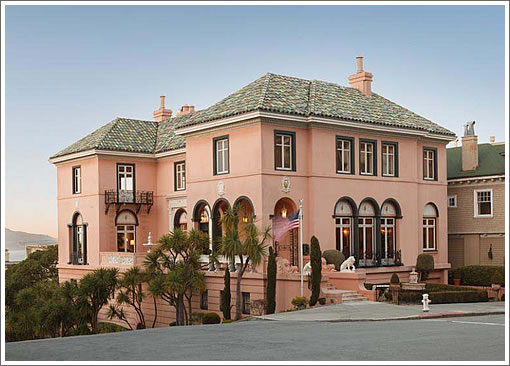

Having hit the market asking $16,500,000 this past March, the list price for the Aliotos’ Pacific Heights home at 2898 Vallejo Street was reduced to $13,900,000 in April.

This afternoon, the sale of 2898 Vallejo closed escrow with a reported contract price of $11,750,000, roughly two million “under asking,” closer to five million under original list.

As we first reported earlier this year, Frank and Frances Alioto purchased the 9,500 square foot home in 1973 for $225,000 following its use in the filming of The Towering Inferno, serving as the mansion for Richard Chamberlain’s character, the cheapskate electrical engineer who cut corners and was to blame for the tower’s fire.

With a tax basis of $439,219 thanks to Proposition 13, the total property tax bill for 2898 Vallejo was $5,205 in 2011. The property tax bill for the new buyers should now be closer to $137,369 per year.

And in terms of the average annual appreciation for the property, call it an effective 10 percent per year over the past 40 years.

After viewing this property I pegged it at about 11.5, so I was pretty close. The property is probably worth quite a bit more, but it was allowed to essentially decompose and little if anything of the original structure is salvageable. The frightening lower two floors are the requisite torture dungeon type spaces you often find in these homes. Also, it seemed structurally compromised, even though I’m not an engineer by any stretch of the imagination. It’ll be a fantastic project for someone with an unlimited budget.

How much of that property tax goes to The City vs. the State?

So, I’ve been paying more than twice as much tax on my small home than the tax on a multi-millionaire’s multi-million home? How can Prop 13 be considered constitutional when the taxes are so unfairly administered? I know it was ruled constitutional many years ago, but that was then, before we could even envision the extreme unfairness of the system.

We should get rid of prop 13 and get rid of rent control. Then get rid of the income tax, because with homes taxed at value, we wouldn’t neet it.

I would be the last person on earth that would try to defend Prop. 13 (I think it’s indefensible), but MoneyMan, please do go and read Justice Blackmun’s majority opinion in Nordlinger v. Hahn, 505 U.S. 1 (1992). It’s pretty readable and I think you’ll be able to understand it if you put your emotional attachment to the idea that tax administration should be “fair” aside while you do so.

As far as “get[-ing] rid of Prop. 13”, don’t hold your breath. Here’s one thing Justice Blackmun had to say on that front:

Emphasis mine. He was writing this in 1992.

And it was already apparent that Prop. 13 is the third rail of California politics. We’ll be lucky if we just get adoption of a so-called “split roll”, which would require the regular reassessment of commercial properties regardless of ownership changes.

“With a tax basis of $439,219 thanks to Proposition 13, the total property tax bill for 2898 Vallejo was $5,205 in 2011. The property tax bill for the buyers should be closer to $137,369 per year.”

What a perfect illustration of the farce that is Proposition 13. Millionaires paying less in property taxes than middle-class homeowners. This perverse result was surely not the intent of the initiative. Let’s fix this broken system.

What’s sad, is that the imbalance of taxes on homes and commercial property is not the exception, it’s the rule. A minority of homeowners are paying full boat, and a majority are paying far less. How less? Well remember that $29 million house that was on the market a few months ago? well it had taxes of about $1,500. There could and should be a way to protect seniors or retirees from the devasting affect of rising taxes during retirement, without resorting to a tax system that is blatantly unfair. Yes, the voters will never override it, but maybe the courts eventually will. It will clearly get much worse before something is done.

Most house trade every 7 years. It is the rare few that are owned for longer than 10. Stop cherry picking data points you look like you want a job with News Corp.

It is easy to get a referendum on the ballot. Go and stand in front of Vons and ask for the signatures.

Yes, it’s so unfair that my neighbor doesn’t get robbed as much by the government as I do.

A great, real SF house.

In ways better than being on Broadway, more private, no tourists. There are a number of people who could afford it who choose outer Vallejo over Broadway.

Congratulations to the wise buyer.

You libs crack me up.

Envious of the elderly and the dead because their taxes are lower.

It does not show up in the MLS, but the buyer is also to receive a free bowl of Alioto’s clam chowder at Fisherman’s Wharf every week for life, and a key to the back door at City Hall.*

*This is probably not true.

It’s not envy, it’s fairness. Prop 13 is incredibly unfair, as is rent control.

The statistic of trading every 7 years is only true for mid range homes. The wealthy tend to keep their homes for much larger, so get outsized benefits from prop 13.

It’s the typical case of a law that was based on good intentions, but people couldn’t be bothered to think about the unintended consequences (just like rent control).

The result is low property taxes, but high income and sales taxes.

California is built to benefit those who are wealthy, and those in poverty, at the expense of the middle class.

“It’s not envy, it’s fairness”

Your complaint then should be to the government that it takes too much of your money. Unfairly too much.

Instead either, like a not too bright sheep, you let yourself be goaded to go after your fellow citizens or you are just envious. At least have one cojon to admit it instead of pretending that it’s about “fairness”.

Whether it’s too much is debatable. Both sides would have reasonable points supporting their.

A $1 million dollar property paying less in property taxes than a $100,000 property merely due to the date of purchase is unfair. One must stretch logic to the breaking to come up with an argument that can present that as fair.

If taxes are too high, making them unfair does not solve the problem.

Oh, and insulting your opponent is not the same as having a valid point.

“Whether it’s too much is debatable. Both sides would have reasonable points supporting their.”

given the above delusional statement, I think there is nothing more to debate here

“Most house trade every 7 years.”

The best data that I can find show that roughly 4% of SF properties are sold each year. That makes it impossible for “most” houses to trade every seven years. It would take at least 13, and that’s assuming that no properties are sold twice during that time.

Prop 13 is helpful to all homeowners, regardless of when you purchase your house. Without Prop 13 many people would have to move out of there home because the can’t afford the property taxes, is that fair? Take a person that purchased a house for $500,000.00 and their house is now say worth $1,000,000.00 they were able to afford the roughly $5,000.00 a year in taxes but they might not be able to afford the roughly $10k in taxes now. Just because the open market says their house is worth more why should they be penalized for a house they purchased and planned to live in long term. With Prop 13 their taxes will be roughly closer to the $5k, in the range they can afford. There are a handful of houses like the Alioto mansion that seem out of proportion, but imagine if some other family had purchased the house back in 1973, how could they afford the $137,000.00 in taxes? Most couldn’t and would be forced to sell their house.

the whole notion of property taxes is absurd – why do we have to pay property taxes at all? Just because we own real estate? Why don’t those who own pencils pay? The assumption is simply that the local government can extort this because people with property are likely (or are more likely) to have money and they can’t easily (or at all) move the asset.

we are told we have to pay for schools. but, of course, we can ask why can’t those people who have kids pay for that?

And why are we paying for THREE levels of government. Federal bureaucracy, state bureaucracy and local bureaucracy. This may have made sense when the federal government was small but now the federales regulate everything from marriage to what I can eat for breakfast. If this the way it is supposed to be then why not get rid of all the useless state and local overhang?

People do not ask these questions because they have given up it seems.

The Alioto house is a mansion, the person who could afford it was always rich.

Prop 13 hurts new buyers because there is less inventory due to people not selling because it costs them nothing to keep.

Houses don’t just jump in price. If the house is now worth $1,000,000 they just made $500,000, I fail to see how that’s a problem.

Prop 13 does not exist in a vacuum, property taxes are low, but income and sales taxes are high.

As they say, the only thing that’s certain is death and taxes.

Taxes will be collected. It’s only a question of how much, on what, and how fair it will be. If you reduce or eliminate property taxes, then other taxes will go up.

Property taxes are generally more beneficial than many other taxes as they create a mobile and productive society.

Feudal societies had no property taxes, but high labor taxes. There was effectively no middle class. That system ensured those in power stayed in power and with all the wealth.

Property taxes incentivize the effective use of property, which is much better than income taxes, which disincentivizes the effective use of labor. I’d much rather have property tax than income tax.

Is it your claim that prop 13 is fair?

They only make $500,000.00 if they sell their house and they don’t want to do that. Why should they have to pay higher taxes just because the economy or the area they purchased in is doing well.

They can also refinance to pull money out. If they don’t want to sell and realize a $500,000 gain then I suspect they can easily afford the tax increase.

Why should somebody have to pay higher taxes on a $1,000,000 home they bought today than somebody who owns a $1,000,000.

If there are a property taxes, the only fair approach is that equal value properties are taxed equally.

If somebody’s income was $500,000 a year ago, but is now $1,000,000 per year, should they pay income taxes on only the original income level? This is no different than how prop 13 treats property taxes.

gribble wrote:

This is, again, a legacy of Proposition 13 that has nothing to do with protecting poor old grandmas from being taxed out of their homes.

I don’t know the precise split in S.F., but I do know that it’s not straightforward, because Prop. 13 established a formula for divvying up property tax revenue among counties, cities, schools and assorted special districts. This formula varies by locality, but whatever the split was in 1978, when Prop. 13 passed, remains the split today; the rules establishing this were part of the implementation of Proposition 13.

You ask a reasonable question, because of course in the aftermath of Prop. 13’s passage and subsequent implementation, the State government started subsidizing local governments at various levels in order to sustain them because otherwise they’d have been eliminated from the lack of revenue to fund public services. Then during the various state budget crises of the last ten-to-fifteen years, that level of subsidization changed wildly.

This is what’s being referred to when you hear people talk about “the crazy quilt of money flows” between various government entities in this state.

Taking out a mortgage to pay property taxes sounds crazy! What if they can’t afford the mortgage payment or even qualify for the loan.

There are a handful of houses like the Alioto mansion that seem out of proportion, but imagine if some other family had purchased the house back in 1973, how could they afford the $137,000.00 in taxes? Most couldn’t and would be forced to sell their house.

Excuse me for not crying over the poor souls that would have to sell their house for a measly 5200% of what they bought at…

And FYI – if someone has millions of dollars in equity with a LTV ratio of 2% or less (as would be the case in your scenario), it is quite possible to get a new mortgage and take some cash out.

What’s crazy is two equal value properties with different tax rates.

If a real person just made $500,000 they are going to be happy, regardless of whether they have to pay taxes on the original value, or new value.

Brahma brings up a good point, not only is prop 13 unfair, but it creates an extremely volatile stream of revenue for local governments.

Taking out a mortgage to pay property taxes sounds crazy! What if they can’t afford the mortgage payment or even qualify for the loan.

Then they can sell and have $500,000 in profit? Sorry, that isn’t something that is going to cause “hardship”.

“And FYI – if someone has millions of dollars in equity with a LTV ratio of 2% or less (as would be the case in your scenario), it is quite possible to get a new mortgage and take some cash out.”

I love it! I suggest the following, we all just hand the keys to the government (bypass the bank middleman) and leave the country.

@lyq: I do not disagree that income taxes are bad. To your question, I have no idea whether Prop 13 is fair because I do not know how you define fair. My notion of fairness deals with my relations with the government. Therefore, I do not care how the government interacts with other people as that does not affect me. It’s the same with compensation – if I feel I am fairly compensated, I do not care as much about what my coworker makes. If do not feel I am fairly compensated, that has nothing to do with what my coworker gets paid.

These Prop 13 arguments are circular and never go anywhere. We simply don’t have a static market. If Prop 13 were repealed, there would be a lot more available inventory and lower prices across the board. Someone who paid 1 million for a property while P 13 was in effect could see a significant devaluation of that property. Using new comps, they would immediately appeal their current tax rate. What the city would gain in taxes from reassessing homes formerly protected by P 13, it would immediately lose in homes purchased during the P 13 inflated “bubble.” The tax collector’s office would be inundated with property tax reduction requests from pretty much every SF home owner who bought within the last 10+ years.

Also, what standard would be used in determining the fair value of these homes? Do you trust the city Board of Supervisors and Assessor’s office to equitably determine what ALL homes in SF are actually worth? Who would really be affected by this repeal? Not the two dozen or so old ladies in Pacific Heights still clinging on to their crumbling mansions. They could probably sell, take their millions and move to Boca. It is the working-class, long-term owners in, say, D10 would be hit hard hit by even modest tax increases. Or would there be a means test to determine what taxes are equitable? This is a state amendment, not something limited to San Francisco or just Pacific Heights’ residents. Also, doesn’t P 13 aid renters almost as much as rent control? Would long-term, “mom and pop” landlords who reap the benefits of P 13 and pass those benefits along to their tenants be exempt from a repeal? There are questions that I never really see answered when these threads come up.

I know a lot of people might disagree, but Prop 13 is being phased out in D7 as people die… and they do die. Look at outer Broadway. The 7 or so sales in the last couple of years have been a massive boon to the city coffers. And no, people no longer stay in their houses they way they did when P 13 initially took effect otherwise the same houses wouldn’t show up again and again on Socketsite (see the post about the twitter house). 3 or four houses on outer Broadway have sold at least twice in the last few years… These are homes that hadn’t been for sale in decades. Does anyway really think that, say, Pincus is going to hunker down in 2950 Pacific for the next 30 years so he can benefit from inflation “lowering” his fixed property taxes (200k).

Yes.

The following comment is directed to the more open-minded and literate readers of ss comment threads, not the objectivist ideologues among us lacking facility with reason.

The notion of property taxes isn’t at all absurd, in fact at least since Henry George’s book Progress and Poverty in 1879 it isn’t at all controversial among educated people.

The absurdity is the other way around. The better question to ask is “why do we have to pay income and/or sales taxes at all?”

IIRC, George argued that we should have only a single tax, and that tax should be levied on the unimproved value of land. The reason is because taxes on income reduces people’s incentive to earn income (that is, to put in more hours at work), sales taxes reduce goods consumption and thus production (because the effective price of the goods is increased due to the tax), etc.

A tax on (the unimproved value of) land is different. When we talk about the value of land, we’re really discussing the combination of two things:

• its “natural” value

• the value created by building on it(or putting in a road to access it, or building a sewer line near it and so on).

The value of a vacant lot in an unimproved state comes not from any sacrifice or opportunity cost borne by the owners of the land, but rather from demand for a fixed amount of land. The owner isn’t creating anything of value by simply owning, he’s just asserting his available stock of wealth.

Therefore, George argued the value of the unimproved land is unearned, neither the land’s value nor a tax on the land’s value can affect future productive behavior. And so any capital gain due to the increased value of that land during the owner’s tenure is unearned.

When land is taxed, the quantity available doesn’t decline, as with other goods; nor would demand decline because of land’s productive uses.

And, of course, in some cases, the owner doesn’t improve the land, he buys property with existing improvements (such as an existing house) and the increase in value, which is due solely to increased demand for a fixed quantity asset, just happens during his ownership tenure and he reaps the capital gain at the end of his tenure for doing essentially nothing.

This is why you often hear real estate being described as “passive income”.

Nope.

The assumption is that as a landowner, you’re asking for local government services, even if you’re a libertarian ideologue who doesn’t believe in elected government.

It seems fairly obvious to me that another related reason the government taxes real estate is because the entire notion of private property is a creation of the state. The reason you can evict tenants from rental property or have squatters removed from your land is because the state can and does send in the police to defend your (the owner’s) economic interests by using the threat of violence or deprivation of freedom against those that impinge upon your (the owner’s) land.

You’re paying for those state-provided services with your property taxes.

“Someone who paid 1 million for a property while P 13 was in effect could see a significant devaluation of that property. Using new comps, they would immediately appeal their current tax rate.”

That’s only true for newly bought properties, the vast majority of properties would see taxes increase. But that doesn’t matter to me, as I’m not concerned with the amount of taxes. I’m concerned with the fairness, as well as other problems with prop 13.

“Also, what standard would be used in determining the fair value of these homes?”

Most states use assessed value, and in fact CA used to do the same before prop 13. It’s doable.

” Prop 13 is being phased out in D7 as people die… and they do die. Look at outer Broadway.”

Prop 13 is not being phased out. People die, and then their house is sold and revalued, but that’s after decades of reduced taxes. It has nothing to do with D7, or phasing out of prop 13. In fact if it’s inherited, the tax basis isn’t even re-assessed!

“And no, people no longer stay in their houses they way they did when P 13 initially took effect otherwise the same houses wouldn’t show up again and again on Socketsite”

That’s completely false, see anon’s post from 12:52 above: about 4% of properties in SF sell each year. And you are completely misinterpreting the meaning of seeing the same houses sell over and over.

People in other parts of the country pay property taxes based on the current assessed value of their homes. Westchester County has insanely high property taxes which adjust like that but the property market there is quite healthy. Some people move to Connecticut to have lower taxes, but their commute is longer. As already noted, taxes don’t exist in a vacuum, so if taxes are higher that will impact property values because it will have more of a long term effect on affordability.

If you have a house that’s paid for and the taxes rise beyond affordable levels, you have to sell. This isn’t a tragedy. The same is true for other home ownership costs, which do rise over time. Utility bills, a new roof, etc all cost a lot more now than they did in 1973. The fact that so many of these grand old mansions are in disrepair suggests that maybe the longtime owners really couldn’t afford them anymore. Prop 13 incentivizes them to stay in huge but crumbling old houses just to avoid paying a “fair” (or current market value) tax bill.

Money man in 20 years when your house is worth much more you will understand.

lyqwyd posted

Houses don’t just jump in price. If the house is now worth $1,000,000 they just made $500,000, I fail to see how that’s a problem.

They made nothing because all homes went up

meaning the new house they will buy went up

so how can you say that they made $500,000

if the new house is one million

so how can you say that they made $500,000

if the new house is one million

Because they only spent $500,000? I’ll gladly “make nothing” by having all houses in SF double in price when I own one. Sounds like a pretty good problem to have. If I feel that I can’t afford the measly property taxes, I’ll sell my house and cash out the gigantic profit and move to a cheaper city (in the Bay Area or elsewhere) where houses didn’t double in price.

Real Estate is not a free market in San Francisco specifically, or in California, or the United States generally. We all variously win and lose based on the distorted incentives that exist.

Everyone is probably better off by understanding the rules, and engaging the civic process when the rules are to be changed, rather than kvetching over the status quo.

How many people understand the CEQA legislation changes that just went through?

^ That’s a ridiculous statement.

Debating the merits and problems of the law *is* engaging the civic process.

1,000,000 – 500,000 = 500,000

That’s how I can say it.

Like I said up at the top… you really have to torture logic to death to find a scenario where Prop 13 is fair.

@brahma: regarding your James quote:

First, you say capital gain but capital gains are not being questioned here specifically. Capital gains are subject to INCOME taxes not to property taxes. We were discussing PROPERTY taxes which are imposed whether or not there is gain.

Second, what does it mean “unearned”? You did pay for the land, right? You earned the money you paid with, right? Or was it stolen (in which case if it was taxed it’s earned anyway as concerns the tax collector, I think)? Are you just talking about gains? Sure, that’s “unearned” (although that adjective is a rhetorical one) but that’s the same with stock and a million of other passive assets – or did you “earn” something when you bought that batch of Apple shares and cashed out later?

As for the other quotes, you are totally incorrect. First, on the facts, in SF good luck evicting someone. One might say that in this case the governmnet is the one who hinders not helps to enforce your property rights (of course, under your definition, that can’t be true because all rights are government given).

Second on the logic. Property rights are not a creation of the state. They follow from what we commonly believe is right (well, by we I do not mean “communists”, I mean humans).

Here is a demonstration. Let’s say there is no state. Let’s say I have a house and you come and you want to rent it from me. We enter into a contract whereby I lease it to you. You refuse to pay rent. I show up with a gun and evict you. Did I need the state? Was I able to evict you faster than I would have with state “help” (particularly in the Bay Area)? Answers yes, and yes.

You might say that you could have just taken the property from me and you would be right but I think we would both agree that that would have been wrong (I hope you would agree) and it would have been wrong whether or not there are any state laws. What you call “Law” is simply a state codification of common mores and customs – our understanding of the natural law if you will. Indeed, if we all agreed what that was we would not have needed any laws. Some people apparently thought murder was ok – hence the 10 (or 600 or so) commandments. I don’t need some monkey with a couple of tablets telling me that though – maybe you do.

Moreover, if your argument is about the state monopoly on violence, then note that is no different than saying one of us has a bigger gun. We do not “recognize” the state as having such a monopoly, we just yield to it. That’s the same as prison culture (or the guy with the bigger gun) – no different.

Indeed, if you believe that all rights are government created, then why stop at property rights? Clearly the same must be true of the Bill of Rights? We have legal procedures for getting rid of it and if the government did that, we could say, oh well, I guess we had some rights and now we don’t.

People owned property before there were kings, queens, states and the US of A. And they will claim to own such property long after each of the foregoing are gone and forgotten.

@wrath

I’m not really clear why you are opposed to the suggestions made by Brahma’s reference.

It suggests that we eliminate income & sales tax, and have only a single tax, based on the unimproved value of land.

Exactly what don’t you like about that?

@lyqwyd If only property owners are going to pay taxes then only property owners should be able to vote. Of course, this is non-sensical in today’s world, but I would sign up for that.

@wrath, those two things are not related.

In many feudal system only property owners the vote (or it’s equivalence: influence), while only the non-property owners paid taxes.

Above you said “I do not disagree that income taxes are bad.” Seems inconsistent with what you are now saying.

@lyq I think that a portion of that was in answer to Skirunman not myself.

I am not saying that income taxes are good and would vote to get rid of those as well but I reject the notion that we have to pay property taxes. I do not see these as related nor are they (unless of course you are running a multi-trillion dollar ponzi scheme called “government” – then I am sure you will take your money where you can get it).

This country was set up so that only the propertied classes could vote – but we’ve since lost our way. The result is something along the lines of mob rule where a portion of the propertied classes that controls the MSM – manipulate the uninformed via the use of emotive imagery and animations and provocative “articles” and opinion pieces.

Then we have a “vote” where the uninformed people (or “informed” by MSM and various helper organizations) go and vote for what their masters have told them to do. The difference and brilliance of this system (vs the “founding fathers” system) is that the poor shlobs actually think they have a “vote” in the system whereas their only role is as a tool for the MSM-wielding property class against the non-MSM wielding property class (sometimes also within the MSM establishment depending on whether you think Fox is in our out).

The danger is that in the end the masters will be eaten by their own creations (once the other groups have been disposed off). Sometimes, I think of moving to China (if they would have me).

OK, I’ve lost interest in this.

I just wanted to conclude by saying “that is why Proposition 13 is the best thing that’s happened to California.

@Skirunman – that’s a nonsensical point. The person that actually writes the check is meaningless, the point of the tax is to generate revenue through as few negative incentives as possible.

If you’re eating in a restaurant, you’re helping the owner pay property tax. If you’re renting an apartment, a portion of your rent is paying property tax. If you’re shopping at a store, a portion of your purchase is paying property tax. The attempt to create a 1:1 relationship between who pays and who benefits is not how to create a tax code.