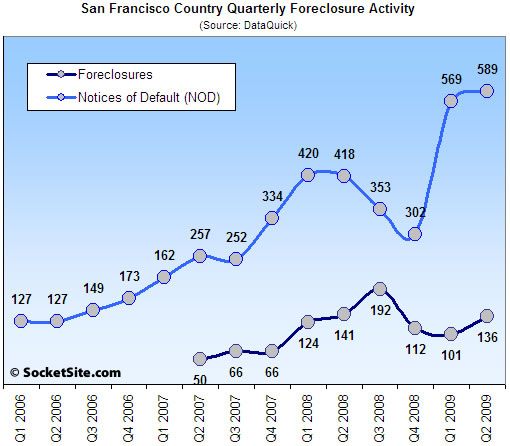

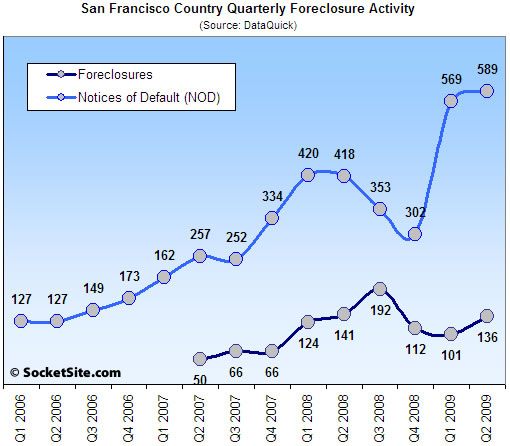

Bay Area Notices of Default (NODs) in the second quarter of 2009 rose 7.3% on a year-over-year basis, up 40.9% in San Francisco proper (from 418 to 589). NOD activity in San Francisco increased 3.5% from the first to second quarter.

Actual Bay Area foreclosures in the second quarter fell 25.4% on a year-over-year basis (from 9,293 to 6,929) with Contra Costa (down 30.9% to 2,048), Alameda (down 18.4% to 1,466) and Santa Clara (down 22.4% to 1,210) leading the way with respect to volume.

Second quarter recorded foreclosures in San Francisco totaled 136, down 3.5% on a year-over-year basis but up 34.7% (35 homes) from the first quarter 2009. Expect San Francisco foreclosures to rise dramatically over the next few of quarters as moratorium delayed NODs work their way through the system.

∙ California Second Quarter Mortgage Defaults Edge Down [DataQuick]

∙ Actual Q1 San Francisco Foreclosures Fall But Notices Of Default Spike [SocketSite]

I’ve lost track, is there still a foreclosure moratorium going on?

You can throw all the graphs you want at it, to the extent the market for SFR north of California went down at all, its low was in March when there was blood in the streets and the Dow was at 6500. Now the Dow is over 9000. The biggest real estate crash in a generation was only a blip for well-located property.

“The biggest real estate crash in a generation **was** only a blip for well-located property.”

Was??? You talk like it’s over.

unwarrantedinlaw,

Dow back to 14K?

Unemployment back to 5%?

Wave of resets behind us?

CRE back to full capacity?

I didn’t think so. It’s a bit early to call the game yet. The blip might be these past 3 month in retrospect.

There seems to be a two quarter lag between movement in NODs and the corresponding movement in foreclosures.

4Q09 is going to be ugly.

Sorry guys, you’re never going to be able to pick up quality SF property for peanuts, it’s just never going to happen. This market survived the darkest real estate gloom in a generation. In March, jumbo loans were impossible to get for most folks. Prices north of Calif hardly dropped. It’s going to have to be hit by a neutron bomb before we see the prices you want.

One of the reasons I started buying in SF was that the prices weren’t much different from the property prices in some real hell holes. Damascus prices weren’t much different, and in Damascus it was all cash, no FNMA.

This Palestinian fellow who got in trouble recently for paying too much and then gutting his houses – a factor may have been that prices weren’t that much different in Ramallah. Except in Ramallah you can expect a bulldozer to come through the dining room wall, or an IED on your way to work. A lot of these immigrants come here, see the relative values, and go nuts. A Syrian friend of mine told me he couldn’t believe he owned his property in SF, couldn’t believe a bank would actually give him a 70% loan, until he had the keys and was standing in it.

“One of the reasons I started buying in SF was that the prices weren’t much different from the property prices in some real hell holes. Damascus…”

Folks, be prepared for Syrians and Palestinians with bagful of cash landing on the Bay Area en masse. The next great way of real estate boom is in the making, and unwarrantedinlaw is way ahead of us.

Someone is still trying to convince themself…

In light of the pending next wave of foreclosures, and the Alt-A and option ARM resets over the next few years, has anyone given serious thought or analysis of trading of DMM or UMM (Schiller’s new major metro market tracking ETFs offered by MacroMarkets)?

I am surprised these haven’t been discussed here at all. I find it a bit worrisome that these funds don’t have any exposure to the real underlying assets (i.e. real estate) and seem to transfer value back and forth as a paired trust. Although nationally we may be bottoming in many places in the flyover, it seems that the major markets may still have a way to go to correct and are most likely to be hit by the Option-Arm and Alt-A over the next few years. I would be especially curious to hear from ex-SFer or LMRiM.

Houses in Bakersfield that sold at 350k in the bubble dropped to 120 in April; now they’re at 135k. Hard to believe that Bakersfield would rise while SF drops. It’s better to get on the ground and see what people are really paying for houses than to analyze graphs.

Thankfully someone created math and we can use it to make sound financial decisions. Perhaps Milkshake and unwarrantedinlaw could use it to show us how SF ‘real’ real estate is a logical buy right now?

My math shows a $1.4M home I WAS going to buy in Jan 2008 just sold for $1.18M. Its ‘real’ SF. Its way cheaper. Its actually quite reasonable. I’m now awaiting for it to return to the market at $1M, or buy the bigger unit upstairs for the same.

I don’t know what you are talking about. ‘Real SF’ is a not cheaper NOW. Several hundred thousands of dollars is not a blip…if you use math.

unwarrantedinlaw,

What you described in Bakersfield is the exact definition of a dead cat bounce. People rushing to the exits making prices go down under some critical technical levels. And the smart people rushing to scoop the good deals that create a blip. It doesn’t mean the fall is over, because technical levels change too. But it’s pretty close I would say…

Bakersfield is a good example for what is happening outside of SF. Very little cash, low salaries (mainly agriculture, manual work and jobs that revolve around it). A perfect subprime environment that took off stronger than prime (gold rush effect from people forgotten by the last expansion) and crashed must faster for lack of any cushion (you can’t finance your overpriced upside down mortgage with your 401(k) when you don’t own a 401(k))

has anyone given serious thought or analysis of trading of DMM or UMM (Schiller’s new major metro market tracking ETFs offered by MacroMarkets)?

I think these are a very novel idea, but IMO they fall more into the “trading” realm than the investing realm. I haven’t looked at these close enough to make a truly informed decision, but in general I don’t like these.

things that I like:

-there seems to be no counterparty risk, as the underlying assets are two paired trusts that hold cash/Treasuries that have exclusive payment ogligation agreements with one another. So if Case Shiller rises then DMM’s trust sends payment obligations (not actual cash) to UMM. If Case Shiller falls then UMM sends payment obligations to DMM. This is quite nice as it is relatively efficient, but moreso because it reduces counterparty risk. (many ETFs such as the Proshares ETFs do hold considerable counterparty risk IMO)

-I like that they hold Treasuries. although I’d be careful to look and make sure that this is all they hold. Don’t want any Fannie or Ginnie in there!

-it gives you another way to speculate on housing prices. (key word: speculate)

—

Things I don’t like:

-I try not to invest in things that I don’t understand 100%. I don’t understand these 100%.

-These don’t appear to be very liquid to me. Looking at daily trading volume, these trade pretty light. I dislike owning illiquid investments, especially during credit crises. Less nefarious, illiquid ETF’s diverge from their underlying value more often than liquid ETFs do (see below)

-The expense ratio is 1.25%, somewhat high for an ETF IMO.

-it’s a new product. in other words: untested.

-lastly: per the prospectus the value of the funds can deviate from underlying value. it states:

Like the market value for most other securities (eg corporate stocks and bonds) MacroShare prices naturally diverge from underlying value. Premium or discounted prices for these securities reflect a variety of market factors and expectations. For example, the the market price of MacroShares Mjor Metro Housing Down will reflect supply, demand, and investor expectations regarding the future path of home prices over the remaining term of the security.

I don’t like this, especially given its illiquidity.

LMRiM is more of a trader than I am so I’m sure he’ll have a better response.

The biggest real estate crash in a generation was only a blip for well-located property

whew. I’m glad that’s over. Good thing it’s all contained.

perhaps someone should notify the recent highlighted Upper Broadway seller that just sold his prime SF home for 20% less than it sold for in 2000?

and perhaps someone should notify the banks sending out all those Notices of Default?

Just trying to help you out, I’ve seen lots of people praying for the market to go down, hoping for others to fail. It never works. The only thing that works is to get up and be a man, get out and make things happen. DMM, UMM, ETF, ARM resets, NOD’s, all that is hogwash. Get out on the street and find out what’s going on.

I am still coughing out the coffee I inadvertently swallowed through my windpipe. I think unwarrantedinlaw just won the funniest post of the week award. Patronizing, self-righteous, demeaning, heavy-handed, the works. When I think I even tried to make some sense of his earlier posts and even responded politely. I want my 10 minutes back.

unwarranted,

please name that street you are talking about.

Tall Guy, can you let us know when you purchase?

20% decline is hardly a blip. Well over $100K.

A few people who didn’t have the income to service the loan or the assets to ride out any problems were turned down, everyone else got loans. So there was no catastrophe, though documentation issues took longer and bidding higher than fair market value may have found an appraiser here and there who tripped up the deal. Armageddon it wasn’t. Everyone I know who wanted a loan got one if they really qualified for one.

Is that situation “over”? Don’t think so. I think it’s here to stay.

But a lot of people I know have been laid off in the last few months. Now, THAT’s different. And they aren’t getting their old salaries back. That’s for sure. And prices in outlying areas are down from a year ago. That’s different too. So things are getting worse for SF real estate, not better. Not staying even.

As for Bakersfield, that’s probably more a function of the foreclosures being bought, fixed up and sold, and the normal rise in prices that occurs in the summer. I doubt it’s going to get much worse there. But are we out of the woods because the places that fell precipitously to practically nothing have stopped falling for now? Doubt it. What will happen is it will allow businesses in that area to lower wages while still allowing people who want to buy a home to do so, and then it will fall again. Too much shadow inventory for anything else to occur.

SF has another problem: the impending disallowance of itemized deductions for families with incomes over $250K. Once that occurs, real estate will be a much tougher sale because you won’t be able to deduct mortgage interest or property taxes, so the rent vs. buy calculation will be a disaster. Bakersfield isn’t going to have that problem.

Finally, PH is not north of California, it’s north of Sacramento. The area in between is really LPH: the quality of the buildings and maintenance in that area between California and Sacramento is spotty and generally poor.

I’ve said this before and I’ll say it again: anyone who buys in SF right now is a complete idiot and will regret that decision.

ahhh the socket!

West Portal,

I’ll echo most of what ex SF-er said. I’m not super familiar with exactly how these ETFs work, but I do know the paired trust strategy is a response to its earlier oil ETFs that had to be liquidated after they reached trigger points (because of the volatility of the oil markets over the prior year or so).

About the new CS ETFs, I like the paired trust strategy, insofar as I can tell what is going on. On a really broad level, macromarkets is employing conceptually a similar approach to what has been done in the swaps (and CDS) markets. WS firms set up “AAA” captive subsidiaries way back in the mid-90s in order to trade swaps with each other without counterparty risk. The swaps typically settled against some notional index. Here, macromarkets is capitalizing some sort of trust structure with AAA securities (treasuries), and I’m guessing at zero or very low leverage (that is, the value of the treasuries in the pool is equal to the value of the shares of the two ETFs outstanding). Like ex SF-er, I don’t know all the details, but conceptually that structure seems sensible.

However, I don’t really like the idea of trading the CS futures. CS seems like a useful spot or historical tool, but there is no natural market for the futures, unlike, say oil (where producers are natural hedgers, and users are natural demand). Partly because there is no natural demand (who really needs to hedge an entire MSA?), the market is very thin. So, to the extent that you want to use CS future data (which is going to get used in pricing the ETFs for sure, otherwise ther’s be an arb opportunity), you are relying on a very speculative and incomplete “market”. Perhaps if the ETFs catch on, there will be more liquidity in the futures, but again so long as there are no substantial natural users of the product (and I just can’t see who would be), it’s going to be purly speculative. I guess just like oil these days 🙂

unwarrantedinlaw, you made my day too with your 11:01AM post

wee need more laughs during these trying times

please keep them coming!

LMRiM thanks for the explanation

Naive question: can’t “so long as there are no substantial natural users of the product it’s going to be purely speculative” be said of just about any non-dividend stock as well?

Hmmm….unwarrantedinlaw = marina prime?

ex-SFer and LMRiM–Thanks for sharing your insights. Your perspectives are always much appreciated, even by those of us who read often but seldom post here.

AsiagoSF,

About non-dividend stocks being purely speculative (because there is no natural demand), it’s actually a pretty good question. All financial markets have some degree of speculation, of course, but I guess there is a “natural demand” for corporate control. That is, the present earnings power (or potential earning power of a company) has value to its owners, who derive income streams from it. It could be through dividends, or through a change in corporate control that results in a cash out or ownership of a different (merged) company, in which case you go back to the question whether that company will pay out dividends or itself be taken over.

I guess if there is no reasonable prospect of future dividends or cash out through merger, than the “investment” in the nondividend stock is totally a speculative flyer, but I’d think the price would be very low (just to relect the option value that the forecast that there was no reasonable prospect of future cash turns out to be wrong). I’d think that very few nondividend paying stocks would fall into this category, but it’s an interesting question.

unwarrantedinlaw

“north of California” That would be Oregon then? Swarms of Palestinians and Syrians hurling gobs of cash at our neighbors to the north.

I understand you fellows’ mentality, been there myself. SF is the best RE in the world. You perform complex calculations to convince yourself that prices surely must come down to where you can buy. But it’ll never happen unless you put your coffee down, get to work, make some money, study the market – not the graphs – and start acting like a man. Uninformed pessimism never works. Hoping for someone else’s misfortune never works.

Wow, those CS ETF’s described above seem to be perfect examples of what is wrong with our financial system, it isn’t a financial system, its another gambling system that has less regulation then regular casinos.

“Get out on the street”

Obviously, that’s where the really good halucinagenic drugs are.

Does someone have stats on the San Francisco (city) foreclosures by districts / neighborhood ?

I ain’t seen no foreclosures in Pac. Heights, or Nob Hill or Russian Hill or any other “Nicer” Neighborhoods, so I am really really curious on these seemingly alarming stats about the City 🙂

Not sure how accurate, but I found a site listing 2500 Divis as Pre-Foreclosure. I’ll cross post there as well. Yikes.

With regard to the MacroShares Major Metro ETFs, I agree with what ex SF-er wrote, but have to point out that the leverage factor is out there in the stratosphere on those things.

I’m not an investment professional so take that with a whole shaker of salt.

Same disclaimer applies to this: I can’t imagine who the “core” market is for these things. REITS with investments in many disparate MSAs?

SF is the best RE in the world.

LOL. I love it…pure comedy.

unwarrantedinlaw – can you clarify your advice on getting into SF RE for women ? Is just going drag enough or are gender reassignment procedures necessary?

unwarrantedinlaw is pure comedy. We’ll see in 5 years who’s right and who’s wrong. Real estate is not like the stock market.

Someone’s forgetting that housing prices are seasonal, and most sources tend to post non-seasonally adjusted numbers. We’ll see if it’s really a bottom this winter…

Real Estate is seasonal, but everyone forgets that Bubble, Pre-Bubble and Post Bubble are seasons too.

Agree that I would like to see some foreclosure statistics for Marina, Pac Heights, Russian Hill, and Nob Hill.

Why?

It’s not just because these are nice areas.

It’s also because most of the homes here were purchased pre-bubble! Some of my neighbors have owned and lived in their homes for 30 – 40 years. I’ll bet that no more than 20% of the currently-owned homes were purchased during the peak of the bubble period (2003 – 2007).

Compare this to SoMA, Hayes Valley, or the Mission.

What percent of SoMA homes were purchased in that five year span? 60%? 70%?

This isn’t just about Pac Heights being wealthy. It’s about Pac Heights being saturated from a real estate standpoint for almost twenty years now. You can’t even build any condos taller than 80 feet in Russian Hill… a few have gone up (Greenwich/Van Ness), but they are few and far between.

“It’s also because most of the homes here were purchased pre-bubble! Some of my neighbors have owned and lived in their homes for 30 – 40 years”

How true. Of my immediate neighbors where I own in the Marina, I am the newbie at 19 years, while they on average purchased 30 or more years ago.

True desirable areas might not see a huge turnover.

But everything is in cycles. I stayed 2 years in a block in Noe (close to 24th and Diamond) and during those 2 years, I saw 2 owners passing away, 3 retiring and moving out replaced by rich retirees of hard working affluent families, a conversion into 2 units that sold pretty nicely. And I knew only what was going on on 1/2 the block. The next block where I have an acquaintance had similar stories. All people who moved out came in in the 60s and 70s. All were paying next to zilch in property taxes. All were replaced with richer people.

Just to say that turnover happens even in desirable areas. Stories of most people being there for 30 years is usually a precursor to heavier turnover.

“Manly.”

Translation: yeah I may have lost a lot of money but at least I lost it like a man. I can hold my head up high because I charged in blindly swinging like a man should instead of sitting around with this girlie-man thinking and analysis. My god, you can’t even spell analysis without anal. Think about that.

The only natural market for those CS ETFs (UMM and DMM) would be households which so risk averse that they will pay high insurance premiums (the 1.5% expense ratio plus the opportunity cost of the money locked up in the ETF and invested in t-bills) so as to minimize the possibility of price losses. But if someone is that risk-averse, then why not just rent? After all, there are many other risk to owning then just price declines. Think someone slipping on the front steps and suing, etc, etc.

A better idea, IMO, is simply expansion of REITs into the domain of detached single-family housing. Instead of buying a house, you would rent, and obtain exposure to real-estate via ownership of shares in a REIT.

NewBuyer and anon94123 are both right on, about these neighborhoods.

Is this why I haven’t seen any significant drops in prices in these long term resident neighborhood ? I would really love to buy a nice free standing family victorian either in Marina or Pac. Heights. And don’t bash me, I do have the funds and resources. Just can’t seem to find anything on the market that is in the 1.5 to 2 mil. range in these neighborhoods, especially near the Palace of Arts.

unwarrantedinlaw,

let’s list some prime props we know of north of California to prove we are “out there”

123 26th ave Seacliff. Just sold for 2MM , previous sale 2.035 in 2004.

196 16th ave Lake district – listed 1.625. Sold in 2005 for 2.1M!

should i continue….

I understand there was this NOVEL financial instrument called a “Refinance” during the boom. That’s where a long time owner refinances and pulls cash out to supplement their retirement. And if you were retired, and had no way to pay the mortgage back, I heard the mortgage companies didn’t even care! They just figured the owners would just save some of the proceeds to make the loan payments, then refinance when prices went up and take even MORE money out.

Wait until those “refinancings” start to reset or recast, with no means of income, those long time owners are going to sell (or be foreclosed) just as fast as anyone else.

Long time owners my A$$ – those people are trapped in their own homes.

^^^ Everyone knows that Palestinians with bags of cash don’t like to buy near the water. That’s why they scooted themselves away from the Mediterranean. And 16th Ave?? Not enough olive groves. Totally different market.

I understand there was this NOVEL financial instrument called a “Refinance” during the boom.

Oh tipster, you’re so naive. People who live in the Marina would never do something like that.

@anon94123, please say hi to the mayor’s … oh, nevermind. Looks like he’s moved out of 3730 Fillmore and the bank has moved in.

on July 23, 2009 2:30 PM, “unwarrantedinlaw” wrote:

And then, at 8:51 PM, tipster wrote:

I realize this wasn’t a direct response to unwarrantedinlaw, and I couldn’t tell if tipster’s comment was supposed to be sarcastic or not, but if it was sincere, it makes unwarrantedinlaw’s earlier point for him. That is, if what tipster is referring to here is not the traditional refinance but the reverse mortgage.

When it was obvious in the 80’s and 90’s that most baby boomers hadn’t saved enough for retirement, lots of people thought that they’d be screwed. There wasn’t enough time for that huge cohort to save enough for retirement. Guess what? That misfortune, to use unwarrantedinlaw’s description, didn’t befall the baby boomers.

First congress created the so-called “catch-up contributions” provision for 401(k) plans. And when that wasn’t enough, reverse mortgages magically appeared on the scene to provide people who hadn’t saved enough for retirement with another asset class that could be liquidated to help defray the cost of keeping themselves alive for the longest period possible.

Not that I endorse unwarrantedinlaw’s thinking on this. On the contrary, I’d like it if he were dead wrong and a whole lot of people wind up dumping their houses on the market over the next twenty four months, since I’m a renter and am currently priced out of the market. But when the The FASB voted to change the rules to allow banks to avoid recording writedowns by relaxing the mark to market requirements, I knew the game was over.

The fire sale prices aren’t going to happen because the banks won’t be forced to foreclose by the discipline enforced by the mark to market rules. And when the foreclosures don’t happen with the velocity they should, then price discovery will either be delayed until the recession is over or else will never really take place.

The Man will always make sure that blood never starts running in the streets.

Brahma:

a few things: although many expected blood in the streets, many of us who understand credit and finance know that RE downturns take forever. (how many times have I said “this will be like watching the paint dry on a painting of grass growing”?) the duration hides much of the pain, much like the analogy of boiling a frog. this RE downturn will be no different, although it will definitely be more severe than any downturn in most of our lifetimes.

There are limits to what even the government and funny finance can do.

Enron is an example. they flew far higher for far longer than they should have due to the fact that they had aggressive “creative” accounting thanks to Andy Fastow. However, there comes a time when accounting gimmicks are no longer enough. In the end it’s cash flows and assets.

The same problem with the banks. We have already zombified our banking system using an impressive array of bailouts, borrowing, and accounting tricks. I for one have discussed before how Ben Bernanke has done a masterful job of trying to avoid the pain-even though I disagree with his desired outcome and think he is misguided. (his goal is to save the too big to fail banks and save the wretched American Financial System as-is)

But this cannot go on forever. The government debt has skyrocketed to get us this far. Foreigners are starting to squawk about our sovereign debt, and we rely on them to continue funding our debt, or we will have to destroy our currency by so-called “printing”. The political will is starting to fade as well. Do you think that the current Treasury Secretary could go to Congress and ask for another $750B for bank bailouts?

And we are only in the eye of the foreclosure storm! we still have the Alt A and Option ARMs coming. Not to mention the Commercial RE, Student Loans, and credit card debt. And definitely can’t forget the near-bankrupt municipalities and states (cough… California)

Can the Federal government really bail everybody out? Seems an impressive feat of juggling.

Overall, the govt/fed pulled us from the verge of financial breakdown, and I give BenB credit for that. It was a VERY scary day when there was a run on the money market funds. But the structural problems remain, and we’ve wasted a lot of money to give the “too big to fail” banks bailouts and record bonuses, and they’re now zombified. Zombified banks cause problems because they don’t act effectively to increase the velocity of money, and this reduced money velocity reduces the effectiveness of Fed policy. Thus, although there is no blood in the streets we have probably prolonged our fate and now face a VERY long painful period.

Do not be surprised if the NBER calls the end of the recession as 2H2009 (late 2008/early 2009 even I a big bear acknowledged that the end of recession may come in 2H2009). But then we will almost assuredly dip back into recession again with a prolonged recovery period. (so called “W” recession)

IMO: there are only 2 more “gimmicks” that the government can do to actually avoid the pain for a prolonged period of time

1) devalue our currency. At some point this is for sure going to happen, but I don’t know about the timing. We simply can’t pay off our debt, and thus will eventually likely default through currency devaluation. But it’s hard to do this when you are still borrowing from your creditors. this is very dangerous (and why China/Russia are squawking openly for a change in dollar as reserve currency status).

2) blow another bubble. this is clearly the intention our govt has chosen. dump hordes of money into everything and hope a bubble happens somewhere. this would work, at least for a time. but then it’ll suck big butt at the end of that bubble. (they blew the credit/housing bubble to get us out of the tech bubble and look how much this bubble sucks! I’d hate to see the aftermath of yet another bubble).

regardless, they’re trying to blow another bubble, and if I had to guess they’re trying to blow it in the stock market again. unfortunately, they can’t control where their money goes and each time they start blowing the money seems to flow to commodities which kills the economy…(oil, metals, etc)

The Fed is in a trap. Ben B is smarter than me and may be the smartest man I’ve ever met, so maybe he will be able to do this. I personally doubt that any one man (or group of men) can do it this time and help the average American. Instead, the spoils will likely go to the well-connected and the rich. (Brazilification of America).

Bernanke may be smart but he sure comes across as a toady and a tool. A Goldman Sackholder, if you will.

No one else noticed the title on the graph?

San Francisco Country

Neo-Secessionist Movement at DataQuick or the bubble to the next level?