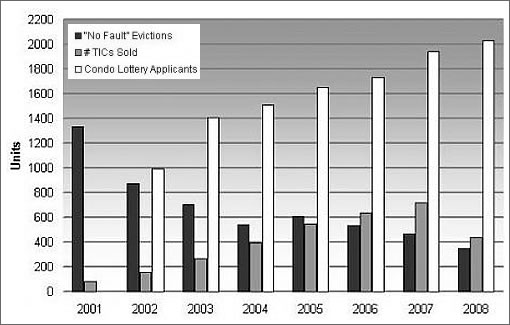

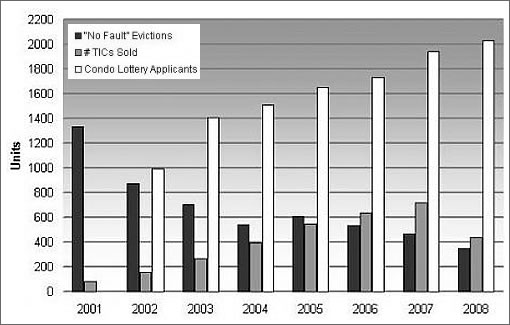

Ticket sales for the 2010 Condominium Conversion Lottery kicked off this morning and will run through 4:45 PM on Friday, January 22, 2010. The drawing for the rights to convert 200 units from TICs to condominiums in 2010 is scheduled for Wednesday, February 3, 2010. Around 2,000 tickets are expected to be sold (2,030 in 2008).

Full details with respect to eligibility and process as well as applications for first-time and returning applicants are available online.

∙ 2010 Condominium Conversion Lottery Details [SFGov]

∙ 2010 Conversion Lottery Applications: First Time | Returning [SFGov]

∙ Demand for Affordable Housing Continues Strong [plancsf.org]

can anyone summarize the pluses and minuses of investing in a TIC now? My understandng is that TIC values have dropped significantly due to a)the general economic crisis and lack of financing and b)the increasing affordability of TIC alternatives (condos, sfr’s) without the uncertainty inherent in TIC’s. I haven’t been paying alot of attention though, and I’m wondering if there is any perceived opportunity in bottom fishing for TIC’s now. And, do they qualify for the first time home buyer’s tax credit?

No conversion to condos ever if there have been two or more evictions from the building (asking someone to leave, who does leave, is an eviction, by the way) OR eviction of a single disabled tenant, where disabled is very broadly defined (and includes a lot of people you might not think are disabled).

It’s tough to investigate whether any of these gotchas have occurred when you buy the TIC, it will usually only come out when you try to condo convert. So buying a TIC and hoping to condo convert is a bigger gamble than winning the lottery.

There is essentially no reason to buy a TIC right now, unless prices are substantially below condo prices. You are just asking to mix your finances with one or more unknown parties. You can get individual financing, but who knows what the docs say the bank can do if one party needs to be foreclosed, and what the effects on the other so called owners would be.

Buying one of these right now is dumb, dumb, dumb when condos are widely available and prices are falling. Anyone who does is likely to get exactly what they deserve.

Um… I don’t believe that a tenant’s voluntary departure is considered to be an eviction, even if they’ve been asked (or financially induced) to leave. Eviction is a legal process. In addition, only “No-Fault” evictions affect eligibility for condo conversion; evicting someone for cause (not paying rent or breaking their lease terms, for example) is not a barrier to conversion.

If a protected tenant was evicted and later reoccupies their original unit, the eviction does not count against the property owner when converting.

I agree that it’s tough to know for sure, when you buy a building, whether any of the relevant evictions have occurred in the past.

tipster is mostly right, but:

You have only yourself to blame if you don’t know what the docs say the bank can do. In case of foreclosure, the bank is bound by the TIC agreement signed by all parties, and thus the agreement has to be reviewed by lawyers working for the bank pre-close. In our case, the bank has unilateral authority to invoke the Ellis Act the building to regain control and vacate a unit in foreclosure, if they so desire. Otherwise, they are not granted any powers beyond what any owner already has.

I would not buy a TIC with intent to convert to condos to cash in on the significant increase in value. You’re looking at up to 20 year wait periods before winning for first time entrants. If you win, woohoo, but it’s a bonus and not something on which to bank.

The biggest and scariest TIC quirk is the possibility that fractional financing will dry up, which means it will be impossible to refinance your mortgage or sell your unit without converting the building back into a joint loan, which would require unanimous consent among all owners. As all fractional TIC loans are adjustable rate and, last I checked, running at between 7.5-8%, you can end up with significantly higher risk AND costs, compared to a condo, even if that condo is $150,000 more expensive (due to the interest cost of the mortgage).

As I recall during a casual conversation with an SF attorney who handles a lot of condo conversions, at least one major lender stopped making fractionalized loans. Wells Fargo had finalized its plans to enter the market but balked when the liquidity crisis hit. I believe Sterling and Circle are still happy to give you a mortgage, if you have many months living expenses in cash, a very high credit rating, a ~35% loan-to-income ratio, and 20% cash to put down.

Can someone explain what the city’s interest is in limiting the number of conversions?

the increasing affordability of TIC alternatives (condos, sfr’s) without the uncertainty inherent in TIC’s.

Lets see, a TIC, where your neighbors have put 10-20% down, or a condo where you neighbors have put down 0%? I am curious, too, about the state of fractional financing. Anybody in the loop? Mischa has an interesting analysis on his blog showing how the price/sq.ft. difference between a condo and TIC has been slowly dropping since the advent of fractional financing in 2005.

Alexel-

The city believes each building converted to condos represents a loss in rental housing, and thus leads to a loss of affordable units.

“In our case, the bank has unilateral authority to invoke the Ellis Act the building to regain control and vacate a unit in foreclosure, if they so desire.”

I’ve always suspected this was true, because it was the only way to knock a single “owner” out. Fractional financing is really a rental agreement. The bank owns the property and the “owners” rent from the bank, pretending to make “payments” that are really rent. How else could the bank invoke the Ellis act if the “owners” were not really renters.

So under fractional financing, you really just rent, at a cost above that of a normal rental, and you are obligated to pay the property taxes for the bank, though you do get to paint the walls.

Wait until the IRS finds out about these deals and goes back and collects the taxes that were deducted by the renters who claimed to be owners. The IRS can assert that the transaction was really more rental than ownership and take back all of the deductions, no matter what the documents purport to say.

So under fractional financing, you really just rent, at a cost above that of a normal rental, and you are obligated to pay the property taxes for the bank, though you do get to paint the walls.

Did you have too much coffee this morning, tipster? Not that I don’t agree with your assessment, but the same case can be made for SFHs and condos with a more conventional mortgages.

FWIW, the nuclear option (being evicted for your neighbors non-payment) decreases as you go from TICs, to condos, to SFHs.

Wait until the IRS finds out about these deals and goes back and collects the taxes that were deducted by the renters who claimed to be owners. The IRS can assert that the transaction was really more rental than ownership and take back all of the deductions, no matter what the documents purport to say.

You’ve outdone yourself on this one. Big brother is watching? check. Fraudulent behavior? check. Ownership belittling? check. Logical leap after logical leap (conspiracy theory?) check.

LOL @ the IRS giving a crap about a bank that hypothetically could invoke a state law, let alone any of the other nonsense you’ve said. You’re getting worse, Tipster. Wow.

tipster-

No, the Ellis Act clause is not in the TIC agreement to force non-paying owners out, it’s designed so that if the owner rents the unit out and then forecloses, the bank can avoid all of the complicated tenant’s rights in SF and just evict them, vacating the unit for eventual sale.

Your comments about the IRS are, well, odd.

Word on the street is that returning condo lottery applicants may not be entitled to more than one ticket. This is as per a recent alert from Plan C:

http://insidesfre.com/2009/11/19/more-condo-lottery-craziness/

If you come up against this, please let Plan C know.

“You have only yourself to blame if you don’t know what the docs say the bank can do.”

Yep. When I was looking for a place I considered a coule of TIC’s but balked when I looked into the details of the financing. The loans for TIC’s always seemed to have a 10-year ballon payment clause. I did not like the answer I would get when I asked “and what happens if I can’t refinance in ten years and don’t have the cash to pay off the entire balance?”

It will be interesting to see what happens with a lot of these TIC’s that were sold if the market doesn’t recover when those ballon payments come due.

Speaking of plan C,

At some point in the not too distant future, I predict the fees to bypass a lottery will become too tempting for the city to not sell. They have an asset to sell for a one time windfall that will also ultimately raise property and transfer taxes. Does not cost the city anything to collect(assuming the other fees cover the costs to convert). Given the choice between cuting services by $50 million and doing the TIC lottery bypass sale, I am pretty sure they will not be reducing services. There have been more than a few thousand units added to the housing stock over the past few years, a fact that can be used as justification for this move as well. What is the downside of this again?

[Editor’s Note: Condo Conversion For A Fee? Yes Please (But Not Just Once) and Condo Conversion (And TIC Lottery Bypass) For A Fee? Nope.]

The progressive supes all hated the idea of paying around the lottery. I don’t completely disagree that it might happen at some point. Logically you’d think that the city’s monetary woes might cause some rethinking of positions. But for now they all cater to renters, and the language last time around was that the lottery bypass was anathema to renters. The soops need to think that the loss of city services means more to their constituencies than fear mongering. That’s a tall order.

The big downside of this is that it’s completely logical and well timed. The Stupidvisors would not want to appear to let current economic realities affect any of their decisions. Better to change the rules in the middle of the game so that we can be exposed to more law suits from frustrated TIC owners.

I’ve always suspected this was true, because it was the only way to knock a single “owner” out. Fractional financing is really a rental agreement. The bank owns the property and the “owners” rent from the bank, pretending to make “payments” that are really rent. How else could the bank invoke the Ellis act if the “owners” were not really renters.

This guy calls himself “tipster”?? Good lord – this a fundamental misunderstanding of fairly basic elements of TIC ownership. Did this guy really think the reference to the Ellis Act was regarding TIC owners themselves??? Whoa… ok, guy. LOL

Regarding what insidesfre posted-

Basically, the change means that you only get as many tickets as the owner who has been there the longest would get. As an example, said our building had three owners– one there for 10 years, one for 5, and me for 2. If the first owner participated in the lottery as long as possible, we’d get 7 tickets. However, if that person moves out next year, in next year’s lottery, we’d only get 3 tickets based on the now 6-year resident.

This is how I’ve always seen it written, but plan C states that in previous years, you got as many extra tickets as lottery losses by the building, not the owners.

In my opinion, this is actually more equitable than the old way, as now each owner has to suffer equally for the same number of tickets. You can’t rely on the past suffering of long-gone owners to benefit. It also readjusts the probability of winning as there may be far fewer tickets this year in the total pool.

On the other hand it could be viewed by the properties in question and not the poeple. A particular property has been contributing revenue to the city via its condo lottery for X amount of years. Just because someone has moved on, is it fair to reset the property to the next longest tenure? When they’re all still paying? I see both sides of the argument. But in an economic environment like this one, wouldn’t the city want to maintain the carrot instead of yanking it away?

God tipster is so full of shit again.

1. Tenant buy outs are definitely NOT considered legal evictions. That’s why owners do them, duh!

2. Comment on fractional loans and banks right to Ellis act are totally misguided, as others explained.

3. I won’t even get into the ‘tic owners really rent from the banks’ and the IRS comments. Sheer stupidity!

These hysterical and always negative comments from him are getting reeeaaalllyyy old. What a sour puss. Must really be angry inside that he doesn’t own SF RE.

rr said:

“The biggest and scariest TIC quirk is the possibility that fractional financing will dry up, which means it will be impossible to refinance your mortgage or sell your unit without converting the building back into a joint loan, which would require unanimous consent among all owners.”

bingo. that’s the problem for most TIC buyers. sterling bank is doing a 5/1 arm fractional loan at about 6.5%. bank of marin has stopped doing fractional loans except for “existing customer projects” – i.e. they’ll only give loans on projects for which they have already financed the development/construction- i.e. the projects where they already have their asses on the line that a sale be made. andy sirkin has all but left the business. it’s a dying bull market product. maybe no one has defaulted on a TIC yet but when it happens the banks will pull in their horns so fast….. everyone that tries to sell out of their financed TIC will be stuck in a roach motel.

Buyouts

Tricky

Beware

FWIW, the nuclear option (being evicted for your neighbors non-payment) decreases as you go from TICs, to condos, to SFHs.

A somewhat poor word choice there as TIC owners aren’t evicted; however, they can be forced to move by a bank (or with a non-fractionalized loan, owner) initiated partition sale. And if we ever do start seeing partition sales, I’d say we are at or near the bottom.

45yo hipster wrote:

> 1. Tenant buy outs are definitely NOT

> considered legal evictions. That’s why

> owners do them, duh!

Not according to Board Prez Chiu at today’s board hearing: he considers that an eviction. Be very scared about what they’re proposing on condo owners who dare to rent out their units. Attend the Dec 8th land-use hearing to hear your worst nightmares confirmed.

^ nothing to do with buyouts. Buyouts are private agreements, and as long as they are done correctly, go around all the rent board bullshit. Don’t let chiu scare you. Also, the rent board does ‘not like’ buyouts because it obviously diminishes their power. To which I say: tough shit.

As for:

buyouts

tricky

beware

I say:

I’ve

done

six

Condo Buyer, can you post the details (loc & time) of the December 8th land use hearing for those of us that are interested?

It’s actually Monday December 7th 1pm Land-Use committee and again at Tuesday December 8th 2pm Full Board of Soups. It is expected to pass at both meetings and there are no indications that the Mayor will attempt a veto (his office is not returning calls ….).

Here’s a link to the original proposal that was amended yesterday: http://www.sfbos.org/ftp/uploadedfiles/bdsupvrs/committees/materials/090583.pdf

I’ll post the full text of Avalos’s and Chiu’s amendments whenever they deign to release it to the public (probably at 12:59 on 12/7/2009).

[Editor’s Note: Just Cause Protection Coming For Non-Rent Controlled Rentals?]

@anonn The city appears to want to get as much money as possible while converting as few condos as possible. This makes it harder for a building to get extra tickets. I have not done the statistical simulations, but my instinct tells me it will also mean higher median years in lottery before winning, thus more $$ per building. Finally, it has the side effect of kicking certain buildings out of the lottery temporarily in case of several sales, which means an even longer time to win.

@resp I imagine TICs will rebound eventually, perhaps several years from now. In the meantime, at least one fractionally foreclosed TIC unit was featured on socketsite and I bet more are on the MLS if you are willing to dig. One advantage of TIC implosions is the last men standing get faster condo conversions. Of course, if part of yours implodes, all hell breaks loose. You might not lose your home, but all of a sudden your share of the maintenance goes up, and forget about trying to get the missing share of property tax back.

The interesting thing about fractional financing as it applies to TIC foreclosures is that the bank’s ability to sell a unit it repossesses is tied to the ability to finance it. Who is going to buy into fractionalized TIC with all cash? As the bank cannot compel me to sell my section of the building to force a whole-building sale and dissolution of the TIC just because it now owns a different section, the loans have to be out there in order for the banks to unload the units they buy back.

I don’t quite have the time to dig through that.. The essence is essentially extended eviction controls to building built since 1979? i.e. no evicting without cause?

There is very little effect of the change, I hate to say. The overwhelming number of evictions from condos are either to allow the owner to move in themselves or to sell the place after which the new owner will move in. Owner move ins are still allowed, and easy to do, and the eviction will have to occur after the sale, but so what, the new owner will have an easy go of it. So for most owners, this is a yawner.

The benefit of the new law is that if the bank takes over, they can’t toss the tenants out. This really only materially hurts the banks. It could even help defaulting owners in that the bank will be less likely to want to take the property back if it is rented out, so they might deal more favorably with the owners to drop the payments in line with the rents.

I think you may want to rethink your opposition to this, the downsides are minor, but the upsides are huge.

Check the link posted above: the ordinance as originally proposed by Avalos allows one owner-move-in PER BUILDING PER BUILDING-LIFETIME. Good luck with your neighbors on that one! Supervisor Chiu has promised an amendment that defines some sort of new “owner move-in just cause” but nobody has seen its definition yet. Avalos was p****d at this amendment but has little choice at this point (legislation still in committee of which he’s not a member).

This proposed legislation would not affect condos or SFHs. One more basis for the desperation of TIC owners to condo convert!

As the bank cannot compel me to sell my section of the building to force a whole-building sale and dissolution of the TIC just because it now owns a different section

Yes they can; read the fine print of your loan and/or TIC agreement (keyword: partition sale). As you point out, though, at this stage of the game, they have a stronger incentive to finance and resell just the fractional interest they may have reclaimed through foreclosure, rather than the entire building.

The links to the City’s information no longer work.

The CORRECT LINK should be:

http://www.sfgov.org/site/sfdpw_index.asp?id=37184

Thanks for playing… you gotta be in it, to win it

BEWARE: There is A LOT of misinformation in the above postings. I can’t go into all of them, but if one of the issues above is of serious concern to you, you should seek the advise of a KNOWLEDGEABLE attorney, agent, or loan broker. Lots of real estate agents and loan brocker claim to be knowledge because they are after the commission, so be careful, but there are some out there who can provide you with helpful advise and certainly much better answers then what has been provided in this blog.