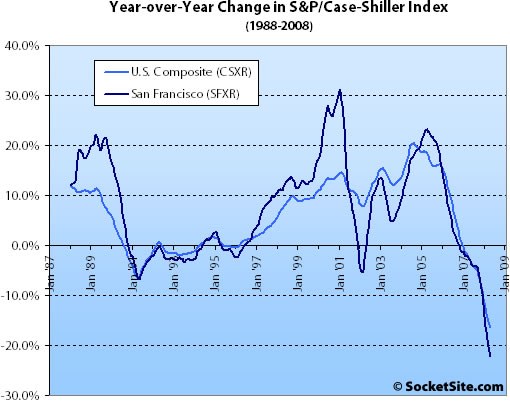

According to the April 2008 S&P/Case-Shiller Home Price Index (pdf), single-family home prices in the San Francisco MSA fell 2.2% from March ’08 to April ’08 and are down 22.1% year-over-year. For the broader 10-City composite (CSXR), year-over-year price growth is down 16.3% (having fallen 1.6% from March).

Las Vegas and Miami continue to share the dubious distinction of being the weakest markets over the past 12 months returning -26.8% and -26.7% respectively. These two markets witnessed some of the fastest growth in the 2004/2005 periods, with annual growth rates peaking above +53% and +32% respectively.

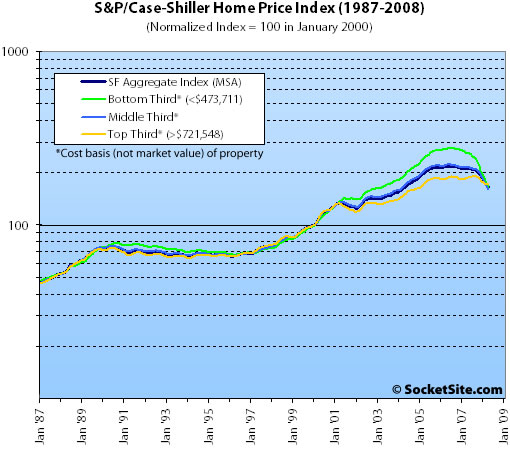

Prices fell across all three price tiers for the San Francisco MSA with the rate of decline slowing slightly at the bottom end and increasing slightly at the top.

The bottom third (under $473,711 at the time of acquisition) fell 4.7% from March to April (down 37.2% YOY); the middle third fell 2.3% from March to April (down 25.7% YOY); and the top third (over $721,548 at the time of acquisition) fell 0.2% from March to April (down 9.2% YOY).

And according to the Index, home values for the bottom third of the market in the San Francisco MSA have returned to February 2003 levels, the middle third to February 2004 levels, and the top third continues to hold at March 2005 levels.

The standard SocketSite S&P/Case-Shiller footnote: The HPI only tracks single-family homes (not condominiums which represent half the transactions in San Francisco), is imperfect in factoring out changes in property values due to improvements versus actual market appreciation (although they try their best), and includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., the greater MSA).

∙ Steep Declines in Home Prices Continued in April 2008 [S&P]

∙ March S&P/Case-Shiller: San Francisco MSA Declines, Top Tier Flat [SocketSite]

You know, I’m starting to have a new philosophy on living in san francisco. I chose to rent simply because it didn’t make financial sense to buy, and because it seemed clear to me that there was some frothiness in the market here and in housing more generally. As that froth (aka bubble) burst / is bursting — I’ve wondered why we haven’t seen more issues in the city. Prices seem to be holding firm and its pretty hard to argue at this point that there is a lot of stability, and a lot of interested buyers waiting to jump-in. It’s an interesting trend and not really all that well understood from an economic viewpoint.

But more on my new philosophy…. I’m very glad that I live / rent here and made a decision to not buy. And for all those people that moved out of the city to purchase a home cause it was more affordable, or get get more for the same money… those are the ones that are getting killed with these month over month / year over year drops. I’m still not sure it makes sense to buy here if you cannot do so under traditional financing conditions / terms — but it’s clear that renting in SF was the much better decision than buying in the outer regions over the past 3-4 years.

Same thing for me. Rent control looks really good at this point. It’s a great hedge against inflation and it already saves me 40-60% compared to ownership.

Let the fools overbid themselves and be house poor.

a few ramblings:

1) someone posted in a previous Case Shiller thread that they would be ready to buy again (or call bottom?) once the 3 tiers converged. It appears they have converged. I highly doubt we’ve reached bottom, and I certainly wouldn’t be itching to buy, but I’m very finanically conservative

2) I have to admit that these posted statistics do not seem in line with the market that I’ve seen in SF-proper. however that may be because much of the SF market is more like the top 1/3rd tier. The top 1/3rd tier statistics do seem at least somewhat consistent with what I’ve seen in SF proper. (flat to slightly down prices over the last 3 years)

3) these price drops nationwide have occurred much faster than I anticipated. I’m not sure if this means that information is being disseminated more quickly allowing us to reach ‘equilibrium’ faster than in previous housing downturns, or if it means that we will have an especially bad downturn, or if it is simply because this is a credit derived issue. IMO the latter is the most likely but who knows.

one thing is for certain: the credit situation is only worsening. it will be a long time coming before we get “easy” credit again, unless we get some sort of governmental intervention. Thus, the SF market will be determined by incomes/wealth of SF home-buyers and not by loose lending.

there’s no reason to think that the bottom will be when the three tiers converge. that makes about as much sense as saying team X will start winning as soon as their three top hitters have the same batting average.

I am the one who thought the market will bottom when the three lines converged.

The lines certain have met, and the bottom two tiers have overshot the top tier.

Yes, I do think it is a pretty good time to buy now if you find the right property. Actually, WSJ has already run articles about Stockton. Investors are finding deals whose rent income can cover mortgage and more.

The biggest problem right now is the mortgage rate. As you can see, the top tier probably dropped barely dropped, probably 5%? With mortgage rate at 20% higher, the monthly payment would still be 10 to 15% higher if you buy today than buying at the peak.

Editor, can you post both version of the graph? It is difficult to tell the numbers from this graph. I want to know if the tiers are about 160.

We won’t hit bottom until Bush and his pack of cronies are back in Texas (or in Federal Prison).

M.R.

I bought a house year and a half ago, below the peak so I the owner got less than they expected, but still I probably am down maybe 10% or 15% based on neighborhood comps.

I will live there for a long time so I don’t really worry about it since I can afford the payments.

If you are a renter and want to own and find a good house that you can afford I would go ahead and buy. SF is tough market and trying to time the market is really, really difficult.

Random thoughts. I’m no expert. . .

That bit on investors starting to buy places for rent in Stockton is not a sign of the bottom. In my mind, it appears to be a pause on the way down. My reasoning:

– There is too much inventory out there (look at the charts over at CR).

– Prices on homes continue to drop in response to the inventory.

– Folks are buying these places to turn into rental property.

– Increased supply in the rental market.

– With increased supply comes increased demand, thus lower rental prices.

– Lower rents, means you get more home for your money, and this lowers demand for purchases.

– Rinse, repeat.

When do we hit bottom? When prices are back where they were at the start of the bubble. 1999 or so. Give it a decade and inflation will finish deflating the bubble.

SF is tough market and trying to time the market is really, really difficult

I totally agree with this. but the turnaround won’t be quick. It has taken us 3 years to have any evidence that the SF proper market is flat to maybe down. Likewise it will be many many months to years before it is obvious that SF market is doing well again. so one doesn’t need to be perfect with “timing”

Purposefully wait until the market is rising again. sure, you miss “the bottom” and you’ll miss the first few % of appreciation. but that’s ok because it’s pretty rare to see a big jump in RE prices right after the bottom anyway. So you wait and maybe miss out on the first 0-5% of appreciation or whatever, and then move in. it limits your downside risk.

i personally will wait until housing appreciates on a YOY basis every month for 12-24 months (probably the latter). sure, I’ll miss out on some appreciation… but it likely won’t be very much and I’ll also miss out on the downside. (specifically, it will help keep me from buying the so-called ‘dead cat bounce’. all markets make blips up here and there during their downturn!)

and if you’re a renter (I’m not), the monthly costs to renting seem to be cheaper than buying… so you’re not losing out that way either.

as they say: “sheep get sheared, pigs get fat, but hogs get slaughtered”. never bother trying to time the absolute top or absolute bottom. It’s a-ok to get in right after the bottom (losing some appreciation), and get out right after the top (suffering some depreciation)! few people will truly ever get in right at bottom, or right before/at the top.

This downturn, like others before it, will be a long, long process, and the bottom chart illustrates this well. Even if you assume SF prices have followed the top-tier trend line, they are now “only” down about 10% from the summer 2007 peak — and still falling. As an example, a home that would have sold for $1.6M a year ago now fetches $1.44M. That would be barely discernible as both are in the range of a million-and-a-half.

But inflation has further whittled away the price, which is not discernible at all. Give it another conservatively estimated 10% decline from the peak over the next year or two (if the current CSI trend continues, we’ll be there in about 8 months), and that same house will now go for about $1.3M. Now you can at least really see the decline, but it still does not look all that significant. However, inflation will have added another 10% to the drop. So that $1.6M house in 2007 dollars will now go for $1.3M in (less valuable) 2009-10 dollars. That’s what we are seeing. It is just like the mid-90s decline, which was sharp and long, but which was nevertheless affected more by inflation than anything else. The difference is this current decline has been much sharper. The bottom is a long way off, and while it may not look that “bad” at the end, in real, inflation-adjusted dollars the drop has been and will be quite significant.

That’s a long-winded way of saying that the first few posters have it right and there really is no sound financial reason to buy in this declining market. Prices are not going up anytime soon but are certain to drop in real terms and nearly certain to drop further in nominal terms. (Of course, one can always continue to maintain the position that SF proper is holding steady despite what all the data reveal).

The country is awash in houses. The low end is falling fastest because that is where prices were fully detached from incomes the most, because of cheap and easy money, which is still available, but the supply of it continues to dwindle.

But everything interacts. Although there are some buyers who will only buy in District 7, as prices in other districts fall, their real estate salespeople will start to show them other neighborhoods that they can get for a lot less money. That takes pressure off prices in the top districts, and those districts will start to fall, once prices in the other areas have truly reverted to where incomes can support them. If you can buy a condo in One Rincon for $750psf or Pac Heights for $850, you buy in Pac Heights. But when One Rincon falls to $550, you figure the views look pretty good and go there because you are saving $300K+. And then Pac Heights prices fall.

We aren’t there yet, but that’s where we are headed. If the lower end pauses, it could take awhile longer, but the lower end is about to face their first set of resets. Many people’s income won’t support a refinancing, or the refinancing will cost 2X what people were paying, and they’ll start looking for cheaper places. As jobs continue to be lost, the problem will intensify.

If these issues are headed off, prices at the top end could hold. But I’m not expecting that to occur.

As for people buying in Stockton, people bought in Japan all the way down. Lots of homes were sold: it didn’t mean there was a bottom.

The country is awash in houses.

“..much of the SF market is more like the top 1/3rd tier”

I disagree. If the C-S methodology used the later selling price to sort the properties into tiers then yes, the top tier would track SF pretty accurately.

However C-S sorts the properties by acquisition price. The purchase date of the house has a heavy influence on the acquisition price. So homes even in the “good” neighborhoods are scattered across all three tiers.

Consider three nearly identical houses side-by-side on the same street :

House 1 was bought in 1995 for $450K

House 2 was bought in 2000 for $700K

House 3 was bought in 2005 for $1M

all three houses sell in 2008 for $1.25M. But house 1 is placed in the lower tier, House 2 in the middle, and house 3 in the top. Nearly identical houses on the same street selling at the same time, but sorted into different C-S tiers.

This part of the C-S methodology seems bass ackwards to me as sorting them by the latter sales price would make more sense. Or am I missing something ?

I am a renter in the city and have been looking for over a year to move to a SFH in Berkeley/Rockridge, either to rent or buy, whatever was the best deal. I have been a strong fundamental believer that real estate is grossly overvalued and that we would soon see pretty nice price reductions in all segments of housing stock, even in the inner bay area. What I have found to be true is a different reality. Rents have absolutely sky rocketed where we are looking, and the market has become ultra competitive. Nice homes go for a minimum of 4k per month, and up to 5k, and I am not talking about the best places, just nice ones in good areas. These same homes can be bought for a price that is pretty much in line with that on a monthly basis when using 5 or 7 year IO ARMs. So, the rent to own spread has basically collapsed, but more so because rents have increased. My belief was always that people could not afford these current price levels, but when the rental market hits the same afford ability as the buying market, then you have to think that people can afford to buy these homes, they are just choosing not to at this time because they think it is a risky investment. I think people that can dole out 5k a month probably have 150k or so for a down payment.

This reality has thrown me into the market to buy. The mortgage game is certainly a factor and it is much harder to qualify now, no doubt about that, but there are still enough people doing so that good places priced well move quickly.

Anyway, that is my 2 cents, I don’t see major price drops for the nice neighborhood, good school district, SFH housing stock in desirable nabes unless mortgage rates increase significantly, and I think the Fed has proven that they are not going to let that happen anytime soon. The clowns that run this country have taken pretty significant steps to bring the foreclosure crisis under control, imagine what they will do when it is their properties and their neighborhoods that are decreasing in value quickly, they will pull out all the stops. I would not expect much of a decline in SFH prices under these conditions.

Does all this make a house a good investment, well I think those days are over, but it doesn’t make it a disastrous one either.

Let me briefly cover some of the counterpoints, just to get them out of the way:

The Case-Shiller numbers say prices are falling in the Bay Area. But that doesn’t affect me because I live in San Francisco proper.

The DataQuick numbers say prices are falling in the city of San Francisco. But that doesn’t mean it’s happening in MY neighborhood.

The SFAR numbers say prices are falling in 8 out of 10 SF districts. But that’s not on MY street.

The guy upstairs sold his condo for $100K less than I paid. But MY unit has only appreciated in value. Because how can things be bad when they’re still asking $1.3 million for 1-bedrooms on Market?

Besides, at least it’s not as bad here as it is in (insert random town name here).

Are those inflation adjusted? because it seems to me if prices are back to 2003/2004 levels (I don’t care about the rich folks’ prices), we’re at 2000 prices, adjusted for inflation. If 2000ish prices were “reasonable,” it’d seem most, if not all of the bubble is gone in real terms, and if declines like this continue, we’re going into the ‘overshoot’ phase, just like back in 1995-1997. As in those days, we can certainly overshoot some more, but that just makes buying in 2010/2011 probably the best time to buy in 15 years.

CSI numbers are not adjusted for inflation. But inflation does not have quite so much impact to bring real prices back to 2000 levels. Takes things back about another year — in nominal terms we’re at mid-2004 prices; in real terms back to mid-2003. Still a long way to go.

The Bunk / Homeowner — you logic is sound but there are a lot of factors that are still causing the housing market to remain strong. You only have to look at the hardest hit areas of the country that are crushed in what was otherwise unimaginable in terms of the number of foreclosures and the number of people that are underwater. It’s still not clear at all that the mid and top-tier markets might not collapse. There is no economic window here and we could very well be in a long down cycle that slowly eats away at equity, and then principle.

My point has always been that job losses are the ultimate indicator of what will happen in the housing market. People that lost their jobs stop paying mortgages — especially when they are upside down. Last look of the papers shows that lots of layoffs are happening.

You’ve got to have [b]a lot[/b] of confidence to be a first time buyer in this market.

The Bunk,

I’ve actually been looking in the Claremont/College Ave/Rockridge area also…both to rent and to buy. I find it is quite a huge difference in rental vs mortgage.

I use http://www.zilpy.com … it’s like Zillow for rental units, except it has the actual listings and prices. The rents for a 3/2 are currently in the $2900-$3200 range and this matches up with craiglists listings. We have also looked up LESS COMPARABLE homes for sale in the area. The fixers are coming in at $900K…and the better condition ones are in the $1.2mil range. Even with 20% down, we’re looking at close to $5000/month NOT INCLUDING property tax.

We’re still leaning towards renting, because

a) we save $2K/month

b) our 20% down could do a lot better in the market right now, while it’s down and we can get a lot of bargain stock.

David,

I don’t think the index is inflation-adjusted. That’s why I said at 160 (we should be around that now), we are already back to 2002 level after adjusting for inflation + population growth – unit growth.

Dude,

The thing is, you are pointing out these “counterpoints” as if they aren’t really happening, “doesn’t mean it’s happening in my nieghborhood”. But your are speculating. In my neighborhood, in fact on my block, three houses sold in the last 6 weeks all way more than I paid for mine in 2005. You make the assumption that is not happening but it is, and not just in Noe or whatever.

People want to live in the neighborhoods they like. When the price is affordable to them they pull the trigger, because you don’t know when you can buy there again. Most people buy there houses for the long term and if they are slightly overpaying so be it.

Fence sitters will eventually get a good deal on something if they only want the best value. That is not what most people want.

“Most people buy there houses for the long term and if they are slightly overpaying so be it.”

Most people who are selling have to sell and if they need to take less than it is worth, so be it.

Both statements are equally (in)valid. You can’t view this or any market from only one side of the transaction.

Price drops will drop in correlation with how much they ran up. Notice Las Vegas and Miami went up the most and are now consequently falling the most.

SF proper did not see these kinds of jumps overall while the bubble was inflating. What we saw were more gradual increases (single digit vs double digit).

The same cannot be said of areas outside of the wealthy enclaves of Marin, SF, and the Peninsula. The Sacramento, Central Valley, CoCo, Alameda, Solano-Napa will be hit hardest.

Eddy – I don’t see a significant downturn in jobs happening in the Bay Area. I am not a general optimist, but having watched closely for the last few years, technology is strong, bio tech is strong, and there is always the prospect of a significant increase in clean energy related jobs that has a strong base here too. That coupled with two great Universities, and we are in better shape than other places. I agree there is some downside risk, I just don’t believe it is that significant. What people are paying for rents now create a pretty decent floor, in my opinion. I do very much agree that any movement in the jobs market would hurt housing significantly, I just don’t see what the catalyst for that is going to be for the jobs that generally fuel the economy here.

Zap – We may be looking at different places, I have not seen a 3/2 that we liked for $3200 for a very long time. We may also be looking in different areas. We saw a nice place in Albany listed for 4k, emailed them, and got an email back that they raised the price to $4500 because they had so much interest. They ended up renting it for $4750 because someone paid more than they asked. One data point, I know, but it happens too much.

Also, with renting, especially SFH’s, it is hard to find a situation where the place is nice and it is not just a short term rental, like the owner is moving to Europe for 1-2 years, then returning. We don’t want to move again and again, that is the other problem we are running into.

I am willing to pay a small premium for the ability to call my own shots in the house I live. I look at it as if I am renting the house from the bank for 5 years, as opposed to a landlord that can a) raise the rent b) kick us out c)not allow us to make it “our home”.

The Bunk – The point you make is interesting. I’ve noticed that the buy-rent cost spread (which used to huge) is shrinking in some parts of SF as well. And the surpising part (to me), is that it is because rents are soaring, which is always interesting in a recession.

However, I agree will a lot of other posters here today that housing price declines historically have taken several years (and often overshoot on the way up and the way down). And I think the spike in rents is probably temporary. I remember paying $3000k/mo for a Marina flat in 2001. That was down from the $5000k/mo they were charging in 2000. And if fell further to $2600k/mo in 2003/2004. Rents can go down, too, especially if the job sitch worsens.

Does anyone have any historical data on rent vs buy ratios and rent vs income ratios? I would be really interested if someone had this data for just SF, or even better, for specific districts within SF.

The national data for these two ratios suggests that, nationally, we have another 20% or so to fall. I’m interested if the SF data suggests the same story. Anyone?

anon,

agreed but someone selling now because they have to doesn’t help the people waiting for the bottom either.

The Bunk,

First off, let me say I don’t mean to be contrarian or argumentative just for the sake of it and I hope I don’t offend. I actually totally agree with you on the benefits of homeownership…which is why we’re looking in the first place 🙂 We’ve been kicked out of our fair share of homes down here in the Silicon Valley, especially during the late 90s boom when rent was jumping by $1K/month, it seems.

Anyways, my point of bringing up http://www.zilpy.com is that the site does a good job of aggregating rental data so that you can have more than 1 point of reference. And in every neighborhood, when comparing the Zilpy rental median vs the Redfin listing median for a 3/2, there is always a significant difference. Obviously, when it comes to houses, every single one is different…so it’s almost impossible to compare a 3/2 rental to a 3/2 for-sale. But the more data we have, the closer we come to the real number. Therefore, I think it’s still more reliable to go with a aggregate site like Zilpy to get a clearer picture of the rental market.

BTW, the exact streets I’ve been looking at this past weekend is Hillcrest/Roanoke/Uplands, between the Claremont Hotel and Hwy 24, north of College Ave.

There is a rental at the corner of Roanoke/Uplands going for $3200/month. Three houses down, on Hillcrest, there’s a house listed for $1.4 mil. The rental actually has a better view, while the listed house has 1 more bath, more sq ft, nicer landscape, but a much worse view (neighbor’s trees). This price difference is common for this upper rockridge area we’ve been looking at.

One interesting side note: While the SF MSA did not see the largest YOY decrease in percentage terms (5 of the 20 markets were a bit steeper), it looks like the SF MSA did see the biggest decrease in terms of absolute value lost given the higher overall home values here. So we can claim to be #1 after all . . .

Looking at Zilpy is interesting, but I don’t know where they pull the data from. Rents are very hard to have solid data around, because the only way to aggregate is what people are asking, not what eventually gets paid, that is not a matter of public record. So, all I know is what I see, and for the most part I am not seeing anything that could remotely garner $1.4MM to buy asking $3200 for rent. There are always deals out there, but they are few and far between, and when the do come up, there is a ton of competition, and often they end up not being great deals because people pay more than what is asked for rent originally.

My overall assessment is that I have expected to see real softness in the housing market in these areas, and for the most part, there isn’t. The story we have been told, and the one I very much agreed with, was that we would see a 30% drop in home prices in the SF MSA. We are at a 22% drop now since last year, and many areas have basically not been affected, or at least not seriously. Is the next 8% going to come from the high end nabes only? Is the number going to settle at 40%? Who knows, but we are getting near the numbers that even the bears said would happen. It may not be the exact bottom, but not sure if that is all that far away.

Does anyone still consider the simple theory of supply and demand? Prices for sales and rentals will always be high due to the limited supply and strong demand. In San Francisco the homes and apartments where the prices will come down the most will be in less desirable places anyways. And the top tier homes are barely affected by this current market. The people who are buying $5+ million dollar homes main concern is not the investment. It is the prestige, the views, and the quality of life.

Ultimately it is inventory that predicates price, right? There are only 63 SFRs in all of District 5. That’s not much. There are only 33 listings in District 1. There are only 41 in all of 9. Thirty in 7 and 8 combined. But there are 93 in the Sunset, 53 in 3, and 68 in four. District 10 has 223.

Notice any difference in price corresponding to inventory?

Fluj has a point.

SFGROUNDLEVEL, there was an a significant change in the structure of financing for homes over the past 6 years where buyers were using zero down, I/O loans in both the prime and sub-prime markets. This drove home values more than anyone realizes. People got away from the traditional standard of home buying which was 80% financed / 20% down. I’m not saying 80/20 is the right mix and that 100 / 0 isn’t right for certain people in a certain income bracket, but a large part of home price appreciation was due to people getting away from traditional home financing.

There were a lot of people in 800k homes across America that did this and those homes are worth considerably less in many cases. I suspect that there are a lot of homes and home owners in SF proper that could easily find themselves underwater / upside down with a minimal down turn. The sub-prime market and homeowners are facing their nightmares, and it seems that prime homneowners are starting to feel the pinch as well (at least if you read the media). This will undoubtably have some affect on home prices but will take a while to shake out — years.

What keeps me out of the market is the fact that I’m not long term SF bound, unacceptably high risk that housing prices could be on the steady decline (1% YoY is not unthinkable) and the high transactions costs of selling in SF (call it ~6-7%). So it’s perfectly conceivable that you could buy a place today for $2M, live in it for 5 years and lose 5% in home value, and then have 6% in selling / transaction costs. All while building no equity and paying 1% in taxes every year and maintenance costs. I honestly wonder how people make the leap.

Eddy – People make the leap, I believe, because of family more than anything. I would never think of buying now if I did not have to worry about schools, and not have to drag my kids around every couple years when the rental I am in tuns over. Buying a downtown condo now seems very speculative and risky, knowing you can live in a similar place by renting and paying basically the same amount, if not less, with no real risk.

So, it is not always a totally financial decision. For the past 3 years or so, there has been no reason to buy because the rent to own ration was so obviously out of whack. Now that the ratio has come more in line, it will push fence sitters like me into the market.

Also, there just seems to be money out there, which really should not be a big surprise given the excesses of the past 6 years. Marin is getting more expensive to live, that says something.

Bunkster,

Are you a school fetishist (not casting stones here, we all want the best for out kids)? While there is a crowd that will “accept no substitutes”, there are others who are willing to compromise. I see two 3/2s for under $400k on the MLS in Berkeley (which is not too shabby, given you couldn’t find anything listed for under $500k last year). Oh, and you get to send your kids to the elementary schools in the hills.

This urban housing bubble combat. House to house, REO to REO, neighborhood by neighborhood… At a certain point a house in the the Oakland hills (with 4 years of private HS) pencils out. But maybe you guys are right. Biotech will save us all (I know the office building we are in right now sure could use some “help”).

Here is a gem from a month ago: $929900 CUSTOM BUILT 3.5 STORY HOME IN THE BERKELEY HILLS. Was sold in 2006 for $1.6 million and a year later WaMu took it back for $1,066,217. Finally made it out of REO purgatory when the bank took it back from a “Craiglist only” REO broker and got it listed on the MLS.

“I honestly wonder how people make the leap”

Eddy – My point is that for a lot of people in this city paying 1% of $5 million a year of taxes and still losing equity isn’t that important to them because of their vast wealth. They just want a great place to live. There is a good article in San Francisco Magazine called The Seven Year Rich (http://www.sanfranmag.com/story/seven-year-rich). The most major price changes in this city will be in the million-dollar (which won’t get you much in a good location).

I’ve always been more bullish than most on this site, but I’m pretty surprised with how quickly the overall RE market in the bay area has deteriorated. It dropped further in a shorter period of time than I really imagined, and a lot of normal people (non speculator types) are feeling the pain from it. A lot of folks expect home prices to continue to experience large double-digit drops (in nominal terms) over the next several years. Given how far things have fallen for the Bay Area however, I think we’re around 12 months away from the bottom. Prices will likely stagnate for years, but I think the absolute price drops are largely behind us.

With all of this said, San Francisco and the CS top tier has held up remarkably well. There have been a few articles lately about 1) the growing desire of people to live in large cities, 2) the declining desire to live in suburban Mc-Mansions, and 3) the influx of more affluent people to SF. I think all of these things have and will continue to bode well for keeping home prices in the city relatively insulated from the craziness happening in places like Solano. It also has some obvious social consequences, but that’s a conversation better suited for another blog IMO.

Why are people so anxious to buy a house in a soft economy? Nobody should be in a rush to buy property, prices are not going to spike back up.

There are alot of things on the horizon that put a lot uncertainty in the future of bay area economy.

The financial industry is a big part of the San Francisco economy, if they start laying off more people it will be bad for home prices.

The technology industry has been helped a lot by international growth which looks like it is tapering off.

Interest rates at some point will have to go up if the inflation situation gets worse.

There are a lot of condos coming to market in San Francisco this year and next year.

I could go on, and I also suspect that alot of shoes are waiting until after the presidential election to drop. Remember out the Tech industry fell off a cliff after the 2000 election.

EBguy – I don’t quite understand any of your points. Have you actually gone into the homes that are listed in Berkeley for under 400k? I actually go and look at homes every weekend, so I have a pretty good understanding of what is out there, and have not seen anything for 400k that is what we are looking for. I have been held up at gunpoint in Berkeley, so I have some ideas of areas I am not going to live there and will pay the requisite premium to live in a safer area.

The Berkeley Hills are downright cheap when compared to Marin or Penninsula towns that are similar. Try getting a 3/2 SFH in Palo Alto or Burlingame or Mill Valley, and see what you get.

Anyway, you may have seen the house on Glen that sold for $1.55MM in 2005, listed a year ago for $1.65, eventually dropped to asking of $1.36. It happens, the days of homes moving way above what is the norm for a neighborhood are over. There is a house around the corner from that one that transacted for 880k in 2005 and they are asking $1.05MM now (no improvements), and heard they got offers, so go figure.

I have been held up at gunpoint in Berkeley, so I have some ideas of areas I am not going to live there…

Egads! I’ll shut up now (though I think there are some areas — like around the new Berkeley Bowl — that will gentrify.) Know some folks who live in that region and the kids go “up the hill” to Cragmont for elementary school.

I will say this though, don’t have much sympathy for anyone (not necessarily you) competing for housing in one of the whitest zip codes in the Bay Area.

In Alameda County, the whitest tract isn’t in the outlying suburbs. It’s in progressive, university-town Berkeley — somewhat to residents’ embarrassment. In Census Tract 4238, in the southern hills above the Claremont Hotel sweeping down to College Avenue, the lovely old houses occupied by student communes in the ’60s are now home to a population 86.3 percent white.

Interesting way to look at the BA real estate.

Could the “flight to quality” be just another name for “white flight”?

Hey, I was held up at gunpoint on Telegraph Hill.

When I lived in South Berkeley in the late 80’s it was a war zone: I could hear gunfire every Friday and Saturday night, with my windows open.

I finally moved out when a guy got shot and killed on my front lawn. There were crack dealers across the street and I guess two of their “customers” got into a fight. At least I was on campus when it happened.

It is much quieter now, but I still think I would rather not live there with a family, if I could avoid it.

Supply and demand is clearly a factor on prices. However the demand in SF has always been high, this explain the historic median income/median price factor of 5-6 times income, vs the national avg of around 3 times income.

It’s not like someone just noticed in 2000 that SF was at the tip of a peninsula and had (what some consider) great weather and a lot of charm and thats what drove the price runnup.

Prices were runnup by loose lending and speculation and those these are gone causing prices to fall, more specularly in some places then others. But at the end of the day the market will return to historically supported economic levels and until then we have not hit bottom.

[Editor’s Note: Related to the discussion: Bay Area Rents Surge, But Housing P/E Ratio Remains Out Of Line.]

fluj’s higher inventory numbers correlate with the shorter-resetting subprime loan areas, whose loans are resetting.

When the option arm prime loans reset, starting late this year and into next, watch what happens to inventory numbers.

Tipster, all manner of buyers used ARMs to begin with. District 10 had a ridiculous price runup, 300% and higher in spots. As we’ve seen.

Well I have an observation about some of the conods in ORH and Infinity. It seems most of those are attempting to rent 2 bedrooms –about 1300 sq feet for 5k -6k a month if the view is good.

which at 24x -the historical average for sfo–is about 1.7m. Does that not suggest that if those rent numbers are correct that the housing market–at leat for soma condos is starting to approach historical levels?

Historical price-rent ratios for Oakland-Fremont-Hayward is astronomical (30 year average according to HSBC is over 30X), likely due to ghetto/rich hills mismatch. Might not be as huge of a mismatch in SF, but aggregated data is probably not totally useful.

However, California’s 30 year average rental yield on a SFR is 5.4%. Shockingly enough, that’s not all that different from the nationwide average of…5.5%. I’d bet that if you buy anything for less than 18X annual rent, you’re getting a reasonable deal (probably not the bottom, but if you stick around long enough, it’s ok).

Keep in mind we are just now seeing the increase in unemployment due to the slowing economy and that is only going to add to price pressure.

If unemployment gets worse downward pressure on prices is only going to increase (but of course the reverse is also true)

PS. I bought. I’ll admit it. Don’t make me cry :).

Did it in the East Bay. Equivalent rent is $200/month more than my current rent ($1750/month), for a place that’s 20% bigger, oh, and with a new kitchen & baths & front porch thrown in. Sellers cleared termite work & paid for closing costs ($10,000).

I get a 7 1/8% tax free equivalent “yield” on my down payment & costs assuming sub-par appreciation (~2%) and the 30 year rent multiple of 18.5X for terminal value, assuming I stick around for 10 years. Considering I’m equidistant (25-35 minute commute) from all likely commuting points (being in Biotech, there’s only 2 or 3, it’s fairly likely I’ll stick around that long. It has enough room (1700 sq ft) so I won’t be outgrowing it either. I’ll suffer your slings and arrows now, but I think it’s an ok deal

San Fronzischeme – When looking at the SFH market, we are talking mostly families, and one of the determining factors for buyers is the schools. I’m not sure I would call it white flight, but my guess is it amounts to something similar. However, it also makes SF proper flight, because not many can afford a SFH prices plus private school here.

It feels to me that there is a rush to quality school districts, and ones that are closer to the city/silicon valley are still doing very well.

Condo’s are a different story all together.

@David:

Congratulations! Out of curiousity, where did you buy? If you have or think you may have kids, the specter of Oakland Unified could very well change your view on how long you stay in your current place.

also @ David: hey, if I could find a place for under 18x my annual rent, I’d likely buy as well. But based on my current rental situation (not rent controlled), prices would need to fall 16%, or over $100K, to get to that point based on wishing prices in my building. I guess the conclusion is that buying is starting to make sense over renting in parts of the East Bay. But not so much in the city. Yet.

I never understand 2 things that are often posted on here:

1) that ARM’s are resetting to huge numbers. Mine didn’t it reset lower. Interest rates are much lower than when these were purchased that my full payment isn’t more than my original interest only. So why is the reset ARM always described as crushing for the market?

2) That all families leave the city, white flight, can’t afford private school and the city, etc. I often wonder if these are written by people without kids. Because it is my experience that the city is filled with families going to private schools and public schools. My kids classes are all full of homeowners who live in the area of the school. So were the others we looked at. So I don’t get that either.

@SFGROUNDLEVEL

Demand is the intersection of desire with money. People desired a house both as a place to live and as an investment. Nothing has changed with a place’s desirability as a place to live but it’s attractiveness as a no lose investment has gone down. Money was also freely available to anyone due to the credit bubble and that has now decreased therefore demand has gone down. In Merced, devastatingly, in SF, not enough to pull down prices except in the fundamentally less desirable areas.

@sparky

You’re right, if you have a straight ARM without a ridiculous markup then the decline in Libor or the Fed Fund Rate (depending on which index you’re tied to) can actually lead to a lower payment after the reset. The concern is more for the recast of option ARMs. There you can go from paying less than the interest to fully amortizing which can be quite a jump. Also for option ARMs the balance has been growing over time increasing the probability that the borrower is upside-down.

That all families leave the city, white flight, can’t afford private school and the city, etc. I often wonder if these are written by people without kids. Because it is my experience that the city is filled with families going to private schools and public schools. My kids classes are all full of homeowners who live in the area of the school. So were the others we looked at. So I don’t get that either.

The white flight I was talking about is the flight of the wealthy and educated from the sprawling suburbia towards the quality zones in the city.

Just walk around Noe Valley (my nabe) and you’ll see what I mean. People will go to great length to buy a place here, even paying double in mortgage what they would pay in rent. A lot of the people I know with kids are out-of-towners or out-of-staters who would not even consider living in Bernal or Glen Park. I don’t know if it’s typical of the current environment. I see the same thing in Cole Valley.

Other friends in the Valley are chasing for the right school districts and all end up in the same area. Why buy in Mountain View or Sunnyvale when East Palo Alto is 1/2 the price and not that far? Safety and school district, the 2 hallmarks of white flight.

I get that and see it as well, into SF from other areas and not out for schools. Noe is chocked full of preggers ladies and strollers, will they all be taking off before school starts I don’t think so.

Lots of people are raising there families in san francisco. There are kids here, lots of their parents own houses, that’s my point I guess.

Why live in chilly San Francisco when you can live in splendor and spend $2 billion (that’s right, with a “b”) on a home in Bombay? And 6% of $2 billion yields a $120 million sales commission! I wonder what the comps were.

http://www.forbes.com/realestate/2008/04/30/home-india-billion-forbeslife-cx_mw_0430realestate_slide.html?partner=msnre

As for the school district, it’s England.

@ Milkshake

You are right in that CS algorithm uses the acquisition price, or as they call it, the first sale price, to determine the tier allocation. However, there is a reason for this, according to CS.

“Note that the allocation into tiers is made according to first sale price. Individual

properties may shift between price tiers from one sale date to the next. We use only the

tier of the first sale, ignoring the tier of the second sale. This allocation was chosen so

that each of the tier indices closely represents a portfolio of homes that could be

constructed on each date using information actually available on that date. Thus, the tier

indices are essentially replicable by forming a portfolio of houses in real time. The Low-

Tier index for a metro area is an indicator of a strategy of buying homes falling in the

bottom third of sale prices (while the High Tier Index as an indicator of a strategy of

buying homes in the top third of sale prices) and holding them as investments for as long

as the homeowner lived in the home. The trend of home price indices in each of the three

tiers reflects the outcome of such an investment strategy.”

The funny thing is CS pointed out that historically low-tier indices perform better than high-tier indices.

“A ‘value effect’, has been noted in the tier indices: low-tier indices have typically

appreciated somewhat more than high-tier indices. Part of this value effect may be

analogous to the effect that motivates value-investing strategies in the stock market.

Individual homes’ prices have shown some tendency to mean revert, so purchasing low priced

homes may have been an overall good investment strategy.”

I guess it is not so true this time around.

But it is tho. If you look at District 10 in San Francisco for example, the runup was colossal. The correction has been less so. Aggregate I would like to see what is the difference between 1998 and now, District 10 (lower tier) versus, say District 5 (middle tier)?

I am not interested in the CS chart. I’m interested in what happened here. There was an article in the Chron a while back about this. They suggested that Bayview had perhaps the highest runup of anywhere in the country. It’s leveled off by 10 % or so now. But this is only after a 300% climb. Maybe only the toniest hoods also approached that type of appreciation. The middle tier neighbhorhoods certainly did not treble in value.

I was looking in Oakland, but a friend of mine convinced me to give San Leandro a try. A little burby, but found a ‘hood where I can walk to a couple cafes, restaurants and a hardware store, ice cream shop and groceries. So not too bad. Basically it’s the same or better commute, lower crime, lower property taxes and cheaper housing than Oakland, so that made the decision a bit easier.

Also no Oakland Unified worries. In the best public grade school in San Leandro (for what that’s worth, but it’s comparable to Cleveland Elementary, a little below Redwood heights in student proficiency scores).

Prices are starting to make sense here in San Leandro. I think there’s at least another 10-15% to go in Oakland, and more in SF. I’m more confident in Oakland’s additional price decline, though, as people will make the same calculation I did. It’s weird, Alameda’s even coming down a bit swifter than parts of Oakland like Redwood Heights. So, with more people heading to San Leandro, Alameda, Berkeley; Oakland will have to come down.

PS. With the money I’m saving versus buying a similar house in Oakland (at least ~$170,000), I can afford school choice, i.e. private school.

“It’s leveled off by 10 % or so now”

Ummm? Leveled off by 10%? What exactly does that mean? Would it be that the “permanently high plateau” that realtors were talking about is now 10% lower than it was a year ago?

@David:

Thanks for the info. Everything I hear about SL is skeeery, so it’s good to hear that there are some nice, safer areas.

And I agree that Oakland will come down still further (course, I think SL probably will too, but that’s a much less informed opinion).

P.S. Private school on “only” $170k? Are you counting on your kid, skipping one or four grades? 😉

Diemos,

“Ummm? Leveled off by 10%? What exactly does that mean? Would it be that the “permanently high plateau” that realtors were talking about is now 10% lower than it was a year ago?

What are you talking about? I specifically said that District 10 in San Francisco has had a correction. Is that particularly difficult to understand?

This time last summer I had a listing in Bayview. It didn’t get a whole lot of traction. I got two below list price offers on the property, about 10% lower come to think. And I saw the same thing happening with other Bayview listings. (I mentioned this more than a few times when I first started posting on Socketsite like last July or something, too.)

How about you save the broad dismissals and word insertions and instead speak to another human being for a change? I’m pretty tired of this type of exchange.

Heh, Foolio.

$170K for 6 years. Counting on public grade school, hence the choice for SL. If I spent more to get into a “good” Oakland public grade school, I wouldn’t have the cash for the inevitable move to private middle& high school.

You should compare crime stats, if you think SL is ‘skeery.’ The “nice parts” are way safer than corresponding “nice parts” in Oakland, except for particularly rarified areas of Upper (NOT Lower) Rockridge and Montclair. The most that happens in the areas bounded by Bancroft/MacArthur, Dutton and School are the occasional broken window or some middle-schooler spray painting your garage door.

It’s way safer too than most parts of Berkeley.

Why? The cops here actually respond to calls. And there’s only about 3 streets they need to watch (the ones that allow access from Oakland). So guess what? Every night they set up shop at those intersections. Crude? Sure. Effective? You bet.