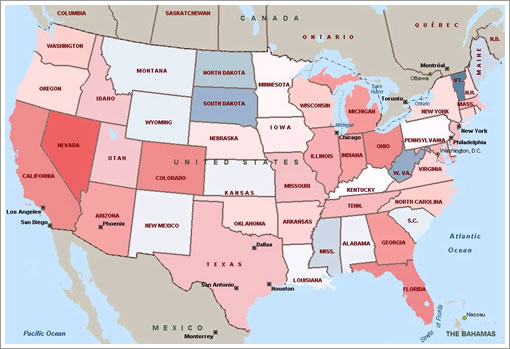

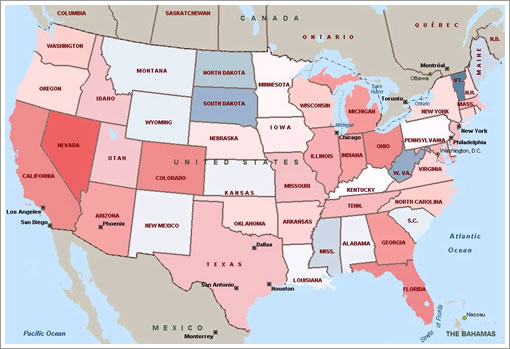

“A total of 39,992 foreclosure filings were reported in California in November, the most of any state despite a 21 percent decrease from the previous month. The state’s November foreclosure activity was still up nearly 108 percent from November 2006, and the state’s foreclosure rate of one foreclosure filing for every 325 households was 1.9 times the national average and fifth highest among the states.”

“California cities accounted for five of the nation’s top 10 metro foreclosure rates in November, one fewer than in the previous month. Stockton, Calif., took the top spot, with one foreclosure filing for every 99 households — more than six times the national average. Modesto, Calif., took the No. 2 spot, with one foreclosure filing for every 104 households, and Merced, Calif., took the No. 3 spot, with one foreclosure filing for every 106 households. Other California cities in the top 10 were Vallejo-Fairfield at No. 6 and Riverside-San Bernardino at No. 9.”

∙ Foreclosure Activity Decreases 10 Percent In November [RealtyTrac]

What’s the take-away from this data? California foreclosure activity for November is substantially down (21%) over October foreclosures. Does this mean we already hit the foreclosure ceiling?

Meanwhile, other realty web sites (http://www.rereport.com/sf/) are reporting that November median prices for a SFH in SF are up 11% over 2006 and back up over $900K. Is there a bear on this site who predicted this?

Month to month data is volatile. Wait a couple more months to see if the trend has changed.

Of course the median price is up. Have you seen what the inventory looks like in Bayview and similar areas? Those markets have basically shutdown.

C’mon, are we really going to have to repeat the discussion of the irrelevance of medians in this market? If you want to read anything into medians, note that the median SFR selling price in SF is down from $940K in June. In the Marina, Pac Heights, etc., it is down from $4.4 million in July to $3.2 million in November. So I guess we can conclude that the market in that district has absolutely crashed.

I might take your point about monthly volatility, except that SF median prices for SFH’s have been higher YOY for I believe 11 of the last 12 months. That’s a trend. Trends may change of course.

No, let’s not repeat the debate over the relevance/irrelevance of actual median sales prices for 178 sales in November. Or the actual median sales prices for all city sales citywide for the past year. Let’s rather focus on small samples or select properties in a few areas so we can each find data that will support our own individual points of view.

The comment about month-to-month volatility was in the response to the November foreclosure numbers.

As for median, yes, there is a trend of less volume in the lower-priced areas. The end of sub-prime lending has hit them the hardest.

sanfrantim,

Here’s a hint. Don’t look at median **sales** prices. Look at median **asking** prices for a better approximation of what is going on. Remember, the nice houses sell. The ugly ones don’t. There is a survivorship bias in the data, and it’s large. One hint is that volume is way down.

Notice how we always get into discussions about how someone who purchased in 2005 (like 3324 Octavia recently) “overpaid”?? Remember the talk about how the buyer at 1495 Monterey (who paid $1.5MM in 2002, but who pulled the house off the market aftr receiving no offers near his $1.85MM asking price **five years later**)? But when we get a sale today, the cheerleaders never seem to question whether the current buyer is “overpaying”. He probably is. That’s why the sale goes through, and gets into the data.

About foreclosures perhaps bottoming, dream on. Notice anything going on with the banks? Does it seem like they are desperate to avoid marking down their assets? Now where do REO values appear (hint: maybe bank balance sheets?)

Really, this bank solvency issue is quite a bit larger than you seem to acknowledge. It is certainly the largest bank solvency crisis since the 1930s. Will the results be the same this time around?

Everyone seems to have unlimited faith in the Fed to fix everything. Wasn’t there a Fed in 1929? You might say they are much smarter today (a common conceit in the Bay Area BTW). Well, if that’s so, how did we get into this mess?

“About foreclosures perhaps bottoming, dream on. Notice anything going on with the banks? Does it seem like they are desperate to avoid marking down their assets? Now where do REO values appear (hint: maybe bank balance sheets?)”

Isn’t the whole point that through securitization of debt, most of these assets are not on the bank balance sheets, but are instead spread through mortgage backed securities to a combination of different entities? SIVs, Norwegian municipalities, Florida employees, etc? The markdowns that are occurring aren’t happening because the core assets of those vehicles are realizing a massive writedown, but because the secondary market has seized up and there’s no way to price the securities.

And, I would counter, banks and other investors are quickly taking the opportunity to mark down as many assets as possible, regardless of their real value. There’s little to no market penalty right now to taking a $10b writedown because the market is pricing that into your stock price anyways. So mark down assets as much as you can, because once the secondary market stabilizes and some liquidity returns, there’s a paper gain that you can realize right away. Plus, no one’s getting a bonus this year, so take all your pain this year, and gain the upside once the assets re-price.

Satchel,

Of course the Fed is smarter. Just look at the economy cycle of the last two decades vs before. And being smarter doesn’t mean never make mistakes. Also, remember the Fed’s job is to keep the economy going, not to keep the RE market going. You think it is a mess. I think it is not a mess until we get into a recession, which hasn’t happened yet. So, reserve your judgement for later days please.

Second, the subprime cycles is nowhere close to the S&L crisis in the term of % of national GDP. With the WORST scenario, it will match S&L crisis. Right now, it is about 1/3.

And regarding the “Overpaying”. The bears will say every buyer is overpaying, in 2002, 2005,or now. The cheers will always say “it is a good deal”. The cheers never said anything “overpaying”, now, or in 2005, or ever. So your logic is pretty much meaningless.

No, I don’t believe the median price is that accurate for short term data, but they are the easiest data to get for long term trend. Also, I think the CS index is the best index to measure the market. Unfortunately, they don’t have CS index for a particular city only (like SF) due to the small number of transactions.

Actually, I agree with a lot of your conclusions, but I don’t agree with your “perma-bear” kind of reasoning.

So, let me put in my prediction again – the RE market will bottom at end of 2009 or early 2010. There will be a couple of quarters with flat GPD in 2008, barely escaping a recession.

Let’s come back in 2010 and discuss again.

satchel checker, you are right that “most of these assets are not on the bank balance sheets, but are instead spread through mortgage backed securities to a combination of different entities.” However, an awful lot of the garbage remains on the bank balance sheets. This is why the market value of many (not all) of the big mortgage lending banks is a fraction of what it was six months ago — Countrywide, Washington Mutual, etc.

You may be right that these banks have been conservative in marking down these bad assets, but the consensus is the markdowns have only just begun.

Thanks Trip. But it’s worse than that. Much of the trash is in trust structures (RMBS, CDO) or off-balance sheet SIVs, all of which have either backstop liquidity lines to the banks, or are directly collapsible onto the balance sheet. Most of the RMBS structures have “put back” features that allow the structure to force the sponsoring banks to eat their **merde baguette** in the event defaults reach a certain level. Hmmm, how do we avoid those (inevitable) defaults?

And also don’t forget all the toxic waste sitting in Level 3 assets on IB’s balance sheets. Now, didn’t the fed just issue a whole mess of Reg 23A exemptions that allow Citi and JP Morgan to downstream HUGE amounts of capital to their captive brokerages?

And also don’t forget that waste sitting on hedge funds’ books. Who do you think advanced the lending lines to finance those funds??

Uh oh, with all respect, we might need another satchel checker 🙂

It’s all in good fun, guys! It’s a LOT bigger than you think. If you really want to dig in to the mortgage foreclosure, etc details I really recommend Calculated Risk blog. Tanta over there does a great job.

BTW, satchel checker, $10B writedowns?? ROFLMAO! By the time this is done, in housing related debt alone, IMO there will be upwards of $1T of realized losses for investors. Commentators are already regularly throwing around the figure of $500B. And the commercial real estate debt bomb has not dropped yet.

Look, it’s pretty simple. in 2000, aggregate housing was worth approximately $11T. By 2006 peak it was worth something like $21-25T (various estimates). The real value has changed very little, of course. Mortgage debt went from $5T to approximately $11T. Meaning $6T of phantom “wealth”. That might have been ok if we had invested in in productive capacity. But we didn’t. We wasted it on phantom housing appreciation, consumer spending, surplus housing units by the MILLIONS, and upgrading of the housing stock (granite kitchens and sexy appliances anyone?). Remember guys, this money has to be paid back! How much of a hit do we have to take to our living standards and growth now that we have to repay (with interest) approximately 50% of GDP?

I’ve heard this theory about the banks “throwing in the kitchen sink” for losses in order to book a paper gain later. Actually, the post-Enron accounting rules are very tough and this is not as easy to do as it would have been, say, ten years ago. To the extent that the pricing of the securities has no determinable market value, there’s little doubt that the banks are painting the most bearish pictures to get at valuation and thus big write downs. However, there are enough moving parts on these balance sheets in terms of credit losses that the very likely upside that might have been guaranteed in the past is anything but.

satchel, sure there are any number of triggers that will force the banks to bring these mortgage backed vehicles back on their balance sheets. however, as it stands, the vast majority of these still remain off balance sheet and thus, your point about looking for REO values on the bank balance sheets is incorrect. Now, does that mean there is less risk? of course not. that wasn’t my point.

As far as taking a $10b writedown, that’s just an example of a per-bank writedown, not the overall number. could the number hit $500b? sure. might, might not.

as far as the banks throwing out the most bearish numbers to get paper gains at a later date, morgan wrote down 9.4b in mortgage-related losses today, their stock went up 4%. the market is expecting huge writedowns, so take your medicine now as much as possible. can you do that all at once? in most cases, no. but, the writedowns are getting bigger, while the underlying value of the asset remains unknowable.

mktwatcher,

“To the extent that the pricing of the securities has no determinable market value, there’s little doubt that the banks are painting the most bearish pictures to get at valuation and thus big write downs.”

You don’t know how wrong you are! The banks are hoping to stretch out recognition of the losses over many quarters, if not years. They also hold out the hope that they will be able to sell all this stuff at favorable valuations to a taxpayer-funded bailout fund, which I believe is a certainty at some point in the future. The simple reason is that if they were to write down all of this now, every one of the banks would be insolvent. Every one. Why do you think they don’t want to lend to each other? That’s the problem. That’s why the ECB and the Fed are lending **enormous** sums of money – levels that I have never seen in my career, and I do not think have ever been seen in the history of the world. Note, though, they’re not **giving** anyone money, just lending. It has to be paid back. How will they do it? Well, they hope the toxic assets work out over time. But in th meantime the banks are scared, they hoard cash, and they restrict lending. This is how the transmission mechanism gets into the real economy. There is no way to stop it, only ways to lessen its impact. The Fed thinks it can avoid a hard landing, but this is silly. (Actually, the Fed knows what is coming – they just don’t want to say it, and they want to be able to say “we tried” after they fail.)

Hope that helps your thinking a little.

@Satchel: “Remember guys, this money has to be paid back! How much of a hit do we have to take to our living standards and growth now that we have to repay (with interest) approximately 50% of GDP?”

We, paleface? I don’t have any debt, so I guess the answer is ‘0’ as far as I’m concerned… Economics is a zero-sum game; for every loser there’s a winner on the other side of that transaction.

satchel checker,

I love having a satchel checker! Let’s agree to disagree on some of this. But don’t go long MS! Not sure how much downside juice in the IBs (probably a lot, but a lot of the easy money has been made).

Let’s watch this unfold. I think you are going to be shocked at the scope of what’s coming in the financial sector. If you want a good risk/reward, get short the commercial REITs. This crisis is about to morph into that space.

@ Jimmy (Bitter Renter),

I do hope you’re right. As I read somewhere, in credit deflations it’s a race to the bottom, and the last one left solvent wins.

Only wrinkle is if you are dependent upon a job (thankfully I’m not). Sometimes that can be a crapshoot. My brother is a cop. That’s a very good job to have in times of credit chaos. The wealthy (real wealth, not the “I owe $4MM on my house but it’s worth $5MM – I just checked Zillow again” kind) always pay for protection….

Well, I own a company that makes sensors. Since the products sense various properties of oil, my fortunes are rather directly tied to the price of oil…. which I’m told is headed up. So I’m not quite ready to take the Police Officer exam quite yet although walking the mean streets of San Francisco and beating down the scum and filth in the city could be a nice distraction from a hard day toiling in the electronics mines…

LOL!

“beating down the scum and filth in the city could be a nice distraction from a hard day toiling in the electronics mines”

I bet some of those “liberal” SFers buying $1.5MM condos in SOMA will be harboring such secret thoughts about the bum defecating in their doorway in right about 2 hours from now….

When values and interests conflict, interests win. Although I do love it here, I have never seen a city where this is more true than SF 🙂

Satchel – I hear what you are saying about bank’s avoiding loss recognition and certainly the evidence you cite about reluctance to lend to each other, but I guess I have an idealistic notion that Big 4 accounting firms auditing the banks will force them to use a valuation process against the assets that determines a best estimate of “true market” value. I know we are in uncharted territory right now, but none of the remaining four want to blow up ala Arthur Andersen. Isn’t it true that until asset prices actually reflect what we all know are going to be much lower values, the losses aren’t realized and thus don’t need to be recognized? I guess what you are saying is that the banks are behaving based on this known future outcome, not necessarily on the official financials of today.

Actually, it is naive to think any business would avoid recognizing losses in this situation.

When there is any major market events, it is to the best interest of the management team to write off as much as possible, so they can say “this is one time thing” and then show consistant operation income in the following quarters. This is especially true when a new guy comes to take the top job. The first thing every new CEO does is to have a huge write-off. Often, it is overblown instead of under report.

Just think about it – if you know your operation will lose 100M per quarter for the next one year, what’s the best way to make it look good? Write off 1B and blame it on the previous CEO, then report next income of 150M per quarter for this year.

Don’t believe me? Study the first act of EVERY SINGLE NEW CEO yourself.

John,

Last post on this issue on my end.

You make an interesting point about new CEOs taking their lumps so as to show good profitability going forward. You can tell I’ve been in the game for a while, and it seems like you have to, so you know we often say things like “New Broom Sweeps Clean”. In general, I agree with you.

But what if by marking down your assets to its fair value means an INSOLVENCY EVENT. Do you think the new CEO wants to take his lumps then? Or do you think he would rather roll the dice and dribble out the bad news in the hope of staying alive? Do you think that the Fed would collude with them to avoid what would be a systemic meltdown of the banking system, which is after all exactly what the Fed was supposed to prevent?

Now, this is off-track, but why do SFers fall so readily for conspiracy theories regarding Bush and foreign policy, and Enron, but think the Fed is lilly white and would not engage in a little “creative accounting” here, a little “hide the weenie” there, all in the interest of saving the banking system?

You think it’s no big deal. I do. I have never seen anything like what is going on now in my career, and I have been right in the thick of a lot of credit collapses (they happen more frequently than you think, just not here in the US for a long while). Let’s agree to disagree about this.

But, last thing, if there is no big deal and the writedowns are going to be resolvable, why did the ECB the other day – in ONE DAY – lend the equivalent of 60% of the ENTIRE ADJUSTED MONTEARY BASE OF THE US!!

These kinds of things do not happen unless there are balance sheet insolvencies of big borrowers. Multiple. We’ve already seen Northern Rock collapse and be nationalized effectively. Why are there no private bidders for the assets? Hmmmm. Countrywide has been stealth bailed out by FHLB, but now that that it’s out in the open, notice the share price taking a nice swan dive? Remember a few weeks ago when Mozilo said the problem was over, and that CFC would return to profitability in 4Q.

Watch how this unfolds. You will be surprised IMHO. As always, the long bond tells the tale.

“But what if by marking down your assets to its fair value means an INSOLVENCY EVENT.”

Good question. In that case, you find additional equity capital first, then you announce a big write-off.

This has happened over the last couple of months with multiple banks – eTrade, Countrywide, etc.

Would you want to under report the write-off? Unlikely. Whatever invested in the capital would do the due diligence, and if the bank (or lender) purposely under report, it won’t have a chance to get another round of funding if they need to.

Granted, some banks may be stupid enough to try to hide the loss at the beginning. If they do that, they will be punished severely by the market.

As many have said look at the long term trend.

Many homes went up 300-400% over the past 8-9

years. The SF Bay Area did not have wage inflation on that order.

The peak has pasted and we are heading down.

http://www.housingbubblebust.com/OFHEO/Major/NorCal.html