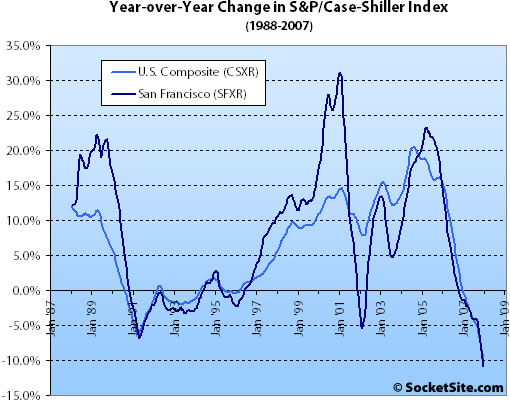

According to the December 2007 S&P/Case-Shiller Home Price Index (pdf), single-family home prices in the San Francisco MSA fell 3.2% from November ’07 to December ’07 and are down 10.8% year-over-year. For the broader 10-City composite (CSXR), year-over-year price growth is down 9.8% (having fallen 2.3% from November).

Miami remains the weakest market, reporting a double-digit annual decline of 17.5%, followed by Las Vegas and Phoenix at -15.3% each. In December, San Francisco slipped into negative double-digit territory with an annual return of -10.8%. Charlotte, Portland and Seattle are the only three MSAs still experiencing positive annual growth rates; however, Seattle came in at only +0.5%, an almost flat growth rate.

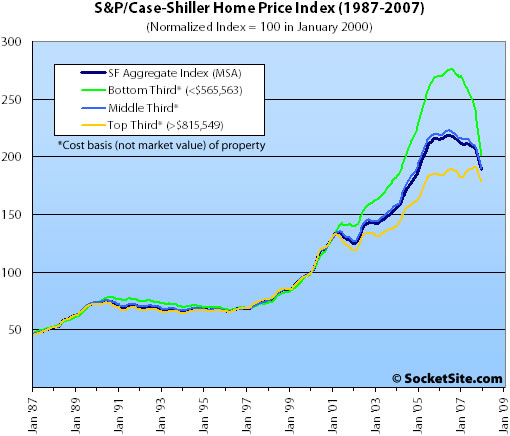

Prices fell across all three price tiers for the San Francisco MSA with the rate of decline increasing most significantly for the middle two-thirds of homes.

The bottom third (under $565,563 at the time of acquisition) fell 5.7% from November to December (down 25.3% YOY); the middle third fell 4.0% from November to December (down 12.1% YOY); and the top third (over $815,549 at the time of acquisition) fell 2.1% from November to December (down 2.1% YOY).

The standard SocketSite S&P/Case-Shiller footnote: The HPI only tracks single-family homes (not condominiums which represent half the transactions in San Francisco), is imperfect in factoring out changes in property values due to improvements versus actual market appreciation (although they try their best), and includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., the greater MSA).

∙ Year End Numbers Mark Widespread Declines [Standard&Poor’s]

∙ November S&P/Case-Shiller: San Francisco MSA Continues Decline [SocketSite]

Investors have absolutely fled the housing market because they are confident in the number of defaults continuing to rise.

My understanding is that there is effectively no secondary mortgage market, outside the Federal Home Loan Banks. The federal government is essentially propping up the prices of homes, or the fall would be worse.

Of course, in the end, it just slows the fall down.

2003, here we come.

Just imagine, 1 yr ago, 70% of people on this site were screaming “get in before you get priced out!”

But what about the un-reality of the San Francisco market, where condo developers “hold the line” on price decreases from their 2007 rate sheets no matter how many units go begging, and private sellers simply pull properties back off MLS rather than be the first to sell at a lower price? Who is going to flinch first, the sellers or the buyers?

“Who is going to flinch first, the sellers or the buyers?”

Sellers, when their Alt-A / Option ARM mortgages start resetting in earnest in 2009. They will have to sell or else walk away and let the banks sell. Forced sales plus tighter credit plus recession equals lower prices.

Perhaps this is just interpretation error, but from looking at the graph, it would appear that in returning to more traditional consistency in pricing between the three categories, the “high end” (>$815K) is setting the market (ie the other two price categories are trending back towards its appreciation rate).

If this is in fact a reasonable interpretation, what do people think is currently supporting the $815K range’s relative stability, and what do people think will cause movement in that range over the next year or so? It seems to me that while $815K+ may have traditionally (ie pre perhaps 2003-2004?) been more rarified air, that’s been close to the median price for the last several years, indicating that there are quite a few ‘units’ in/above that price point, and that it is therefore vulnerable to a lot of the same factors (ie ARM resets, etc) that are plaguing the other ranges.

Would also appreciate any perspective on 30 year jumbos (already approaching 7%) wrt today’s news on core inflation vs. the raised jumbo cap. While I recognize that the Fed overnight rate and the 30 yr jumbo aren’t directly tied, is it conceivable (likely?) that we could see jumbos in the mid to high 7%s by end of 08?

Still more room to drop….when the three tiers merge, that’s when it will bottom out. Right now the high end is about 175, low end is about 200. They will probably merge back together at 160.

The developers are flinching. Not widely known but even the Infinity has joined the crowd of developments offering incentives as they struggle to close out remaining inventory in tower 1.

“Would also appreciate any perspective on 30 year jumbos (already approaching 7%) wrt today’s news on core inflation vs. the raised jumbo cap.”

Long-term mortgage rates are set by the rate on 10 year treasuries plus a risk premium. As treasury rates have dropped risk premiums have gone up. If foreign buyers of treasuries get spooked and pull their money out rates could increase significantly. With rising default rates lenders will likely be increasing risk premiums. I would predict higher interest rates going forward unless one puts down a significant downpayment.

Anna – would love to hear what information you have on the incentives being offered at the Infinity as I am in the process of looking there. Thanks!

@diemos

great explanation, thank you!

“…includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda”

These are all very different markets. I wish the data analysis was more finely grained so that meaningful local interpretations could be made. Are SF, SM, and Marin in effect propping up the index? Don’t know from this data.

So … are prices up or down in Russian Hill? The unit next to me just went on the market for $799k. The identical unit down the hall sold last August for $815k. Hopefully the buyers of the unit down the hall (who paid $815k) aren’t too miffed at losing about $65k (depreciation + selling costs assuming they sold) since August on their condo in Russian Hill….

Hi all,

I’ve been a faithful follower of this website to gauge the SF housing market as I am looking to move either at the end of this year or the end of next year. Needless to say, I enjoy visiting this website every day.

My biggest question for you all is do you think the SF market will continue to decline through the end of next year? I know it is hard to “predict” market bottom but I am wondering how long [historically] real estate declines typically last. And I am also taking into consideration a turn around in the lending market to influence my jumping back in to the housing market (current lending rates are some of the lowest ever, no?).

For me, my current rental lease ends in Oct 08 and I am considering either extending my lease agreement or moving to SF to purchase a place.

Thoughts?

Thanks in advance for such a great forum!

Hey Looking to Move. Yep it will continue to decline –Best case is an additional 15% decline over the course of the next 18 months then bottoming out for 2-3 years. More probably it will be a total decline of about 30% from peak to trough in SFO. I don’t think it will get much worse than that because you start to get into historical averages of rent to propery value ranges that make a bit more sense. Although who knows…BTW where is fluj and sonoffluj. Can’t wait to see them try and spin these #s as there not being any price declines.

LookingToMoveToSF –

The market will reach its bottom on January 17th, 2009. You should go month-to-month when your lease is up.

BTW. i think that 25% is for the market overall..meaning the low end pretty much has already met or exceeded that target. I think the next year will be about the upper end catching up.

Cooper

“meaning the low end pretty much has already met or exceeded that target. I think the next year will be about the upper end catching up.”

In “low end” do you mean the lower priced homes category?

amused, i think it would be nice if you were a bit more specific. i believe the bottom is going to be january 17th, 2009 at 3:17pm (you forgot the time!). ha!

“Who is going to flinch first, the sellers or the buyers?”

I would argue that sellers have already flinched. Inventory up significantly in January/February and price reductions galore.

It makes sense that sellers would flinch first, too. They’re the ones holding diminishing assets, and they keep seeing terrible stories in the paper everyday to remind them of that fact. Not to mention, maybe of them cannot comfortably afford their adjusting mortgages.

Meanwhile, potential buyers sit back in their rent-controlled apartments and wait…

Prices need to drop more on the lower end. I look a lot at the East Bay (cuz it’s cheaper, and an easier commute to the financial district than just about anywhere in SF) and it’s completely ridiculous that “starter homes” around 1,000-1,200 sq feet (2-3 br/1 ba) are still priced at $450+/sq ft. The next tier (the “move up”, 3/2 or 4/2+) are a better deal, typically 1500-2000 sq ft and priced at $300-$400/sq ft. There’s ABSOLUTELY no reason to buy a starter home. I can rent one for $1800-$2100 or so in the East Bay, and unless you assume prices will go up more than 3-5% annualized over the next 5 years, it doesn’t make any sense to buy (never mind the pain of moving, etc). And you can’t convince me the lot is worth anything, since it’s so painful to do any additions/teardowns etc anywhere in the Bay Area.

I’ve tortured the numbers more than Putin’s done to his enemies and it just doesn’t work–it’s better to rent and save up the $$ to buy a mid-range house in 3-4 years (assuming R.E. doesn’t resume a double-digit rise).

The lower end has another 20% to drop, AND that’s assuming the mid-range and upper range doesn’t drop that much any more. So, if the mid/upper range drops 10%, which is probable, the lower end will drop 30%, which would return things to the long-term inflation trendline in 3-4 years.

Interesting david…so does that mean the low end is going to be down 40-50% total? You said you crunched the #s a lot, but one would expect some stablization around the time when the rent to home value reached more historical norms. And most own vs. rent calculations don’t work until housing stops dropping. Even a 1-2% decline destroys value too quickly.

Check out 1915 Pierce Street:

Asking 2.495M

after 21 days on the market – Sale Pending.

flujluvchild

Dede @ 8:22AM wrote:

“I wish the data analysis was more finely grained so that meaningful local interpretations could be made. Are SF, SM, and Marin in effect propping up the index?”

I don’t want to mix apples and oranges, but county data is available from CAR/Dataquick. Yes, I know the methodologies are different, but the mix should remain somewhat stable.

SF is down 0.7% year over year.

CoCo down 15.6%

Alameda down 13.0%

San Mateo down 10.3%

Only Marin was up by 0.7%.

But they’re all down from their respective peaks, with SF down over 10% from the peak set in May of 2007. So prices are indeed falling across the bay area. Just more slowly in SF and Marin, which is understandable.

[Editor’s Note: We’ll interject an “apples to pineapples” comment here and quickly remind people that DataQuick simply reports changes in Median Sales Price which is a decent measure of what people are paying for homes, but a less than decent measure of how those homes are actually appreciating (or not).]

these numbers are UG-LY.

I’m sure that many people are praying that the hypothesis “SF Real Estate is completely independent from the rest of the Bay Area” is true.

I personally wouldn’t bet on it.

This is exactly the pattern we saw in San Diego.

Started with the far exurban areas

Then the nearer suburban areas

Then hit the city proper, especially new high rise condos.

I do think that ONE asset might hold it’s value in SF:

Pristine well-cared for SFHs in the most desirable locations

there is another important aspect to this data that may be overlooked:

1) falling Case Shiller and OFHEO data will make getting a loan in SF HARDER

2) falling Case Shiller and OFHEO data will likely DECREASE what the new conforming limit will be.

Despite how some people say “it’s all micro”, it’s not.

The willingness of lenders to lend on a property is DIRECTLY tied to the Case Shiller numbers and also the OFHEO numbers.

both are showing stress in the Bay Area Market.

Do you think a lender will be MORE or LESS willing to lend 90% on a high priced home in SF proper after seeing this data?

Also:

OFHEO is charged with coming up with the new limits on conforming numbers. it is likely they’ll be based on either the OFHEO index (duh) or the Case Shiller index.

Both indices are FALLING. thus, the conforming mortgage limit will FALL as well!

(don’t forget, OFHEO was AGAINST raising the conforming limits in the first place)

Tony: I don’t know much about real estate (other than what every SF condo owner knows) but I know something about interest rates so I’ll take a stab at your question. First of all, 30-year mortgage rates traditionally track the 10-year Treasury rate a lot closer than the overnight rates set by the Fed. And as Mr. Greenspan so famously said, and others are saying once again, we have something of a conundrum with regard to longer rates: with inflation rearing it’s ugly head (the PPI spiked again today), they should be a lot higher than they are. Since we don’t really understand why the 10-year Treasury isn’t 6-7% right now rather than 3.9%, it’s hard to answer your question, but I do think as the fact of renewed inflation, aggravated by Fed cuts required to hold off recession, sinks in, these rates–including 30-year mortgages–are going higher. A 7% jumbo 30-year mortgage is not at all unlikely.

these numbers are beautiful.

ex SF-er said: “falling Case Shiller and OFHEO data will make getting a loan in SF HARDER”

That’s a big point.

Despite the lower price (which may not even be the case in SF), it is definitely getting HARDER to buy.

If you look at monthly payment, a 1% increase in mortgage rate from 6% to 7% has the same effect as 15% increase in price.

So, let’s forget about whether sellers come out ahead…..because buyers are definitely NOT doing better in this bear market. To make it worse, while the RE markets are local (and it is quite possible some micro-markets are seeing higher prices), the lending market is macro and the lenders won’t give you a 6.05% just because SFO only dropped 1%. They will want their 7% no matter where the property is.

Buyers are screwed.

John,

Like most other Realtors you are over-simplifying the situation. Increasing mortgage rates will eventually likely exert additional downward pressure on home prices, as buyers will not be able or willing to pay higher interest for the same price range.

The most notable aspect of this latest report, and similar recent market reports, is how the decline in SF prices has accelerated in recent months. Prices are really in a freefall — much more drastic than in the early ’90s. This was somewhat predictable after the lending crunch which began last August and has only worsened since then. The SF market was propped up by large, low- or no-down loans. Those are largely gone, and to the extent they can be found anywhere, they are much more expensive. In addition, the universe of buyers who can qualify for any loan at all has shriveled to a fraction of what it was given tightened lending standards. It is plummeting demand that is driving things now, seen not only in declining prices but declining volume. It is going to take far lower prices AND loosened lending standards before things pick up. (And to top it all off, interest rates continue to rise).

if “buyers aere screwed’ by mortgage rates, then prices will adjust (aka drop) accordingly.

“Buyers are screwed.”

Wrong. Demand will continue to drop as it becomes harder and harder to buy. What happens to prices when demand drops?

If anyone is screwed it’s a seller that’s counting on cheap and easy money in the hands of a buyer. An increase in rates will decrease what buyers can pay and it’s sellers that will feel that pain.

julf,

I am not a realtor, far from it.

And feel free to search for my posts on craigslist and ss before. I am mostly a bear. I am just being realistic.

The raising mortgage rate HAS already put downward pressure on the price. The problem is SFO sellers haven’t blinked. So the SFO buyers are between rock and hard place.

Actually, I wished I got into the market when the 30-year is 5%.

If you don’t see that, you are just burying head in sand.

Cash is king. If you have to take a loan, the SFO market condition is worse than 1 year ago.

I know we’ve beaten the entire Google factor to death, but has anyone seen the stock price today? Not looking good for those potential Google employee millionaires.

‘Prices fell across all three price tiers for the San Francisco MSA with the rate of decline increasing most significantly for the middle two-thirds of homes.’ – this should be bottom two thirds presumably? (the rate of decline actually slowed for the top third).

Bad numbers indeed, but be cautious about applying this to the SF market – as I understand sf city sales are about 20% of the MSA – but yes, will be higher than this for the top third, lower for the bottom third…

@ BT

Thanks also for your explanation. It does, as you called out, beg the question of why the 10yr (and thus the 30yr mortgage) is “artifically” low. My (limited) understanding is that the only way such a condition could exist for treasuries is if there were an over supply of buyers (ie, that’s driving prices lower). Is it possible to look at inflows/outflows of secondary mortgage market (as the first poster on this thread points out) vs treasuries to see if that’s where the dollars are going?

It’s hard for me to believe that the smart money thinks that locking up cash at 3-4% for 10yrs is smart; if that really is the case, that’s pretty terrifying…

The Feb numbers for San Francisco will likely look like Jan – volume way down, but not a lot of evidence of any price declines on a per sq ft and district basis (outside of Dist 10). SFH’s, few as there are, do seem to be selling quickly and often above list price. These sellers don’t seem to be blinking (yet) and there are still willing buyers. I think that the downward trends are clear and will likely accelerate (in SF), but frankly I am surprised that prices haven’t moved more.

Tony,

One of the reasons for the low interest rates we’ve enjoyed over the last several years has been the abundance of foreign Tsy buyers who were flush with US$ from selling us all those cheap imported goods. These investors tolerated the low yields because of the perceived safety of US Tsy. The problem we have now is that many US Tsy investors, not just foreign, are getting nervous about the depreciating US$ as it erodes their real return from translation into a foreign currency or if it’s a US investor from the effects of inflation.

You’re right, we all better hope there isn’t a sudden reaction to sell US Tsy’s as this will cause an almost instant spike in borrowing costs of all kinds.

Dude, those data are pretty interesting. I also was around in the early ’90s and prices certainly did decline through those years. Surprisingly, I see that sales volume did not fall all that much from the late ’80s boom through the early ’90s bust. As I’ve said many times, the recent bubble is off the charts — SF (and elsewhere) has never seen prices so inflated with respect to economic fundamentals (earnings, rents, etc.). And despite higher YOY supply, we’re now seeing sales volume declines that appear to dwarf those of the most recent previous downturn (thus distorting comparisons of medians, by the way). And as today’s CSI data indicate, prices are following accordingly.

Higher supply + lower demand = well, you know.

Cooper, I’ve seen some places (REOs, but still in decent, i.e. rentable shape) in the East Bay that are currently priced 40% off their peak. Even in the hills, there are a couple, and of course more in more marginal areas (San Leandro has simply been torched–down 24% Y-Y on average, plenty of places are 40%+ off peak). So no, 50% drops are not out of the question at all.

As to the numbers, you can rent starter homes for about $1.25-$1.50/sq ft, or about $1800-$2100 in most neighborhoods. Assuming a 20X price/annual rent multiple (pretty close to historical house rental average), you’re talking $300-$360K for a starter home. If rents go up 10% the next 3 years, you’re talking $330-$400K for a starter home. That’s still a solid 10-20% under what’s currently available (and livable) now, at least.

My rent/buy calculator usually assumes a 2-3% annualized appreciation rate over 5-7 years, which over the coming stretch might be optimistic. I certainly don’t think we’ll see an annualized 4-6% gain or more over that time period. At reasonable appreciation rates (2-3% max), unless you’re getting practically no return on your down payment money, it makes no sense to buy.–Example, on a $430K house, assuming 10% down and a 8% return on your down payment money, the usual costs and repairs, and a $1750 monthly rent, you have to assume you can sell the house for $489K, or a 2.6% annualized appreciation in 5 years. Just to break even, and derive no benefit from owning over renting. And a $430K house is unlivable in Oakland, and barely so in San Leandro, and still doesn’t exist in Berkeley/Albany. If your rent is $2000/month, you could pay $490K to break even. Again, there are a few houses in that range in Oakland that are livable, a few more in San Leandro, and none in Berkeley/Albany.

So, using two different metrics (historical price/rent and using hard numbers) you still have drops coming. I still say, that despite it “making sense” to buy at, say $490K if your rent is $2000/month, if I were in that situation (my rent is less), I would save up for another 3-5 years and just buy the $600K home, and spare myself the hassle of selling and moving the extra time. $600K homes are way better deals, usually about $300/sq ft and in nicer neighborhoods–this again is why the “starter homes” will drop.

It’s inaccurate to say that the bottom third is houses “under $565,563 at the time of acquisition”

It’s true that homes are classified into tiers based on the acquisition price (not the selling price) but the breakpoint varies over time. Any house bought for under $565,563 in December 2007 would be in the bottom tier but a house bought for $550K in 1987 would be in the top tier.

David, thanks for the numbers… I like your analysis EXCEPT:

I wouldn’t assume an 8% return on the investments if you didn’t use it as downpayment

we’ll be lucky to get half of that for the near foreseeable future…

it’s one of the things making these rent vs buy decisions so hard.

that said, I would never dream of buying, but i also wouldn’t model in 8% returns…

FWIW:

I would have modeled a 4% annual return on investment of the downpayment, instead of 8%

the reason: you can get 5 year CD’s for 4%. That’s risk free, and a conservative estimate.

I understand your caveat ex SF-er, but you can get 5% Fed&CA tax-free munis right now, 12% in junk bonds, and 7% in preferred stocks.

Over 5 years, 8% is pretty reasonable for a conservate stock/bond investment mix, and I think it’s silly to be in CDs for 5 years with your (sizable) down payment money. Heck, with a mixture of the above, I can get an 8% yield right there, never mind any appreciation in junk or preferreds or even munis. That’s not even counting a stock market component.

I understand “de-risking” your down payment, but I would do that starting about a year-18 months before you start looking, not 5 years, therefore, I use an 8% rate. Looking at the behavioral finance way–the HSBC “froth finding” report estimated that people use a 7% “discount rate” on their down payment.

My personal internal rate of return on my investments has been 13.5% annualized for 11 years now.

PS. Even if I parked my down payment in tax-free munis for 5 years (at 5% yield), my break-even buy/rent price (at $1750/month in rent) is $465K.

At 2000/month rent, it’s $535K.

$465K doesn’t get you much in Oakland, nothing in Berkeley/Albany/Alameda and gets you a decent starter in San Leandro. $535K can get you a decent starter in Oakland, and still just about nothing in Berkeley/Albany/Alameda, although at least there are a handful of houses at that price in the latter areas.

So even with a more modest rate of return on your down payment and rent savings, you still can’t justify about 90-95% of starter home prices around the East Bay.

And again, that’s assuming a 2.6% annualized home appreciation rate over the next 5 years.

There’s some risk to that assumption, compared to the nearly no risk of 5% yield in your munis. I’d point out that risk factor again–there’s risk to the 8% return I used over 5 years. How about the risk to the 2.6% R.E. appreciation? 🙂

Lower end houses simply have more room to drop. This behavior is also typical in a R.E. bust–the lower end houses moved up the most percentage wise (as seen in the graph); they will move down the most percentage-wise.

Some interesting numbers. Using Redwood Heights as a neighborhood in Oakland, which has a decent mix of “starter” homes and move up homes, generally lower crime and relatively family friendly, along with a couple little retail areas. All around, generally middle/upper middle class area, pretty “normal.”

The $$/sq ft in sold homes peaked at $468 in 2006.

THat declined to $422/sq ft in 2008.

In just the past 3 months, the $/sq ft has dropped to $333, down from $379 in the August-November period of 2007.

HOWEVER, speaking to my above point, the $/sq ft for houses under 1500 sq ft sold in the past 6 months is $429, but for houses over 1500 sq ft, it’s $333.

Paying 30% more on a sq ft basis for a starter home is silly. I understand there is some premium to the lot, but I think that’s out of line. Therefore, starter homes have at least 20% to drop, probably closer to 30%.

Again, for comparison, $/sq ft didn’t reliably go above $300 until 2004 in this area, just in case you wondered. So even at $300ish/sq ft, we’re only back to 2003-2004 levels.

What was it in 1997? $160. So even if we inflate another 20% on top of the 40% inflation of the past 11 years over the next 3-4 years, we still only get to ~$270/sq ft. Prices still need to drop 20% over the next 3-4 years just to drop back to trendline, at least in Redwood Heights in Oakland. Just as an example, but I think it’s not an unusual example for a neighborhood around the Bay Area

construction costs have risen substantially in the last 10 years. wholesale construction costs according to the contractors I know are $200-225 sq/ft not including permits,fees, or of course the actual land it’s built on. retail costs in sf proper are at least $300 and closer to $400 for anything reasonably nice net of fees, permits or property costs.

Ok, little obsessive here.

Re-crunched the numbers, the average starter premium from 1989 until 2004 was 5-15%.

So, right now, starters “should” be closer to $370ish/sq ft, again a significant drop.

Case-Schiller for SFXR peaked in May 2006 at 218.37.

Today, Case-Schiller for SFXR was recorded for December 2007 at 189.23. This brings the index level back to the January 2005 level.

While I am not a huge fan of Elliot wave analysis, I di find it interesting. I am a fundamental analyst. That said, the Case Schiller chart begs to be read as the start of a 5 wave decline, with the largest wave, Wave 3, now underway. Simply put, 5 wave decline have a Wave 1 drop, a Wave 2 rebound, then a huge Wave 3 decline, followed by a Wave 4 rebound, and then finished off with a final, Wave 5 decline.

I think we are in Wave 3, and that it will extend into the Summer of 2009. There would be in this scenario not a single respite, from home price declines until next year. I think we will put in a low in late Summer 2009, then drift higher slightly into Christmas 2009. The final decline will occur in Spring 2010.

You will do pretty well if you are a buyer, therefore, to hold off until late Summer 2009. You may see lower prices in the Spring of 2010, but not too much lower. However, I want to emphasize–the declines between now and August 2009 will be big.

Real big.

We should get back to 2002 levels in pricing, before this is all over with. Let’s say 140.00 on the SFXR.

Best to all.

-The Kid

the cat is dead. it is falling. and it hasn’t bounced yet. but it will.

David:

thanks for the re-calculations. it does show how overvalued RE still is around the land.

I should clarify: I wasn’t criticizing your use of the 8% per se, only that I personally use 5% as a “risk free” way of calculating, to silence the RE bulls who say “8% isn’t possible… why not estimate 15% return on investment!”

🙂

No problem ex-SFer.

By the way, I just crunched the numbers for Glenview, another relatively “normal,” family-friendly, low-crime area in Oakland dominated by SFR’s.

In Glenview, the historical premium attached to a starter home is closer to 20%. HOWEVER, sales over the past 6 months have attached an unbelievable 60% premium to starter homes in terms of $/sq ft. Ridiculous.

Additionally, $/sq ft has collapsed 20% for move up homes in the past 6 months compared to the first half of 2007 to $321 from $385.

HOWEVER, the $/sq ft for a starter has only declined 6% to $514 from $550.

“Starter homes” are a horrible deal. If you want to live in a smaller house, rent it, otherwise, you’ll NEVER move up. Seriously–in this Glenview example, you’ll lose 25% if premiums narrow to their historical average, assuming move-up homes don’t drop in value.

Bad bet.

Hope this was helpful to others, it was eye-opening for me.

Starter home sellers (including REOs) need to slash prices. No wonder sales are dead in the starter market.

Building costs may very well be $200 per sqft (actually, I’ve been told they’re much higher), but please don’t be foolish and think that’s a floor to prices – that’s just the price beyond which new construction doesn’t happen.

In just about every major housing bust, anywhere, prices fall below construction costs – the true floor is usually somewhere around where it starts making sense for them to be investment properties – that’s somewhere well below 200x monthly rent (not 240x as mentioned previously). In the last bust, that magic number was around 120x monthly rent.

The only real question is: will rents continue to hold up as the area slips into a deep recession? Will they rise as people choose renting over owning, or fall as people leave the area?

Folks sure are going to be surprised at low this can go.

Jim,

Prices can always overshoot to the downside, but the 30 year average price/annual rent ratio for a SFR in the Bay Area is 20. Of course, that swings from 33X recently to probably ~11X closer to the previous bottom.

David

Jim,

I cannot see how someone can buy a rental property and hope to break-even at 240x, or even 200x.

More like 150x at current mortgage rate.

SurveyKid,

I have always said the bottom will be the end of 2009 to early 2010, despite some people thinking me as a bull, and even think I am a realtor.

And I happened to think the 2003 price is the “normal” price, which is lower than the 2002 index (a small dip). However, I use the real term. The “normal” appreciation of RE from 2003 to 2009 (six years) should be about 20% to 25% (just to keep with the inflation), so I think the bottom will be 20% to 24% above 130 = between 156 to 165.

And that’s where the three tiers finally meet again.

At 200x, you can at least start to shop if you expect appreciation (I don’t, btw). But yeah, 120x monthly rent is probably a better ballpark number for getting something profitable assuming no appreciation. You have to work the CAPX for each individual property, of course – and SF makes that harder, since they give such grief to landlords.

As for the market recovering in 2010 – you know that’s when the Boomers start to retire in earnest, right? Just as their move to their 50’s effected the stock market (as they started to save belatedly for retirement), their move from homes to retirement homes will effect the housing market. So I wouldn’t count on 2010 if I were you.

Besides, peak to trough the last bust lasted 8 years – is there any doubt this one will last longer, just from it’s starting size?

Building costs, like everything else in SF and much of the Bay Area, are much higher than they should be. Yeah, there are many factors that drive this – and I guess some of them are unavoidable. But homes of reasonable quality are built for $50/sf in other parts of the country – even in parts of CA. It shouldn’t cost $200/sf in East Bay and $250+ in SF for average quality construction. We are way too tolerant of high prices here.

Peak to the same price lasted 8 years the last time, i.e. you sold a place for 150K in 1989, you sold the same place for 150K in 1997, of course, inflation adjusted that was a 30% loss, but you were looking at 10-20% nominal losses (with inflation, probably another 10-12%) in the trough, which was 1992-1993.

This bust could last longer, or it doesn’t have to if the REOs start really exerting more pricing pressure as the banks get desperate.

As to the Boomers, I don’t buy that argument. Nearly all Boomers will stay put until the last few years of their lives. SF is already the oldest or second oldest city in the country, and given the psychology of long-time residents around here (brainwashed into thinking it’s the best place on the planet), I doubt enough will cash out to exert a significant pressure. And it’s just as likely that the Boomers will just hand it off to their kids. That’s been happening in NYC for, oh, 150 years, and I’ve already seen it happening around here too.

Where prices will get slammed is the outer ring ‘burbs. Boomers don’t need 4-5 br houses 50 miles from anywhere, and so the ones who do trade, will probably go into inner ring ‘burbs, downtowns and small “character” towns (think Madison WI or Charlottesville VA).

actually I think the data here (fron Dataquick, posted by Dude above)

SF is down 0.7% year over year.

CoCo down 15.6%

Alameda down 13.0%

San Mateo down 10.3%

Only Marin was up by 0.7%

and the MSA index are consistent, which leads me to believe that these median price changes are fairly indicative of what is happening (at least measured by Case Shiller.

based on jan 08 sales, I weighted each regions price change as follows:

Alameda 36%, CoCo 31%, Marin 5%, SF 14%, SM 14% and came out with overall decline of 11.0% – pretty damn close compared to 10.8% Case Shiller.

So, as I have said before, I believe the SF median price remains a reasonable but not perfect indicator of what is happening, and the MSA numbers are a poor guide to SF City, given the representation is around 14% in total and the mix of price declines is so different between regions.

For those who want a YOY comparison that focuses on San Francisco, here are the numbers for 1/07 – 1/08. District 10 has been hit pretty hard. Other districts are doing fine so far.

—————

District 1 Jan-07 Jan-08

Number of Sales 7 7

Median Selling Price 1,000,000 1,250,000

Average DOM 47 66

District 2 Jan-07 Jan-08

Number of Sales 20 21

Median Selling Price 788,000 830,000

Average DOM 54 56

District 3 Jan-07 Jan-08

Number of Sales 4 9

Median Selling Price 774,500 960,000

Average DOM 58 60

District 4 Jan-07 Jan-08

Number of Sales 27 11

Median Selling Price 871,000 1,155,000

Average DOM 57 56

District 5 Jan-07 Jan-08

Number of Sales 13 17

Median Selling Price 1,180,000 1,530,000

Average DOM 66 48

District 6 Jan-07 Jan-08

Number of Sales 2 3

Median Selling Price 1,250,000 2,050,000

Average DOM 111 60

District 7 Jan-07 Jan-08

Number of Sales 7 9

Median Selling Price 2,647,500 3,350,000

Average DOM 63 38

District 8 Jan-07 Jan-08

Number of Sales 2 0

Median Selling Price 1,241,500

Average DOM 43

District 9 Jan-07 Jan-08

Number of Sales 13 10

Median Selling Price 1,025,000 792,500

Average DOM 41 45

District 10 Jan-07 Jan-08

Number of Sales 48 20

Median Selling Price 676,500 561,500

Average DOM 66 100

Wow, prices in the Western Addition have almost doubled in the last year! Over $2,000,000 per house! This proves the bears are full of it. I better buy now.

DOM stats look remarkably resilient, excludng district 10.

DOM is down because only the good stuff is selling. Same thing that’s driving median price up.

“District 10 has been hit pretty hard. Other districts are doing fine so far.”

The district 9 median is down 20%.

We all know monthly stats for individual districts are subject to fluctuations (except maybe 10 due to the higher volumes, and lower spread in prices).

But, on balance, those figures to me, do not spell impending doom for SF SFHs.

Also, I posted in detail 5 or 6 posts up, the median prices per area do not appear to be distorted by only the good stuff selling – as I reconciled the Case-Shiller index pretty accurately.

If the ‘beauty pageant’ school was to be believed, then my calculation above should have given a much lower fall than the Case-Shiller numbers, as each regions median prices for Jan08 would have been driven up by this effect.

Did anyone notice that Google stock has fallen quite a bit in the past 3 months?

And the chart is still heading down sharply. Anyone who joined the company in the past year is going to be underwater on their stock options pretty soon …

Any opinions on whether the internet media bubble is deflating before our eyes?

Been in Tahoe, Internet free, for two and a half days.

But a 10 city composite, of which the “SF MSA” is one city?

Please. Everyone on here knows better than that.

The Seattle MSA which includes Tacoma, Bellingham, Olympia, the San Juan Islands, and ….

Seriously, is that how that one is? I haven’t looked it up.

Or is it just us?

The 10 city composite is down 9.8%. The SF MSA alone is down 10.8%. The fact that the SF MSA is down more than the composite is frightening.

“Any opinions on whether the internet media bubble is deflating before our eyes?”

Hey Jimmy, have you seen this yet? Hilarious.

http://www.youtube.com/watch?v=I6IQ_FOCE6I

What are the MSAs of other cities? Does LA’s include the Inland Empire?

fluj – LA includes only LA and Orange counties – no inland empire. All of the definitions can be found here (scroll down for the details):

http://macromarkets.com/csi_housing/market_definitions.shtml

Thank you. These regions are deeply flawed, and anathema, to my perspective. I understand what others say about it: that surrounding regions are of course linked. Sure. But it’s just not what I see, day in and day out. Tustin and Santa Monica. Monmouth, NJ and Lower Manhattan. Greater Tacoma and Queen Anne, Seattle. CoCo to Pac Heights?

Sorry. It just aint right. It’s valuable in a sense, because hey, they’ve got numbers. But continually flouted in this manner? I’m calling foul and I will continue to call foul.

I see your point fluj, but I just don’t think it flies. Look at how over the last 20 years the SF MSA prices trends mirror those of the U.S. composite almost exactly (albeit with somewhat larger peaks and valleys). So the argument that SF trends are disconnected from the 5-county MSA that includes SF is pretty tough to swallow.

Why is it tough to swallow when a disconnect has been happening for over two years in numerous areas? Two being one tenth of twenty. (Just a little quick math for ya!) SFR exising median gained, LAST MONTH.

But come on man. Monmouth and Manhattan. ‘Nuff said.

“Median” was up 64% yoy in District 6 last month. “Median” was up 32% yoy in District 4 last month. “Median” was up 30% yoy in District 5 last month. Median is worthless. ‘Nuff said.

OK, Michael. I’ll take that point for the sake of argument. You’re making median even more worthless in going distict by district. Reductio ad absurdum for laughs. (Even though we all will admit that that is the real dynamic in the city currently.) LOL. OK, then, sure. I’ll play. It IS worthless. Please remember your current stance if and when median actually shows decline in SF. There will be a cyberchoir singing the death of median on here. Till then it’s Monmouth and Manhattan, brah. Monmouth and Manhattan.

Fluj, I don’t see this two-year “disconnect” you’re referring to. Look at the chart — the correlation between the SF MSA and the U.S. composite has been tighter than ever over the last 2 (and 5) years. CSI controls for things like medians and compares apples-to-apples. Again, I suppose you can argue that there is a disconnect between SF and its own 5-county MSA, but that extremely counterintuitive position needs some support with relevant data, not YOY median selling prices, which, as Michael notes, tell us nothing.

I was speaking of SF and its own 5-county MSA over the last few years. And come on now. Everybody knows that to be fact.

And I bet if you look at other strongly performing cities over the same time period you will see a similar disconnect. Why that does not call “MSA” into question is unknown. Again, hey man, they have numbers. That’s something. I guess.

“Please remember your current stance if and when median actually shows decline in SF.”

If and when? Median is down 1% yoy and down 11% from peak.

https://socketsite.com/archives/2008/02/san_francisco_sales_activity_in_january_down_again_271.html

Guys, this issue has come up many times and is easily answered. Fluj, you’re a realtor, so you have access to the NAR and CAR historical numbers, right? It should be pretty easy to solve this:

1) Graph historical San Francisco home prices for the last 20 years.

2) Do the same for Marin, CoCo, San Mateo, and Alameda counties.

3) Compare the graphs.

Those charts would include the old high point (’89), last trough (’93-’94), and up through the next peak(’06-’07) and then current environment.

You could easily tell if San Francisco really does march to its own beat, or if it follows the rest of the bay area. You could even run a regression to determine the correlation of SF to it’s MSA and see if it’s statistically significant. But first, you need prices by county for the last 20 years…

Michael, I can’t believe you threw up that link. Those same figures show a gain for existing SFRs. We’ve been over that. The Chron reported it one way? SS chose to present it in another manner? Etc etc.

Fluj, if you have access, do the SF numbers on a $/sq ft basis.

Focusing in on the Richmond, the last 3 months of sales have averaged $485/sq ft.

In 2005, it was $543, in 2006, $554, in 2007 (until August), $564, and then, after August, $577, but segmenting out sales after December, it has dropped dramatically to under $500/sq ft ($493).

I don’t think SF will prove immune to the declines.

I never said immune. You did. I said it is different, starkly, unequivocally, and has been so for a period years.

I look at that stuff all the time. I just looked at Potrero and Bernal last night because somebody was on about the death of District 9. For SFRs in those areas, honestly, no great shakes, and not a ton of volume for a dataset YoY so far. Potrero was like 16 sales 16 YoY 9/1 to today. Just a few big sales in either year messing up the median.

David,

There are many ways to look at the same data.

By looking at the Jan 08 vs 07 median price, it shows the median price went up a lot (from 1M to 1.25M) in district 1. We all know in SF, the price/sqft is lower for bigger homes. So, combining those two data, to me, it says the bigger homes are selling better in district 1 (Richmond). Given the longer DOM, and CS index on three tiers, I would say it is a perfect reflection of the upper tier is doing well, but slowing down of the other two tiers.

But in this case, comparing price/sqft is as meaningful as comparing median prices.

A bit of a tangent, but this discussion should also factor in the fact that inflation has run at just about a 7% annualized rate over the last 3 months, so the big recent price declines we’re seeing in the data here actually understate the scope of the downturn by a pretty significant amount.

and the data is so sparse for district 1 – 7 sales in Jan.

$ per sq ft is a reasonable guide to the market though but as this graph shows itrs holding up OK into 08. Did decline a bit at the end of last year – maybe, as stated above, less smaller houses selling. But again, overall, doesnt seem to spell impending doom – nor does the median price graph – up some months, down some others at the moment.

http://www.altosresearch.com/research/CA/SAN+FRANCISCO

Several Nov 08 CME San Francisco Housing Futures traded hands a couple of days ago at 166.00. As of Dec. 07 the SF Index stood at 189.23. By my calculations this is predicting an average 1.11% decrease per month! Try yelling that at an open house. Don’t worry, I’m sure the carnage will be limited to the East Bay.

In the Richmond, “starter” homes (under 1500 sq ft) are priced at a 40% premium over the past 3 years to “move up” homes.

Segmenting out the “move up” homes, I see that $/sq ft peaked in July 05 (shocker) at $600/sq ft. Over the past 6 months, it has dropped to $535/sq ft, a ~6% drop. Less than the East Bay, but a drop nonetheless even for the “rich” people.

The starter homes have dropped from $780/sq ft in 2006 to $700, again a 10%+ drop, more than the move-up homes, again indicating a more solid, less subprime market in the bigger homes.

So, to sum, the Richmond is seeing $/sq ft declines, with higher % declines for smaller houses. All behavior consistent with past R.E. busts–less desirable locations and less desirable houses, which ran up the most during the boom, get hit the hardest during the bust.

But again, no area is immune, nor is even a reasonably desirable area like the Richmond in SF, which is seeing behavior remarkably like the behavior in the East Bay, if you went back in time a few months. I would fully expect price declines to continue, with greater declines (on a % basis in $/sq ft) in less desirable neighborhoods and in smaller houses, just like the East Bay (see my posts above).

Thanks, David. Great info. Out of curiosity, where do you mine the $/sq. ft. data, if you can tell us?

If you look at all of District 1 YoY, from 9/1/2006 to 2/28/7 versus the corresponding dates this year, there are 10 more (88 to 98) sales this year. They have sold a week quicker this year (45 to 38). I’d love to tell you they sold for more a foot for sure (and I doubt there’s no way they did not given 120 Sea Cliff selling for $15M) but the damn MLS is acting really buggy right now.

David, actually, in the past down-turn (at least the last one), the higher priced homes went down first, and recovered first.

This downturn is significantly different because most of the gains over the last few years were at the low-end, and that’s where the drop occurs right now….as your data shows, and as shown with the CS index.

I get my data from Redfin, and I try to get rid of spurious datapoints, like some place with 80 br’s selling for $50/sq ft.

As for the last bust, I remember SoCal, not here, and in SoCal, the outlying areas (i.e. Riverside) went up the most on a percentage basis and dropped the most during the bust. It could have been different up here.

Regardless, it makes sense to me that lower-ends are dropping first and most, because this market was the one propped up by the loosening of lending standards. So during the bust, I expect starters to get crushed. The move-ups…a lot of them were bought by upper middle class people cashing in a lot of equity offloading their starter home, so while I don’t have the data, I wouldn’t be surprised if a lot of them have more equity AND smaller loan balances than the subprimers getting 100% financing on a $500,000-$700,000 starter. Additionally, I expect a lot of the move-up homes are occupied by relatively stable families who don’t have to and don’t want to move anytime in the next 10-20 years (kids are in school, don’t really need more space etc etc).

They’re only in trouble if they refi’d up the wazoo, and there are surely more than a few of them, but I don’t think it’ll be as bad as the 100% financers on the starter end.

Just a note on those who wonder about specific area price declines in S.F. I bought on Telegraph Hill in San Francisco in 1989. I think that this neighborhood in a couple others were the last to get hit in the nation during the rollback of prices during the 90’s. If you can learn from the past, this is what I learned; The top of the market was approx. 1988, the bottom 1993. Following the prices of the same properties that sold at the top and then again at the bottom, and had no significant work to them, I saw a 37% drop in prices. Amazingly, of the 8 properties I followed they all fell within 3% of one another.