As we first reported last month:

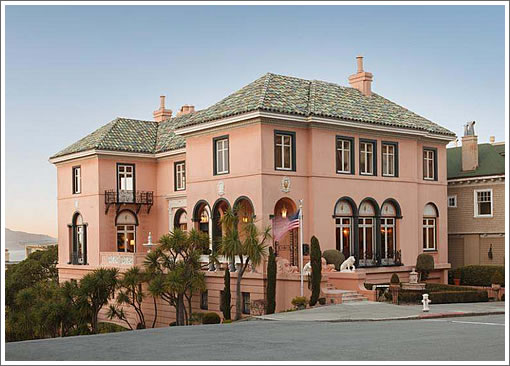

Frank and Frances Alioto purchased the 9,500 square foot Pacific Heights house at 2898 Vallejo Street in 1973 for $225,000 following its use in the filming of The Towering Inferno, serving as the mansion for Richard Chamberlain’s character Roger Simmons, the cheapskate electrical engineer who cut corners and was to blame for the tower’s fire.

Frank passed away in 1994. And with Frances’ passing this past November, the estate is now bringing the five-bedroom Beaux-Arts home with five full baths and a five car garage to the market for $16,500,000.

With a tax basis of $439,219, the total property tax bill for 2898 Vallejo was $5,205 in 2011. A sale at asking would likely increase the annual bill to around $193,000.

Last night 2898 Vallejo was officially listed and interior photos just went live:

Feel free to take a peek inside and check out the views.

Don’t forget the floor plans with an estimated 8,945 finished square feet (click to enlarge).

∙ Listing: 2898 Vallejo (6/5.75) 8,945 sqft – $16,500,000 [2898vallejo.com]

∙ The Alioto’s Towering Home On Vallejo Hits The Market For $16.5M [SocketSite]

Not a single photo of the kitchen or any bathrooms.. add a substantial renovation budget to the asking price.

Seems like we have seen a small handful of these super mansions in Pacific Heights with a super small tax basis changing hands recently. I calculate that the original tax basis in 1975 under prop. 13 was about $207,000 (439,219/1.02^38). Hard to believe that that was was the fair market value of the house back then.

[Editor’s Note: As reported above, “Frank and Frances Alioto purchased the 9,500 square foot Pacific Heights house at 2898 Vallejo Street in 1973 for $225,000…”]

I see that Joseph Alioto was the mayor from January 8, 1968 – January 8, 1976, so he was in office when the SF tax collector appraised the house for the prop. 13 basis. They are saying the value went from 225,000 in 1973 to 207,000 in 1975. Interesting.

@fred What’s the source for your 2% discount factor in your calculation?

I am using a 2% increase in the assessed value per year per prop. 13. Another fun fact is that the market value increased by 11% per year over 40 years on average (using 16.5M as its current value, for instance).

You slept through the second half of California history in high school. Proposition 13 didn’t even come before voters until 1978, so you can’t start at 1975.

Brahma,

It was approved by California voters on June 6, 1978.

The proposition decreased property taxes by assessing property values at their 1975 value and restricted annual increases of assessed value of real property to an inflation factor, not to exceed 2% per year.

http://en.wikipedia.org/wiki/California_Proposition_13_%281978%29

Doh! that’s what I get for commenting off the top of my head, I forgot about the back-dating of assessments to 1975 values in the initiative.

I guess I should avoid pointing out that Joseph Alioto wasn’t mayor in 1978, I’ll probably turn out to be wrong about that, too.

@Fred. Has the rate been constant at 2% over the entire 38 years. What is your source for the average actual rate?

I just assume the full 2% would apply each year. I don’t know the actual history. I guess the interesting this is how the taxes stayed really low while the value increased really high.

Average of 11% appreciation over 38 years…boy, can you say chaaa-chinggg! Hell, I’ll settle for 5% average annual appreciation over the next 30 years for me….hee hee.

Prop 13 should be found unconstitutional by the courts. There’s no equal treatment when a home worth $16 million has the same taxes as a $300,000 home. I know the law was held constitutional, but since then the unfairness has increased by 100 fold.

@Fred. Acknowledging that you know nothing of the actual history, will you please withdraw your prior comment implying that former Mayor Alioto and the City assessor were dishonest?

What’s interesting, in looking at the floor plans, is that the master bedroom is in the front, street side and not facing the view. Hopefully, the new owners will leave it that way as it’s such a beautiful room and has south exposure.

That 11% appreciation is all inflation. Not real wealth gains

imc, pretty much all the view homes in Pac Heights had the master bedroom in the front of the house. I’m not sure why the view wasn’t a priority, but that’s just they way they were built.

To: 49yo hipster.

Prop 13 is not unconstitutional. Equal treatment does not guarantee equal outcome. As someone who was in the workforce in the 70s, I can tell you that the voters didn’t pass Prop 13 for no reason.

Consider that you and I both bought a house for $250,000 in 1975. We each had worked and saved the required down payment and qualified for the mortgage. We each worked, saved, took care of our property and now we are retired and our mortgage is paid off. Based on the city/neighborhood that we bought into, my house is now worth $1 million while your house is worth $16 million. This change in value has nothing to do with either one of us, it is a function of the economy and real estate market. Our retirement income is a similar amount and we are able to live comfortably. The question is should you be forced out of your home now by a tax bill that you cannot paid? Why should that be? You did everything so you could live out your life in your paid for home.

This article is about Frank Alioto, not Mayor Joseph Alioto. Two different people.

Regina- don’t look at me sister, as owner of several properties in SF, me love me that prop 13! (I think you meant to address no-“moneyman” 🙂

TweedleD- “That 11% appreciation is all inflation. Not real wealth gains”. I don’t know what you’re smoking, but it must be pretty good! That statement is preposterous.

LOL at the “3rd bedroom”. Why not just label it honestly as “Maid’s quarters”?

Interesting to stage the upstairs 2nd bedroom as a “family room/library.” Also they paneled over a main window in the master, leaving the window all white on the exterior.

Like @Joshua said, the first thing I noticed was a lack of photos of the kitchen and bathrooms. That’s a huge red flag for me and I’m operating under the assumption that all will need major renovations.

The list price for 2898 Vallejo has just been reduced by $2,600,000 (16 percent), now asking $13,900,000.

Not surprising. This place is something of a wreck. It’s not a cosmetic fixer by any stretch of the imagination and needs extensive, and expensive, structural work. It’s not a project for the faint of heart or light of budget. I’m expecting a sale closer to 10… maybe 11.5? A buyer who is not a professional developer should probably look at a budget of about 10 million, including interior design and furnishings…

In Escrow.

$11.7M. Big discount from asking. Nice call Denis. Anyone have the scoop on the Jackson St French Consulate?