that 15% of these condos would have to be set aside for people who’d otherwise be living in a Daly City duplex, either.

The fact is that a lump-sum payment to a general housing fund, that can be used in a very precise and targeted way, makes much more sense than trying to both define and require set-asides for “below market rate” units in a building such as this.

Totally agree

second that

Third that. The money paid in lieu of these units can be made to go much further building middle income units in another location in the city.

Disagree wholeheartedly…and here’s why: On face value alone, I would agree with you, but what happens down the road and what the spirit of the program in SF is about are completely sacrificed in the process. Why?

From Cabrini Green, the first “low income neighborhood”, what we’ve learned in project after project, is that when you put a bunch of poor people together, you don’t improve their lives or economic mobility. In fact, everything that’s bad for society goes up – dependence on assistance programs, violence, incarceration, gang activity, drugs, teen parents, etc… In fact, the architect who came up with the idea and built Cabrini Green has said time and time again, he did it all wrong and nobody should ever do it again.

The only way to have the social outcomes low-income housing tries to achieve is to have a true mix of incomes and classes. The poor folks learn from the middle class and the middle class learns from the upper class – there are models of economic mobility. You’re in day-to-day contact with neighbors of varying income classes and you learn what it takes to achieve more out of life, not to mention are able to network with folks in different income classes. This model has proven effective wherever it’s been implemented.

And this is the mixed income housing situation the Mayor’s Office of Housing is *trying* to achieve by establishing the 15% requirement on developments of 10 units or more (at least it used to be 10 units, that may have changed).

Anyway, I’m all for keeping San Francisco diverse and that means economically as well as culturally, so I implore the Board of Supervisors to reject this variance.

I’m well aware of the social science here, but as Sierrajeff mentions, it’s hard to really see what a loss this is at this stage. I’d think that having the city spending that developer money elsewhere would be much more useful to actual working class folks to make, say, a 1.5M place cost 500k, instead of making a 5MM place cost 4MM.

And FWIW, as a self-identified “middle class” person, I’m not sure there’s much of anything I want to “learn from” the people paying for those ridiculously-priced condos anyway.

@ SFCitizen

You think shameless classism is “brilliant”?

If the BMR people aren’t paying ridiculous HOA fees and don’t have access to certain amenities then yes. It’s just a building stacked on top of a building. I don’t think they should have an entry in an alley or something gross like that controversial one in NYC, but having a separate lobby i think is fine. It’s just another building.

I need to see your certified financial statement showing your net worth before I give you an answer.

If the goal is to actually have developers include BMR housing, the “Poor Door” concept works nicely.

If the goal by progressives is to force utilitarian mingling of the wealthy with BMR tenants, I predict more payments by developers for off-site BMR units.

Well, $1.26 million per unit could do a lot more good somewhere else in the city. I wonder how that number was decided.

How much does eliminating or segregating BMR add to the value of the other units in the building? What kind of people are willing to pay a premium to be insulated from the merely middle-class?

My guess is it that is about the difference between what the units would sell for at market rate and BMR.

Here is a back of the envelope:

The building is costing something like $10 million per floor on average and the BMR units would have used up about 2 floors. That gets into the $2M/unit cost range. If the BMR price would be below one million and the market price will be above two million, then the difference could easily be in this range.

If that is the basis, then I think the city should have gotten a small additional premium, but this amount does look like it would be better spent in a less expensive location.

Sure, but the “poor door” wouldn’t have been invented if it didn’t raise the bid price of the market rate units. At minimum, developers must believe that they will recoup the cost of the separate entrance and elevators for the hoi polloi, plus whatever value they assign to loss of goodwill for explicit classism. I guess if that’s less than $5M split across 63 MR units, it would be insignificant compared to $MR – $BMR.

I guess my real question is, are the city negotiators any good or do they usually leave a lot on the table when facing developers?

If one can build ‘affordable housing’ for $400 per square foot, and your boy Jay Paul ponies up $13.85mm, that means the city should be able to yield 34,625 square feet of living space.

Assuming 750 square feet for two bedroom apartments, that’s 34,625/750 = 46+ units of living space. It could cover more than a third of that enormous Richmond Special we just read about at 360 Berry.

The city gets the builder to pay for 46 extra units when he is building 74, a bonus yield of 62%.

I haven’t been so boggled by the state of the world since JR Bobby Dobbs suggested the car wash be converted to a hobo cleaning station in the other thread. I don’t know whether the appropriate response is revulsion or comedy.

thanks for that calculation! the city would be wise to take this $$ and build MROE affordable housing units in a part of town that’s not as insanely expensive.

Face it, all areas of town are insanely expensive.

A general fund to build mass projects elsewhere = 21st century projects

Totally agree. God forbid of the rich people have to cavort with the working class. What is this city turning into? 🙁

Its a great calculation, but in SF, after all the hands in the till, you are lucky to end up with 10 units for that money. I don’t have the SF budget in front of me, but “we” don’t get what we pay for when it comes to city developed housing. It comes out to around $3000/SF factoring in the bureaucracy.

I would love to see the cash used to rebuild the Potrero Terrace into the Mix of Subsidized and Market Rate Housing that is planned , though I think the desired density is still far to low

The Mayor’s Office of Housing, and all the (very good) non-profits who build the affordable housing in the city do not want the affordable units to be built on-site but prefer the “in lieu” payment so they can do stand-alone projects that these payments subsidize. The only people who prefer that the units be build on-site are the bleeding heart liberals worried about rich vs. poor enclaves. The bad joke is that forcing affordable units to be in larger buildings harms the affordable residents, who are subjected to the higher HOAs for services they don’t use or want.

BMR buyers are not necessarily the hoi polloi. I know a person who bought one when he had just finished graduate school, some years ago, and he still owns it. He has an IQ, and now professional achievements, above the average of the owners of the market rate units. Along with every other resident of the building, he has a nice second home. No one would consider him socially inferior.

But, I think he might be violating BMR program rules.

It has nothing to do with social inferiority, but rather practicality. The money could build about 40 nice units of permanently affordable housing, rather than have the developer build 11 token onsite “affordable units” that come with whopping HOA fees that are completely unaffordable to the low to moderate income people who are supposed to live in the “affordable units.”

@Conifer – if his BMR is his “nice second home” then he’s in clear violation of the rules set forth in the BMR program. So despite his high IQ and professional achievements, he’s no better than any other scammer who’s worked the system, and is no better than his “hoi polloi” neighbors.

If the BMR unit is his primary residence he would still be within the rules.

Ironically, if my wife quits her job and stays home, I could qualify for a BMR.

(1) Other posters are correct – if primary residence, then he’s not in violation; (2) the BMR rules have changed radically in the last 10 years. When I first moved to SF, I qualified for BMR b/c I took ~8 months off of work during the transition and all they looked at were your previous year’s tax returns. I entered a handful of BMR lotteries. I was touring one property when someone was closing on a BMR unit – she had her father with her who tried to cut a check for about 75% of the $300k cost of the property as a “down payment”; the sales person just said, “whoa…put that away. I can’t take that. Here’s the contact information for a lawyer who can help you structure a legal way to make this work out for you guys.” That kind of scamming of the system won’t work any more. They’ve figured out the loop holes and plugged them, as best I can figure out.

What does BMR mean???? Market Rate minus $1, or Market Rate minus x% of the lowest/highest priced unit? Or something else? And what about HOA fees? THOSE are usually KILLER.

[Editor’s Note: Try clicking on the link to “below market rate” which we included above.]

The city will, in part, dump the $13.85M into the Goodwill deal at Mission and South VanNess to make that project go. More shoving the “below market” stuff to islands in the city.

Ridiculous. Those who are ONLY able to buy a BMR have no inherent right to live in an expensive development. there’s nothing wrong with some projects being ALL upscale.

Well, if the City wants to have BMR in developments, it’s a political choice decided by elections.

Where I do not agree is the method. Adding a “BMR tax” targets one small segment of the population to finance a social program. This is very similar to rent control: take money from individual entities instead of the tax base.

Yes, I agree with you.

The BMR program is rent/purchase control with means testing.

I continue to wonder at something I’ve never got a satisfactory answer to: Condos have regular monthly assessments and sometimes special assessments, usually based on the square footage of the unit. How would truly middle class buyers ever be able to afford assessments of the size and sort that wouldn’t phase buyers of $5 million apartments? I am not aware that buyers of “affordable” units get any special break on assessments. Do they?

There are no discounts on HOA fees in my condo building, and I believe it is standard practice in SF for even affordable unit owners to be charged full HOA fees. My neighbors who live in an “affordable” unit pay the same HOA fees, and I know it is burdensome for them and others who live in supposedly affordable units.

HOA fees are one reason I really do not support so-called “inclusive housing” requirements (at least not in condos). I support charging developers a fee to fund affordable housing, but I do not think there should be any requirements for the affordable units to be onsite. Everyone should have safe and clean housing, but not everyone needs to live in a luxury highrise. More importantly, we could be housing far more people if developers simply paid a hefty fee to build affordable housing, rather than requiring a token set-aside of onsite units.

Better yet, get the most bang for your buck and build these units in Detroit.

Developers are no different from anybody else with skin in the game. Whether you are a small time mom and pop developer or an individual with aspiring dreams. Everything is dictated by business and numbers. There is no room for ideology (unless you are Bill Gates/ Warren Buffet.) On top of this business layer is government regulation and bureaucracy which encompasses political motivations, factions, NIMBYism which subverts (rightly or wrongly) market forces. This is a delicate balance. Too much one way will upset the balance, consequences (intended or not) will be felt.