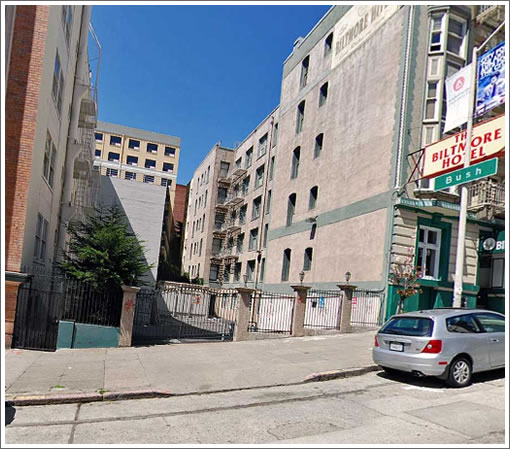

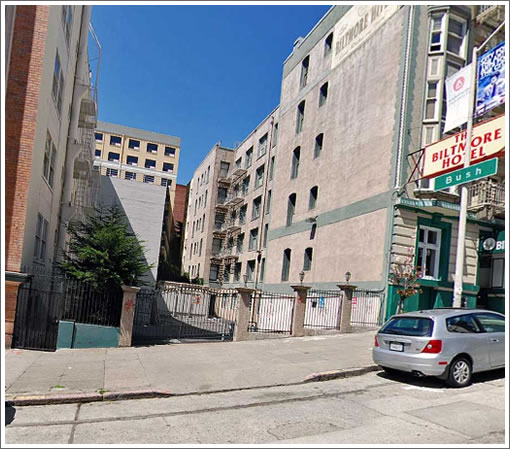

A plugged-in tipster snaps a picture of 723 Taylor rising, a bit of urban infill on its way.

Eight (8) stories and twelve (12) units when complete. And while we believe that it has been condo mapped it should be rentals at first. Now who has a line on its design?

∙ Zillow Is A Lot Catchier [SocketSite]

Haven’t seen the design, but an 8-story, Type-1 concrete building with only 12 units (incl 1 or 2 BMR’s)in the tendernob? Someone’s gonna take a bath. Or maybe the land was free.

Virtually all (if not all) multi-unit housing constructed recently is condo mapped even if it’s rental apartments: it’s a condition of financing where the bank wants to ensure that you can “flip” from one to the other if the market warrants.

yeah, perhaps it’ll pencil out with ‘free land.’ like a grandpa’s family trust, and the kids want to play developer. it gives them something to do and they can claim they developed a building in SF. lotsa legacy bias like that going on all over the city…i hear about it again and again.

Maybe developers are being squeezed for slimmer margins. At this scale the units should come out to around 2k sq ft each which means they should have multiple bedrooms and be worth around $1.5 million or so. At $1.5m each twelve would be worth $18m ish. Is it really going to cost that much more than nine or ten million to buy the lot and develop the whole property including inevitable underground parking garage? Around 30k sq ft at around $350 per sq ft is around there (being just a tad vague with the numbers). There is no way this is going to be super profitable, but only poor execution will cause anyone to loose their shirts on this. The location is shabby chic par excellence.

but Shabby chic ain’t selling for $1.5 mil. That’s too expensive and luxgurious for da loin. More like $600k 2br 1 ba would fit that location IMO.

Taylor between Sutter and Bush is hardly the Loin. You’re almost surrounded by tourist hotels. $1.5 mil is probably high, but $600k is ridiculously low if they really are 2k sq ft each. $300 per sq ft? Really?

The lot is 35×81; take out a 15-foot rear yard, stairs & elev and you got 1900 sf net/floor.

Looking at the pics on Ian Birchall’s site(they’re the architects), it seems that the top two floors are 2 set-back penthouses ($1.5M each). That leaves 10 units on the lower 5 floors – each at 950 sf ($700K ea).

Gross rev = $10M

minus $350/sf hard -$7M

land & soft -$1.5+M?

oops.

forgot about the BMR unit/fee.

takes the rev down a bit. They gotta make these sweeeet to work out…

$600kfor 2/1’s at 1000-1200 sq ft per unit.