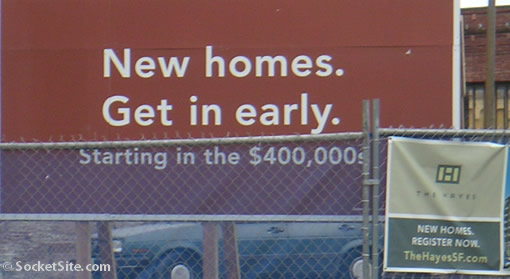

A year ago we broke the news that The Hayes (55 Page) would be offering condos in Hayes Valley “starting in the $400,000s.” In August, The Hayes sales center was advertising studios “from the $430,000’s.” And in December, six condos in The Hayes hit the MLS with the least expensive unit priced at $431,375.

Yesterday, a studio condo in The Hayes (55 Page #322) was listed on the MLS for $399,000. And once again, don’t forget to ask about the incentives.

∙ New Condos Starting In The $400,000s? [SocketSite]

∙ Arterra and The Hayes: Sales Centers [SocketSite]

∙ The Hayes (55 Page) Hits The MLS [SocketSite]

∙ Listing: 55 Page #322 (0/1) – $399,000 [MLS]

∙ Incentives At The Hayes (And Bonuses At Arterra) [SocketSite]

The longer you wait, the more you save!

Yup. So much for getting priced out forever, huh?

I can’t wait for 2008/09 – will finally be a good time to buy after about 5 years of insanity in the SF market.

At $1000/sqft, these prices are still really steep. I’m not sure if I’d use this listing as a sign of things to come. The pricing on these seems absurb IMHO (even with the reduction).

I’m curious about how this does for the simple reason it’s located in an established neighborhood, in contrast to the flood of new units in Mission Bay and Rincon Hill. Will that give it a sales advantage? For what it’s worth, I understand that Broderick Place (also in an established neighborhood) is mostly sold out.

[Editor’s Note: As of a few weeks ago, there were only five units left at Broderick Place.]

Patience – these things take time. You don’t need to buy but developers need to sell or rent. It’ll be a war of attrition until prices come back into balance with what people are willing to pay (in a normal market).

Speaking of which, Case-Schiller indices for December are out today.

[Editor’s Note: With regard to the Case-Shiller index for San Francisco, it’s down 0.8% from November ’06 to December ’06.]

I can’t wait for 2008/09 – will finally be a good time to buy after about 5 years of insanity in the SF market.

If prices continue to drop nearly one percent per month, that would be down 25% or so in your time frame.

But I have to believe that prices drop from November to December almost every year. What was the difference in the prior year in November to December?

11/05 had an index value of 215.70 while December was 215.11, so a drop of 0.003%.

The index peaked in May of ’06 at 218.37 and has been steadily falling since then. December’s value of 212.13 represents a 2.8% drop from the peak. All of this info is free at macromarkets.com.

What does everyone think…If you’re buyer Joe Smith should you wait or pre-empt a developer’s nervousness by offering 10-15% below asking price on a new unit. I know most Developer’s are reluctant to drop prices and would rather offer loan buy down programs, paid HOAs, upgrades etc. but a sale is a sale particularly give the pool of qualified buyers is getting smaller. Thoughts?

I’ve always been of the opinion…”all they can do is say no.”

I’d feel them out first and find out if you’re talking to a person with a business head on their shoulders or just a hairdo-posing-as-a-sales-agent.

Doing it around the end of the month/quarter could also be an advantage.

I’d give it a shot. It wouldn’t be the first time I’ve been told “no”. 🙂

Has anyone noticed that the utilities are not undergrounded along the Page Street facade of “the Hayes”? If they’re not, it’s going to look very ugly – big utility lines just feet from the building. I wonder if the developer is going to pay for undergrounding of the block?

Of course, those lines are not in the renderings for the building. What a surprise.

Visited Broderick Place a month ago. The only units left are all 2-bedrooms. Can’t remember the prices though.

Why can’t I find any of these condos from the Hayes or Arterra on the multiple listing service website? When I click on the links from the website, I can access the listing, but not when I run an independent search on the website.

i walked by the sales office Howard Street and went in just curious about the developments for sale, Arterra and the Hayes.

Honestly, i was really displeased at how much the units were per square foot. I drew a square the size of a square foot on a piece of butcher paper when i got home (i’m an artist) and I realized that I would be paying $750-$900 for something that SMALL. It’s really very sad that these units…and not just THESE…BUT others out there too are so overpriced. I mean come on, this isn’t NYC, so stop pricing like you want it to be.

“It’s really very sad that these units…and not just THESE…BUT others out there too are so overpriced. I mean come on, this isn’t NYC, so stop pricing like you want it to be.”

–As long are there are [people] that think that RE in SF will always go up, and willing to pay those prices, and happy lenders giving them 100% financing, those units will be overpriced.

It seems things are chaning thou. If I was in a market to buy something, I would not in the next two years, until the dust has setled.