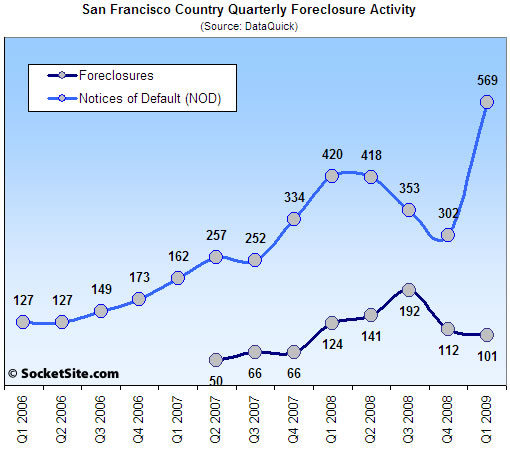

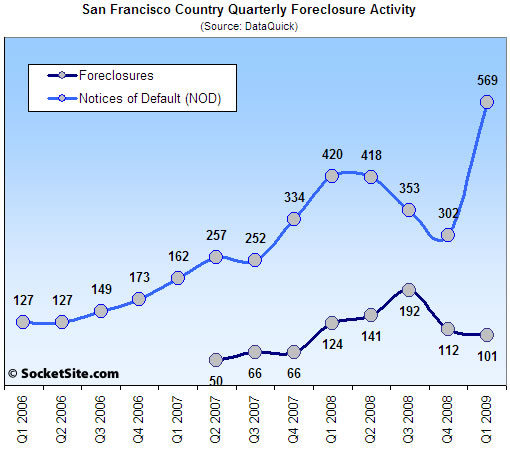

Bay Area Notices of Default (NODs) in the first quarter of 2009 rose 17.6% on a year-over-year basis, up 35.5% in San Francisco proper (from 420 to 569). NOD activity in San Francisco jumped 88.5% from the fourth quarter (302) as a Fannie Mae and Freddie Mac foreclosure moratorium in the fourth quarter expired on January 31, 2009.

Actual Bay Area foreclosures in the first quarter fell 9.0% on a year-over-year basis (from 6,646 to 6,050) with Contra Costa (down 22.0% to 1,738), Alameda (down 8.0% to 1,681) and Santa Clara (up 24.9% to 1,157) leading the way with respect to volume.

First quarter recorded foreclosures in San Francisco totaled 101, down 18.5% on a year-over-year basis and down 9.8% (11 homes) from the fourth quarter 2008. Once again, however, keep in mind that foreclosure moratorium by Fannie Mae and Freddie Mac.

∙ Golden State Mortgage Defaults Jump to Record High [DataQuick]

∙ Actual San Francisco Foreclosures Down 42% QOQ (Up 70% YOY) [SocketSite]

I’ve seen elsewhere that notices of default really started shooting up in March with the various holds lifted. A record high in SF (281 for March alone) and in the state (prior record was April 2008 before the various moratoria and delaying procedures).

Trustee sales have been kept down by these efforts for the last 9 months or so, but it looks like they are going to start catching up now. I don’t know what pct of defaults are winding up in foreclosure these days.

It’s becoming clear that forced foreclosure takeovers driven by unemployment are going to be the kicker in this economy.

There’s also the fact that for a few programs it requires [three] missed payments in order for them to talk to you about about rate/principal decreases.

Sorry. That was “three.” The lack of an editing feature for this BBS has become really painful, IMO.

It’s becoming clear that forced foreclosure takeovers driven by unemployment are going to be the kicker in this economy.

Don’t forget the 1/4 of all mortgage holders who are paying more than 50% of their pre-tax income on debt service. These are people who were either hoping to suffer a bit for a profitable flip, or they were expecting their incomes to double in a short period of time. In either case, you don’t need high unemployment — income stagnation or even mild income growth will force a large fraction of this population into default.

I’m reposting Trip’s link on Option ARMaggedon from the No Rebound for You! thread. It’s required reading (especially if your name ends in nn). Jump to page 37 for the good stuff (The Outlook is Grim, we’re still in the “middle innings” of this crisis).

Inquiring minds want to see a district breakdown…

I read that, EBGuy. Frankly that one was one of the few posts by Trip I’ve read in some time. Usually I see his name and skip, for obvious reasons. Explain to me precisely what it means to San Francisco, bearing in mind the points that I have brought to light numerous times, i.e., higher down payments, and a government intervention aimed at Alt-A which sub-Prime did not see?

Related (somewhat) to this thread, I recently came across an interesting site that aggregates CA income tax receipts day by day.

http://www.sco.ca.gov/taxtracker.html

Given the fairly progressive nature of CA taxation, the 14%+ falloff from last year is showing a pretty large dropoff in income at the mid- to upper-end that is going to find its way into the foreclosure stats ultimately.

If all houses in SF go into foreclosure, that would initiate a rebound wouldn’t it?

you don’t need high unemployment — income stagnation or even mild income growth will force a large fraction of this population into default.

Your last name isn’t Shiller perhaps? 🙂 But, yes, you are correct and I agree completely. But I do think that unemployment will force the hands more readily than individuals who would rather service a bad loan product than suffer a significant one time loss.

Reports / analysis out today indicating that there are massive economic issues waiting for us if unemployment reaches 13%. Further evidence being reported elsewhere:

Prime borrowers at least 60 days behind on mortgages — “Delinquent” is the official term for this period — rose from 497,131 in December to 743,686 in January, according to the Federal Housing Finance Agency. This is almost double the total for October…..

These are Prime borrowers folks. Not a good sign.

See name link for quote source.

Explain to me precisely what it means to San Francisco

Nothing, IF Ess Eff is passed over by The Masque of the Red Death. But it certain explains the mechanism and timeline (which you were a bit fuzzy on at one point) by which REO capitulation COULD happen in Real SF. That said, all we can do is wait (Outer Sunset tallies: 29 foreclosures, 35 homes for sale. Leaving Real SF soon?) FWIW, are you currently seeing any “non subsidized” buyers looking to buy a house or condo at this time?

Yeah, eddy, the foreclosure trend is moving upmarket. Everything I’ve ever seen indicates that SF buyers have stretched as much as anywhere else or more — NY Times just had another article today making the point. And I’ve said here many times, there will be no bailout for those who bought $1 million-plus homes. That could never sell in DC.

http://www.nytimes.com/2009/04/22/business/economy/22leonhardt.html?

[Editor’s Note: Keep in mind the NYT piece is MSA rather than County.]

“Explain to me precisely what it means to San Francisco, bearing in mind the points that I have brought to light numerous times, i.e., higher down payments, and a government intervention aimed at Alt-A which sub-Prime did not see?”

anonn, please provide any support whatsoever you have for these arguments. Show us anything that demonstrates SF purchasers during the bubble made higher down payments than elsewhere. Show us anything that demonstrates SF purchases took out fewer of the toxic loans that are on the cusp of resetting than elsewhere. And please describe the “government intervention aimed at Alt-A” that you’re referring to and explain how it will make a difference. Trip, EBGuy, LMRiM, eddy, all provide the sources behind what they say so you can examine them. I suspect you have absolutely nothing concrete to back up any of these points you have “brought to light,” and you’ll either not respond at all or respond with non sequiturs.

Nice chart ! One can infer that there is a one to two quarter lag between NOD and default trends. Q309 should be interesting.

Fortunately a large percentage of NOD receivers dodge default.

“Show us anything that demonstrates SF purchases took out fewer of the toxic loans that are on the cusp of resetting than elsewhere. And please describe the “government intervention aimed at Alt-A” that you’re referring to and explain how it will make a difference.”

Joe, not that I agree with Anonn or anything, but when i was in the process of buying a home, My appraisal report reported that most loans in the area were not sub-primes, option arms, etc. I don’t know how the appraiser had ready access to the loan database, but assuming he did, that is what he said in his report. I don’t know how true it is. When my brother bought his home in [Sacramento], his appraisal report said the opposite.

That being said, SF will still continue to go through some sort of correction over the mid-term.

I gave you my opinion, Joe, based upon actual experiences that dwarf any one of my bashers. It comes from writing probably a couple hundred offers for dozens of clients during the peak selling years and “losing out” many times. I always followed up to see what the winning bid was like. Invariably it was with a lot of cash, and that’s easily understood due to the competition. I do not care if you don’t believe me. It happened, and it’s a big reason why a lot of homebuyers can sit the correction out, thereby limiting capitulation.

As for the gov and alt-a intervention, just do a google search. There are probably four or five programs at this point in time. A new one in is today’s news cycle, and it’s aimed at second liens.

“My appraisal report reported that most loans in the area were not sub-primes, option arms, etc. “

Jeremy – Did your appraisal report state how large the area polled was ? A few blocks ? The zip code ? The whole city ?

I’m assuming your home is in SF.

“FWIW, are you currently seeing any “non subsidized” buyers looking to buy a house or condo at this time?”

Yes. There has been somewhat of a spring bounce. I mentioned that four 2+M prices sold one day, I think sometime last week. A lot of properties got into contract today as well. It’s not peak-level spring bounce stuff. But it isn’t armageddon either. And there’s usually a few plus-dollars apples in the bunch too. I just don’t bother getting into it, because four posters on here will go find everything I’ve said in the past week and try to deride every single thing. Plus this format sucks and is quite dated.

Wow that’s a big increase and we are back to the original trend. A few probably have been saved from foreclosure in the process, but the mass of the people currently in default still cannot afford their overpriced homes no matter how low the rate, and even less if they are upside down.

Who in his right mind would go on paying for a 600K home with 800K in mortgage? That’s good cash thrown after negative equity for many many months for sure. And cash is a precious thing nowadays.

Foreclosures should resume their uptrend next 2 Qs and prices will probably be impacted at least in the market segments concerned and the ones around.

“I do not care if you don’t believe me. It happened”

I figured you had nothing better.

Jeremy R, yeah there must be some database that provides this info. It’d be nice to find access (but then what would we debate about it?). The only things I’ve seen are second-hand — posted here many times — showing that something like 60% or 70% of SF purchases in 2006 were with these toxic-type loans. Obviously the vast majority of SF homes were bought (or refinanced) outside the bubble years when these sorts of loans were not even available, so it would not surprise me if on the whole this pertains to a small percentage of SF homes. The problem is with the 2004-2007 purchases and the looming recasts for that vintage. The pretty steep rise in NODs shows that something is happening, and I suspect all we’ll have left to debate on the not-too-distant-future is the cause.

LMRiM – the state controller site is fascinating. The daily revenue tracker indicated that for fiscal YTD at the end of March 2009 we were down about 10% from 2008 ($30.3B v $33.8B). But by Apr 21 (three full calendar weeks), we’re down by 13% ($34.6B v $39.6B) on the fiscal YTD. So the April MTD collections are down by a full 25% from 2008 ($4.3B v $5.8B).

This would seem to indicate that things are getting worse (no surprise). Part of it may be that people were over-withheld this year and this wasn’t fully realized until the April tax returns. But a 25% delta for Apr 09 v Apr 08! Is that fully factored into the state’s budget and cash flow projections? (I do see the note on the website that the state spending plan adopted in Feb projected receipts at $38.3B by Apr 30 – we should hit that level if the pattern of the final 9 days holds.)

Good point about the progressive nature of the CA income tax rate. It does portend problems at the high ends of the wage scale and the housing market.

As for the state (and municipalities), they need to slash spendng now. But they won’t – we’ll just keep jacking up the already ridiculously high sales tax and marginal income tax rates. Dennis Miller said he’s already made plans to exit the state if the rates are raised again. (I know, he’s on the Glen Beck Network now and therefore to be dismissed by enlightened San Franciscans.) But this tax revenue gap is staggering.

I always followed up to see what the winning bid was like. Invariably it was with a lot of cash, and that’s easily understood due to the competition.

I’m not trying to be a pest — this is an honest question: why would a seller care about the source (cash/loan allocation) of a buyer’s payment? Isn’t it the same lump payment as far as the buyer is concerned?

(I’m inferring that you’re talking about equal bids in terms of purchase price; otherwise it wouldn’t make sense to stress the cash variable.)

“I figured you had nothing better.”

sigh. So be it.

But you have never taken notice of a single program aimed at stemming an Alt-A reset tide, either, right?

But Joe,

Tell me this. Where are all the SF resets?

anonn, see that top number at the far right of the chart above? You can also look at the Option ARMaggedon link.

the more cash the more likely the sale will ultimately go through. sometimes the winning bid can be lower than the highest bid, depends on the strings attached, the more cash, the less strings.

those curves track each other pretty close but a quarter lag. Hmm, what’s that big wall of water doing there?

“Given the fairly progressive nature of CA taxation”

That’s some uncharacteristic understatement from you, LMRiM! California has to have either the most, or one of the most, progressive income tax structures in the country. I’m generally for that, but it can cause big problems and requires great discipline to manage. The incomes of those in the higher brackets are very volatile plus they have quite a bit of control over when that income is realized. That’s OK if you bank the excess funds in the good years (like high earners with fluctuating incomes tend to do) — but California doesn’t do that. It either grows the government or cuts other revenue sources, like the vehicle license tax. So we really hurt in down years, like this one.

The answer, for California, is a less progressive tax structure that doesn’t depend so disproportionately on the top 5% of earners. The high earners have taken a bigger hit than others this year (because they had the funds to get hit — and yes, this will also be reflected in foreclosures moving upmarket). This state does not have the discipline to deal with the volatility (my preferred route) so we need to reduce it.

Yes Joe,

but where are they? EBGuy said he saw, what, 29 in the Sunset. Out of how many thousands of houses in the Sunset? Any one of these guys whose lead you follow in attempting to deride what I offer up without malice predicted quite differently. My points stand.

California has to have either the most, or one of the most, progressive income tax structures in the country

Let’s not get carried away here. California, like most states, has a regressive tax structure, once all state and local funding sources are taken into account.

Households CA Tax Burden (as a % of household income)

——— ———

bottom 20% 11.7%

20-40% 10.5%

40-60% 9.5%

60-80% 8.7%

80-95% 8.0%

95-99% 8.0%

top 1% 7.1%

I understand that CA is a high tax state, but it is certainly not a progressive tax state. This is of course, because the state is primarily funded by a combination of use-fees, regressive sales taxes, and regressive Pigovian taxes. Due to Prop 13 distortions, property tax revenues are much lower than they otherwise would be, and of course are not so tightly correlated to income as they once were.

It was my understanding that an “all cash offer” is one where there is no financing contingency? That doesn’t mean anything other than the buyer took the risk that if the property didn’t appraise for the loan amount, the buyer would cough up the difference in cash.

I wrote a few “all cash offers” myself. It didn’t mean I wasn’t going to get a toxic loan, it just meant that, whoopie, with zero down, I might have to put 10% down. BFD. The properties always went for 1-2% higher than my bid, so I really never took any risk at all. My mortgage broker told me he had never seen a property not appraise, in many years, so I was hardly taking any risk.

In those days, ANY contingency lost the bidding process, so basically everyone was an all cash buyer. At those prices, many would have gotten toxic loans. So I don’t doubt anonn’s story, it’s just doesn’t paint a complete picture, that’s all. I’m sure there are plenty of toxic loans.

As for option arm recasts, that disaster is already baked in. Nothing anyone can really do about that. The loan amounts are far too high for saving and they were not agency loans, so they are not going to really qualify for any help. Furthermore, the LTV is way over 105%, and the homeowners don’t have the means to pay even the interest. The ending to that story is already written – it’s only a matter of how far backed up the earlier foreclosures are, and when the banks finally get around to those.

By the way, I think you’ll see that graph trend down in a quarter or two. That big jump up is just the banks catching up. Everyone put everything on hold to wait to see what the rules for government bail outs would be. Those rules are out, and so the resumptions of the NODs are in full force, but a big part of the blip up is that they are just catching up for the quarters that they basically only took over the ones that were in serious trouble and basically abandoned.

The catch up process will be over in a quarter or two, and then you’ll see it drop for a few quarters.

Option-Arm interest now in the 3%’s…

Due to Prop 13 distortions, property tax revenues are much lower than they otherwise would be, and of course are not so tightly correlated to income as they once were.

I certainly agree with the second part of your statement, Robert. But I’m agnostic about the first. Sure, prop taxes as a % of valuation is relatively low her (1-2%, and tilted towards the lower end of that range for most jurisdictions in CA). But the property values are very high, so that the marginal purchaser is paying an enormous amount in taxes in absolute terms. Given the turnover, I’m not sure that the state isn’t squeezing about as much property tax out of people as possible, at least in aggregate.

Just anecdotal, but apples to apples, taxes being paid on recently purchased houses in the Bay Area are not out of line with what taxes are in much of the NYC metro area, for instance. A so-so 3/2 in a top suburb here will run you $1M+ and generate a property tax bill of $12K+, while a roughly comparable house in a top suburb like Scarsdale or Rye in NY would sell for $600-700K and run you approximately $12K+ in taxes there! (And the house would be nicer in the NYC suburbs, with more land.)

I suspect that a good deal of the distortion in prop 13 is subsidization among cohorts, and that the distortion has driven prices high enough to capitalize most of the “excess” taxes that you posit would otherwise be collected if the distortion were not in place. This argument could of course be generalized to commercial property, although there the infinite duration issue of corporations perhaps changes the analysis a bit.

It’s so hard to find good data on state finances (at least it seems so for me – many of you are much better at finding this data), but take a look at this graph, which shows property taxes in CA as generating the largest component of revenue for CA and growing historically right in line with personal income taxes:

http://www.lao.ca.gov/2009/tax/revenues_0209/revenues_020609.aspx

(see Figure 4 in the linked source)

It would be interesting to see property tax revenue as a % of state “GDP” and compare CA with some other notoriously high tax states (like NY) and some other “low” tax states like Florida and Texas (which actually have very high property taxes, but no personal income taxes). If you had an easy way to find the data, it’d be an interesting project imho.

LMRiM – I think you’re leaving out commercial property taxes in your consideration, which are certainly MUCH lower than they would be without prop 13, because every property is owned by a shell corporation (you’d have to be an idiot to not set up a commercial property in one of these vehicles).

Tend to agree with you on residential property, though.

Robert, the revenue tracker at the state controller site from LMRiM’s link reflects only personal income receipts by the state. But, per the contoller, personal income taxes accounted for 57% of all general fund revenues. The personal income tax has always looked pretty progressive to me since I moved to this state. If your taxable income is under $50K, you basically pay nothing – while every dollar earned above $90K or so (depending on filing status) gets taxed at 9.3% (and another 1% over $1M). You call that regressive? I am glad that you agree that this is a HIGH tax state.

LMRiM – that is another interesting site you noted. Looks like property taxes will be larger than personal income taxes in the next FY.

I wonder what percentage of these is in South Beach.

I don’t disagree with you about commercial, anon. I noted the “infinite duration” issue in my post regarding corps. I wonder how high, though, commercial property tax revenues are in other jurisdictions (as a % of total revenue or state GDP). Even if prop 13 went away for commercial property, I’d imagine that revenues wouldn’t go up quite as much as one might imagine, as the low tax base has been incorporated into the price structure, and a change in tax would reduce values. Still, as you note, I bet there would be a large bump in revenue if prop 13 were removed from commercial properties.

It would probably be a very big deal for the many “mom and pop” residential real estate empires (I’m guessing some are pretty large!). They really wouldn’t be able to pass through the increased cost to the rents – the few rent controlled areas wouldn’t allow it for political reasons and the rest (non rent controlled areas) are already presumably charging the max the market will bear.

It’s fun to play “what if?” but prop 13 isn’t going anywhere until a total collapse of CA finances (which may come ;)). There are too many entrenched interests at work.

@FSBO – I sort of look at CA income tax as “somewhat” progressive. The brackets seem really compressed and you go to 9.3% (soon to be 9.55%) very fast, as you note. The jump up to 10.3% (10.55%) takes a “little” longer 😉

I don’t care about the “regressive” nature of sales taxes, fees, etc. This isn’t a welfare utopia. If you buy the product pay the tax. Seems fair. I could tolerate a little “progressivity” in income taxes (because of declining marginal utility of income and vague ideas of “fairness”), but it is a travesty in a representative republic/democracy that a large class of people pay nothing yet vote on what others must pay. That to me seems the road to tyranny.

Perhaps a flat 5% of income rising progressively to 10%, with a constitutional provision that prevents the percentage tax ratio of the highest bracket to the lowest bracket to never exceed some agreed “x” would work. Who knows? I’m pretty sure that the system that tells people that “the rich” are going to pay or utopia is not going to work in the long run, that’s for sure.

Just finished reading all of those LAO tax hike proposals LMRiM. Looks like they’ll be here sooner rather than later. No dollar will be left untaxed. I may need to accelerate my exit plan to become an ex CA-er.

I always loved this argument, that implied foreclosures were meaningless/unimportant because they only represented a fraction of a present of ALL housing, when I used to see it in the craigslist housing forum. It was so fun to watch it get torn to shreds like the flimsy piece of paper it was.

I guess I would respect anonn’s arguments more if he didn’t constantly fall back on these false RE cheerleader statements that are designed as smokescreens to hide the clear signs of a highly distressed housing market. You know signs like spiking NOD’s and rising foreclosures.

Explain to me precisely what it means to San Francisco, bearing in mind the points that I have brought to light numerous times, i.e., higher down payments, and a government intervention aimed at Alt-A which sub-Prime did not see?

1) the Option Arm problem is starting to recede. Option ARMs were not used heavily in SF, thus SF understandably did well through the Option ARM reset scheduile

2) SFers did take out an exorbitant number of Alt-A loans. It went from 70% in the mid 2000s. (information from dataquick and the various big lenders: countrywide, indymac, BofA, Wells, Wachovia, Washington Mutual, etc all are ocnsistent on the 70% number). Those are set to start recasting/resetting now.

I trust this data more than yours. Not because I disbelieve you, but because you likely have a specific SF niche, so are ignorant about SF outside of your niche.

3) as we have seen all over the country, it doesn’t take 100% of people to default on their mortgages to start a vicious downturn in the RE economy. not anywhere near this. Even in places like Miami over 92% of all people are paying their mortgages just fine. Look at their RE valuations.

4) thus, a small percentage of people falling into harms way will significantly impact the local RE valuations. This is because RE prices are set at the margins.

5) it is expected that a small but significant % of Alt-A products will fall into foreclosure as they reset/recast. THe Option ARMageddon data shows you the timing of this, which is the next 3 years.

it will take a miracle for SF valuations to do well over the next 3 years, as mounting foreclosure pressure will continue.

**I have a huge quibble about the Option ARMageddon chart, it neglects Prime recasts/resets. although Prime resets go into foreclosure less often, there are SO MANY of them that in absolute terms they are very very important. If you overlay Prime on top of Alt-A the picture looks much more dire, but ends quicker (Dec 2011 instead of Summer 2013).

Lastly, there ARE foreclosure programs out there. I don’t have the data off hand, but I believe out of >1,000,000 properties that were in trouble, 8,500 got a workout.

that leaves 993,000 that weren’t helped.

and if you think that the govt is going to leap to give millionaires bailouts for their high priced housing, I think you misjudge “normal” Americans. (yes, I know that not everybody in a million dollar home is a millionaire. now you try to convince Joe Blow in Akron Ohio of it).

correction:

It went from 70% in the mid 2000s.

should say it went from less than 5% in the 1990’s to around 70% in the mid 2000’s.

I used a (less than) sign originally, which deleted part of the sentence due to HTML issues.

—-

on a side note:

the timing of all of this has not been a surprise to many of us. it’s all about the resets/recasts.

There is a reason why SF has followed SD’s downturn by about 2 years (something I used to talk about a lot and was always grilled on). It’s because SD boomed 2 years earlier. they took out their toxic loans 2 years earlier. their toxic loans reset 2 years earlier. And thus they had their downturn 2 years earlier.

the reset schedule and loan types are a big reason why the big boomers boomed together and then flopped together (Miami, LV, phoenix, etc).

It’s also why places like Charlotte did relatively better (affordable, less toxic loans than elsewhere)

this is the same reason why the last holdouts are now suffering together (SF, Portland, Seattle).

also:

California is suffering disproportionally as a state compared to other states due to the sheer unaffordability. In much of the midwest and south people can (and did) buy homes at 2-4x income. In California it was often 5-6x income, and even up to 10x income (more rare). unaffordability issues were briefly masked by toxic loans, but that is unsustainable. (obvious from the start to anybody who was looking, and who didn’t profit from the unaffordability products). now that unaffordability has re-asserted itself, it makes “saving” these people much harder.

also: due to the sheer loan sizes (prime loan or jumbo loan compared to subprime loans) the prime/jumbo loans defaulting is going to put a lot of pressure on the banks.

one $1M foreclosure is the same to a bank as five $200,000 foreclosures.

we are in the eye of the storm. Option ARMs have mostly reset/recast but Prime/Jumbo/Alt-A resets/recasts are just beginning. and the idiot (or lying, not sure) bankers and govt staff think we’ve gotten through this just because of a 25% bear market rally. the fundamentals HAVE NOT CHANGED, except that we have wasted nearly $12 trillion on bank bailouts, filling in holes due to errors from the past. we will see very little of that money back.

and now we still face

-credit card defaults

-student loan defaults

-commercial real estate defaults

-even possibly municipal debt defaults (California anyone?)

remember, these are the same fools who told you

-national real estate values have never gone down. (**of course they did during the depression, but the “experts” made this rediculous claim anyway).

-there is no housing bubble

-there may be some froth, but no bubble

-if the froth ever popped, it would be a soft landing like a souffle (many many people, including Fed Chairman Greenspan)

-this is a subprime problem (many people again, including Greenspan)

-this is “contained” (many people again, including Bernanke)

-this is the strongest economy I’ve ever seen in my Career (Treasury Secretary Hank Paulson)

-My bazooka will be so big I won’t even need it.

for some reason our banking/business leaders and govt keep thinking of “going back to normal” as going back to 2005. That was a bubble, there is no going back there unless we create another bubble (something they’re desperately trying to do)… and then we’ll be right back here again in just a few years (just like how blowing a bubble after the tech bubble burst brought us here).

the reality is that the US is uncompetitive and we need to SEVERELY reduce our standard of living in order to “compete” with the rest of the world. That is globalization.

we need to SEVERELY reduce our debt burden as well. that will reduce consumption. And our economy is based 70% on consumption.

it’s bad. there is no easy answer. there is no quick fix. there is just lots and lots of pain. and we have to go through it some time or another. the more we delay the more it will hurt. the more we waste our resources on the banks, the more our people will suffer.

it is disgusting what has happened over the last year with crony capitalisim disguised as “helping the people”. Unfortunately, Mr. Obama has either sold us out, or he doesn’t undersand the problem (he’s been captured by Larry Summers and Tim Geithner).

there are only a few people who seem to be fighting for what is right in Govt now… among them is Volcker (sidelined to obscurity) and Elizabeth Warren (who is getting pounded for looking out for us).

pathetic.

Any chance the banks are trying to push the bad apples out before they have to follow or are pushed to follow the rules of the new home stability program? I hear it should be implemented in the next few weeks to a month. The new program may in fact help a lot of SF residents given most are typically over 31% DTI for housing due to prices in areas like SF?

“and we need to SEVERELY reduce our standard of living in order to “compete” with the rest of the world.”

Or we could stop competing with the rest of the world. The only thing the rest of the world has that we need is energy and we could become self-sufficient in that if we wanted to.

anonn wrote:

> I gave you my opinion, Joe, based upon actual experiences

> that dwarf any one of my bashers.

I’ve been tracking Bay Area rents and real estate values since I was a kid in the 70’s (clipping out ads from the Examiner, Chron and Times then following up to confirm the actual rent and sale prices). I wonder if anonn started in the 60’s???

> It comes from writing probably a couple hundred offers for dozens

> of clients during the peak selling years and “losing out” many times.

> I always followed up to see what the winning bid was like. Invariably

> it was with a lot of cash, and that’s easily understood due to the

> competition.

How does any seller know if the buyer made a 20% “cash down payment” or got a “20% loan from Uncle Pete and a 80% loan from Wells Fargo” (and as tipster pointed out if he had been around for a while he would know that an “all cash offer” does not mean that the buyer has a big box of $100 bills)???

> I do not care if you don’t believe me. It happened, and it’s a big

> reason why a lot of homebuyers can sit the correction out, thereby

> limiting capitulation.

Let’s assume that many people “can” sit out the correction, the big question will be how many people “will” sit out the correction??? If you bought a little 2br 1ba in Burlingame or San Mateo at $1mm+ bubble prices and made a 20% down payment you will be paying about $30K to $40K more every year than the renters next door (probably $50K more than the renters next door if you have an 80/20 loan with a high interest 2nd TD). I predict that we see many people who “can” make the payments walk away because after a while you are just throwing good money after bad…

> As for the gov and alt-a intervention, just do a google search. There

> are probably four or five programs at this point in time. A new one

> in is today’s news cycle, and it’s aimed at second liens.

I read about the new programs early this week. I Google search found that “U.S. Housing Secretary Shaun Donovan said a revamped Hope for Homeowners program could involve incentives to holders of second mortgages, such as home equity loans.

The incentives would go to second-lien holders who agree to re-subordinate when the first mortgage is refinanced under the program. “

As someone that has owned and sold second TDs I can tell you that not a lot of second TD holders will be excited about this…

P.S. The new program may work a little better than the first version of Hope for Homeowners:

“In its first two weeks, 42 applications were filed for the program. Not a single one was accepted.”

http://washingtonindependent.com/16445/less-hope-for-homeowners

FormerAptBroker,

I’ve been reading what you have to say, and I feel as if you’re quite out of touch with what went down in the SF r.e. market over the past five to six years. And now you’re predicting what people in San Mateo and Burlingame are going to do. OK.

Hey FormerAptBroker,

Multifamily in CA has been dead to me for quite some time.

I think CAP rates are headed from 5% to 8%. What do you think? Not good for owners if rents are down too.

I finished a 6.06% 5 year I/O due in 15 for 25 units in Fremont in October at a DSC Ratio of 1.18. I do not think this product exists anymore.

Paul

fall back on these false RE cheerleader statements that are designed as smokescreens to hide the clear signs of a highly distressed housing market

And I would respect you if you didn’t come out of the woodwork with meaningless buzzword derision and insults. Even if you consider the number of houses sold in the last five years, BDB, 29 is a tiny percentage of Sunset homes in foreclosure. Be honest with yourself. Foreclosure happens in all sorts of different scenarios. Not just purely from loan resets, it’s usually down to employment. Twenty nine in the Sunset, a huge area that you and your ilk predicted would experience an early demise, shows that it is not even fazed.

Careful, FormerAptBroker, or anonn will start skipping your posts “for obvious reasons,” i.e. that you call him on his utterly groundless B.S.

anonn, anyone can say anything they want here. It’s just an anonymous blog. You may think people pile on you, and maybe they do, but that’s just because you are the first to resort to mockery and personal ad hominem attacks (e.g. “you’re quite out of touch”) on anyone who says anything that goes against your party line, no matter how well supported or incontrovertible. Yet you mostly just spout unsupportable blather, and I’m sure you will continue to do so. As I’ve said many times, at least you’re predictable. But you can expect people are going to call you on it.

“shows that it is not even fazed.”

Personally I would count prices off their peak by 20% as “fazed”.

Any other city in the US would kill to have these foreclosure numbers.

“Personally I would count prices off their peak by 20% as “fazed”.”

Some individual houses are off 20 percent, and they are typically the ones that actually are REO. Many, many Sunset houses that are selling every single day are not. The 729.5K base just went into effect too.

But regardless, diemos, what is this thread about? Do I need to include the question in the answer like I’m writing a term paper in high school every time I say something? OK dude. “Fazed by foreclosure!” LOL.

@anonn

See how easy that was to blow up your “only 29 foreclosures” smokescreen.

Joe,

Read the thread. It was you who went negative. FMRAptbroker followed suit, BDB was third.

BDB,

I should point out that “as we’ve seen all over the country … in places like Miami” is not a fair argument here. Therefore rendering your fourth point meaningless. And the notion that you “blew up” anything preposterous.

But “blow up” a smokescreen? LOL. When one blows up something, doesn’t one create a smokescreen?

Funny. That’s what you just did too. Caused an explosion with accusing me of buzzwords, then brought ina few of your own, like Miami. The result? a smokescreen.

“The only thing the rest of the world has that we need is energy and we could become self-sufficient in that if we wanted to.”

What.. no cheap shoes?

🙂

Joe,

anonn, anyone can say anything they want here. It’s just an anonymous blog. You may think people pile on you, and maybe they do, but that’s just because you are the first to resort to mockery and personal ad hominem attacks (e.g. “you’re quite out of touch”) on anyone who says anything that goes against your party line, no matter how well supported or incontrovertible. Yet you mostly just spout unsupportable blather, and I’m sure you will continue to do so. As I’ve said many times, at least you’re predictable. But you can expect people are going to call you on it.

At least you’re using balanced language to point out my lack of balance. Not.

Let’s break this down.

so again, anonn tried to imply that the number of foreclosures is meaningless/unimportant when compared to ALL the homes in the Sunset or ALL the homes sold in the Sunset in the last 5 years. This is an argument that he knows (or at least as an RE professional should know) is a FALSE argument because, as EX SFer points out, RE prices are ALWAYS set at the margins.

Then I went on to say, OK, just take the houses sold in the last five years for your base.

(And I was OK with allowing you to ignore the fact that foreclosure is by and large always going to be about employment. That’s always going to be far more signficant than loan resets. Which haven’t happened. And which the fed is striving to prevent, witness the tabling of the FHA loans this week.)

You countered with Miami, a market derailed by condo as second home speculators. You tried to present minute percentage shift as applicable regardless of region or market make-up.

And then I was all like, and he was all like, whatever.

Anyway, did a quick cross-check of the MLS for D2 compared to bayareasoldhomes.com. Here are the results:

1910 47th Ave, listed for $519K, last sold for $638K in 6/04. Down 19% in 5 years.

2307 45th Ave, listed for $550K, last sold for $686K in 6/05. Down 20% in 4 years.

1750 19th Ave, listed for $625K, last sold for $553K in 10/03. However, seems a total renovation and 400 square feet of legal space was added.

1938 34th Ave, listed at $628K, last sold for $470K in 5/03. Again, renovated, with at least a new kitchen.

2582 46th Ave, listed for $638.5K, last sold for $650K in 8/05. Flatish.

2126 40th Ave, listed for $649K, last sold for $750K in 4/05. Down 13% in 4 years.

1850 31st Ave, listed for $685K, last sold for $725K in 1/08. Down 5% in a little over a year.

I stopped there because the trend was obvious. These are all top-down from the MLS, compared to what previously sold during the bubble years. And these are just asking prices. Important to note that many of these are not foreclosures or short sales per the MLS.

Conclusion: Outer Sunset is TANKING! Tell your clients.

ex sfer,

Good analysis (6:01 a). Krugman is another who has been trying, to not much avail.

“I was all like. He was all like.”

Yeah, not really.

And then, whammo. We’re talking “Sunset,” which by the way has seen 2506 sales in the past five years.

You pare it down to “Outer Sunset” list prices.

Would you like me to find a bunch of sold counter examples to your tanking claim? I’m pretty sure I can if you like.

FSBO – Robert isn’t saying that the income tax is regressive, he’s pointing out that the total state and local tax burden is regressive. Which is a pretty well known fact in public finance circles – there’s just no controversy about this. The site you cite, however, reports only income tax receipts, so LMRiM’s point about the implications regarding the fortunes of high income individuals may still hold.

LMRiM – I don’t understand how one would avoid paying any taxes. At a minimum, one would pay sales tax (it’s pretty hard not to ever buy anything). I also don’t understand universal suffrage, as opposed to only granting voting rights to those above a certain economic stature, amounts to tyranny. Though I can understand how it might seem that way from your perspective. The 1800s are calling and they want you back. 😉

Dennis Miller said he’s already made plans to exit the state if the rates are raised again.

I’m confused. Is that a promise or a threat?

Yes, please do. Show us some non-renovated D2 properties that have sold this year for more than previous sale. I’d wager you have to go back to 04/03 or earlier for previous sales dates to find any appreciation. Anything from ’05 onwards is likely flat or underwater. Just my guess.

Without such critical data, anonn, we cannot reject the null hypothesis that Sunset is TANKING!

actually, it was bdb using my argument of miami.

Miami and SF are completely different markets. I only used Miami’s data to show that a small number of foreclosures severely hampers a market’s valuations. even a piss poor market like Miami has most people paying their bills just fine. It negates your argument that a small number of foreclosures in Sunset is no big deal. (they are).

The vast majority of people are up to date and performing well on their mortgages (90+%). but RE prices are set at the margin. thus, you don’t need a lot of people to get into trouble to cause lowered RE valuations.

let’s take SF specific.

as a VERY ROUGH guesstimate: there are between 300-600 sales per month in SF. so let’s take the high end, 600 sales x 12 equals 7200 sales per year (there aren’t that many, it’s a rough guestimate and on the HIGH end of the guesstimate).

how many units are there in SF????

in 1998 there were 335,000 units in San Francisco.

http://www.sfgov.org/site/moh_index.asp?id=5812

so let’s pretend that only 2% go into foreclosure. (in line with current data)

2% x 335,000 = 6700 properties.

so basically, if only 2% of San Francisco domiciles were foreclosed upon that would be almost as many properties as sell in a year.

which is UNcoincidentally what we’re seeing in much of California, where 50-60% (and even more) of sales are foreclosures.

so like I said, the problem is that RE is set at the margin (even in SF).

we see this all over the country, BOTH in bubble times and in crunch times.

SF escaped the Option ARM mess because SFers in general didn’t use that product.

But they DID use Alt A products which are now defaulting in record numbers

And they also used Prime products which are defaulting in record numbers.

and those reset/recast dates are coming. as they do, we expect higher foreclosures. That will impact the local (SF) market.

this is a SF specific argument of why SF faces a huge hurdle.

there is a possibility that SF will come out unscathed, although it is very unlikely given what we’ve seen to date.

1) if all this refiinancing has allowed people to refinance out of their toxic Alt-A products into better products, OR if it has allowed them to refinance pushing their reset/recast date back a few years (which will buy them time)

**the problem is that in general the people who really need to refinance to escape their loan don’t qualify under current guidelines… the people who most need this help aren’t getting it.

like I said: 1M people in trouble, only 8500 or so got a workout.

2) the govt can somehow manage to increase wages through its inflationary policies. this is hard given global wage arbitrage. they may increase inflation, but how to transmit it to jobs. My guess: they will try and fail, and then will decimate our dollar and enact protectionist measures (against China, Japan, Europe, rest of world) to get the wage/price spiral they need.

I wrote:

“and we need to SEVERELY reduce our standard of living in order to “compete” with the rest of the world.”

diemos responded:

Or we could stop competing with the rest of the world. The only thing the rest of the world has that we need is energy and we could become self-sufficient in that if we wanted to.

this would still drop our standard of living, at least in material terms.

we live so well (materially) because we have near-slave labor in China and the rest of the world who will produce things cheaply for us.

their governments peg their currency to ours which causes an imbalance keeping their labor inappropriately cheap and ours inappropriately high.

simply put, we’ve been exporting price inflation for some time.

if we stopped competing and just relied on our own labor and ingenuity things would cost more here.

So no more $150 iPods and $800 flat panels and Walmart specials.

(there is a reason iPods are designed here and then made overseas)

I’m not saying we shouldn’t do this… just that the average American would spend far far more on their stuff than they do today or American wages would fall.

but you can’t have $20,000 cars and $150 iPods if Americans making good salaries are making the product.

anonn,

As we touched upon in a prior post, we all have our self serving reasons for posting here. As you maintain that you are not posting here for marketing (professional) reasons, the question remains as to why you actually do post here.

You seem like a sucker for punishment, judging from the amount of (metaphorical) flogging to which you subject yourself at SS. Moreover, you seem to actively incite the flogging by provoking responses with the particular tone you use. It’s as if you are a small child daring to inflame the rage of a domineering daddy.

Most people do not enjoy the ridicule you often endure, and would tend to find other hobbies where the ridicule is minimized if not non-existent. If you are not enduring the “abuse” in order to help sell houses, what motivates you to take on all the negativity?

Note that I’ve made no value judgment about whether or not the ridicule and scorn are warranted. Even assuming that the abuse is unfair, most people wouldn’t stick around to be used as a human pinyata.

I only used Miami’s data to show that a small number of foreclosures severely hampers a market’s valuations. even a piss poor market like Miami has most people paying their bills just fine. It negates your argument that a small number of foreclosures in Sunset is no big deal. (they are).

But it doesn’t though. There is a logical leap there that I’m not willing to concede. The two markets are very different, and Miami is itself striated. However, any way you slice it, San Francisco was not derailed by second home condo speculation.

nnona,

Nice name. I know who you are.

The thing is, I basically win every argument I’m in. They are all still arguing from a perspective of future times by and large. It’s easy.

Just because it’s a simple majority that I argue against, it means nothing. And the language you used in the guise of a balanced summation was inflamatory.

but you can’t have $20,000 cars and $150 iPods if Americans making good salaries are making the product.

In the short term, this is correct. However, in the long term I’m not so sure. You’re correct that we’ve been exporting price inflation for some time, which has the incredibly negative effect of discounting investments in domestic productivity. Why work on becoming more productive when you can acheive the cost savings without the work? With time, putting this natural incentive back into place would encourage productivity growth in the US.

anonn wrote:

> The thing is, I basically win every

> argument I’m in.

I had a member of the flat earth society tell me the same thing once…

I always followed up to see what the winning bid was like. Invariably it was with a lot of cash,….. and it’s a big reason why a lot of homebuyers can sit the correction out

I actually think the larger downpayments are forcing these buyers to sit out the correction vis a vis those with no capital at stake.

Why questions annons, or anyones, motive for posting on SS. I find his points generally on target. My only criticism is that his comments lacks any future-looking perspective. But its hard to make this criticism as he generally is ‘reporting’ what he is seeing in the market, which is inherently either real-time or historical. I find the retorts highly entertaining. My only real question is how some of these people find the time to post their loooong responses to such a micro audience. Kudos to them and thanks to all. Best.

“The thing is, I basically win every argument I’m in.”

Really? News to me. But a knight as valiant as you, Señor Quixote, ought to have his own blog. Why waste your time here, overcoming hard numbers with personal anecdotes?

Still waiting on your Sunset comps. Although I suppose we could just take your word for it, though, given you’re always right.

“The thing is, I basically win every argument I’m in.”

Really? News to us. But a knight as valiant as you, Señor Quixote, ought to have his own blog. Why waste your time here, overcoming hard numbers with personal anecdotes?

Still waiting on your Sunset comps. Although I suppose we could just take your word for it, though, given you’re always right.

All this “us” “we” “our” stuff all the time on here has got to go. Really now. Y’all fancy yourselves a movement? That let Tipster in? Nice one!

I looked at the “Outer Sunset” (even though we weren’t talking “Outer Sunset”) and I didn’t see too many apples. Or big losses. I saw a number of remodels that ostensibly showed modest gains. I showed the Ortega apple that took a 10 % loss, after an ill advised huge overbid preceded by a stale marketing period for less, and a bunch of houses that lowered their prices a bit and sold. “Tanking” I didn’t see. Nor, for that matter, did your own examples display “tanking.” You showed two near 20. One at 13. Two flat. And some remodels that showed gains. All after somebody else said “everything is 20 percent down.” So whatevs. Chalk up another one in the double U column for the kid over here. “We” will take it.

EBGuy – Outer Sunset tallies: 29 foreclosures, 35 homes for sale.

Just to be clear, some of the “foreclosures” (NODs, NOTS and actual REOs) stand a chance of being cured before being put on the auction block. The REO ratio* is a forward looking metric that attempts to show the “pent up supply” that will soon enter the market. A neighborhood with a REO ratio greater than or equal to 1 gets kicked out of “real SF”. For example, the Excelsior neighborhood is around 2:1. As a comparison, the city of Pinole has 4(!) foreclosures for every home currently for sale (according to Trulia).

*REO ratio =

# of Foreclosures/(# of Resales+new construction) as shown on Trulia.

@ Legacy Dude, other members of the ROYAL WE SQUAD TM

You said, “Why waste your time here, overcoming hard numbers with personal anecdotes?”

You do realize that you say this while taking national charts from T2, and foreclosure stats almost definitely drawn from relatively local areas right? While slapping them on all of SF and projecting/ predicting the future?

Yet it’s hard data. And so much more relevant than years of experience.

Uh huh. No. Not having it.

In fact, you see evidence of my claims almost daily. By and large the “apples” any of you would want to actually live in show what? Banks taking losses?

No. They show people who put down large down payments taking the losses. They knew they were going to take a loss if they went through with the sale. Yet they did it anyway. WHy? To get at as much cash as they can, because they need to.

YOu know, very much like how I said the winning bids had been working, with large down payments?

The proof is in the (apple) pudding.

almost definitely drawn from relatively local areas right

I meant to say relatively localized and contained (read D10 and D3) but forgot to get back to it due to this site’s lack of an editing feature.

What do you know? Somebody looked into this “only D10 and D3” theory of yours and found that those district have fared slightly better than the rest of the city since the peak of the bubble:

http://www.pegasusventures.net/wordpressblog/2009/04/14/are-san-francisco-home-values-rotten-to-the-core/

Yes, this uses MLS medians. Got anything showing the real picture is anything other than these real numbers other than your “years of experience” which gives your unfounded rants such credibility?

I don’t understand how one would avoid paying any taxes.

I was only referring to income taxes, but I guess the wording could have been a little clearer. I am very troubled by the idea that a very large proportion of the population is not paying any or exceedingly minimal income tax. For a good percentage – because of credits like the EIC – they are actually “negative” income tax payers. This group will not care about the burden of income taxation anymore and are susceptible to the politician’s pitch that someone “else” will pay as government programs are expanded. Of course, they still pay (generally) some payroll taxes and other taxes, but they of course are users of these services/purchasers of these products. I haven’t tracked down the data lately, but I think at the Federal level somewhere around 40% of the population pays zero income tax or actually gets a welfare check in the form of the EIC credit, but I’m open to conflicting information if anyone has it.

@ Legacy Dude –

Thanks for tracking some of the data down on specific Sunset properties. We’ve got good friends in Parkside, and on their very recent refi their house was assessed at 5% less than the house next door to them sold in 2004. They estimate that the value of their place is down 20-25% from where it was in 2006. They’re not concerned because (like Trip) they bought in the mid-90s and have not looked at their “equity” as an ATM. People in that category are in the catbird’s seat. They bought at a time when home prices were much more in line with rents (and therefore income), and now with the insanely low rate structure they can reduce ownership costs to below rental equivalent.

But judging from the data you provided (anecdotally supplemented by the appraisal data from that Parkside family and another friend who is in Forest Hill Extension)), it sounds like a good number of people got suckered in the mid-2000s out there. Nothing to be done now – the die is cast. “It’s all over ‘cept the crying”.

anonn: great job critiquing my claim. And great job of your usual huffing, puffing, and posturing. If you can’t address the issue, attack the person raising it. Debate 101, and classic anonn.

Anyway, you wrote:

“Would you like me to find a bunch of sold counter examples to your tanking claim? I’m pretty sure I can if you like.”

Yes, I would. Please find them. I’m curious how far back the prices have rolled. Again, I bet folks buying in ’04 still have some gain, but most of the buyers from ’05 forward are now flat to down. But I’m willing to be proven wrong if you want to post some Sunset apple addresses.

I told you I looked into the “Outer Sunset,” and I told you what I found. No real apples. I said I thought I could find examples. I didn’t. But tanking, IMO, I also could not find.

I attacked the positing of the T2 chart and the non-neighborhood specific chart atop this thread as hard facts.

I attacked your depiction of “tanking” as going along with “20 % declines,” true.

I will look into “Sunset” numbers later.

Joe,

I responded to this:

http://www.pegasusventures.net/wordpressblog/2009/04/14/are-san-francisco-home-values-rotten-to-the-core/

Here: http://thefrontsteps.com/2009/04/08/san-franciscos-core-districts-vs-san-francisco-as-a-whole-avg-median-price-chart/#comments

and I’m pretty sure you saw it.

Followed your link and I’ll paste your “response” here: “No, good districts have not shed 20 to 30 % in value like D10 and parts of D3. I don’t care a whit what this chart says.”

Yep, you’re predictable. Your “years of experience” are far more credible than actual facts. I guess that’s why you “basically win every argument [you’re] in.”

I found two Sunset “apples”.

1491 43rd Avenue. Purchased 4/25/2005 for $875K. Sold 9/23/2008 for $730K. Not too bad. Only about 16.5% down and about $190K in capital sacrificed to the bubble gods. Anonn also likes to say that the “hit” really only took place after September 2008, so perhaps it would be lower today? Prop shark shows that $175K was put down in the “first loss” position in the 2005 purchase – I hope for the seller’s sake they cashed itout on a subsequent refi that doesn’t show on prop shark. Still, a worthy sacrifice I guess.

http://www.redfin.com/CA/San-Francisco/1491-43rd-Ave-94122/home/1684987

2495 33rd Avenue. This one was a “success”. Purchased in November 2002 for $634K and just sold for $700K in 3/09. That would have covered transaction costs and maybe left $10K. Pretty good – 2002 purchases seem safe. It’s interesting to note that permits have already been filed to significantly expand and remodel, so perhaps it’s a flipuvestor who bought?

http://www.redfin.com/CA/San-Francisco/2495-33rd-Ave-94116/home/933912

You too are predictable, Joe. I elaborated on my outright dismissal further along the thread. You predicably skipped the rest of the read once you thought you had your “ah ha moment.” This is a pure example of median distortion in a small dataset. Of course it’s going to reflect a downward shift when the top tier districts are showing a large grouping at the bottom — due in large part to new lending standards — with only a very occasional top price sale. And the lower price districts never had that high of prices. Now that some higher ticket items are selling this spring, I predict an updated version of this graph will look different in July or so.

And LMRIM, who asked you?

“Jeremy – Did your appraisal report state how large the area polled was ? A few blocks ? The zip code ? The whole city ?

I’m assuming your home is in SF.”

The report was VERY general. Here is what it said.

Neighborhood Description: Urban Residential area, primarily comprised of average quality compatible housing types, in average to good condition. The neighborhood is located near all typical urban amenities. No unfavorable conditions are apparent. Downtown area, freeways, and regional transit are located within 1-3 miles.

Market Conditions: Residential real estate values are generally stable, with supply and demand in relative balance. Financing remains favorable in terms of interest rates and includes mainly conventional loans. Concessions and creative financing have minimal impact on market.

And the lower price districts never had that high of prices.

Not Sunset, but when I hear this sort of stuff I always trot out my trusty Oceanview “apple”, 262 Minerva. Sold for $630K in 2006, it’s now asking $369K – 41% under 2006 – and at 122 BOM it’s going to go lower I’ll bet, lol:

http://www.redfin.com/CA/San-Francisco/262-Minerva-St-94112/home/1465061

Amazing that real estate “professionals” (appraisers, agents, lenders, etc.) signed off on that price back then. Then again, not so amazing 😉

Yeah, you always do, don’t ya? The boldings. The realtor digs. The winking emoticon, (like anyone thinks your wise to spend all your time looking at Oceanview property when you rent in Tiburon), etc etc. I’d say there are a great many things that you always say on here, over and over again. Don’t quite see the fun/point of it myself. Other than that axe to grind you never told us about, that is.

There’s a problem with the graph. On the Notice of Default line Q4 2006 is 173 while Q1 2007 is 162, but is shown as going up on the line.

anonn: “with only a very occasional top price sale”

Of course, that couldn’t drive prices lower in the top tier, could it, in your world?

“posted here many times — showing that something like 60% or 70% of SF purchases in 2006 were with these toxic-type loans.”

Most of my friends bought with “toxic-type” loans. They had great jobs and great credit, but they liked nothing down funky terms becasue the payments were lower and they could buy more stock with the amount they saved. At any rate, almost all of my friends have been able to refinance in SF. One friend, who lives in a condo complex in SJ was not able to because he is underwater, but most people in SF are not underwater, even today. So that huge refinancing boom probably eliminated 80% of that 70%. And even still, that 70%, probably only represents 5% or less of all outstanding loans in SF as people bought in 1990, 1991,etc. and not just in 2006-2007.

I want prices to fall as much as anyone, but I am being realistic.

Also, I didn’t end up buying the home I was trying to buy. The lender increased the down payment from 10% to 15% three days before the loan was supposed to close.

The home was in district 10 by the way.

But it has, and I’ve said it numerous times. Why are you trying to portray me as an “up up up” guy? I’m merely sitting here trying to say that there hasn’t been a 20 % price slide in nice ‘hoods. Every time I say something it’s you, buddy.

I want to see a chart for every single property you ever wrote an offer on for a client, anonn, or else I’m not buying it. Only charts are “reality.” Even if they depict national forecasts. Or Miami. Or underpeforming neighborhoods, using median.*

Forget that tho. You changed the subject. I explained why Misha Friedman’s chart looks the way it does, and you know it.

*you are not allowed to explain median dynamics in market that has fallen. you are merely allowed to disregard small datasets in a stable market.

“but where are they? EBGuy said he saw, what, 29 in the Sunset. Out of how many thousands of houses in the Sunset? Any one of these guys whose lead you follow in attempting to deride what I offer up without malice predicted quite differently. My points stand.”

there are 180 blocks in outer sunset. That is nearly 1 foreclosure every 6 blocks. That is not small for a city as robust as SF. If that number follows the forecast (NOD) then it would be a foreclosure every 3 blocks.

But it doesn’t though. There is a logical leap there that I’m not willing to concede. The two markets are very different, and Miami is itself striated. However, any way you slice it, San Francisco was not derailed by second home condo speculation.

the same process happened in Boston, and also in San Diego, and also the Inland Empire, and also in Miami, and also in Las Vegas, and also in Phoenix, and also in much of the 9 county SF Bay Area just to name a few.

Second homes were clearly a big issue in places like LV and Phoenix and Miami, but not so much in San Diego or the greater Bay Area.

all of those areas saw huge price declines once the foreclosure and NOD level increased, even though the vast majority (well over 90%) of people are making their loan payments on time, and even though only a small percentage of properties actually went through foreclosure.

your argument seems to be essentially “SF is different”. which is true, but irrelevant in this case. NODs and Foreclosures put pricing pressure on local real estate markets. Everywhere. regardless of how “different” that market is.

a relatively small number of NOD/foreclosures can put MASSIVE pressure on local RE markets, as seen by many diverse “different” RE markets that are in downturn around the country

SF was affected positively by the credit bubble (like everywhere else), and now is affected negatively by the deleveraging process (Like everywhere else)

or are you still “surprised” by the SF RE market’s downturn last fall when lending tightened?

anonn;

“Nice name. I know who you are.”

——

I’m absolutely certain that you have zero freaking clue who I am. 😉

******************************

“The thing is, I basically win every argument I’m in. They are all still arguing from a perspective of future times by and large. It’s easy.”

——-

My bad. I erroneously thought you were a masochist, it turns out that in reality you are delusional. 😉

http://en.wikipedia.org/wiki/Delusion

http://en.wikipedia.org/wiki/Delusional_disorder

Why all of this constant bickering? The San Francisco market is what it is and and will be what it will be. Stop already!

Jeremy R,

“there are 180 blocks in outer sunset.”

The operable term was “Sunset.” There are a great deal more blocks than 180.

and nnona, wiki defitions now? LOL. Here’s one for you.

http://www.urbandictionary.com/define.php?term=weaksauce

and ExSFer,

You want me to disregard the fundamental differences in these markets, and instead to only look at their similarities, but I will not do it. You also want to throw out the several years lag time between SF and many (all?) of the markets you’ve mentioned. The lag time has been populated with numerous subsidies and incentives to refinance, among other things. I cannot overlook that either.

There’s a lot of fighting, but no one is putting anything into ANY context. Yeah, we all know that the market is changing, we’re in a recession. Beyond that? Good time to buy and where? Where is the forward thinking that has been mentioned? Any strategies being formulated by any of you in terms of figuring out how to come out ahead in this market, and SF in particular? Oh yeah, that you can share. Show us some real brainpower and not just who can be the queen bitch.

You shouldn’t overlook the fact that the prices went up during peak time because of easy availability of cheap loans (not demand), which has dried up……

Beyond that? Good time to buy and where? Where is the forward thinking that has been mentioned? Any strategies being formulated by any of you in terms of figuring out how to come out ahead in this market, and SF in particular? Oh yeah, that you can share

I’ve done this many times.

over the last 2+ I advised people to hunker down, pay off debt, not take on new debt, etc etc etc. I started saying this 1.5 years prior to the downturn. if people listened they would be sitting quite nicely today. some i’m sure did. others proclaimed how SF is special and different. or how tech is immune to recessions.

I’ve also said what people should consider going forward many many times

-there is no reason to try to time the bottom in terms of RE (or stocks for that matter)

-RE will probably face considerable pressure until Dec 2011 minimum, so there is no hurry.

-consider purchasing when the market has 12 consecutive months of YOY gains. You will miss the absolute bottom, but that’s better than catching a falling knife.

-instead of timing a purchase, buy well below your means. Might I suggest around 1-2x your annual salary maximum. another strategy would be to wait until buying is CHEAPER than renting even when you don’t figure appreciation into the calculations

-the goal the next 2-5 years should not be to make a lot of money. instead it should be to lose as little as possible.

-only those with extreme knowledge AND signficant time to monitor equity markets should be involved there, given the massive amount of govt intervention and the overwhelming dominance of quant and computer trading these days, and the casino volatility.

-do not go into debt right now

-try to build up a large CASH emergency fund

-pay down debt as much as possible.

unsexy yes.

but we face depression. now is not the time to be too cute.

Update from the state controller’s daily tax revenue tracker:

http://www.sco.ca.gov/taxtracker.html

Tax revenues (from personal income tax) are now 29.5% below 2008 for the month of April (through 22 days). Just yesterday (through 21 days) the delta for the MTD was -25%. For the fiscal YTD (since Jul 1), we’re now down 13.5%. As of Apr 1, we were “only” 10% behind last year’s pace.

This is just the personal income tax component of total state tax revenues – but it accounts for 57% of the total (at least it did last year). I wonder how accurate these day-by-day numbers are and if they are subject to revision. It’s scary to think about what will happen if this accelerating trend continues. A decline of this potential magnitude can’t be fully baked into any official forecast. I’ve never been a big muni bond investor – but do risk premiums on state munis reflect this situation? Anyone know of stats on the number of people filing for extensions?

Holy smokes, FSBO! I’m guessing that there aren’t going to be too many capital gains taxes being paid around tax time this year, and that the delta is going to grow even worse.

All I can say is keep your hand firmly on your wallets, folks. There’s nothing “patriotic” (to paraphrase that estimable scholar Biden) about voting higher taxes to prop up a crazy system like this. May 19 is at least a chance to send a small message.

FSBO,

Although personal income taxes are 57% of the General Fund (or were), they are a lesser % of the total budget, because the General Fund is only around $100B and the total budget is around $144B. I’m sure there is a website somewhere that reconciles the two figures, but it would probably take some digging. Off the top of my head, I’m pretty sure that Federal transfers, Prop 13 revenue, bond borrowings and “special funds” make up the lion’s share of the difference between General Fund and total expenditure.

About California muni bonds, I don’t like them at all (except as a trading vehicle for short term moves, perhaps). If you want your head to explode and have a reason to get flat CA credit, look no further than this historical pattern:

http://www.sen.ca.gov/budget/budgethistory.pdf

(Current expenditure is north of $144B – the data are not updated in that pdf to 2009-10.)

The next phase of this catastrophe will be the government grabbing everything it can to keep government workers’ salaries and pensions flowing.

But of course, when everyone discovers that isn’t going to be possible, the real revolution will begin.

@anonn,

“The thing is, I basically win every argument I’m in.”

Wow…. Your narcissism is unsurpassed, Kenneth.

tipster wrote:

> The next phase of this catastrophe will

> be the government grabbing everything it

> can to keep government workers’ salaries

> and pensions flowing.

Take a look at:

http://www.pensiontsunami.com/

Sorry to bring up a factual point in this discussion :), but the claim that SF is a city of Alt-As, not Option ARMs makes no sense. The categories are not exclusive (Alt-A isn’t even well defined, for that matter).

“In addition, many loans with nontraditional amortization schedules such as interest only or option adjustable rate mortgages are sold into securities marked as alt-A. ”

from http://www.newyorkfed.org/regional/techappendix_spreadsheets.html

but the claim that SF is a city of Alt-As, not Option ARMs makes no sense. The categories are not exclusive (Alt-A isn’t even well defined, for that matter).

amused in soma:

the argument does make sense.

there are Option ARM Alt-A products, and non-Option ARM Alt-A products.

there is data that distinguishes the two. and the data showed that the majority of Alt-A products sold in San Francisco were NOT of the Option ARM variety.

it’s kind of like “asian” and “Hmong”

they’re not exclusive.

San Francisco has a lot of Asians.

but most of San Franciscans Asians are not Hmong.

similarly, SFers took out a lot of Alt-A products. But most of them were not Option ARMs.

Where is the data ex-sfer?

@ Jorge,

“Wow…. Your narcissism is unsurpassed”

Even though you took that out of context, and went personal, again, “Joe Friedman/anon/Jorge/insertanyhaternamehere/” anybody can see that your vocabulary is still ill-formed.

I will be the one to bite the bullet here be that I agree or not… annon you win.. ok, let’s all move a long here.

Where is the data ex-sfer?

A great question.

I’ve seen the data twice I believe.

off the top of my head, one of the sources was one of the Federal Reserve Papers, which I believe cited OTHER sources as source of the actual data research.

the other place I saw it was an analysis done of the loan characteristics of loans originated by the major mortgage lenders (Countrywide, Indymac, etc)

I’m 99% sure it was Loan Performance, a San Franciscan company.

I had the loanperformance.com source saved on my home computer a few years ago (it was when the Chronicle first started publishing the 70% Alt-A data a few years ago), so I’ll go home and check if I still have it saved.

the problem: I’m pretty sure that you have to have a membership for LoanPerformance’s research. At one time I had access to a membership, but I no longer have this access…

so I’m not sure that I can get the data and post back here or not… but I’ll check their historical files… sometimes you don’t need the full membership for the “old” data.

I don’t remember the numbers, but SF was different than SD in terms of the % of Alt-A products that were also negative amortisation.

(**remember: in a lot of the data sets Option ARMs are called negative amortisation products)

a third possibility (less likely, I don’t believe it gave SF specific data) was Wells Fargo’s surveys… the ones that consistently showed that 75% of people in Option ARMs payed the minimum payment, which argued strongly against the idea that these were cash management products aimed at the financially literate affluent

35% of all new AND REFINANCED homes in San Jose were pay option arms. I realize that SF has a lot of tech wealth, and San Jose couldn’t possibly have that level, with so few tech firms in the south bay and all (sarcasm), but I’d expect that with higher SF prices, the numbers had to be higher. In any event, it’s going to be among the highest number anywhere.

http://www.businessweek.com/common_ssi/map_of_misery.htm

Prices were higher in the SF MSA than in the SJ MSA? News to me. Also news to the data.

What is pathetic is that when I was buying late summer/ early fall 2008 It was difficult to require, request and convince Wells to sign me up for a full doc 30 year fixed product. I could easily qualify but they were forceful in pushing the Alt A and a bunch of other crazy products on me. So happy I did not listen to them although it caused a lot of tension.

ex SF-er,

I think you’re referring to the graph on page 4 on the link below. It shows the Loan Performance data for the Bay Area.

http://www.capebuyerbroker.com/PDFs/Exotic_Toxic_Mortgage_Report0506.pdf

satchelfan:

thanks for the link. it’s a great paper.

that graph does show the high % of interest only loans that occurred in SF.

the debate was the percentage of those IO loans that were negative amortisation (or “option ARM”) loans.

that chart doesn’t show it.

I’m home now, and no longer have my LoanPerformance research on my home computer. I’ll have to dig for it.

tipster: I agree with you that Option ARMs made up more of SF’s market in 2005-2007 than ever before, by multiples of the past.

however, I still recollect that the Option ARM use was less in SF than in SD, Miami, LV, Phoenix, etc.

doesn’t mean SF is ok. on the contrary. the pain is to come given the high % of Alt A products set to recast/reset.

ex SF-er,

It looks from the map I provided that option arm loans were used in high income areas where home prices had nevertheless exceeded the ability of people’s incomes to pay even interest only loans, and in speculative areas where flippers just wanted the lowest possible payments.

So you basically HAD a problem in Miami, Las Vegas, Phoenix, San Diego and Sacramento but the flippers, as opposed to the homeowners, have by now mostly walked away. These areas dropped around 50% because their option arm holders walked. They didn’t walk due to resets, they walked because even the minimum interest on the loans wasn’t being covered by any reasonable rental income, and they knew that the market was not going to recover to make it profitable if they kept holding onto the home. Not all of them, of course, but many of them. And more of them each day.