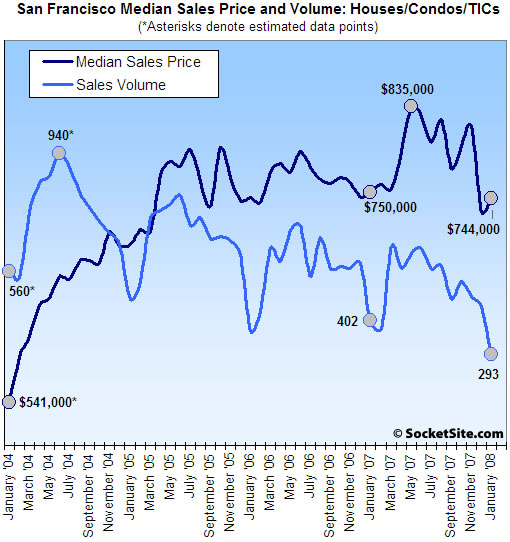

According to DataQuick, sales volume for existing homes in San Francisco fell 27.1% on a year-over-year basis last month (293 sales in January ’08 versus 402 sales in January ‘07) and fell 34.2% compared to the month prior (445 recorded sales in December ‘07). And as we’ve noted over the past three months, the data once again suggests that October’s uptick in reported sales activity was at least partially driven by a delay in September purchases/closings rather than a significant rebound in buyer activity.

The median sales price in January was $744,000, down 0.8% compared to January ’07 ($750,000) but up 1.8% compared to the month prior. That being said, we continue to believe that mix is playing a significant role in supporting the median in San Francisco.

For the greater Bay Area, sales volume in January was down 41.9% on a year-over-year basis and fell 29.2% from the month prior (3,586 recorded sales in January ’08 versus 6,168 in January ’07 and 5,065 this past December). The recorded median sales price fell 8.5% on a year-over-year basis and was down 6.4% compared to the month prior.

Last month’s sales were the lowest for any month in DataQuick’s statistics, which go back to 1988. Sales have decreased on a year-over-year basis for 36 consecutive months. Prior to last month the slowest January was in 1995, when 4,326 homes sold. The strongest January, in 2005, posted 8,298 sales. The average for the month is 6,319 sales.

At the extremes, Napa recorded a 55.1% year-over-year reduction in sales volume and a 1.8% drop in median sales price, while Marin was the best performing Bay Area county with a 1.8% increase in Median Sales Price (but a 37.4% drop in sales volume). Both Contra Costa and Alameda Counties recorded significant drops in both sales volume (down 42.4% and 39.0% respectively) and median sales price (down 15.8% and 14.4% respectively).

∙ Bay Area home sales lowest for any month in two decades [DQNews]

∙ San Francisco Sales Activity In December: Down Again (-24.4% YOY) [SocketSite]

The data is Bay Area but you title these posts “San Francisco.” I’m sure that’s fun for everybody. But I’m not getting involved any more.

[Editor’s Note: That’s incorrect. The data above is San Francisco county specific (Bay Area sales volume fell 41.9% YOY).]

No it isn’t. Not the DQ News link I clicked on.

[Editor’s Note: Read the entire report. County specific data is provided at the end (which is what we chart).]

293 sales in San Francisco? That’s it? Does anyone know the last time we saw sales numbers below 300?

uh oh, fluj. Check the table in the DQ News article at the bottom. I’m beginning to reconsider my offer to look you up to be my realtor when it’s time for me to buy my trophy home here…..

Well, if nothing else, at least San Francisco had the lowest percentage change in sales volume in the Bay Area. Most counties dropped over 40%. Plus, it looks like the median price only dropped about 1%, not that that really tells us anything.

I’m curious as to what will happen this spring in SF. There is going to be an unprecedented amount of inventory, almost exclusively in the form of condos. A lot of new construction will mix with older condos with increasingly desperate owners.

why would mix support the median price? according to dataquick, purchases driven by jumbo loans are down 63% since august. mix should be driving the median price down, not supporting the price.

[Editor’s Note: Specific to San Francisco, more transaction have been lost in the lower cost districts (think ten) than the higher (think seven).]

Mix makes no sense, when sales volume plummets like this, YOY comparisons of medians or averages become very unreliable. Missionite (who used to post here frequently) gave a nice illustration of how this works:

http://submedian.blogspot.com/2007/11/what-hell-is-median-and-why-should-i.html

As SS notes, sales volume (and prices) have dropped across the board but volume has fallen even more on the low end. So the median is higher even though prices are lower.

You highlight a point that might start to affect the mix in the other way. Jumbo loans continue to have much higher rates and are harder to come by than conforming loans. The new conforming limits might change that (but I doubt it). Regardless, it wouldn’t surprise me if prices and volume start to fall faster at the high end than the low end soon, given the growing and persistent difficulties in qualifying for jumbo financing. It looks like that is already happening in surrounding counties.

I agree that the “mix” should be exerting more negative pressure on median prices at this point. This is exactly what is happening nationally. Afterall, if the “mix” propped up prices for so long- as many on this blog argue- then once the jumbo loan financing fell off the table shouldn’t the mix be pushing the median down in S.F.?

On the other hand, the median price in S.F. is down about 11% from its peak (835K to 744K). Also, unless I’m reading the chart wrong it looks like the current median price is about exactly what it was three years ago in Jan/Feb. 2005. With inflation factored in, median prices have fallen about 10% since Jan. 2005.

If the median price ends 2008 at 700K, then that will represent approximately 40% aggregate (nominal) appreciation over a six year period (with all gains from 2002-2005 and flat prices from 2005-2008), which doesn’t really seem far off the historical average.

Why can’t we say that, on average, prices have not risen in S.F. in three years.

These discussions about “mix” miss the “beauty pageant effect”, well known to behavioral finance guys and many on this blog. Simply put, when you have declining volumes, the logical corrollary is that the “prettiest” assets are selling. The ugly ducklings are not, and that’s why the volume numbers are going down. Even holding steady for mix, if you “force sell” all the ugly ducklings too, you’d see a further drop in medians.

It makes comparisons with prior periods difficult, and probably meaningless without a lot of data digging. While mix is important too, especially when you have declining volume numbers, the beauty pageant effect is likely to be overwhelming.

This is so funny that people are arguing what the median trends really are.

In a typical city (not SF) in which there are multiple small Realty companies, none of which has the power to influence what gets sold, the median is indicative, to a degree, of what people are spending on houses, not the house prices themselves.

But in SF, it isn’t even indicative of that because a very few Realty companies control the bulk of the market, and those companies can decide what they want the median to be, within limits, and then just list a mix of homes that will cause the median to hit that level.

Median down? That’s no problemo at all. The realtors can just slow up the process that brings lower price homes to the market place while rushing to market higher priced homes. That will serve to keep the medians high.

If you have 6 sellers of homes at 600K, 6 sellers at 700K, 3 sellers at 800K and 2 sellers at 900. That would cause the median to be 700K. Let’s assume there are at least two buyers at each of those levels, you just list 2 of each of the homes at 900K and 800K, but only 1 each of the homes at 600K and 700K. You tell the remaining sellers that there are too many homes like theirs on the market, so they need to wait.

Now, when the tallies are done, you have sold prices of 900K, 900K, 800K, 800K, 700K and 600K. Viola: a median of 800K. You’ve just raised the median by 100K. Hooray: our town is so special.

For awhile, you can pretty much just pick a median and hit that target every time! If I were doing it, just for good measure, if someone came at me with a wildly overpriced property at 700K, I’d take that listing right away, just to hide what I was doing, confident it wouldn’t sell and pull down the median.

You are motivated to keep the medians high when those medians will hit your bottom line. When median’s fall dramatically, only the bottom feeders show up and knock the price down on every transaction. You lose money. So you’ll keep them up if you can. In SF, you can!

So a very few large players in a declining market can keep medians aloft for months, maybe longer. What they can’t keep aloft are sales volumes. Those are a much more telling indicator of the “market”.

Volumes of 560 at the January peak to 293 today tells me everything I need to know. The median? That just tells me how well the big 3 Realtor companies are tuning the market, but tells me nothing about the market because it’s so easy to manipulate.

I thought the numbers were also broken down into the top 1/3 and bottom 1/3, as well as the median price. Those numbers should give us a better idea of how the mix is affecting the median price.

SFHawkguy – you’re thinking of S&P Case/Shiller data, which splits into tiers.

So sales volumes are at record lows. Meanwhile, MLS inventory has increased to 1,268 today compared to 1,085 when SocketSite reported it at the beginning of the month, so a 17% increase in 2 weeks. Movoto picks up a lot of “pocket listings” and is showing inventory of 1,338. The CII showed potential inventory of 3,170 including new condos coming to market.

Any bets on whether there’s a “spring bounce” this year? Because if the CII number is correct, we’re looking at nearly 11 months of inventory in the city based on January sales.

tipster, that analysis is off the deep end. Realtors control the median price? Yikes. Buyers control the median price because they’re the ones paying for the houses.

SFHawkguy- the price tiers are in the Case-Schiller data.

This may be off topic but anyone else noticing anecdotal trends in SF that I’m seeing?

1) A huge increase in the number of day laborers seeking work near Cesar Chavez street.

2) A decrease in the amount of visible residential remodeling? I think Satchel characterizes it as the port-o-potty index?

Sleepiguy, No doubt SF will hold up better than outlying counties – I don’t think anyone questions that (if only because it also had less run-up, in percentage terms). But saying it had the lowest percentage drop in sales volume of that group is damning it with faint praise. Its 27% drop in sales volume puts it where Napa Co. was in January 07 (27% drop in sales from Dec 05 to Dec 06). And actually, if you think median price is at all informative, SF is trending worse than Napa was (Napa was up 2.4% in price, whereas SF is down 0.8%). Certainly not the type of environment that I would make an investment in!

A side comment involving “the mix” and jumbo loans. I know someone looking in the sub $1 million market and the financing they were looking at (with 20% down) was a conforming plus a second. Thus, you can have a mix skewed towards the high end homes (supporting the median), while also having fewer jumbos. Don’t know how common this is in the current market.

OK so to get a better idea of the alleged changing mix, is there available a split of the 402 (01/07) and 293 (01/08) by district?

My other thought was that as the Case-Shiller includes (if I am not mistaken) data for SF, Alameda, Contra Costa, Marin and San Mateo, the county of SF only represents 14% of the sales.

I know that the proportion of the top third tier will be significantly higher than this, but still I doubt whether it would be high enough to make even the top tier Case Shiller index very useful as an indicator to the SF market.

@REpornaddict

There are some great tables of sales volumes & median prices broken down by district on Blackstone’s website.

SFR here:

http://www.blackstone-sanfrancisco.com/198.html

Condos here:

http://www.blackstone-sanfrancisco.com/199.html

Unfortunateley it only covers whole years & the year-to-date period, so it doesn’t give you the exact information you are looking for.

Thanks happy renter!

I don’t see the mix changing significantly though: district 10 for example had 21% of the total sales in 06, 20% in 07 and 20% for 08…..

Well, what about district 7? Without pulling out my calculator, that appears to be overrepresented in the 08 numbers. By a considerable amount.

OK so to get a better idea of the alleged changing mix, is there available a split of the 402 (01/07) and 293 (01/08) by district?

Yes (or at least a fair proxy), but you’ll you have to wait until tomorrow. In the meantime, consider the common refrain, “but the good stuff continues to fly off the shelves.”

Not so sure it is – it sells far more condo than SFRs and district 7s share of total condo sales has been constant at around 12% from 06 into 08.

True its share of SFRs has jumped to 8% from 4% but still not a huge slice of the total market – and the average price has fallen (with the small data) from 4.4 to 2.8m! Certainly no sign of a beauty pageant effect within district 7!

Either way, without getting bogged down in the details of one particular district, (I do think 10 merits separate analysis though) I dont think theres any sign of a real change in the mix at all, at least not from these numbers.

I pulled out the calculator for D7:

Condos: 2007: 290 out of 2336 (total)= 12.4%

2008 11 out of 90 = 12.2%

SFH: 2007: 102 out of 2305 = 4.4%

2008: 10 out of 120 = 8.33%

total 2007: 392 / 4641 = 8.4%

total 2008: 21 / 210 = 10%

I’ll let people draw their own conclusions as to whether they think the numbers really make any difference but it looks like sales volume in D7 is keeping pace with last year while everywhere else is way down. D4 is off as much as D10.

Those trying to compare info from different data sources need to be careful. I’m not sure where DQ gets its numbers, but it appears to be broader than MLS sales, which is the source of much of the other numbers being discussed on this thread. There were only 215 sales in SF off the MLS in January (106 SFRs–down 5.4% YOY and 109 condos/TICs–down 19.3% YOY).

On the broader topic of price trends, sales volume is way down while inventory is significantly higher. Both components of the supply-demand curve thus indicate declining prices. If anyone can explain how these could result in anything other than that, please tell me.

So I played around with the BlackStone data HappyRenter posted to see what happened during the last downturn (’90 to ’97).

SFR prices fell 17.0% on average, and the peak to trough cycle lasted 4 years. District 10 had the biggest drop, 22.2%, which took 6 years to run. The smallest drop was in district 5, where prices only fell 9.6% over 3 years.

Condo prices fell 14.9% on average, and the cycle lasted 3 years. District 8 had the biggest drop, 22.2%, which lasted 3 years, while District 6 condos fell only 5.6% over 4 years.

Of course historical data is no precursor of what this downturn will bring. But it illustrates the point that prices in San Francisco have fallen materially before, albeit over the course of several years. Coincidentally, the last downturn did not have volume declines as large as what we’re seeing today, either.

hahahah. check the chart at the bottom of the article. but make the headline sing out. typical. by the way, i saw the chart in the first place. but what does the article SAY? What does the headline SAY? Gee whiz. It says volume down, price about the same. Really now.

I just re-read Tipster @ 1:21 p.m. for a laugh. It’s a nice read if you enjoy sub Bay Guardian conspiracy type silliness.

fluj, what are your thoughts as to why volumes are down so much? To repeat Trip’s question, can prices realistically hold at these levels if inventory keeps rising and volumes don’t pick up?

The MLS sales count for Jan 08 stands at 217 right now (for SFH + condos for SF). (Anyone know why late January reportings continue to trickle in 2 weeks after the close of the month?) The Jan 07 MLS count was 317 and Jan 05 was 352. The the 08/07 delta is about 32% – pretty similar to the DQ decline. The DQ count for Jan 08 was 293 and, again, I guess we attribute the increase over MLS to be unlisted sales.

I posted a preliminary median price comparison (YOY) by district at the end of January. (Note the BX, er Blackstone, shows “average” in their table. Not sure if that means mean or median – but it’s a great table.) At the district level (where the total counts are small) for Jan, the medians went UP for SFH’s in most districts except for 9 & 10. The condo mean was up in District 1 & 5, but down in the higher-volume districts of 6,7,8 & 9.

I do think that Satchel’s “beauty pagent effect” may be a factor in these recent sales. I also think the SS comment about the good stuff flying off the shelves is true too. So far in February, there have been 82 reported sales. This puts us on a pace of 200+/- for the month (although we do have an extra day – and it’s a Friday) which will again be 40% or so below recent peak years. But perusing some of the sales, the medians look UP (a little) and some DOM are really low. It will be interesting to see how our area performs in the next few months – but it seems like SF (and maybe southern Marin) are completely decoupling from the rest of the Bay Area.

I think that a lot of buyers are out of the mix because of credit restrictions, first and foremost. I think secondarily that that has created a bit of a downswell which in turn is giving even qualified buyers pause. People are being cautious these days. I think that’s it in a nutshell: caution. Those who need to buy are still out there. But they are proceeding with caution.

And by the way, is 293 really scary? This is not hypothetical. If any realtors with 20 years experience or more read this, maybe they can answer that. Going back on the MLS it looks like it’s similar to ’01 type volume. I remember that being thought of as a good year for real estate.

As sales volume keeps going down, realtors seem to have more time to spend on socketsite obsessing about the direction of the market (a known unknown). socketsite’s postings volume and SF RE sales volume seem to be inversely correlated. Someone should post a correlation chart 🙂

“Those who need to buy are still out there.”

This is the crux of the problem that the REIC never seems to get. No one NEEDS to buy. Everyone is living somewhere. Anyone who is transferred or moves in can rent if he or she chooses to. The perceived “need” to buy is driven by just that: perception.

Before, it was the perception that someone would be priced out if he or she didn’t jump on the housing “ladder”. That was always a foolish fear. Also, there was the perception that real estate is a “good investment” (it can be I think, but only if you buy at a sensible price). These perceptions are washing out now. Coming soon, I think, will be the perception that buying is a “sucker’s game” and people who bought in 2003-07 will start to hide that fact. I am guessing that there will be a sea change in the way people talk about their real estate. They will say things like, “Yes, I bought my place”, but then hurriedly interject, “but it was a long time ago” before finally saying, “anyone could have seen that buying in the last few years was a bad move….I feel sorry for them….” You’ll also hear, “I rent my place”, more often and more proudly – and without the need to explain why. BTW, if you were in NYC in the early 90s, as I was when I was just starting out professionally, these are EXACTLY the sorts of things you heard.

So, IMO there is never really a NEED to buy. But there is always someone who NEEDS to sell. Just look at the foreclosures and preforeclosures. 🙂

I don’t get why are lot of you are thinking there is some big mystery where prices are going. They are going DOWN. Sorry but real estate prices were inflated by excessive lending. Now that that money is gone prices will be down between 30 – 40% in some cases 50% over the next 3 years. Realtors that don’t start advising their clients to reduce prices a lot now, vs a lot more later won’t be realtors for much longer. Oh and if you are not really selling or buying homes for clients, which only 217 people were last month, then you are not really a realtor anyway.

yeah Satchel you are happy renting and good on ya. Want, need, whatever. Some people prefer to buy. Plain and simple. Stop projecting your view onto others, my man.

And Cooper, 30 to 40 huh? 50 even? In San Francisco? Ohhhhkaaaay …. I just sold a house today. Am I a realtor in your estimation?

The b.s. some of you guys spout, man. Too much. Even Tipster would be red faced

agreed– the b.s. you guys spout man. too much. why can’t you just keep it absolutely factual like all realtors and the N.A.R!

Satchel, I think your comments are always well reasoned and I agree with the trend you are forecasting. BUT I very much disagree with the amplitude.

Do you really think GOOG will be $150, or that SFH in desirable parts of SF would decline by more than 30% over the next few years?

Nobody needs to buy, but saying that renting is comparable is just silly. The rental stock in the city is pretty shitty, especially for SFH. There are always exceptions, but if you just moved into the area or living in a condo and need more space, your chances of getting a nice rental are very low. As you said yourself, you got your rental earlier this decade which was probably the best time for renters in the past 12 years (since I moved the bay area).

There is a lot of things you can’t do to a rental, including hanging pictures on the wall in some extreme cases.

Clearly some people don’t care about these difference, but many people with money actually care. There are plenty of people who accumulated enough money to retire but still continue to work (myself included), so it’s only sensible they SPEND (CONSUME) on housing. After all that’s where they spend most of their free time.

People are justifiably sitting on the sideliness, and yeah some people must sell, but not a lot. Sales volume decline but also inventory. Many properties are withdrawn, which can be considered a bearish sign, but still does people afford not to sell, AKA they don’t NEED to sell.

A major recession and job loss is a totally different ball game. But under that scenario many people will be hurt, homeowner or renters.

Satchel, you mention that you live in the western side of the city. I got the impression you weren’t referring to Pac Hts, Presidio Hts, Lake, Jordan park or Sea Cliff. No one NEEDS to live in these hoods (I don’t), but the discussion here is about desirable parts of the city.

Try renting a renovated SFH in a nice neighborhood (or even a condo outside of the south eastern wasteland), and you’d be greatly surprised what happened in the rental market.

GOOG could easily be at $150 in a few years. Do you remember what happened to YHOO and the other internet darlings between 2000-2003? I bet many people would never have guessed they could’ve fallen as far as they did in such a short period of time.

Pretty impressive the median is only down 0.8% in SF in Jan when jumbo loans are down 60%+ and we’ve got the worst credit crunch in history. You’d think the Median would be down more like 10-15% given the mix of less higher end homes. I guess with the conforming limit going to $729K come mid-March, more mid-higher end homes will sell again.

Still waiting for inventory to come online (besides the $1,000-$1,600/sqft places at The Greenwich and other expensive places in SOMA). The Firestation house for $2.3 mil as the cheapest house in District 7 is not cutting it. Where have all the $1.5 mil SFH houses gone?

The big question is: do people actually spend their 2007 bonuses this year, or save it? I’m inclined to believe in the latter.

Prime Time

I actually do NEED to buy. I have to pay an exorbitant amount of taxes beyond the amount deducted from my pay and both my CPA and financial advisor have told me the best way to offset this will be with a mortgage…

Au contraire,

In very limited situations – almost inconceivable in the SF market these days, and considering the amount of income required to comfortably afford something nice – there are tax advantages to buying versus renting. As I said, at THESE prices and in THIS market there is usually no advantage. Typically, in most markets and at most times, the USG confers a real benefit on homewoners, but it’s less than most people commonly believe.

Tax advantages are likely to accrue at the lower ends of the market, where rents are higher (relative to purchase cost) and where prices are well within the $1MM acquisition debt limits. Also, we would typically be talking about salaries and income in the $125-200K range where there are likely to be significant benefits. Above that, phaseouts atart to become an issue. Additionally, relative tax benefits are more likely for singles than marrieds, and no children versus children (kids have “built-in” tax benefits that are not dependent upon whether they live in a rented home or a mortgaged one). If you feel like it (it’s just an anonymous blog), post your details – income, marital status, dependents, W-2 earner?, current rent, projected purchase price, etc., and I’ll run a very rough numbers scenario.

But, this is the key. Tell your planner and your CPA that you expect your home value to go down by 20-25% over the next few years, and stay down for a decade. Ask their opinion then. If they look at you like you are crazy, ask whether they gave the same advice in 1989 in SF (this time will be worse). Last, ask them whether they have assigned any risk adjustment in their straight calculation of cash outlay in both the purchase and the rent scenarios. You will find that most planners and accountants are very unsophisticated in their analyses (most, not all).

I’m game, Satchel…

– Married with one child and another on the way

– HHI between $175-195k

– No W2

– Current rent: $2700/month

– Projected purchase price: low 700s

HistoryBuff, I actually worked in the tech industry will before and after the crash and have a LOT of context. If you feel that GOOG is another WebVan/Kosmo/Pet.com or even YHOO more power to you. GOOG is now $525, you could short and make a killing. Good luck.

Satchel, I see that we adjusted our gloomy forecast, not it’s 20%-25%? Is it adjusted for inflation or in nominal terms?

Au contraire, Satchel is right, please fire your CPA, he is a moron. Doing something just to get a tax break still means you spend 60% of YOUR money.

The buy .vs. rent calculation is already taking tax deduction into account and if renting feels the same to you like owning (as Satchel suggest), you don’t NEED to buy.

“- Married with one child and another on the way

– HHI between $175-195k

– No W2

– Current rent: $2700/month

– Projected purchase price: low 700s”

Keep renting, you can’t afford to buy. it’s not a knock on you in any way. the market is severaly overpriced. Someone in your good financial situation (assuming low debt and good credit) should be able to buy above the median.

For your current rent price, you would only be able to look in the sub $550K range for housing. With abck of the envelope calcs, no one with a HHI under $200K should be paying over $600k fo housing

The tax advantage is limited if the price declines, particularly when he sales price is a high multiple to your current income. On google, that dang thing is not a pets.com or webvan or whatever. The business will only grow particularly if they don’t pick up any licenses out of this new auction, I’d buy more. As for my forecast on prices–6 monhts ago on this board I said 15-30, right now my # even with all this talk of government intervention (buying loans from banks), I’d say it’s 30-40% decline in prices over 3 years from the peak. And from what I can tell at least 1/3rd of that has already occured. With volumes super low- realtors are not advising their clients well trying to get them to hold on. I’d rather take a 10-15% price decline now then carry a property for 6 more months so I can get a 30% decline. People who need to sell should sell now and price it to move before it continues to get much much worse.

Thanks for the info, au contraire. Just eyeballing it, I’ll say you are much better off continuing to rent, assuming you like your rental. With two kids (soon), you should consider a nice SFH if you are not in one now. A number of nice, fully renovated properties are showing up now for rent in District 4 (nice areas) at $3.5K-4.0K wishing rent prices, which should be attainable at $3K (more or less) for a good family with high income as you seem to be.

I am a little scrambled right now, but I promise I will run through your numbers and post some basic analysis. I am assuming that “no W-2” (I was a little unclear) means that you are a traditional salary earner, subject to the full ravenous maw of Federal and CA taxation. I also assume that you have a 401(k) that reduces your taxable income by ~$10-15K? I am also guessing you’ll put down 10%, and perhaps have to pay a bit of PMI, such that your effective financing cost will be around 7% (more or less). Last, slightly more than $700K for a place doesn’t sound like it will get you a very nice place for a family in SFH. That $3.5K-4.0K wishing rent range applies to properties that would cost roughly $850K – $1.3MM (approximately), but I will go with your numbers.

If I’ve missed anything material in the assumptions (401(k) especially) let me know. I’ll get to the numbers just after market close today, so I’ll post it soon after that.

Cooper, I find it hard to find any evidence that at least 1/3rd (represnting a 10-13% fall) has already happened.

Medians were reported as fairly constant yesterday, and after looking at a breakdown of sales by district I couldnt find nay real evidence the mix of district sales was supporting this figure.

True volumes have plummeted and this may well lead to drops in the future – but if we really are 1/3rd into this I dont think its going to be at all bad. I did note as well from the graph above that there were material drops in volumes this time of year in 05, 06 and 07. While I appreciate the drop is bigger this year, I do believe its not until say March that the picture will really clear.

Dead REpornaddict: You find it difficult eh? I said 10% from peak to trough. Look at the graph at the top of the page. Top median $835,000. Current Median is $744. That’s without making any median vs. average arguments which would make it much much worse.

someone,

About my forecast, I actually have a range, and I don’t think I’ve really changed it much. I think SF on average will get a 30% decline (peak to trough). By “average” I mean that if you were to throw a large number of darts at a map at time T1 (the peak – meaning on average the end of 2006 is my best guess; again, an average – some neighborhoods peaked earlier, some later), and revisit those properties identified by the darts at time T2 (24-36 months from now), the average of the declines in aggregate will be 30%. Some neighborhoods will do comparatively much better – parts of Marina, say, or maybe Pac Heights, who knows? will see lower falls. Some nieghborhoods will see 50+% declines (parts of Bayview, parts of Sunnyside, parts of Bernal Heights going down the hill towards Alemany, etc.). There may well be 70-80% declines in some spots. Most places where people who are not super wealthy but who desire a stable reasonably nice place to raise a family will see declines of 20-30% IMO.

I think mostly in real terms, but I am not forecasting a lot of inflation, and the bond markets seem to agree with me, so I think most of the adjustment wil be in nominal terms. There is a nontrivial chance of outright mild deflation (as in Japan), which would lead to even greater nominal price drops.

Satchel, you’re correct regarding the 401k and the fact that we’re both salaried employees. We are paying additional taxes of approx. $15k/year on top of our regular payroll taxes with 0 withholdings. We will put between 10-15% down on a property.

I’m afraid we do need to consider moving as our current place will eventually feel too small for a family of 4.

Satchel, sorry, just to clarify, the HHI number I mentioned is our taxable income *after* 401k deductions.

Sorry Cooper – I take your point about your prediction (and Satchels) being from peak.

what is interesting though is that 30 from peak is about $585k – which would only bring us back to prices in the Spring of 04 – which does show the extent of the appreciation in 04/early 05 given that prices have been fairly flat since then.

@someone

How about Cisco, Intel, Microsoft? Is GOOG comparable to them?

With all of the above their products make it hard for the installed base to switch to the next new hot company with cool products. Because switching costs money and real infrastructure. Yet being leaders in the market their stock took a beating and never really came back to the dot com days.

With Google one only needs to type a different URL or change the default search engine to another one. A couple of missed quarters and GOOG will take a huge beating.

Au contraire posted:

– Married with one child and another on the way

– HHI between $175-195k

– No W2

– Current rent: $2700/month

– Projected purchase price: low 700s

I would be interested in where Au contraire plans to buy for $700K in the Bay Area where he wants to move a family. The place I rent in Pac Heights for $3,500 a month would probably sell for $1.5mm as a condo.

For those worried about painting or “hanging pictures on the wall” when renting why worry about it since when you can rent for thousands less every month it is not a big deal to pay a little for patching and painting to make the landlord happy when you move out.

PacHeights Renter,

“why worry about it since when you can rent for thousands less every month it is not a big deal to pay a little for patching and painting to make the landlord happy when you move out.”

Truer words have NEVER been spoken! Think about it, people. In ONE month, you often save enough $$ to cover the ENTIRE security deposit, when you are talking about renting a $1.5MM place for $3.5K versus “owning” it. (btw, almost EXACTLY the ratio I encounter: $3.1K for an SFH that would sell for $1.3-1.5MM, but in a somewhat less desirable neighborhood than Pac Heights).

The “equities” of the situation favor the renter, here. Do what you want to the property – who cares? – you’ll lose the equivalent of TWELVE security deposits in the first year if you buy! (assuming no appreciation). Not to be too blunt, but someone here once talked about a landlord who was “hassling” the tenant about showing the house, etc. Gently remind him that you are in possession of his bubble asset. Point out that tubs, for instance, have a nasty habit of overflowing and destroying nice wooden floors, and causing all sorts of sheetrock damage. He’ll get the message… 🙂

Why not nail a hole in the wall of a rental? Sounds like normal wear and tear to me. Same with painting. I’m going to just paint a rental if I want to. There is no damage to the rental by my choice to do that.

If a landlord is going to punish a renter by withholding from the security deposit he better be sure the law is on his side. In San Francisco a landlord has to be pretty stupid to nickel and dime his renters this way. I might be ticked off enough to pursue treble damages (or whatever damages allowed) if I felt the landlord was being unfair. Don’t underestimate the emotional factor–if a renter feels he’s being screwed he will pursue a claim even if the monetary return is minimal.

And btw, I had one landlord that requested I use hardware (these brass clip thingies) that attach to the moldings to hang pictures (this was a typical old SF apartment with 12′ ceilings). I happily complied with her wishes but would not have hesitated to just punch a hole through the wall if need be.

From the Chronicle’s SF Gate today: Head: Home Sales Through the Floor

Lede: Transactions hit 20-year low and prices in some local counties slide over 20%. But not S.F. and Marin

Scroll down, and :

“San Francisco resale home transactions declined 32.1 percent year-over-year to 152, another 20-year low, while the median price increased by 5.8 percent to $820,000. When new homes and condos are included, the median price fell 0.8 percent to $744,000. The median means that half the homes sold for more than that amount and half for less. ”

Quite a difference in presentation, I’d say

Resale median UP 5.8%!

why is that so much better then when new homes are included – 0.8% (new condo developments bringing this down?)

Am I right in saying that resale medians are a better feel for what is going on?

SFpornaddict, you really meant to say “SFREpornaddict”, right? 🙂

Bears would use whichever number seems worse market. Bulls would use whichever number seems better market.

Oops a Freudian slip????

Just that I believe the Case Shiller uses resale prices only, and is much celebrated for doing so.

I’m surprised that resales can turn a 5.8% gain into a 0.8% loss though – but I guess its possible where resale volumes are low.

‘I’m surprised that resales can turn a 5.8% gain into a 0.8% loss though’

should read ‘surprised that new sales….’

of course!

PacHeights Renter, I think it’s quite likely that I’ll be able to find either a small 3-bedroom or large 2-bedroom place (the kids would have to share a room) in the Sunset, Richmond or Parkside areas for the low 700s.

tipster – Oh man, you’re disappointing me. Usually your posts make a lot of sense. But the big 3 RE firms colluding to manipulate inventory ? I don’t think so.

I can see it now. The heads of the big RE concerns meet at the boardroom of Dr. Evil’s underground lair carved into the rock beneath Alcatraz. “OK it is decided then. We’ll sideline this batch of properties to force the median up and then we will reap One Million Dollars!”

If I were a self-interested owner of a large RE firm, I would be making sure that every one of my listings was getting the right exposure and had the highest likelihood of selling. That means marketing it properly whether that be via a pocket listing, MLS, web, or whatever. That also means convincing sellers to accept a contract price that a buyer is willing to offer. The name of the game is to get inventory off of the shelves and increase transactions. After all it is the transaction that creates the commission. Manipulating the market makes no sense.

That doesn’t mean however that RE firms don’t manipulate the stats other ways. The DOM figure for example is almost meaningless here in SF. The “over asking” statements are also highly suspect.

Satchel – Agreed that no-one really needs to buy. However many have a strong desire to buy and that is effectively the same as a need. The only variable is the buyer’s patience.

I want to buy and most likely will when the numbers come into alignment. I believe they will some time in the next few years and I can wait. I made my last two purchases near the end of a several year slump in the market and just before periods if high appreciation. The first by chance and the second absolutely intentional. In fact it was the slump in the market that woke me up and got me out on the streets looking. Otherwise I probably would not have bought.

AuContraire: Realty Trac shows lots of homes in the Parkside district in pre-foreclosure. Low 700s should be a snap out there.

Satchel, given your elaborate explanation we only mildly disagree. I think SF will fair a bit better on average, but your numbers are in the right ball park IMO.

Au Contraire,

My rule of thumb of buy .vs. rent is 22 years, i.e. if the house sells for a lot more than 22 years of rent forget it. (using 7.5% for intreset+prop tax and 40% marginal tax rate (state+fed)). In your case the marginal tax rate is lower and you probably don’t have enough of a down payment to get a cheap loan, so I’d go with 8% and 35%, which leads you to around 18 years multiplier.

I know nothing about the rental market in district 4. Your 700K budget seems sensible given your income, and it’s probably equivalent to $3250 rent.

The only way to really make the decision is personally face the facts. Go look at rental/for sale stock in those neighborhoods you can afford. My hunch is that a $3,250 rental would be in a better condition than a 700K house.

Rent for couple of more years and buy those homes for 550K

Au contraire,

I’ll get to the numbers I promise, and I’m guessing I’ll come out somehere near where someone did. But in terms of renting, you should have no problem getting a nice 3/2 SFH in a nice area in District 4. As a high income family, you are a very desirable renter. When you look on craigslist, discount all those wishing rents by 10-25%. Many small landlords use high advertised rents as a way to “screen” tenants whom they would like to reject for racial or other reasons. Whatever – you don’t have to agree with their motivations, who cares? – take the marketplace as it comes I always say. If you show up as a professional traditionally married family out here in the nice family parts of District 4, I think you will have a big advantage. In looking at specific rental properties, ALWAYS check how much Prop 13 tax the owners are paying. Target the ones with absurdly low Prop 13 taxes. Many houses are vacant out here because long-term owners are just keeping the properties for their kids. These are the sorts of landlords who are unlikely to raise your rent or oterwise try to maximize rental income. They are generally more interested in preserving their asset and generating a little cash flow on the side. Offer to pay cash. Larceny lurks in the heart of every man, and the temptation to get some tax free green should never be glossed over!

Here are a few rentals from craigslist right now. I don’t know any of these specific situations, but ALL are in EXCELLENT locations if you have a young family. Most of these have been vacant for MONTHS, and you would be able to get discounts on almost all of these, and on some, substantial discounts, or I’ll eat my shoe. I know you are probably not looking right now, but this should inform your thinking a bit. Rents will go lower too as the recession takes hold, but in the very short term there might be some pressure as potental buyers who are priced out by the credit restrictions have to rent for a bit. Shouldn’t affect the $3K rental market too much but you never know.

http://sfbay.craigslist.org/sfc/apa/575409331.html

http://sfbay.craigslist.org/sfc/apa/575352960.html

http://sfbay.craigslist.org/sfc/apa/575167140.html

http://sfbay.craigslist.org/sfc/apa/574805549.html

http://sfbay.craigslist.org/sfc/apa/571911021.html

http://sfbay.craigslist.org/sfc/apa/569841515.html

http://sfbay.craigslist.org/sfc/apa/569751522.html

http://sfbay.craigslist.org/sfc/apa/567350428.html

Remember, don’t even DREAM of paying these wishing rents, and don’t forget the possibility of a cash “discount”. And, once in a while you will come across a failed flip (there are one or two above). Treat those owners with all the disdain that their foolishness warrants, and be careful if you ever rent from one. Use an escrow agreement for the rent, and security deposit. Some of them are going DOWN into the BK dumper and you don’t want to get your good cash mixed up with their folly.

Oh MY! Don’t look now, but if those Craigslist listings are for real, San Francisco rents are looking almost cheaper than Chicago! I work in Chicago about 40% of the time and am VERY familiar with what it costs to rent condos or homes in similar neighborhoods. I hear some people say that rentals in San Francisco are dumps, but have you ever looked at used homes that are not fluffed and staged lately that are for sale? These rentals are really quite a good value.

I bought wayyyyyyyy back in 1990, so my situation is different, but I had no idea what a good value some of the non-glamorous neighborhood rental homes are right now. If I were younger and moving to San Francisco, there would be no choice but to only rent right now.

anoncomplainer, you took the words out of my mouth.

Many young professionals (we included) completely ignore that part of town, because of the weather and amenities. It’s also a lengthy commute for downtown/SV. Luckily I bought early enough and don’t really need to work, so I can afford a very nice place in the more desirable locations (Noe). But if you are just a “normal” double earner, you really can’t get anything 3/2 that nice anywhere “desirable” in the city for less than $5K/month or $1.5M ( buy).

Only exceptions would be Bernal and Portero, but the rental stock is crappy and they are 3rd tier.

Au contraire,

As promised, I ran a very rough numbers scenario on your circumstances. You should compare these numbers with the ones your accountant is telling you, and obviously make any adjustments to the assumptions that would result in a more accurate scenario analysis, and of course NEVER rely on what random anonymous bloggers are telling you!

Bottom line, IMO you are MUCH better off renting for now, so long as you are not expecting significant appreciation of Sunset or Parkside properties. If you are expecting depreciation (as I am), buying an SFH there now will be a VERY bad move.

Under reasonable assumptions, if you buy a $725K SFH, you can expect that your actual real cash after tax housing expense will increase from your current $2700 to $4100. Although my numbers are rough, they should be within 5% of your “true” cost, and if anything my estimate is likely to be on the low side. So, so long as you are not forecasting appreciation – and leaving aside the noneconomic benefits of owning – you should be indifferent as to buying a $725K SFH or renting one for approximately $4.1K per month. Go rent yourself a nice 2300 square foot house in Monterey Heights, Westwood Highlands or West Portal (all much nicer areas than Sunset or Parkside IMO) for $2.5-3.5K and enjoy your life! (That rented house will be significantly nicer and/or in a significantly better neighborhood that just about any $725K SFH in Sunset.)

Here are the numbers and assumptions.

Salary after 401(k) deduction: 185K

Married, joint filer, (2 dependent children – soon! Congratulations! I’m a parent too)

House cost: $725K, 90% financed @ 7% (perhaps a slight bit high, but maybe not)

Property tax: $8.3K

Annual insurance (including earthquake): $4.8K (based on CA insurance website survey averages for Sunset properties at this price)

Nondeductible PMI: $3K (annual, you could wrap into loan and make it deductible but then it would be a little higher and never goes away until refi)

Annual maintenance/improvement: $3.6K (this is LOW of course, at only 0.5% of purchase price – remember, one roofing job will eat through 4-8 YEARS’ worth of this estimate)

So, under those assumptions above, with NO house, you should be paying approximately #33,989 in Federal tax, and $11,386 in CA tax, for a total tax burden to fund the ravenous maw of government and to subsidize all the foolishness that the USG and CA do (they do some good things too, but very few) of $45,375.

NOTE THAT THESE ARE ALL 2007 NUMBERS. Your burden should be LESS in 2008 because of bracket inflation (I added the 2nd child in there, though, so it shouldn’t be directly comparable to what your accountant is preparing now.)

Once you purchase the house for $725K, under the rest of the assumptions above, your new tax burden will be $20,356 Federal, $7,023 CA, for a total of $27,379.

The difference between owning and renting from a tax perspective is therefore $17,996, or $1,500 per month tax savings. NOTE that if you have other deductions (you almost certainly do), this relative tax benefit goes DOWN. NOTE also that you do not encounter any AMT issues under either scenario, but that you are already into the “phaseouts” where your income starts to reduce the value of your mortgage/property tax deduction (the realtors never tell you about this – most in my experience don’t even understand basic tax, leaving it mindlessly to their “tax guy”, ASTOUNDING when you consider that they are advising on $1MM+ properties….).

So, here’s how we get to the monthly rental equivalent number. Deductible expenses of $3.8K mortgage interest + $690 prop 13 tax. Nondeductible monthly expense of $250 PMI, $400 insurance and $300 average maintenace costs. Add $160 for the after tax return (invested in the safest CA munis – this is a LOW estimate) that you would have earned on the $72.5K that you just plunked down as a down payment, and it all adds up to cash expense (or foregone investment return) of $5.6K per month. Netting out the $1.5K tax benefit, and you get to the $4.1K figure.

Last, just as an OT aside. Save your money. Your kids are your true wealth. Don’t trust them to the psychotics running the SF public school system (unless you happen to win the lottery and they get into Clarendon or West Portal School – even then, it’s iffy. The kids of the principal of the West Portal school themselves go to Catholic school out here!!). There are also some reasonably normal private schools, and excellent (though pricey) Jewish schools. It really is a wonderful and normal family life out here. Lots of stay-at-home moms (and even a few dads!)organizing playdates and gatherings at local parks. Good nanny network for those who have to work. Standing room only at Mass at St. Cecilia’s. A few neighbors on my street have each other keys in case of emergencies or to feed the cats/fish, etc. For SF, it’s almost like the “land that time forgot”.

I hope the above numbers are helpful. Again, CONSULT YOUR OWN TAX ADVISOR, and DON’T TRUST RANDOM BLOGGERS, but those numbers should be a good starting off point for thinking.

Au contraire,

Here is a contrarian’s perspective: Do not base your home buying decision finally on others’ predictions of whether “the market” is appreciating or depreciating. Many folks here will not buy until prices fall by their predicted 20-30% — i.e., they will never buy.

I’ve been in the SF market for 10 years. In 1998, they said prices were too high; in 1999, they said prices were not in line with incomes; in 2000, they said prices were going to drop dramatically; in 2001, they said the market was overheated. In 2002, prices had not come down enough, and were going to fall further.

I bought in 2002; wished I had bought in 1998.

Bottom line for SF — if you can afford it; if you want to live there; if you plan on living there for at least 5 years – buy it.

@ sanfrantim- thank you, I could not have said it better myself. Excellent advice.

@sanfrantim: I agree with you (and have a similar anecdote), but *this time it may be different*, and there is no harm waiting a bit.

It’s surprising we’ve had such weakness (and sales weakness even in SF proper) given we are not officially in recession, and the full effects of the credit crunch have not been felt (or exposed, frankly). It reminds me of that South Park cartoon where everyone resorted to canabalism after two hours without food. What would happen if things were worse? 🙂

Brushing this off like it is 1998 (clearly just coming off the last low) or even 2002 (already in recession, which turned out to be mild because of loosened credit standards) might be premature. Five years is not too long, and in a recession, your plans can change quickly unless you are wealthy.

My google lazy indicator suggests good properties (which I hereby refine as the SF-county median) should be back to fall 2006 or so, but it makes no volume predictions, so the data broadsided me 😉

Also agree most bears will never buy. In a recession, these folks are in a bunker drinking powdered milk and blogging about spreadsheets, not going to open houses staged with chopped pillows!

Satchel,

Althought I agree with your conclusion (rent is better), your numbers are inflated to justify your point. The mortgage rate is nowhere that high right now. He can get 6% with decent credit.

Nobody pays the earthquake insurance. It is better to use the money (your 0.5% maintainance cost) to earthquake-proof the property. If you are really worried about earthquake, don’t buy. Even most condo’s insurance doesn’t cover earthquake, and it costs an arm and a leg to get it.

The insurance on a $700K house (no earthquake insurance) is about $50/month.

So, just by eyeballing it, his monthly after-tax cost on buying is about 3200.

Also, remember, the principal portion of the mortgage payment is NOT an expense. It is transfering money from one kind to another. If you consider that, his real expense is about $2800/month, maybe up to $2900, but not much higher.

My problem with his number is that he should try other ways first to reduce taxes. Since there is no W-2. He can take self-employment 401K or SEP IRE, and put 20% of his income into retirement. That will reduce his income to $155K to 160K. That’s below the AMT phase-out level for the couple, and reduces the tax deduction benefit, and thus changes the calculation above.

Still, we are looking at marginal higher cost. If he makes $240K or higher, I would say that’s a definite buy (since he is solidly in the phase-out level even after the solo 401K). Right now, it is a judgement call.

Guys, guys. I just have to jump in here. Can’t speak for all bears, but this one has no problem buying. It’s all a game to me – I don’t buy overvalued assets period – but as you might guess, my method of asset price evaluation is pretty sophisticated, and is not for everyone.

BUT, keep in mind Au contraire’s situation before you get all misty-eyed thinking about your future SF real estate wealth (and yes, double dub, this time will be different IMO). Au contraire is a parent, with 2 children (soon) and a household income of $185K. He or she is looking to buy in SUNSET or PARKSIDE. This isn’t Noe (even Noe won’t be “Noe” in a few years!). Are you forecasting significant appreciation for Sunset from the $725K SFH level? Just how high do you think it will go in 5 years?

Also, keep in mind rental stock out here in District 4 and points west. We’re talking about being able to get a whole house for less than $2.5K – at least a house that will be comparable to what the Au contraire household is looking to purchase. That will be a little more than HALF what it will cost to buy, in after tax dollars. If that household were to sell in 5 years, don’t forget the pounds of flesh extracted by the used house salesman and the transfer property tax monsters.

Also, don’t forget the school cost for this family once the little ones are ready. We’re talking another $15-40K per year in after tax dollars, just to save them from SFUSD!

I did a back of the envelope calculation. At $2.5K rent versus $4.1K cash outlay to buy (in each case per month), and factoring in the selling costs of the property in 5 years (mentioned by sanfrantim), and assuming an almost absurdly low 3% return on the money saved by renting versus buying, the $725K Sunset house today would have to be worth $886K at the time of sale JUST TO BREAK EVEN. Do you guys want to predict that the $725K Sunset house today will be worth $886K in 2013?

If you do think that, you are probably the kind of “investors” who drew a line regarding the NASDAQ in 1999, and projected that it would be worth no less than 10,000 today. I told a bunch of people who asked me at the time (I get these questions all the time with my finance background) that fair value was no more than 1500, and it might go lower. Most laughed at me. Some of them (after getting wiped out in tech stocks) rushed out to buy properties in 2003-05. I was ctually a big buyer of stocks in 2002-03, and some of those people asked me again. I was bullish, and they laughed at me once again, telling me that properties were the way to go. At least one bought in Bakersfield as an investment and another bought in Foster City, San Mateo County.

Like I said, it’s all a game to me. But it might not be a game to the Au contraire household if I turn out to be right, that’s all.

BTW. I bought the NASDAQ all the way down from 1500, and probably averaged in around 1300-1400 equivalent (actually bought the QQQs – now they’re the “QQQQ”s) and got out (where tax efficient – where not efficient I went flat or short with options) around 2500 this past year.

John,

Thanks for the agreement with my conclusion. The numbers may be inflated a bit, but I assure you not to try to make my point look better! I just don’t know the exact parameters here (I do in Greenwich, CT, BTW).

About insurance costs, this is a 90% financed property. I do not think the lender will allow them not to have full insurance, including earthquake. Correct me if I am wrong about this.

About mortgage interest, I was only deducting interest. Of course I understand the difference between pricipal and interest deductibility. But in the first years, principal payoffs are very small, so I basically ignored it. About 6%? We are talking a jumbo here. Even with good credit, I don’t think you are getting 6% (with no points) but I stand ready to be corrected! Calculated Risk had a good piece this morning about what is going on with jumbos right now. Bottom line, they are going to be separated and they will carry higher rates and fees than old conformings.

About W-2, they are salary employees (they clarified it) so no free tax cheese for them!

Just a note. What is the insurance cost for a $700K house in Sunset? I just used the average from the CA gov website survey (I actually went low on the average). I also estimated PMI low. And I think I estimated maintenance low (remember we are talking an average of 0.5% over a reasonably foreseeable investment horizon – most people suggest 1%, and I even think that you yourself suggested that condo maintenance fees are roughly comparable to SFH maintenance costs, and I don’t think those condo HOAs are less than 0.5% annualized, but maybe I am wrong?).

Satchel,

Great assumptions and analysis. I think private school tuition is really the straw that breaks the camel’s back for most home buyers in SF. Factor the cost of tuition for two kids (for us that would be $23k/kid), and the inflated home prices, and no wonder families are leaving. And yes, we tried the public school lottery…

You are taking a large risk when you are buying a house. You’re taking a very large chunk of your liquid cash and tying it up in a highly illiquid asset. You are willingly paying large transaction costs when you buy and larger costs when you sell. Why? I saw immediate monthly cash flow savings over renting when I bought my house in 1996. It’s very clear from reading this thread that today you have to pay extra each month for the privilege of “owning”? I don’t see why anyone will choose the risks and uncertainties of buying over the freedom of renting while saving each month. Oh yeah, “House Lust”!

Satchel.

Do your math. The “small” principal payment for 700K home is about $500/month. Of course, 6K/year is “small”, but when you look at the monthly cost, that’s about 15% of the total payment.

Yes, 6% can be had, even right now. He could even get a conforming loan with the new limits. Again, please call up an lender and ask. Don’t say “Eloan won’t give 6%, so it doesn’t exist”.

Don’t use some government data for your insurance estimate. Call an insurance agent (State Farm, Farmers) and ask. Your number is way off.

No, lenders do you require earthquake insurance. Please, call up a lender and ask.

Au contraire posted:

– Married with one child and another on the way

– HHI between $175-195k

– No W2 http://www.newsweek.com/id/39380

By the way, put 20% down and save that $200/month PMI. His monthly cost will be damn close to renting.

If you don’t have 20% down, and enough saving to last four or five years, you shouldn’t buy anyway. See, I am actually quite conservative.

Satchel,

Thanks for providing those rental listings. I went through them and was excited to see

http://sfbay.craigslist.org/sfc/apa/575352960.html. This gives me a perfect apples to apples rent-buy comparison since I am pretty familiar with this property.

I took my wife and my visiting mother-in-law to see this place at its open house in Nov (http://www.trulia.com/property/1046062857-835-Foerster-St-San-Francisco-CA). After taking my mother-in-law to 2 really terrible places she was urging us to move out of the city. Then we visited this house and she urged us to make an offer. It is pretty nice, but not at $989,000 (last sold $950k on 8/06). It is one of the properties I have been watching to check out its final sale price. Looks like this one never sold. We’ll see how long the owner can afford to take a loss on renting this house out.

This house would be a good one to rent for au contraire. For me, I’ll stay in my $2000/month 2bd/2ba condo until we need the space.

Au contraire, my calculations on 700K property:

At 6% mortgage rate, 20% down, your interest portion for the mortgage is $2800/month. Property tax $665/month.

Your marginal tax rate (if below the phaseout level)is 26% + 9% = 35%. Tax deduction from the mortgage interest is $980.

Your insurance cost is about $50/month. Maintainance cost $300.

Oppotunity cost on the down payment $400/month after tax.

Your total cost/month. $2800 + $665 – $980 + $50 + $300 + $400 = $3232.

Now, if your income is above the phaseout level, your marginal tax rate would be 42% instead of 35%. Your real cost will be another $200 lower – at $3036/month.

For 725K SFH, it is $3347/month (if income below AMT phaseout level) or $3144/month (if above AMT phaseout level).

However, since you said “no W2”, you should talk to a tax advisor about setting up a solo 401K or SEP IRA first. SEP is quite easy to do at Schwab.

And personally, I wouldn’t buy unless the buying cost is lower than renting. You still save $300 to $500/month by renting. However, some people like owning, even if it costs a little more. It is up to you to decide whether it is worth the additional cost to own.

OK, I had to scroll back a lot to see the clarification about “salaried employees”.

Hey John,

Thanks for pointing out that I didn’t include the principal. You’re right! It is about $500 per month. But, of course, you’re wrong about that omissions “inflating” the true cost of buying. It actually deflates it, as the principal is not deductible.

You’re tax analysis, though, is all wrong. I’ll rerun the numbers as soon as I have a chance. For some examples, “phaseouts” don’t really have to do with AMT. Also, you can’t deflate deductible expenses by the marginal rate. This was already pointed out to you in another thread, so you should know better.

About insurance, I am surprised about that $50 per month figure. But I’ll go with it. Are you sure that is comprehensive, and that it covers things like liability (important when you own a property as you know – you can be a target for suit – and putting the house in a revocable trust ain’t going to help you with that one)?

6%? No points? Again, doesn’t sound right, and my brother actually sells title insurance so I know something about this, but well – what the heck – I’ll go with that as well.

20% down? Au contraire mentioned a resource constraint, saying they could only put down 10-15%. $140K+ is a lot of cold hard cash for most young families. I went with 10% because of my predisposition to not get too much $$ caught up in a mispriced asset. I’ll stick with 10% because that is what Au contraire posited.

SF schools good? I take it you do not have any children. You know less about that than I do about CA insurance!!

I’ll post some numbers tomorrow for those who care. The comparison (even with the too low 6% interest rate and the seemingly low $50/month insurance cost) is going to be WORSE, I’m about 95% certain.

evan,

That 835 Foerster property sold in 2006 for $950K BEFORE it was renovated! So, even at $989K wishing price, the flipper is eating a LARGE loss.

The property has already stopped paying property tax, and it was financed 100%. Any renter giving that yahoo more than $2.5K has to have his head examined (it’s probably only “worth” $3K as a rental at most even if there was a stable ownership situation there).

My guess is that one is going into foreclosure, to join its brother right down the hill at 414 Foerster.

Glad you didn’t put in an offer on 835 Foerster! I know this area very well. I’m a bear, as you can tell, but I bet if you are patient you will get properties like that in the high $500’s. Might take 2-3 years.

evan,

I should point out that my only information about 835 Foerster is based on publicly available information – Propertyshark and the SF property tax website (https://services.sfgov.org/ptx/PropertyDetail.asp?ID=VECPOVYTFPXJIZBDBLCEPRLPFNDMOJFKOFOQRBNTFXDOEHROPJ)

Still, though, I’m glad for you that you didn’t put in an offer. Real anecdotes like this house and the 414 Foerster foreclosure down the street from it (sold for $770K in 2006 BEFORE renovation, and now in foreclosure and sitting there unsold at $642K) really make you question whether the “true” market ahsn’t already started its decline out here….

sanfrantim wrote: “I’ve been in the SF market for 10 years.” So you have no idea that many people that bought in 1989 had to sell for less than they paid in the mid and even late 90’s…

Satchel,

I was never in any danger of making an offer on this house – I don’t even have an agent yet. I was actually trying to show my mother in law what is happening here, and why I am not eager to triple my monthly payment. She was pretty impressed by the fancy kitchen in 835 Foerster although for $1M you should expect high end appliances. The agent told us that it was renovated before this guy had bought the place. Maybe he was just unlucky to be left holding the bag.

I am not interested in buying a house as an “investment” so much as a nice and cost effective place to live. When people say things like, “You have to buy now or you’ll be priced out of the market” you know that it is the wrong time to buy.

I have read many of your posts, and many of your predictions are based on a belief that the economy is in big trouble. I admit that your analysis is over my head, but I still don’t understand how our economy works when we don’t actually make anything. I would think that a country needs to make money from people in other countries to be an economic superpower. But, I’m a software developer, not a finance guy.

So, I’m going to operate under the assumption that we aren’t going to fall into a severe recession or depression. I would expect the price of houses to stabilize with respect to equivalent rents. These are the types of numbers I am trying to come up with to determine when it is time to buy. Obviously, it is not now.

Satchel,

At that income level, the tax deduction is the marginal rate in AMT. I used the 26% + 9%, conservatively. It still comes out $3300, instead of your $4100.

And I have kids. I am not going to explain my family situation. That’s private. I know full well some of the SF public schools are good, some are not so. The issue is the lottery system.

However, if you want definite good public schools in bay area, you will have to move to Cupertino or Fremont – not the kind of urben life like SF.

So it doesn’t matter anyway. It is only a factor when you decide where to live (SF vs Cupertino). Once you decide to live in SF, that’s not a factor.

7/1 Mortgage rate is easily 5.75% and penfed.com. 10/1 at 6.25% for conforming loans, no points. Like I said, I don’t know when the new conforming loan limit will go into effect, and what kind of impact it will have on the rates. Given that average families in US live in the property for 7 years, I wouldn’t get 30-year fixed.

Talk to a loan broker, and I am sure he can get rate lower than that. However, YOU HAVE TO SHOP AROUND.

That down payment will be a problem. I am totally against people putting 5% to 10% down and pay that stupid PMI. If you have to do that, take one 80% loan at 6%, and one second loan or HELOC at higher rate (maybe 8%).

Satchel, your calculation is based on worst case, take whatever the most convinient route, and get ripped off. I already said, if you are that kind of person, don’t buy. However, I am sure even you shop around when you buy your TV, computer, or digital camera. I am sure you don’t pay MSRP for your car either. When you buy RE, you have to shop around too. You used MRSP. I used better deals you can get with a little bit of work by just making 4 or 5 phone calls for each item (insurance, mortgage etc).

By the way, guess what will happen when the Bush tax cut expires after 2010? (we all know it won’t be renewed). Buying will make even more sense for people in high tax brackets. That’s one reason I continue to predict the bottom of the market at end of 2009/early 2010.

And Satchel, you didn’t understand that principal payment is not an expense. Interest is. Principal payment is still your asset, just changed a format. His monthly mortgate payment may be $3300. However, only $2800 is expense.

That’s why sometimes it is easier to make comparison with an interest-only loan. Whether that’s the right loan to get is a different story, but that’s the easiest one to use for apple-to-apple comparison between rent-vs-buy.

And then again, to be fair, you have to add the cost of buying and selling. That’s about 8% to 9% of the price (2% when buying, 7% when selling). If we don’t make any assumption on the pricing trend, and assume the average 7 year stay, that averages to $700 to $800/month. That will indeed push the cost per month to over $4000.

John,

“And Satchel, you didn’t understand that principal payment is not an expense. Interest is. Principal payment is still your asset, just changed a format. ”

Now, this IS stunning. I think you really do not get it. When you make a principal payment, that money is safely in the pocket of the bank. It is NOT your asset – at least it is not you asset free and clear, as it was before you wrote the check. It is now subject to the risk that you cannot sell the home (after paying the “6%-er” and the transfer tax) for more than your remaining principal balance on the loan PLUS your principal tied up in the down payment.

You are VERY wrong in your tax analysis. I have a few minutes this morning and I will run the numbers. When you do a tax scenario analysis, you need to work through the brackets for a particular income/dependent/deduction scenario versus a base case. With tax software, this is trivial, of course. You CANNOT deflate a payment by a marginal rate. As an extreme to show you the idea. If you make only $70K per year, in theory your “marginal” tax rate (for a family) is going to be 15 or 25% at most. However, when you work through the calculation, you will find that the mortgage deduction is worth $0 because of the threshold standard deduction plus exemptions. At the OTHER extreme, if you have AGI of $2MM, your marginal rate is ~35% at the Fed and 10%+ at the CA level. Yet, because of the phaseouts of itemized deductions (which you obviously do not understand, but which are themselves being phased out slowly for 2008 and 2009, but which will “snap back” in 2010 when the 2003 revisions expire, as you seem to grasp), this $2MM AGI taxpayer will see 80% of his mortgage deduction disappear! Between those two extremes of course lie most peoples’ situations, and that is why you need to run a scenario analysis.

@evan – The realtors ALWAYS say it was “renovated before”! They NEVER want to give the impression that a house was bought to be renovated and flipped. My wife and I have heard some HYSTERICAL ones in our neighborhood at open houses. They say the craziest things, like, “Oh, this family bought the place to live in and did live there, but a ‘job change’ forced them to move out of town – there ‘might’ have been a little updating here and there…” And then we point out that we live in the neighborhood and we know for a FACT that there was a down to the studs remodel, and NO ONE WAS LIVING THERE the whole time, they just change the subject or give you that blank, silly look. A little sleuthing often shows that the “job transfer” is suspect, as the flipper all the time owned and continues to own a nice house elsewhere in the neighborhood. It must be tough to be a realtor – I actually feel for them…..

Au contraire (& John),

Wow, after all this I hope you are still reading! Last post from my end on this, unless someone cn show me a legitimate flaw in my analysis.

John made the helpful suggestion that I not ignore principal payments, and he’s right. It is a cash outlay, and I was just being sloppy.

John also thinks that comprehensive insurance for a $725K property in the Sunset (which would cover damage to the structure and liability for people injured with in it, but NOT earthquake) would only be $50 per month. On the East Coast, this figure would be between 1/3 (in Connecticut) and 1/10 (in, say, Florida) of the insurance cost there but I will go with it.

Also, John thinks that 6% for a 90% financed jumbo (principal amount $652,500), 30 year fully amortizing, no points, is right, so I’ll go with that. While one could get creative with 7/1s or 10/1s or other structures, for valuation exercises I think it makes sense to think in terms of “traditional” mong-term amortizing mortgages. Didn’t the whole economy just get in trouble basing valuation on these exotics?

John also thinks that everyone should put down 20% in cash. I agree with him (in fact, I’d like to see 50%, as it was typically before the 1930s, but that’s another topic). I don’t think he understands that if there were such a 20% requirement, you would see median SF prices fall into the $400s (more or less) in pretty short order. Just how many people buying in the Sunset or Glen Park or even St. Francis have 20% in cash?

Anyway, I use all the other assumptions I used in my post above:

Posted by: Satchel at February 16, 2008 7:09 AM

As before, please do not RELY on what random anonymous bloggers are posting. CONSULT YOUR OWN TAX ADVISER. Have him run a scenario analysis. With his software, it will take a fraction of the 10 minutes it took me, and it will be more accurate because he knows all the specifics of your situation. You’ll find that he agrees with me.

Here are the numbers.

As before, without a house, and at the $185K AGI level with 2 dependent children living at home, etc., Federal tax liability and CA tax liabilities are estimated as before, namely $45,375 in aggregate.

Adding just a $725K house in the Sunset, financed 90% with a 6.0% fully amortizing 30 year, Federal tax liability would be estimated at $22,129. CA tax liability would be $7,650. The total is $29,779. Subtracting this figure from the “no house” scenario, you see that you have “gained” $15,996 in tax savings, in exchange for the risk you have taken on in purchasing the asset using leverage. THIS DIFFERENCE IS EQUIVALENT TO A MONTHLY TAX “SAVINGS” OF $1,300.

NOTE THAT THESE ARE FIRST YEAR OWNERSHIP NUMBERS. As the loan amortizes, and the Prop 13 tax rises (slowly), your tax savings will change, and will in any event depend upon your evolving financial situation and the tax laws. In general, you can expect LESSER tax savings relative to not owning, as bracket inflation decreases the value of deductions (may be offset by rising income, though) and the amortizing principal (nondeductible) payments increase relative to the loan payment. However, the slowly rising Prop 13 tax will counterbalance these trends somewhat, as deductible property tax expense rises.

Here are your monthly cash outlays:

$3912 loan payment (of which an average $668 is nondeductible principal repayment)

$690 Prop 13 tax

$250 PMI (estimated low)

$50 Insurance (I still can’t get past this)

$300 Maintenance

$160 Foregone investment return on the down payment (from above post, estimated low)

TOTAL: $5,362

LESS $1,300 tax “savings”

EQUALS $4,062.

It appears that my initial estimate (which used a 7% interest rate, and a too high $400 insurance payment) was too LOW. (I initially estimated $4,100, +/- 5%)

John, for your info here are the background numbers you will need to run your analysis should you choose to do so: aggregate interest costs (1st year) of $38,932, prop 13 tax of $8265, AGI $185K. I don’t see where you get your $3300 cost (maybe even less), I really don’t. If you want to respond, please reference a hypothetical 1040 or CA 540.

As a last aside, I don’t agree that renting should be cheaper than buying in all circumstances. For a nice SFH that you can consider living in for a while (like 10-20 years), one would expect to have to pay somewhat more to buy it than to rent it. There is a premium on stability and the (imperfect) hedge against price inflation that a home provides. However, when estimating, one needs to be careful in my view to use “equilibrium” rents and “equilibrium” interest rates. We don’t have either right now. Not by a long shot.

Au contraire, I’ll sign off here (unless someone can legitimately show a flaw with my logic and analysis). I hope this whole discussion is helpful. Please let us know!

oops! There is a typo above. The “15,996” tax savings figure should be “15,596”. It DOESN’T change the analysis in any way – the monthly $1300 figure is correct.

Good thing I am not an accountant. No wonder why they call them “green-eyeshade” people!

Last point, and then I’ll shut up.

TO BRING IT BACK TO THE SUBJECT OF THIS OVERALL POST ON SF MEDIANS.