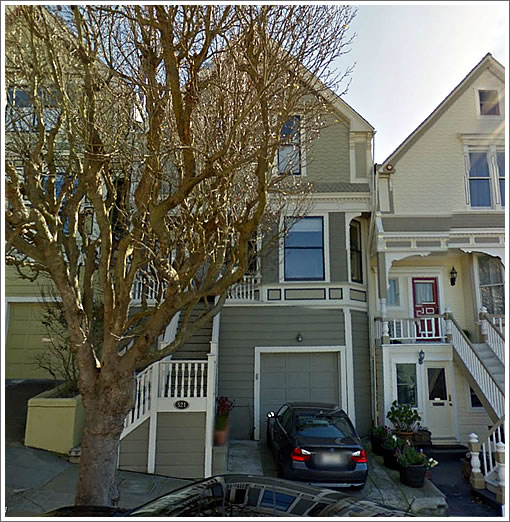

As we reported with respect to 521 Liberty in June:

Purchased for $1,161,500 in 2006 then gutted, rehabbed, and returned to the market asking and selling for $1,950,000 in 2007; the owner of 521 Liberty passed away and the home is back on the market and listed for $1,795,000.

In the words of a plugged-in ex-neighbor who notes the owner did some landscaping and minor work in the basement, but nothing that should really change the value:

I’m not sure what to think of the price. I thought [$1,950,000] was a crazy peak at the time in 2007. But it is a fantastic street, and with what’s been happening recently, could this actually be underpriced? I’m just not sure anymore.

The sale of 521 Liberty closed escrow yesterday with a reported contract price of $1,800,000, officially “over asking” by $5,000 but $150,000 under its “crazy peak” price.

∙ The Circle Of Life And 521 Liberty [SocketSite]

∙ Life, Liberty, And The Pursuit Of Profit A New Home [SocketSite]

No need to put over asking in quotes. This seems very much in line with the market & C/S data. I’ve long said buying / selling a home in 5 years is a bad strategy but I guess death is fairly difficult hurdle to overcome. Congrats to seller agent for pricing this well; and to the buyer. Nice home.

If only there was a 2010 Apple that we could discuss. 😉

“Congrats to seller agent for pricing this well”

Agreed. This is the kind of ability we should be awarding agents for, not under pricing and then giving everyone high-fives for selling “way over asking”.

1100+/sf. Wow.

Wow just had a look at the pics.

I guess that’s a good example of staging isn’t always necessary. Although, if I knew the agent was coming to take pics, I think I’d at least clean off the kitchen counter.

As I said in the last one, not sure why you don’t wait until the tenant is out and you can clean up a little..

They definitely would have received a higher price. How much higher, got me..

double what lol says..wow, that’s a lot. Yard does look to be nice sized though and the layout (bedrooms all upstairs) is good.

And as I said in the previous thread, I think the square footage was slightly (not hugely) greater because the kitchen has a bump out that I do not believe was included in the posted square footage. But it’s still 1K/sf anyway, so still very high.

The prime areas of SF housing demand is still strong? Why? The high paying jobs in the area.

The prices people are paying on the court house steps in SF, has amazed me for years.

When a prime property goes up for auction people can push the sales price up to just about normal asking for no “court house steps discount”

BTW I thought that Facebook would double in value in the first 3 months. Well Facebook Stock is on sale at almost half off the IPO price.

How is this a “wow” when it lost $150k in five years? What am I missing

The Wow is the price per square foot, which is on the high side for sure.

OK, but isn’t the ppsf lower than it was 5 years ago?

anon, of course. But the price was an outlier then. And appears to still be an outlier. Apples are a great concept, but can’t completely be used as a mirror for the market as a whole, as there is a lot of individual variation in real estate purchases.

Don’t forget that 2007 was probably the absolute peak of the market for SFH’s in this hood.

And also don’t forget that in 2007 this house had lots of new car smell, being a brand newly renovated spec flip. And this time around it was shown distinctly NOT in its best light (take a look at the photos). With all that, I’m frankly surprised it’s only 150K off the bubble top.

So down 7 1/2% plus down another 10% from inflation in 5 years. Good result for the 2007 buyer, relatively speaking. Other 2007 buyers are far worse off.

well the 2007 buyer is dead, so I don’t think he really cares.

Other 2007 buyers also did similarly or better in this current crazy market.

If something trades lower, then the previous sale price was an outlier. Or it was an example of the problems of a shorter than five year buy and hold. For the properties that are not selling right now in this hot market, or are on and off the market, they are problem properties or are mispriced or have the wrong agent.

But if a property trades higher, it is a sign of a booming market regardless of the last sale price. And if I point out this kind of rationalization, then I am a dumb ar se who is not one of the insiders of the real estate market.

Btw, I am not a housing bear– just find the rationale on both sides of the coin to be borderline hilarious sometimes. And I know the market is doing better than last year.

Why consider something unimproved since the last peak market sale and rented while showing to be excuses? Your rush to label black or white is what’s humorous here.