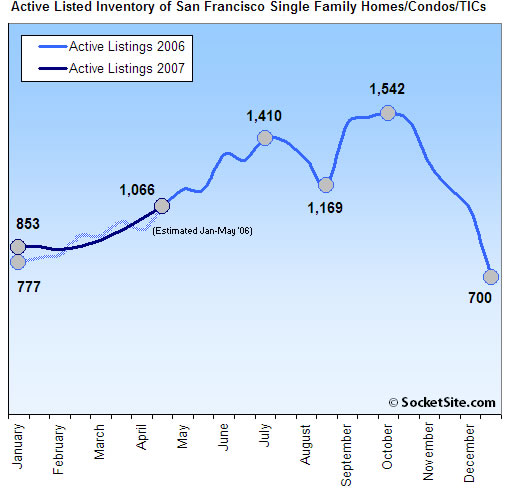

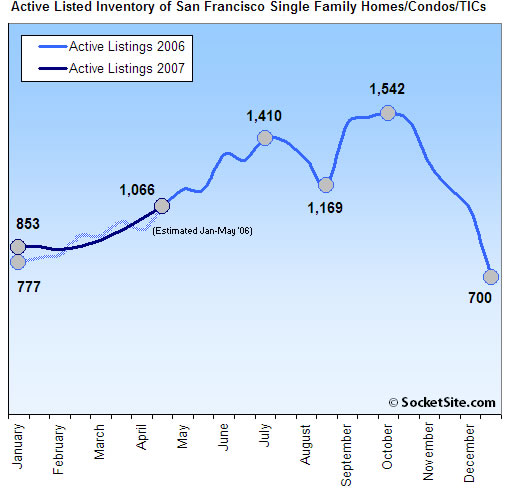

Based on our calculations, re-sale activity for listed properties in San Francisco increased around 10% over the past two weeks. At the same time, new listings have continued to outpace new sales as Active listed housing inventory increased slightly as well.

∙ San Francisco Housing Inventory Update: 4/16/07 [SocketSite]

In downtrending markets, inventory flow gets very volatile, largely owing to Seller frustration over weak pricing. The strong downward move in inventory available towards the end of the calendar year is Seller’s deciding to stand pat, until Spring. This is why in downtrending R.E. markets there is often a pop, or uptick in pricing in Spring. This makes other sellers hopeful, but that of course brings on supply, so that by late April and into May, prices weakness reasserts itself. The dynamics I describe here will be much more pronounced for the greater Bay Area, as I have remarked before, S.F. will be last man standing as the R.E. market makes a bottom–probably in late 2008. People who understand these markets will also readily understand my final comment: downward pricing in places like Boston and Seattle which is already well underway will also have an effect for the B.A. Real Estate remains local, but, at the margin is much more national now, than ever before. Severely depressed markets in Florida and Nevada are going to effect every other city in the US–at least a little.

I’ve actually noticed an interesting phenomenon in the first quarter. SurveyKid is right, I believe, in sellers holding back, but getting to the point of “all real estate markets are local,” Noe Valley saw some very high selling prices on condos in Q1. The reason, in my view, is that there was SO little inventory on the market, but still high demand, that those looking for condos (esp 2 beds) were driving up prices significantly fighting for the limited inventory. Rarely was more than 1 quality place (location) on the market at the same time, and the result was 3-12 offers per house. Again–it’s not about what the media says, it’s about where supply and demand intersect. While I believe the market is still correcting, demand remains sufficiently high in places like Noe, and prices certainly aren’t moving downwards from what I’ve seen.

Of course, once potential sellers realize this, the market will overreact and flood with inventory, hence you will see locally volatile inventory levels, IMO.

What’s uncanny about the graph is how closely this year is trending to last year. SurveyKid can prognosticate all he wants (and may be right, we’ll see) but SO far, not much has changed locally despite all the nervousness.

The above chart is for SF inventory only. Which is fine, and I’m glad to have the data on SF alone. However, Inventory in many Metro Areas, including the Bay Area, is now well ahead of last year. Again, SF proper is a special case. It will be one of the last markets to really crack, but crack it will. The periphery is getting hit pretty hard. Remember, we are still early in the housing recession. Yes, it’s a recession. And yes, it’s early. Usually takes about 24 to 36 mos to play out. I mark the start to Summer of 2006, but one could surely mark the start to March of 2006.

I would not even consider SF proper for purchase until Q3 2008, though, the East Bay will have seen some very good price correction by then.

In the grand scheme of things, its important to remember that markets have their own internal rhythms, even if they appear to be driven by things like “the economy.” In fact, I think this housing recession will really confound people as the stock market goes higher this year, and next.

But, we shall see.

This is interesting info, b/c one quick search for SFH property in District 7 shows absolutely nothing reasonable under $2 million, and half the SFH’s under $4 million already in contract.

Does nobody care that 13 out of 14 units at 3028 Pierce St. are all sold already at prices $900-$1,000 sqft? There’s no point posting listings if there is no follow up with what the sales prices are. Socketsite, please update the 13 sales prices, as many on this board believed none of them would sell it their asking prices. We appreciate it!

Isn’t it funny how there’s such a big disconnect? Nobody I know looking says there’s a good amount of inventory. There is a LACK of inventory. I wonder if this new 2007 data includes many new SOMA condos for sale, and since the levels are the same, that means there’s much less inventory for other listings?

Just go to sfarmls.com guys. You can see for yourself.

Sorry, I meant 3208 Pierce St not 3028 Pierce St.

https://socketsite.com/archives/2007/01/3208_pierce_new_website_and.html

At any rate, what do you guys think about my SOMA condo theory on why there’s such a big discrepency between the reported inventory stats, and the perception there’s so little inventory on the market?

prime – are on on The District 7 payroll? If not, you should be. Maybe you should send in your resume for DL’s job?

Nice one icallbs. My handle is a clue for you. I like to focus on areas I want to live. At any rate, want to contribute to the topic or make jokes? lol

It won’t last. Bay area housing inventory is up 40% from last year. I almost found that a little hard to believe. 40%? Asking prices are down by 9%.

http://www.housingtracker.net/askingprices/California/SanFrancisco-Oakland-Fremont/

Maybe SF can outlast this trend, but as the rest of the bay area drops, people will just switch out of SF into neighboring cities. Obviously, there is a price at which people will start to leave the city.

When you go visit your friends in Palo Alto in the house they just bought at 1/3 the price, you start thinking 38 minutes on Caltrain to reach SF isn’t really that bad!

@tipster: I assume you mean east palo alto 🙂

tipster & SurveyKid are spot-on. I know quite a few people (most with small kids) who are starting to eye the east bay more and more as prices there soften. Eventually it’ll get to the point where you can buy an SFR in Rock Ridge or Pleasant Hill for the same payment as renting a 2-bedroom in the city. Prepare for an exodus at that point.

Plus, according to the papers, SF is going through a baby boom right now. Outer bay starts to look really good when you realize the public schools there are decent, while in the city it costs $25K/year just to send Taylor and Bailey to kindergarten.

I think the inference we’re all drawing is that, as alternatives get cheaper, prices in SF will have to fall to compensate or the city prices itself out of the market and will continue to lose people, jobs, and tax dollars. Oh well….there’s always tourism.

You can do all the speculation you want, as long as interest rates are low, people will be buying in SF.

“At any rate, what do you guys think about my SOMA condo theory on why there’s such a big discrepency between the reported inventory stats, and the perception there’s so little inventory on the market?”

That it’s completely wrong as are most of your statements. Very few new development condos are listed and if anything they are the tip of the new condo iceberg. Don’t forget to add in the 1000+ unlisted condos if you want to go down that route. Inventory just doubled.

Always amazes me at how people trumpet rate levels as a key driver of the market. Interest rates were at all-time highs in the late 70s and we still had a real estate boom. Today they’re near all time lows and we’re heading into a real estate recession.

Assume a median SF property bought for $750K. Buyer puts 20% down and finances $600K. On a 6.0% loan, the payment is $4,500. 6.25% = $4,600, 6.5% = $4,700, and 7.0% = $4,900. So a full 1.0% increase raises the payment only $400/month. That’s equivalent to a weekend of drinks, dinners, and cab rides here in the city. Point is, a 50 basis point change in rates doesn’t move the needle that much.

However, if the $750K median price falls by 10%, an 80% carry at 6.0% is a payment of around $4,000, $4,400 at 7.0%. A bigger savings than the effect of low interest rates.

Point is, those of us who think prices will fall are better off waiting. Even if rates go up, your monthly payment will be lower provided prices fall around 10% or so. Which they’re already doing in Napa, Sonoma, and now the east bay.

Good luck waiting for prices to fall 10% in SF! It’s not impossible but it’s highly unlikely. There’s still a supply problem (other than in SOMA). I live in 94114 and anything decent seems to get multiple offers and sells for over asking. And I’m not a realtor but I’ve been following the market since 1983. Sure there have been a few dips but it’s basically a continuous upward spiral. I’ve been listening to friends who have waited too long to get in and they eventually got priced out.

So there will never feasibly come a point when you run out of richer people to sell to? Ever? Will studios really be going for $1.5 million in 2015?

At that point, will anyone be left in the city besides: 1) trustafarians; 2) people who bought pre-1999 and can’t sell because they can’t move up or afford property taxes on a new place; 3) rich Realtors; and 4) people commuting in from far away to work $10/hour jobs serving appletinis and rhubarb compote to 1) through 3) above.

Hmmm…sounds like some Orwellian parallel universe to me. But I guess it could happen.

In 1983, people thought 300K was outrageous for a 3 bedroom house in 94114. Now they are selling for between 1.5 and 2 million so unfortunately a studio could be 1.5 million at some point. Probably not as soon as 2015 but it is pretty scary.

In 1983 the median home price was $135K and the average San Franciscan made $18,000/year. So a multiple of 7.5x. That multiple is over 10.0x today.

Then prices in the city were stagnant/down from ’89 to about ’96. So unless it’s another paradigm shift, today’s $400K studio will probably still be worth $400K in 2010.

So go ahead and wait, Dude. Next year the prices will be up and the interest rates will too.

We’ll see. Let’s agree to meet here in 12 months and compare notes.

Agreed.

I actually do believe prime location 600-700sqft studios will be over $1 million by 2015. That’s simply $1,500-1,600/sqft, which is the norm in many other cities such as London, HK, Tokyo, etc.

It always seems expensive now, and then you wait a year and realize, you made the right choice.

I actually the Fed will start cutting rates next year, allowing many to refi to longer term mortgages at the same rate or lower. Nobody is talking about lower rates. The Fed will save middle America, and coastal America is going to go hog wild for more cheap money. It’s a great system.

Anybody want to talk about the 13 out of 14 sales at big bucks at 3208 Pierce St. in The Marina?

Prime

“Anybody want to talk about the 13 out of 14 sales at big bucks at 3208 Pierce St. in The Marina?”

What do you want to talk about? That a sucker is born every minute? LOL

I agree with Prime. Prices in San Francisco likely are much akin to cities like Hong Kong and Tokyo: Both of them had huge speculative bubbles followed by large downward adjustments.

http://www.haver.com/COMMENT/070323x.htm

http://www.pathfinder.com/asiaweek/99/0716/biz1.html

I’m not sure prices in SF ever reach those of HK, London or Tokyo — all those cities are centers of commerce and trade not to mention major financial centers. San Francisco has tourism as its main industry.

Any market is cyclical. What goes up will always come down..

Its same with stocks

Its same with commodities

Its same with economies..

Why would it be different with real estate?

If not now, it might take 2 years, 5 years, 10 years.. I donno, it will still come down.

“I actually do believe prime location 600-700sqft studios will be over $1 million by 2015. That’s simply $1,500-1,600/sqft, which is the norm in many other cities such as London, HK, Tokyo, etc.”

Hmmmm, probably not a good idea to compare SF with Tokyo. Last time I checked, Tokyo was down 70% in nominal terms since 1989.

Isn’t it funny? After a 70% nominal drop in prices, SF still is much cheaper than Tokyo on a p/sqft basis. That just goes to show you how out of whack Japan’s property prices were. The city of Tokyo alone was worth more than all of California real estate combined during the height. Crazy.

“Isn’t it funny? After a 70% nominal drop in prices, SF still is much cheaper than Tokyo on a p/sqft basis.”

I wouldn’t exactly compare Tokyo with San Francisco. Tokyo is the economic center of Japan while San Francisco is a tourist hang out with some nice views.