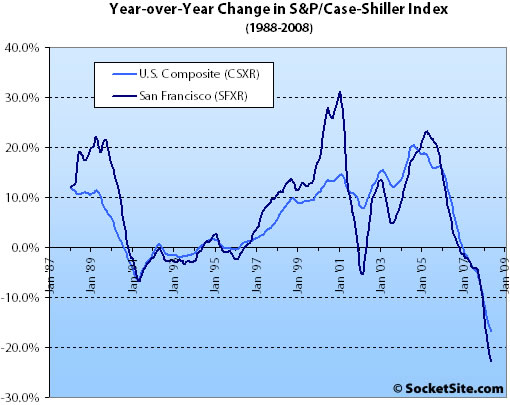

According to the May 2008 S&P/Case-Shiller Home Price Index (pdf), single-family home prices in the San Francisco MSA fell 1.2% from April ’08 to May ’08 (the slowest rate of decline in eight months) and are down 22.9% year-over-year (a record low).

For the broader 10-City composite (CSXR), year-over-year price growth is down 16.9% (having fallen 1.0% from April).

For the month of May, markets that experienced large gains in the recent real estate boom continue to be the biggest decliners. Miami and Las Vegas were the worst performers returning -3.6% and -2.9%, respectively. On a brighter note, Charlotte and Dallas have recorded three consecutive months of positive returns. These two markets are also showing the smallest annual declines, with Charlotte down 0.2% and Dallas down 3.1% versus May of 2007. From a longer-term perspective, since January 2000, the best performing markets are Washington, Los Angeles, New York and Miami.

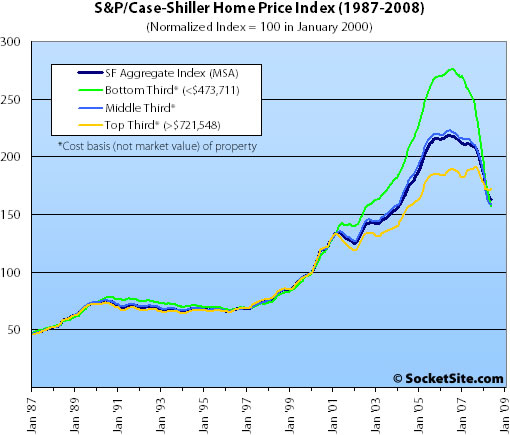

Both prices and the rate of decline continued to fall across the lower two price tiers for the San Francisco MSA while the upper tier recorded a slight month-over-month gain for the first time in nine months.

The bottom third (under $461,780 at the time of acquisition) fell 3.6% from April to May (down 38.8% YOY); the middle third fell 0.6% from April to May (down 26.1% YOY); and the top third (over $716,171 at the time of acquisition) rose 0.9% from April to May (down 8.7% YOY).

And according to the Index, home values for the bottom third of the market in the San Francisco MSA have returned to August 2002 levels, the middle third to January 2004 levels, and the top third continues to hold at March 2005 levels.

The standard SocketSite S&P/Case-Shiller footnote: The HPI only tracks single-family homes (not condominiums which represent half the transactions in San Francisco), is imperfect in factoring out changes in property values due to improvements versus actual market appreciation (although they try their best), and includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., the greater MSA).

∙ Record Low Annual Declines Recorded in May 2008 [S&P]

∙ April S&P/Case-Shiller: San Francisco MSA Declines Across All Tiers [SocketSite]

I guess no bottom yet for the lower 1/3 of the market.

No.

But possibly for the top 1/3

and even possibly the middle 1/3

“I guess no bottom yet for the lower 1/3 of the market.”

I gotta say. I have had some worrying thoughts about what this is going to do to society here, social interaction. San Francisco is polarized enough as it is.

What did I say? I have predicted multiple times that when the three tiers meet, that’s when the market bottoms out.

That does not mean the market will bounce back (“V” shaped recovery).

Originally, I predicted the bottom to be late 2009. Now, I predict that to be the recovery time (the index will start going back up), but before that, it could be a flat bottom for a while (“U” shaped).

Where are these numbers in regards to 1/3’s comming from? They are way off SF, to the point of being worthless here; I suppose they make some sense for Contra Costa and Alameda counties.

But in regards to SF of the current 648 houses for sales, only 44 are at or below the bottom tier.

fluj, good point about the impact on social interaction. Homeownership has been sold to the less fortunate as a way to get to the middle class. You own your house and you refinance it to pay for the kid’s education and a better life. Now that the market is sawing off this social ladder, there will be no easy way up. Welcome to the Real world.

I guess what I’m saying is that 60%+ of SF falls into this top tier category.

The tiers are down YOY 39%, 26%, and 8.7%. The top tier just hit its peak in August 2007 and is now back at early 2005 prices. Remember that the monthly data provided is a 3-month moving average, not straight monthly prices, and real estate is very seasonal (hence, the standard use of YOY measures).

Inventory is up, sales are down, listing prices are way down, median sales prices are significantly down, foreclosures continue to rise by orders of magnitude, and the CSI apples-to-apples data show steep declines at all price tiers YOY. (CS is SF MSA, but all the others are just SF). And interest rates are moving higher. I don’t see how anyone can reasonably interpret any of this to call for a bottom anytime soon, although one might be able to feasibly argue that the declines are no longer accelerating, just continuing in a linear path. These declines take a long time to turn around.

Here are the composite numbers from the SF MLS of active listings in districts 1-9:

Bottom Tier (<= $461k) : 126 (9.2%)

Middle Tier ($462k to $715k): 407 (29.8%)

Top Tier (>= $716k): 832 (61%)

Good call Sparky.

[Editor’s Note: Keep in mind that the Case-Shiller price tiers are based on the seller’s, not the buyer’s, purchase price (i.e., not the current market value).]

I only counted single family homes, but it seems to be about the same % wise

Trip, where are you getting the data that listing prices are way down?

I thought http://www.altosresearch.com/research/CA/SAN+FRANCISCO

coverts listing prices for SFHs (top graph).

Seasonality effects in real estate are key, as Trip notes. A good argument could be made that even 3-month rolling averages are too short, and that something like 12 month rolling averages should be used, but I don’t really have a strong view because I haven’t mined the data (and the data are “dirty” enough that it’s questionable how valuable that exercise would be anyway).

Top tier prices could well have ticked up (on a rolling 3 month basis) in the SF MSA, or it could just be noise in the data and “beauty pageant” effects. I really don’t have too much of a view at this micro level, although I do find it funny that the same bulls who always dismiss Case Shiller now seize on this 0.9% increase. So, does that mean that the 8.7% YOY drop in the upper tier is also right, and once and for all we can all agree that SF has gone DOWN over the past year? (hehehehehe) After all, 60% of SF is “upper tier” (down 8.7%) and there seems to be no argument that the other tiers are down significantly.

Look at the chart above. I can’t see any signs of bottoming for the SF MSA from the technical picture. The macro picture is worsening, both for the US and for SF specifically (finance implosion, China going down, CRE beginning its swan dice, etc.), and both the chart and the macro picture support the view that we are clower to the top than to the bottom. This real estate crash will unfold for years….

S&P uses the prior sale price to determine which tier the sale falls into, not the more recent of the paired sales. I’m sure a higher percentage of SF homes fall into the top tier than is the case in the 5-county MSA, but you can’t just look at recent sales to discern anything about the tier distribution.

Satchel,

My near bottom prediction ( i would never be so bold to predict an absolute bottom), also the time I am predicting buying, is Q2 2010 (although i realize we may stay at the bottom for a few year).

Based on your above post, what would you guess for a near bottom or a good time to buy? of course this is mere speculation based on the history of the housing market.

Wow, now we’re just ignoring that District 10 even exists?? Rich.

REPornaddict, you are right. I was referring to Altos’ data (the only source for historical SF listing info I can find). The median list price for SFRs is at about the same level as a year ago (but down from 2006), but the square footage is way up, leaving list prices on a $/sf basis down about 20% over the past year according to Altos’ charts, from about $610 to $510.

http://www.sfnewsletter.com/Docs/Altos_SF_News_CA_SAN_FRANCISCO_2008-07-18.pdf

“What did I say? I have predicted multiple times that when the three tiers meet, that’s when the market bottoms out.”

Dude, you’re a lunatic.

Satchel, I think you were speaking about me as the bull in your post, and that I was using this chart as some point to make a positive spin claim. I wasn’t, I was just trying to yet again point out that this chart doesn’t hold much value either. By that I mean it claims those tiers represent something important but they don’t, as there are not even properly distributed for SF by any means. This is an SF real estate site, and this is skewed to not in SF numbers. SF numbers are down, I agree; but this chart is about the greater bay. And month to month is pointless, I agree.

So the thing is I’m not a bull, I’ve been writing low ball offers for months in SF because I want to see the benefits of the downturn as well. I keep not getting them, so I think SF is not as bad as projected.

I’m anti-misinformation. That’s what I am.

I think that the 8.7% will overestimate the decline for good SF SFHs.

The closer you are to the heart of the main problem (bottom tier homes in CoCo, Solano) the bigger the ripple effect.

So top tier homes in those areas will have a bigger decline than SF or Marin. Its likely that these homes also saw a bigger run up than those in SF.

SF itself is also a small proportion of the total index (10% maybe?) although of course the number will be bigger for the top tier. But yeah, some areas will do better than the 8.7%, some worse, and I am pretty sure SF is one that is doing better.

Thanks trip.

Out of interest, and thios isnt the first time I’ve noticed this, but condo $ per sq ft is much higher. Is this just a function of size, as condos tend to be smaller?

Or are there other factors at work do you think?

The difference in $ per dq ft seems big, much bigger than I would have guessed.

Sparky, what market segment have you been writing offers on and by how much have you been lowballing? Do you know what the successful offers are? I”m curious as this would be more compelling information for me rather than these broad based statistics.

Thanks

Definitely a proof that mortgage financing is a big issue in this market:

1 – Markets that depended on 90%+ financing are being hit hardest. No safety cushion = you’re screwed during a downturn.

2 – Markets that depend on knowledge workers, part cash/part financing are doing so-so. Good salaries = mortgages still obtainable.

3 – Markets that cater to the wealthy are holding on. Cash rich = mortgage optional

2-3 years from now we’ll probably have a good vision of the effects of the financing meltdown on all tiers.

Hey, I’m just an RE investor making my living on the SFRE market. That doesn’t make me a bull…

LOL

Sparky, I would like to know to. Can you give us more details on what kind of properties you have lowballed to?

My guess is the properties at 1.2M are the hardest to get, due to tax reasons (AMT limits the mortgage tax deduction to 1M loan) and we have a lot of highly paid people in bay area. Away from that (either higher or lower), it gets easier.

Foolio,

I don’t own anything except my personal home, and I’m not selling it. I make my living several ways, most RE related. Currently, as a GC, I am working on other peoples houses…who are not selling. I maintain an excellent crew of employees, when I buy a big factor is their continued employment. I am currenly shopping long term projects to buffer a currently busy work load. The lower I buy the better, is that bullish?

The prices of the tiers are tracking the durations of the loans used to purchase homes in those tiers. Subprime loans are resetting and so that tier is getting socked right now.

The tier that had a lot of option ARMs is not resetting yet and so that tier has not been hit. Quite the contrary, the owners of that tier are literally stuck in their homes: they can’t sell because they owe 120% of the 2005-2007 purchase price.

Thus, in contrast to the bottom tier who are bailing out, voluntarily or involuntarily (via foreclosure), driving inventories up in the lower tier, inventory in the upper tiers is being depressed by the structure of the loans used to purchase them. That drives prices higher than they would otherwise be.

I think you’ll see the upper tier at least hold steady until next spring. People are literally trapped in their homes: the normal outflow isn’t occurring and that is keeping inventories artificially low.

When that dam breaks next year, you’ll see the upper tier graph look like the lower tier graph does now.

Satchel and Trip,

I have predicted multiple times that when the three tiers meet, that’s the bottom (or at least near-bottom). I even said the index would be around 160 to 165 (To me, that’s 2002 level, adjusted for inflation).

I am not a bull. It has nothing to do with bull or bear. I made the prediction months ago. I also predicted that this would happen late 2009. That part of prediction was wrong.

Trip, if you call the bottom AFTER the lines go back up, that’s not called prediction. Maybe you can call it postdiction. Prediction is not about talking about what has happened. It is about what will happen.

And the fun part of predictions is that I could be wrong. So, it will take another year to know how close I was.

FWIW, check out the historical C/S Index during the last downturn. There is usually a local max in August before it continues downward; this happened for several years in a row before the market finally turned around.

John,

I think that’s right on, and falls in line with the “fixer” in good neighborhoods.

Spencer,

“Based on your above post, what would you guess for a near bottom or a good time to buy? of course this is mere speculation based on the history of the housing market.”

I think it makes a big difference whether you are looking at owner-occupied or as an investor. There are lots of benefits (both noneconomic and economic – because the tax code lets you offset mortgage interest against any active income anywhere for owner occupied primary or secondary residence) to owning your own place. No need to get the absolute bottom, but so long as identical properties are available to buy for $1.3-1.5M or to rent at $2800-$4000/mo in places in the Bay Area where I want to live, I’d be in no rush to buy. My guess is that 2-3 years from now would be “safe” for buying an owner occupied residence, but if you find something you love, maybe as soon as beginning 2010.

As an investor, it’s going to be trickier, and I’m only a little interested in this, so I don’t have a real timetable. Your idea of Q2 2010 might be fine, who knows? This is VERY different from recent real estate cycles. ALL cycles in the US since the 1950s have ocurred against the backdrop of steady credit (1950s, 60s and 70s) or an extraordinary credit inflation (1980s, 90s, 2000-2006). I firmly think that this cycle is different, because it will play out against a backdrop of credit deflation, at least for the next 2-4 years. Interest rates on safe debt should go down over this period, and this will have the effect of moderating the rise in risky interest rates (mortgages, corporate debt, etc.), and generally slow the asset price deflation from what it would otherwise be (both for stocks and real estate). At some point the pain will be too great and/or the Fed will run out of treasuries with which to manipulate rates, and then we will get serious monetary inflation, similar to the late 1960s/1970s. Rates on all debt will rise, hurting the ability of “inflation-hedges” that are also dependent on financing to rise. in this environment, I would think owning real estate recently purchased at low interest rates will be good as an investment, largely because of cash flows (rising rents) rather than asset price increase (which wil struggle as rates rise). Timing as an investor would seem to me to be tricky – to buy after the lion’s share of price depreciation has occurred but before rates rise too much. Maybe a year or two after it would make sense to buy an owner occupied home, so maybe 2011-13? Much will depend on what the Fed/USG do over the next 2 or 3 years IMO.

Last, IMO the upcoming monetary inflation will treat asset prices differently than at the beginning of the last great monetary inflation (late 1960s) because we will probably be going into it at historically high asset values, relative to earnings (in the case of stocks) or incomes (in the case of housing), but I guess it depends on how far those markets fall in the next 2-3 years of credit deflation!

I think the thirds comments are stemming from the fact that of the 601 SFRs in SF right now, 223 are in D-10.

When the “heated towel rack” crowd on socketsite is gone, we’ll have reached bottom.

Until then, buckle up.

anon, what does that mean?

At some point the pain will be too great and/or the Fed will run out of treasuries with which to manipulate rates, and then we will get serious monetary inflation, similar to the late 1960s/1970s.

Did you notice that it had been relatively quiet at the TSLF the past two months (floating around $100 billion). Then, kaboom, last week’s auction had a bid-to-cover of over 2! There is a “spare” $25 billion in this week’s auction (even if all TSLF borrowings from 4 weeks ago are “rolled over”), so it will be interesting to see if the demand is still there.

“I made the prediction months ago. I also predicted that this would happen late 2009. That part of prediction was wrong.”

Gotta say I would place odds that your whole “prediction” blows up in your face. It’s based on nothing but lines meeting. Seriously, you’re a lunatic. I sincerely hope no one makes any moves based on anything you’ve posted. Then again, a fool and his money…..

Treeman, you don’t have to agree with me, and a lot of people don’t. However, generally, only people who are losing a debate use personal attack.

Are you threatened by my little prediction?

By the way, I have not told anyone to make a move. If you read carefully, I am predicting a U shaped recovery…that means, even if you believed me, you SHOULDN’T make a move until late 2009 (which gives you enough time to prove me wrong).

That means, not only you cannot have a civilized debate, you cannot read either.

although I also disagree with the intersecting lines theory, I see no reason for slamming a person based on said theory. can’t you just be civil?

here’s an equally off-the-wall prediction that has no more/less validity: the bottom will come when everybody stops looking at these charts since “RE only goes down anyway”.

John,

Well, I don’t think you are a lunatic, but you are misguided IMO about lines meeting at 160-65, and that forming a “bottom” (maybe U-shaped, maybe a “bounce-along” bottom, but a bottom).

Take it from me – I’ve been through credit cycles like this at least 4 or 5 times in my short trading “career” (this is the first time it is happening in the US, but the main outline of these crises is always the same). This has a LONG way to go…..

********************************************

I don’t realy mean this as a jab (although it will probably sound like one), but your analysis of the debt/financing problem has not been very probing. Back at the end of 2007, you basically thought the banks had taken their losses, and implied that I was “naive” for thinking that banks would try to stretch out recognition of losses. I’ll actually quote myself here because I think it was a pretty good prediction:

“The banks are hoping to stretch out recognition of the losses over many quarters, if not years. They also hold out the hope that they will be able to sell all this stuff at favorable valuations to a taxpayer-funded bailout fund, which I believe is a certainty at some point in the future. The simple reason is that if they were to write down all of this now, every one of the banks would be insolvent. Every one. [snip]…they hope the toxic assets work out over time. But in th meantime the banks are scared, they hoard cash, and they restrict lending. This is how the transmission mechanism gets into the real economy. There is no way to stop it, only ways to lessen its impact. The Fed thinks it can avoid a hard landing, but this is silly. (Actually, the Fed knows what is coming – they just don’t want to say it, and they want to be able to say “we tried” after they fail.)

Posted by: Satchel at December 19, 2007 3:14 PM”

And here is your “response”:

“Actually, it is naive to think any business would avoid recognizing losses in this situation.

[snip]The first thing every new CEO does is to have a huge write-off. Often, it is overblown instead of under report. [snip] Don’t believe me? Study the first act of EVERY SINGLE NEW CEO yourself.

Posted by: John at December 20, 2007 12:42 AM”

Both posts from https://socketsite.com/archives/2007/12/realtytrac_reports_november_2007_foreclosure_activity_i.html

Actually if you look back at that old thread (it’s worth reading in order to see just how much hope people had imbued in the Fed, banks, accountants, etc. back then!), you’ll see I’ve been pretty consistent on this, and pretty right on (so far, fingers crossed…..)

@Satchel, you were right on about the write-off’s.

However, everyone was right-on so far, since everyone said the market would decline, even me 😉

So, not much to talk about yet. Next year will be interesting.

RE prediction is as dangerous as market timing. I do it for fun, nothing serious. I don’t know why Treeman is so worked up about this.

@ex SF-er, I had a long post about 160 – 165. It is not just simply “the lines meets”. I just don’t feel like posting it again everytime SS updates the CS index.

I love that a small one month uptick for the top third brings out all the bottom callers. Look at the chart just before 92, you see the top third tick up slightly and then continue to slide downward/sideways for the next 4 years until 96.

the 89/90 bubble took 5 years to work itself out and it was only a fraction of the size of the latest bubble. If people think that after a year of some declines this is over, well, I guess they are free to think that but history of previous cycles argues strongly against the idea that we are at, or even near, the bottom.

John:

yeah, I know… I only named it the “interesecting lines theory” to shorten the post.

to me, the important part of my post above was that

a) I didn’t personally agree with your analysis

but

b) that’s no reason to start calling anybody a “lunatic”

John, why do you think we’ll be at the bottom when the three tiers meet? There may be some basis for this prediction, but I don’t see any connection between the tiers meeting and the market bottom.

If we’re tossing out predictions (guesses?), here is mine as to the three tiers. While the lower two tiers still have some ways to decline, I can see the top tier passing them on the way down within the next few quarters. The combination of tighter lending, higher jumbo rates, lower conforming limits, the alt-A reset problem being a couple years behind the subprime problem and really just starting, and simply a longer distance to drop very well may put more downward price pressure on more expensive homes.

Who knows how long it will take to reach the absolute bottom or how far down that will be, but past downturns teach that we will stay there for a couple of years at least before things starting turning upward. Buy when you start hearing about bidding wars again becoming the norm — you’ll miss the absolute bottom but you’ll also miss the falling knife.

@badlydrawnbear

You got three things wrong.

1. As far as I know, I am the only bottom caller (if you want to use that term), there is no “all the bottom callers”.

2. I didn’t call AFTER the upstick. I called months before, given the condition how the trent will work. That was a prediction, not a reaction.

3. Calling a bottom (or near-bottom) doesn’t mean I am calling a recovery. Far from it. Even in the late 80 RE market crash, you can call a “near-bottom” 5 years before the recovery, and you are technically right.

It seems SS readers think you are either a bull or a bear, so if anyone says anything slightly “un-bear”, he has to be a bull.

Far from it.

Back to the topic!

There is a basic problem with ALL real estate sales statistics that should always be considered, and which even Case Shiller (which tries to make adjustments for improvements, outliers, etc.) cannot get a handle on. I often call this the “beauty pageant” effect, but it’s probably more descriptive to think of it as “selection” bias. It’s akin IMO to the “survivorship bias” that many people are familiar with when thinking about aggregate, average or median mutual fund returns.

Think about it. A house is a hard thing to value, especially in a very varied housing stock city like SF (the problem, obviously, is nowhere near so bad in more uniform suburbs, or condos, for example). When trying to come up with an idea of what something is worth (fair value), no one is going to get it “right” – that goes for both buyers and sellers – and this is to be expected. In hindsight, it becomes more clear – someone “overpaid”, someone “underpaid” or got a “bargain”, etc., but this is not clear at the time of purchase (from the buyer point of view) or sale (from the seller point of view).

My strong belief is that – all other things being equal (ie, exogenous factors like financing environment, evolution of desirability of neighborhood, etc.) – those properties which were purchased at less than “fair value” are the ones that are staistically more likely to show gains, and therefore will allow the sellers to recoup their “investment”. Some people always have to sell, but at the margins, those who “underpaid” (which becomes obvious in hindsight as they now try to sell) are MORE likely to sell than someone who “overpaid”. This is because people are “loss averse”, a fact which has been noted of course by numerous behavioral finance academics and which is common sense and readily observable.

This reluctance to sell at a “loss” (“I’ll just hold onto it until someone is willing to pay what it’s ‘worth’ [ie, what *I* thought it was worth when I plunked down so much of my labor productivity for this asset]”) leads to a systematic bias in the sales data, even paired data like Case Shiller, over all but the longest timeframes. This theoretical construct accords generally with observed instances of people pulling houses off the market when they can’t get their price, a phenomenon we have been observing for a while now. It is also consistent with sales volume declines, as well as with average returns to individuals from ownership of the asset being lower than reported median (or average) price changes over a given period.

If this general framework for thinking about the data is right (and I for one am CERTAIN that it is), we would expect the selection bias to be most strong in regions where incomes and financial resources are higher (such as SF), which again is exactly what I think we are seeing.

Bottom line, I think based on the median data, sales volume, and the likelihood that this selection bias is affecting the reported staistics, that the overwhelming majority of people who bought places in SF after December 2004 are now “underwater”. Perhaps not in Noe Valley (yet), or in the most desirable SFHs on the North Side, but it is certainly true in practically all of District 4 (the only area I am very familiar with). Note that this selection bias is really quite different from “mix”, although it’s pretty easy to see that as enough houses slide down the “ugly” part of the beauty pageant, over time mix will be impacted.

Just a few recent SS examples of this reluctance to sell at a “loss” to clarify the idea.

Many people say Noe Valley has gone up or at least flat over the last year or two. But tell that to the unfortunate purchasers of 1420 Douglass Street, who clearly “overpaid” for a renovation of a crappy little shack in an out of the way corner of NV (really Diamond Heights in my mind)! They couldn’t unload it at breakeven (or small loss, after commission), and so pulled it off the market. They are now living in a house that they do not want to live in (or at least wanted to sell!), and are “absorbing” the economic loss of their decision.

The same is true of the 3035 25th Avenue property being bandied about in the other thread today. that property sits vacant (for months now) because the owner refuses to lower the price to below breakeven.

Same thing for 135 Fernwood (ultimately rented at an economic loss), 195 St. Elmo (ditto), 1495 Monterey (basically no realizable gain since 2002, and so pulled from the market), 260 Santa Clara (pulled, vacant), 215 Santa Clara (pulled, but owners still living in it even though they’d clearly rather not), 835 Foerster (vacant, now short sale after poor attempt at flipping), 45 San Andreas (pulled after failed attempt to flip)etc., etc. Believe me, the list goes on and on in the parts of SF that I am familiar with.

@ unearthly: do you have those stats for SFH only? I’m assuming those numbers include condos which are excluded from Case-Shiller.

@ Trip and the Editor: I get your points above about CS being based on the original sales price. However, if prices have dropped (as most people on this board profess), then that means that AT LEAST that % of SF would be in the upper tier (i.e. – it understates the percentage). This number should also go up once you look at SFH.

I think CS has it’s limitations, but it would be nice to know the approximate portion of SF that falls into the “top tier”.

John, and the board –

I appologize for using the word lunatic. I meant it in the nicest possible way – of (and this prob. won’t come across quite right either), you’re crazy. I’ve read your explanation and I think Satchel said it the most diplomatically – it’s misguided.

Now if you’re just randomly throwing theories together, fine. I can get down with that. But you came on the board to pound your chest – way before anything has been shown to be factually true regarding your predictions. I find that extremely odd.

We can all come up with random theories, but don’t think for a second the intersection of these 3 lines means squat, other than they intersected.

Sorry to have come across harsh.

To Satchel’s point, I am amazed at how many people that I meet trying to rent their SFH’s have just pulled their homes off the sales market to rent them instead, because they are certain they will get what they want “in a couple years”. I think their logic is flawed, if I were them I would drop the price now and get out, but many just won’t do it.

There has been a very hot rental market recently so this decision has been less painful because renters have been willing to pay close to a mortgage for rent. However, I am starting to see the worm turn a little bit on that, the rental market where I am looking has cooled a bit, and anyone who bought after 2004 has enough of a mortgage that it will never be made up on the rental market.

Anyway, these are interesting times, and I do believe that people hate to take losses or perceived losses, so try not to and want to live to fight another day. I have a feeling a lot of these people who did not sell now are going to take that loss later, after taking a loss on renting the place for a couple years, just my guess, but we will see.

@Treeman.

You did not come out harsh.

You sounded worked up. Usually, only people in the game gets so worked up. Bystanders usually don’t care right or wrong, and just laugh at it.

I really don’t care if people agree or disagree, and I don’t care whether the market goes up or down. It is mental exercise for me. However, I found your behavior interesting. Are you in the RE game?

How about a CPI-adjusted graph?

heh, heh, heh,

I’m chuckling at the question of me being in the real estate game. Aren’t we all at some level? I don’t currently own, I got out in Feb (luckily – after 7 months of my house being on the market). Bought in ’05, out in ’08, broke even – not really as I put money into the house, but I never bank on that (that’s for my own personal taste and comfort really). So I consider myself lucky in a sense. I got out because I saw the writing on the wall. So I rent right now.

So I’m back to the itch to own (as we’re brought up believing we’re not happy unless we own a house). But that won’t be for a long time now. This is where my personal speculation comes into play – I don’t believe we’ve even scratched the surface yet. Satchel does the best job outlining many of my reasons, and does it better than I could.

However there are other things at play that never get mentioned. The top 10 CPG firms are all, or have already taken pricing >10% across the board. That, if you haven’t seen it already (I have), will hit you in the store of >15%. All at a time when no one is getting cost of living increased in wages (by staying at their current job). Oil prices (while coming down now) are very high. I guess I’m just stating that overall, We’ve hit inflation that isn’t close to being done in it’s ascent and will be the worst I have witnessed in my adult life. And income is not going up to compensate for that.

So shouldn’t it follow housing rises along with it? Not if people have no money it won’t. So we’re getting a quadruple whammy right now that has nothing to do with lines intersecting on a graph.

1) Commodity prices (more than oil)

2) Inflation

3) Wage stagnation/unemployment increases

4) The mortgage meltdown/tighter lending standards

This is all at a macro level. I don’t even have the stomach to look at the micro level, as it certainly won’t get prettier when digging into the details.

Now, has SF held some of this off? Yes. But it can’t forever. It will fall the hardest. It’s beginning to happen to Seattle.

Hold onto your hats (and I know many people will disagree, but that is my layman’s outline)

That explains it, exactly what I thought.

Ummm… OK. Glad to be of service 🙂

“Now, has SF held some of this off? Yes. But it can’t forever. It will fall the hardest.

It’s this kind of “analysis” that I love to see so frequently on SS. Why will it “fall the hardest”? Not because of any underlying fundamentals but because it hasn’t tanked yet… I think this is a lot of wishful groupthink.

hey John, not every post today is about you (although clearly this one is) but in response to your response …

I would also cite from this thread

point 2, well, again, I wasn’t really talking about you specifically so fine

point 3, again … fine … although I might point out that even when prices hold steady nominally, which is what is represented in the graph above, they are actually falling in real terms due to inflation.

Of course the vast majority, again not necessarily you but some random group of people, do not really concern themselves with real vs. nominal prices so that kind of analysis tends to be meaningless to them.

but hey, I am just some random stranger on the internet so who gives a crap what I think anyways 😉

“SF… will fall the hardest.” Bull.

As Shiller and DQ news data has shown, SF proper has stood firm for the most part. If it were to fall “the hardest,” it would done so already as most other cities already saw 30%-50% collapses.

What is taking SF so long you may ask.

-Because we’re fairly rich.

-We bought early.

-SF did not rise as much as most others (in % terms).

-We don’t have to sell.

-Prop 13.

-Most walkable city in the country, when gas might hit $5-$10/ gallon in the near future.

-Bottom line: Low supply, high demand.

2008 is actually the best year to sell because when Obama is voted in, capital gains taxes will double. However, it’s just not happening.

If I’m not going to sell when taxes are at 15%, why on earth will I sell when it’s 28%+?

We should be selling now, but it’s just not gonna happen.

Feel free to add to this list. Because I’m sure I missed a few.

“I think this is a lot of wishful groupthink.”

Valid point “Dave,” but don’t forget that groupthink is what defines markets, notably their trajectory/momentum. It’s what created the bubble on the way up, and it’s the antithetical negative reinforcement that is deflating it on the way down. If enough people share our wishful bearish delusion, it becomes reality. Sell now or be priced in forever!

@badlydrawnbear,

You are saying San FronziScheme and REpornaddict are bottom callers? Hmmm….. they may be offended by that. (J/K)

😉

assa-9, there’s a $500,000 exemption for home capital gains for married couples. It doesn’t really matter much if the rate is 1% or 50% unless you’ve seen really, really big appreciation, in which case you’re not that bummed about paying the hypothetical, possible 13% difference on the gain.

As has been oft-noted here, a significant difference between SF and the hardest hit areas is that SF did not have much subprime action. That is what has been smacked, and what there was in SF has been equally smacked. But SF had a LOT of funny money, I/O, neg-am loans, and those resets are yet to come. That is when the rest of SF will really follow suit. The prospects for escaping it are looking worse every day with interest rates rising, values falling, and lending standards tightening. Won’t be able to re-fi out of it, and probably already can’t.

I do agree with you that the smart move for those facing this future would be to sell now. But people are optimists tend not to make a big move like this, particularly at a loss, until they have to and not before.

assa-9, there are ZERO capital gains taxes (if gain is $500k or under for a married couple) if you reside in your home as a principal residence for two years before the date of sale. So this is a non-issue for most people in the US.

Rule of thumb: bottoms can occur when rental does not make sense anymore and by far. Trends that correct tend to overshoot (so that an average stays an average, and a trend stays a trend) and so far I haven’t seen this.

But I kind of called the top, though, in real life. Prices stopped making sense in 2002 and I stopped buying. I even sold 80% of my RE assets in 2005-2006 following another rule of thumb: “when things are too good to be true, they probably are”.

Dunno how far we are from the bottom, but it’s not by reading anyone’s post that you’ll figure it out.

No one can predict the future. But what if Real Estate in general does hit bottom and we do experience a turn, and SF proper houses are still at $850K Median and $1.3M Mean?

What then, are we still be the one to get “hardest hit”?

“What did I say? I have predicted multiple times that when the three tiers meet, that’s when the market bottoms out.”

i think i posted this before, but the idea that the key to hitting bottom based on when lines meet seems pretty specious to me.

assa-9,

First, to comment on one of your previous posts, you quoted Prop 13 as a reason for SF’s resiliency. Prop 13 is statewide and therefore cannot be used by itself. But I agree that “Prop 13 + tons of people who bought cheap 20-30 years ago” is a stabilizing force. Who in his right mind would sell a house in Noe bought in 1973 at 30K. Depending on the situation, once you move out, there’s no way back. Some of these homeowners will be carried out of their houses when they croak and nobody can blame them.

Next, SF is a very localized market and I agree with that. There are forces unique to this place. Successes in Technology and entrepreneurship have brought a lot of fresh cash.

Another trend is the flight to the city centers by a certain segment of society. Maybe some white flight (at least for family-friendly nabes), maybe some lifestyle choices (commuting sucks), maybe the drag of the cosmopolitan nature of SF (euro-wannabes), and maybe a mix of the 3.

Maybe some white flight

You know this term traditionally means the opposite of how you used it, righyt?

FLUJ, or is it fluj?

Wake up and smell the coffee. White flight in big urban centers is happening counter to yesterday’s white flight that were from blighted downtowns to the outskirts and further and further.

Look at Noe. It was working class, and some upper areas were even dominated by latino at some point. The affluent is now buying up the nabe and pushing out the latino along with the lower middle class.

“SF will fall the hardest”

possibly the worst prediction I have heard on this site.

So SF will overtake the declines seen in the worst hit parts of CoCo and Solano?

Really?

So whats that? prices in SF to fall by 50-60% perhaps?

Sorry, but no…

“Wake up and smell the coffee. White flight in big urban centers is happening counter to yesterday’s white flight that were from blighted downtowns to the outskirts and further and further.”

That’s true. But it isn’t called white flight.

And, no.

I am not calling bottom.

But we may at least be able to see the bottom now.

The bottom tiers decline has slowed in the past 3 months – from 5.9% to 3.6% with an increasing rate of recovery.

Middle tiers decline has drastically slowed over past 3 months – from 5.9% to 0.6%.

The top tier has gone from 2.5% decline to posting an increase in the index over the past 3 months.

gentrification and white flight are the same thing in SF if you look closely. I know people from Daly fleeing to Soma. Very liberal, educated and tolerant, but they’re leaving Daly nonetheless. They’re attracted to the big city life, but I suspect it’s not the only reason…

Fronzi – I also disagree with how you use the term “white flight”, as I don’t think that is what is happening. I think it is just old fashioned gentrification of certain nabes, that happens in every city. For every Noe Valley there is a Bucktown or a Jamiaca Plain, I would not call that white flight. If anything, it is the exact opposite. There has been a change where young families now seem to prefer to live in the city instead of out, but they are not fleeing anything.

They are fleeing the burbs. I fled them.

You don’t know how bad they suck until you have actually experienced them first-hand by actually living there.

Sure, I live in Noe and talk to some newcomers on my street. They like the “safety” for their kids.

It sounded very very familiar…

I personally feel that SF will have considerable RE pain going forward but that they will be nowhere near the hardest hit. That dubious honor will go to the exurban wastelands that will slowly but steadily become too expensive due to high energy costs (heating, cooling, transportation). So places like Queens Creek Arizona as example.

but SF will have some headwinds that will not ease anytime soon

1) Much of the current tech game right now is really advertising. Yahoo, Google, Facebook, Myspace, you name it are actually advertising companies in a tech cloak. If our economy faces a downturn then these companies will falter (advertising dollars drop in recession). but even if they don’t SF real estate is susceptible as these companies are valued at growth rates… so simply putting up good numbers isn’t enough. only getting good numbers will = punishment of stock prices…

2) the Venture Capital game is suffering. I’ve already posted this, but 2Q2008 was a disaster with no VC backed IPOs. the first quarter this ever happened

3) Private equity is also doing very poorly right now due to the lockup in credit markets. They can’t get the leverage to juice returns.

4) hedge funds are suffering for the same reason. A select few are doing well, but most are doing horrifically. if trends continue, this will be the first year that more hedge funds close than open.

5) financials are still taking a beating, and will for some time. Most people don’t understand this, but it’s NOT just about getting over the ever-rising losses… it’s also about finding a new revenue source. Where are the IBs and Banks going to get future revenue to replace all that’s being lost (perhaps forever) in the securitization world?? it is unlikely they can so the Financial world will need to shrink

6) biotech. biotech is still strong. I see no imminent severe headwinds save one. With CMS restructuring its future payouts we may see a reduction in payment for biotech advances. I’m not sure if this is anything or a nothingburger though… it depends on what CMS direction occurs going forward.

so in sum, much of the wealth that is SF (tech, financials, hedgies, VC, Private Equity) is under attack right now except biotech. this attack will continue for some time.

there is a possible saviour however… SF has become adept at becoming a world center of “the next greatest thing”. Who knows what the next greatest thing will be… it could be renewables and green technology as example… and SF is set up well for those spaces. perhaps it will position itself to take advantage of whatever the next “it” technology is.

but it better do it soon, because a lot of the wealth that is in SF is under pressure right now and will continue to come under pressure.

also:

although I think that short term (10 years) SF RE will do quite poorly, I think that LONG term (30-50 years out) SF has some great advantages.

1) it’s weather is temperate enough that one rarely needs either heat or AC.

2) it is compact enough that if the city gets itself together it can have decent public transportation (highly unlikely but I can dream)

3) it is on the water, and thus easily accessible by boat, one of the lowest energy intensive modes of transportation

so as the energy crunch hits more and more over the coming century SF will likely be a “winner” whereas urban sprawl high energy places like Phoenix will get slaughtered.

Guys, I have a question for you:

Do you think the high tier will eventually reach the low tier in term of % down?

To give you an example (not in SF), Livermore went down more than 25% from peak while Pleasanton went down about 5%.

I would guess that Livermore may be close to bottom (maybe 5% more down) while Pleasanton still has a long way to go. The price difference between the two sister cities is too big to be sustained.

What do you think?

ex SF-er – Not sure I agree with the tech piece. Those companies are not the main tech employers here in the area, you would be looking more at Oracle, Cisco, Intel, HP and then the up and comers like VMWare and SFDC, among many others. So, although Google and Yahoo certainly face headwinds with ad spends, painting the tech sector the same way is misguided. Facebook and MySpace are small potatoes employers. I think what is supporting the housing market in the area is the amount of good, not great, paying jobs by those large employers. If you are talking only about homes over $2MM, then you may be right, but the typical $1MM home is being supported by people at the big employers and they don’t face the same headwinds.

Much ado about nothing.

70% of San Franciscans rent, leaving 30% who own. Of that 30%, what percentage bought in the 70s, 80s, and 90s, pre-dotcom, pre-run up? I’m betting a very large percentage. These people have absolutely no reason to sell whatsoever.

Prop 13 keeps their property taxes low.

Their mortgage payments are a pittance.

On top of that, what’s the alternative, rents are screaming.

This leaves a miniscule # of people who might come “under pressure” to sell. Not much at all, really.

True.

but what happens to technology expenditures in a recession?

CSCO and Oracle have been under a slight amount of pressure. Intel is doing quite well of course, although facing a wee bit of pricing pressure.

I know that a lot of traders will disagree here, and a lot are pouring into tech right now… but I think their faith in tech going forward is misguided. I personally feel that the tech field will be under pressure for quite a while. (but like I said, a lot of tech people and tech analysts would completely disagree with me here).

now if the US/world avoids recession then my analysis is all moot.

lastly: I’m not really sure who is buying homes in SF. it would seem to me that the average job in the tech field is not sufficient to afford such lofty real estate. my position COULD be supported by the explosion of ARMs in SF from 2002 to 2007, and the subsequent pain when credit situation tightened, which would indicate people are buying through financing.

but again, that is all conjecture and I have absolutely no data to back this claim. The only people that I know that buy in SF have gotten the money through stock options or by overleveraging. (examples: cash out google stocks… or buy a $1.2M home with only $150-200k income). but I don’t know what a typical Oracle manager salary is as example… maybe it’s $300-400k/year people and I’m just talking out of my bum.

“I have predicted multiple times that when the three tiers meet, that’s the bottom”

John, what is the rationale for your prediction?

Believe me, I have asked myself the question many times, who in hell can (or wants to) afford these prices. I worked at Oracle a few years back, people are not making 3-400k there, or at least not very many.

I work for a tech consulting firm, and we have seen no slowdown of business in our pipeline, and we are looking very closely. We will see what happens, but when we do our debriefs with Oracle and IBM, they are also saying they are seeing strength in their forward pipelines as well. Corporate balance sheets by and large look pretty decent, so there is money to spend for IT. The trouble may be a year off, if there is any.

asiagoSF, sorry, you will have to find the old threads about CS index. I explained there. Don’t want to repeat again.

Here’s some activity in the top tier across the Bay. Let call it: If you build it, they will default.

This appears to be a section of Berkeley that was burned out during the Oakland Hills Firestorm of 1991. Empty lots were purchased and new homes were built. Enter a buyer not quite up to the task of home ownership.

7151 Buckingham Blvd – taken back by WaMu for $1,057,604. Currently listed at $868,900.

7157 Buckingham Blvd – fully financed for 979,000; now for sale at $775,000.

This is an area of $1million+ homes. I hope this doesn’t affect the comps…

the bunk:

thank you for your input. I am actually following the tech story closely and may make some moves there going forward (I currently have no position in tech). your info is very much of interest to me.

to date, I have found that in general the tech story is strong for now. but my contacts in the thick of things are reducing their expectations substantially for 2009 and 2010. I personally expect significant weakness in tech starting next year, not unlike the oil story that is unfolding (tremendous strength and then… drops off a table).

if I may ask: what is your pipeline looking like after Jan 1 2009? my contacts are worried about tech revenue after that point. (most contracts of substance are obviously locked in already for fiscal year 2008 and calendar year 2008.)

this is only sort of off topic… because the future of SF is clearly linked to the future of tech.

EBGuy,

Houses in the bush i.e Berkeley Hills, Oakland Hills, even Lamorinda are probably going to be the first to be affected in the East Bay downturn. With the fear of forest fires, high gas prices, mudslides, and the recent fad of convenience vs. views I wouldn’t be surprised if homes in the EB hills drop another 20 percent by years end.

North Berkeley, Albany, Piedmont, and Rockridge are still hot as ever however, even with a mad rapist at large! I’m really not sure when those areas will ever ease up.

FYI, white flight refers to white people LEAVING an area, usually because of a desire not to associate with minorities. Example: when the schools in Philadelphia were desegregated, it caused White Flight from Philidelphia as whites moved from the city to the suburbs.

Regarding IPOs, I too am in a support role for the tech industry. Obviously the lawyers, bankers, accountants and the like who handle IPOs are hurting big time. For those people, the source of money is ultimately the new shareholders, most of whom are out of the area, who pump money into the area for their services. That money is staying out. The tech insiders (e.g VCs) who sell their shares in the IPOs have the same flow of money: that money is staying out of the area. VCs have pulled back a little – that money is still flowing in from oyt of the area, but it is slowing a bit, and that slowdown will continue if the economy continues to drag, unless the next big idea pops.

The strong tech firms, especially those with multinational presences are doing pretty well from foreign sales, though most have hiring freezes. They don’t tend to make average joes insanely wealthy from stock, but that money is still coming in.

The easy alt-a money well has also dried up. That money flowed in from pension funds and the like and was handed to people locally.

The products that we buy typically are not made here: they get made elsewhere and flow in and our money flows out.

So by and large, more money is likely flowing out than in, and so the bay area is getting poorer. If Comrade Obama gets elected, more money will flow out from taxes on the “wealthy” here and get redistributed to the rest of the country who are poorer and the problem will get worse.

So the fact that some large companies are still doing OK, though with hiring freezes or slowdowns, is not enough to save real estate at its lofty levels, IMHO.

Since we do large implentation work, we only have a view for about 9 months out, and things look good for us. I just sat with some sales management for Oracle and they are looking at pretty strong growth in North America for this fiscal year (ends May 09). IBM is giving us pretty much the same story, and for the most part we are not seeing weakness in North America for most of our lines of business. I don’t have global responsibility, so those numbers are out of my purview.

On the investment side, I don’t know what are good names to buy, but we are not seeing a downturn ahead for valuable technology implementations. Companies are still willing to invest in technology if they can find a positive ROI, and we are in the business of providing that justification to them, so the train keeps on rolling.

I would have thought that by now we would have seen some weakness or delays in spending, but nothing so far.

Hey guys — longtime reader, first time poster here.

I recently bought a nice sized 2BR on the edge of Russian Hill and the Marina at around $580/sqft. It’s not luxury, but it’s a solid and recently renovated place with parking.

I chose to buy because I am planning to live in SF for a long time, several years at least, and I am confident that I could rent the unit for an amount comparable to my mortgage payments.

By purchasing and occupying this home, I am also able to write-off a massive portion of my income for years to come.

Now, I hear a LOT of people talking about how crazy it is to buy right now, but, honestly, this is a case-by-case scenario. I think that I got a great first home at a very reasonable price (I don’t think Russian Hill is ever gonna get much cheaper)… and wasn’t willing to rent someone else’s property until 2011.

Wow now it sounds like the great tech crash is coming next year!

Its quite entertaining to see the bears pontificating about strategic tech spending on a real estate board.

Everyone knows that Oracle’s blog software, VMWare’s advertising platform, and Cisco’s Web 2.0 accelerators are recession proof!

LOL!!! There is a sucker born every minute.

How many SocketSite readers purchased their home or loft in the past 18 months thinking that prices couldn’t fall any further?

Guess what? You overpaid by at least $100,000 or more. TIMING IS MUCH MORE IMPORTANT THAN LOCATION.

As for SF future buyers, don’t be another sucker and wait until mid 2010 because SF prices will continue to drop until then.

Read all of my previous posts for the past 2 years and you will see that I have always recommended to wait until 2010.

I work for a small sized .com in SF that has a mix of revenue streams (ad supported for our destination site, and licensing and professional services fees when distributing our products and services).

We’ve definitely been impacted this year, with March most definitively marking the turning point.

Our advertising clients are holding dollars constant and shortening the duration of their campaigns (flights); they are also buying closer in, with less total % budget commit for their 2009 upfronts.

We have a lot of partners/clients, most all blue chip in our vertical or in online/tech. They are continuing to spend if ROI justified (our vertical is in general becoming more competitive) or if ‘transformative’ – market expectations are for a changed dynamic with customers/end-users in a (likely) new political environment that will lead to regulation and reform.

The current slowdown in advertising (high leverage, good margin revenue) is making us take a more conservative stance, impacting our product roadmap, which in turns lowers our likelihood to license “inputs” (data, content, third party products and services), “infrastructure” (servers, new laptops for non-existent additional employees/upgrades, etc).

We’re hardly alone, and the things impacting us ripple. We already learned that during the first .com downturn. This one won’t be as bad, but all comp tech, not just online advertising, can and likely will be impacted before all is said and done.

Intel and Apple seem to be making smart bets right now from what I can see.

Scott,

I assume that was in reference to me. Clearly your analytical skills aren’t taking into account things like the huge tax break I get by owning a house vs. renting for the next four years.

But, alas, way too many readers of this site aren’t using the full equation. As one of the only guys here with an actual Econ degree, maybe I’m just weird for having considered things like inflation, opportunity cost, tax breaks, etc. into the equation.

NewBuyer, as one with an econ degree, please explain for us how things like inflation, opportunity cost, tax breaks, etc. provide a financial advantage to buying vs. renting. There has been a ton of discussion on this board of such matters, and I’m curious to hear your reasoning as one who actually put the theories into practice. Please provide the numbers so we can see how it all works out.

My prediction: we are over half-way through the downturn in prices, percentage wise. My reasoning is that prices in places like Antioch have already dropped 50% from the peak, they are not likely to drop all the way to 0.

A similar argument follows for the bottom tier: if they have already dropped 38% from the peak, they are unlikely to drop another 38% from peak for an overall drop of 76%.

Some have argued for a delayed response for the more expensive homes, but I think that is unlikely, for all the reasons stated before. I do not expect a V or even U shaped recovery, more of an L shaped one. There are a lot of structural imbalances in the US economy caused by years of over-reliance on cheap oil, that we still need to work through. The exurbs will continue to take the brunt of this adjustment.

Anon,

I did use a pretty decent excel model when putting together the rent vs. buy equation, but here is a short summary of some major reasons why I chose to buy this particular home:

1) The price was below comparable units in the area, and the mortgage payments were roughly equal to what I would be paying in rent.

2) The unit is owner-occupied by me, which means that I get to write off about $50,000/year in taxes (comparable to me pocketing about $20,000 year). While people on SocketSite like to PREDICT where the market is going and make guesses, here’s something that is a FACT: I’m gonna pocket $20,000/year due to tax writeoffs. For many years to come, too.

3) We are heading for an era of higher inflation. Text book econ scenario: inflation benefits borrowers, hurts lenders. Since I am locked in to a fixed rate that is very reasonable, my payments are going to seem like less and less every time I make them.

4) As much as SocketSite readers predict that the housing slump has years left on it, so too do I believe that the stock market has a long road to recovery. Think that it can’t fall another 10-20% in the next 18 months? Don’t be so sure!

Thus, the opportunity cost of putting in a downpayment is mitigated. Plus, I can live in a house, whereas I can’t live in my stock portfolio. That’s what we economists call utility!

(And, no, putting it into a bank or investment-grade bonds with a return that barely covers inflation is also not attractive.)

5) While it’s true that Google, Yahoo, etc. are having moderately disappointing earnings, they are still jacking up housing prices? Why? Because there is heavy pressure to move offices to SF. Tech companies are having trouble attracting top graduates to go live in Sunnyvale (not a surprise). And every time a tech company opens a 500-person office in SF, that’s 500 more yuppies scrambling to find rent in the Northeast part of the city. Doesn’t matter if they have blockbuster earnings. What matters is how many jobs they are shifting to SF. It’s a trend, it’s real, deal with it.

Clearly home prices in SF continue to rise. I bought a place in February of 2007 and I just got a letter from an “assessor” that says my place was worth at least 2% more on January 1st, 2008 then what I paid for it. Surely this was an objective fact based review of my property by a third party without an interest in artificially inflating the value of my property, right?

newbuyer – I have gone through the same thing you have and honestly have gone back and forth on which to do, buy or rent. I have other issues that make buying more attractive (a family that I don’t want to be moving around every couple years). However, I am currently looking for both. There are two truths our there that I am dealing with, one of them is that rents have gone way up, in the places I am looking there is still significant competition for SFHs (although it seems to be waning a little bit right now)and that has driven prices up to very near mortgage payments on many properties. The other is that there is not a ton of inventory out there on the sales market, so there are not a lot of good opportunities coming along, and the ones that do often have competition, negating the “low ball” strategy.

Anyway, people on this board seem inclined to talk about “when” is the right time to buy. I don’t think it matters, it is the price you pay that matters. If you get a good deal now, that may be what is the average price in 2-3 years when people think the “bottom” will occur. If I can get a solid deal, then I will take it, otherwise, I think it is too risky. I do expect real estate to drop in nominal terms over the next couple years, even in SF and other desirable areas in the Bay Area, so I can be patient and wait, and if a great rental comes along, then I will go that direction.

Anyway, if you can afford your place and plan to be there, then be happy with it.

In reference to whether a person who buys a home now is a “sucker,” note that many buy homes for their families to enjoy. If you are single and live by yourself you can probably sit around and try to time the market when you buy. In the meantime, families need rooms for their kids to grow, for a home office, for pets to roam, and so on, and go ahead and buy. It’s not purely an economic decision. Sure one can rent, but the available stock is not as nice as most owner occupied properties.

Noevalleyjim, you are certainly right that places will not fall to $0. But the Antioch-like declines are now moving westward and there is still far more room to drop there before we’re back at fundamental values. And prices in the burbs do discipline prices in the more desirable areas. Moreover, just as a matter of simple mathematics, even Antioch could (and will) see further declines from here in percentage terms. Say the typical crap house out there was going for $600,000 in 2005 and has now declined to $300,000. It very well could, and should, drop to $200,000, which is a 33% decline from today. You are right that is only another 17% drop off the peak, but it is still a huge risk for anyone thinking about buying today because “prices have dropped by half and therefore can’t go much lower.” It would completely wipe out a down payment and more.

“I just got a letter from an “assessor”

I did too, and I’m also up about 2-3% from the last one. I think I could probably sell the place for about 200K more than what the assessor said, but that’s another story.

NewBuyer – Can you please elaborate on “mortgage payments were roughly equal to what I would be paying in rent” ? Numbers and neighborhood would help. Also did you have a “normal” down payment of 20% or less ?

NewBuyer — Also, was it a TIC?

@Milkshake of Despair,

If you have been in the market, you would know the buy vs rent analysis is starting to make sense for many properties.

I have a concrete example of a house I saw last year. Unfortunately it is on a busy street so we didn’t jump on it. It is close to 2000sqft plus a 700sqft remodeled in-law. The rent would be close to $3000 ($2000 for the main, $1000 for the in-law, conservatively). They asked for 800K, and sold for that.

You can do your own buy-vs-rent. Just be honest. Use the lowest mortgage rate you can find/qualify (instead of some 7% which many bears like to use).

To tell the truth, I kinda regret not buying it.

NewBuyer.

“1) The price was below comparable units in the area, and the mortgage payments were roughly equal to what I would be paying in rent.”

Wow, this is amazing considering mortgage payments for most properties in SF are 2-2.5x comparable rent.

‘Anyway, people on this board seem inclined to talk about “when” is the right time to buy. I don’t think it matters, it is the price you pay that matters. If you get a good deal now, that may be what is the average price in 2-3 years when people think the “bottom” will occur. If I can get a solid deal, then I will take it, otherwise, I think it is too risky.’

‘Anyway, if you can afford your place and plan to be there, then be happy with it.’

The Bunk,

While there is a ton of elaborate ‘noise’ on Socketsite, from both bulls and bears, the aforementioned extracts from your last post, IMO, are some of the best advice offered here. Of course, one can always argue about what qualifies as the ‘right price’, but I concur that if you make an accurate informed decision, you have a ‘buffer’ come what may in the uncertainty of the next 1-2 years.

To answer everyone’s questions:

1) Yes, it is a TIC. I specifically wanted one, provided the building met my strict criteria. It had to be already in the lottery process (i.e. majority owner-occupied AND with provisions in the TIC agreement that everyone would seek and not prohibit condo conversion).

In my opinion, those who are willing to wait out condo conversion, which will definitely take a few years, it’s a great chance to experience an overnight 20% increase in value. Sure, nothing is guaranteed in life, and rules do change. BUT, at worst I’ll sell it as a TIC, which is what I bought it at.

And my loan was fractional. I am NOT sharing a loan with any other tenants. In my opinion, TIC’s are undervalued due to stigmas that are no longer accurate and must be viewed case-by-case. If you find a TIC with good circumstances, you might be getting a good deal. As I did.

2) My downpayment was larger than average, which I should have explained. But I also got a very good rate per the terms (mid 6’s).

As mentioned, it’s a large (over 1000sqft) 2BR in Russian Hill, and my monthly mortgage payments are under $3000. Rarely do I see 2BR in Russian Hill that rent for under $3000/mo, and when I do, they are usually very unappealing and don’t have parking. Mine is recently renovated and has a tandem parking space with one other tenant. The unit has rented previously for $3,200/mo and I plan to make some high-perceived-value improvements.

Rent vs Buy makes quite a bit of sense for anyone financing with an 5-7yr IO ARM (at least on a lot of properties I have seen). Those products make sense for people buying 1-2 bedroom condo’s and are single and don’t plan to be there for more than the date of adjustment. You technically own the home, so you will incur downside if you have to sell at a loss, but in reality you are just renting it from the bank, and at current rates for those products and current rents, often you can buy for less than rent per month. However, the big issue is what will RE prices look like in 5 years? I am not advocating for this, but the math does usually work out, more or less, on a lot of properties out there.

I bought a 2/1 SFR with a garage last year in Noe for under $1m with a normal down payment and a 30-year fixed. I did a refi last month and my mortgage payments are under $4500 a month. I have a very elaborate rent vs. own spreadsheet. (We have two MBAs in the house; one with a background in corporate finance.)

I’m not saying that everyone should go out and buy. But the math worked for me. I sold my old place at the top (summer ’06) and waited. It may not be the best time to buy but I was sick of renting, my mortgate is ~6%, and I’m happy.

For those around here actually considering a purchase (rather than just talking your book) it’s not cut and dry, like most seem to think. No arrows will converge on a chart to indicate a true bottom. (What if you buy at the bottom and a terrorist nuke goes off in the Bay?)

If you have the means and the patience, you can find a deal today. Will prices go down more in your target area? Maybe. I think there’s more downside pressure than upside, for sure. But ignore all this crap about how SF is due for a major correction because of a delayed reaction. And keep an eye on rents because it’s the closest thing to earnings in the housing market. Skyrocketing rents is one of the reasons that SF is hanging on. It’s a point that’s often ignored around here.

NewBuyer, how are you able to write off about $50,000/year in taxes with mortgage payments that are under $3000/mo?

Property Tax payments can be written off.

Now, I admit that renters dont pay these taxes, true. But then again their monthly payments get flushed down a drain, whereas a portion of mine go into an asset… so who’s to be nitpicky 🙂

Also, I just rechecked my Excel model, and my total to be written off is actually closer to $45k, so I apologize for that. I still think the point holds though in all its glory.

“My downpayment was larger than average…”

I guess then by choosing the right size of down payment any property can be purchased and made immediately into a cash flow positive rental.

Milkshake,

That’s assuming your expenses (outside mortgage) are covered by the rent.

Just to name a few: If the place is old and has a lot of delayed repairs, if the price you paid is very high and your property taxes are huge, or if the HOA insists on having high end ammenities in the building (like 24/7 security or valet parking).

There are plenty of ways to lose money on a rental which is why money-making landlords are often scrooges.

Milkshake,

Even if my down payment had been lower-than-average, it would have only increased my monthly payments by a few hundred dollars a month.

This is still far from the Mortgage-to-Rent ratios that one typically sees. If my mortgage payments were $4,000 and the fair-rental price of my home was $3,000, then I’d still be thrilled with the deal.

Downpayments are higher these days, unfortunately, and they never should have been as low as they were a few years ago.

So if you ignore all of the following:

transaction costs: commissions on selling, closing costs, transfer tax, points;

opportunity costs of the downpayment and the higher monthly mortgage payment compared to rent;

maintenance costs;

HOA fees;

HO insurance

You can buy a TIC and only come out a little behind versus renting. Factor in all of these real costs and it’s more than a little behind. Even with this apparently very good deal you got, it still does not make any sense to buy at current prices unless you anticipate increases in housing prices. May happen, but everything seems to be pointing in the other direction for the next several years.

anon,

Well, the mortgage is about equal to the cost of renting elsewhere, so the big-ticket item is a wash. Then the thousands and thousands I save in taxes more than offsets a few hundred a month in HOA, insurance, etc.

Plus, HOA are more than just a nebulous monthly expense. They contribute to the improvement of my asset, make the building nicer, cleaner, etc. If you live at any sort of higher-end apartment complex (Avalon, etc.) then you are going to have a defacto HOA factored into your rent.

As far as appreciation goes, I agree that we have not hit bottom. But my guess is that the bottom will be sooner than most SocketSite users think.

As for the “opportunity cost” of the downpayment, there is a very real chance that stocks will suffer worse than real estate in the next 18 months. I’d be much more worried about oil prices, international strife, banking meltdowns, etc. knocking the Dow below 10,000 than I would be about Russian Hill real estate collapsing.

NewBuyer, congratulations on your purchase.

A few things I think are essential to rental investments:

– Try to keep a good margin of error. If the place doesn’t rent at the price you want. If you underestimated the costs, repairs, HOAs. Plus, if you have some elbow room, you can jump on another good deal if it comes across and improve your ROI.

– Try to buy more than one (not necessarily all at once) and plan for it in your budget. Having one sole rental that represents a big chunk of your expenses/wealth/income is a bit risky. Pick different areas, different market segments. Diversification always cushions the unexpected.

The first purchase is often the challenging. You’ll be 10 years from now saying “WTF was I thinking?” But I’m sure you won’t regret any of it. My first purchase was 14 years ago and I really didn’t know what I was getting into. My Excel simulation went down the drain after 6 months due to many many unforeseen events (more good than bad in the long run). This jump tremendously changed my range of opportunities.

New Buyer:

your story still doesn’t make sense. the only way you could write off $45,000/year would be if you had $45,000 of interest and tax payments, right? unless you’re writing off one heckuva lot of points per year. unlikely to be that many points.

but $45,000/year is $3750/month. but you stated your entire PITI payment is only $3000/month (or $36,000/year)

where’s the extra $9000 in write-offs coming from?

if you are writing off $45k/year, you’d expect your interst plus tax payments to be that… and this DOESNT INCLUDE your principal or insurance payments (which can be quite high) or your HOA payments.

your math doesn’t work well IMO

either your PITI plus HOA is a lot more than $3k/month, or your deductions are a lot less than $45k/year IMO, unless you can show us where we’re wrong.

Yeah, New Buyer, come clean! (hehehehe, just kidding).

Look, a few things here to note, in addition to the tax issues identified by ex Sf-er.

We are talking about a roughly $650-700K property here, aren’t we? I mean, with a PITI of around $3K per month at the identfied “mid 6%” rate by New Buyer, we’re talking about a financed amount of around $475K-500K. I’m of course assuming a 30 year loan, which would be the optimal from the point of view of generating the most deductible interest, which seemed to be the clincher for our eocnomist, as it is for most of the unsophisticated buying public.

Based on the statement that he “put down a little more than usual”, I am assuming about $200K or so in downpayment. New Buyer looks at this as reducing his payment, because he makes the implicit assumption that the price won’t go down over the next few years, or that even if it does, he’d always be able to rent it out at more than the PITI payment, at least on a net basis. Thus, he dismisses opportunity cost calculations, as well, for the downpayment dollars, with a facile argument to the effect that Russian Hill starter TICs are practically certain to do better over the next 18 months (interesting time horizon for a purchase of a home, isn’t it) than a diversified basket of stocks (and of course, no mention of all the other asset classes available for passive investment).

I prefer to look at the downpayment as the notion that he just put himself in the “first loss” position for the coming price declines. The Fed loves guys like this. A large downpayment has the psychological effect of “locking” in the debtor, keeping the subject immobile while the parasitic banksters feast on him, as he absorbs the principal loss. Or, I could be wrong!

Anyway, I’m not so familiar with Russian Hill, or with rents there. I thought it was expensive, like really expensive. A $700K large 2 bed w/parking – I know parking is a nightmare there and an acquaintance of mine is finally on the cusp of completing a 5-YEAR project to add a garage that went 4 TIMES over budget (the garage cost significantly more than your TIC) – must be a dump. Is it a 1 bathroom place? (I bet it is.)