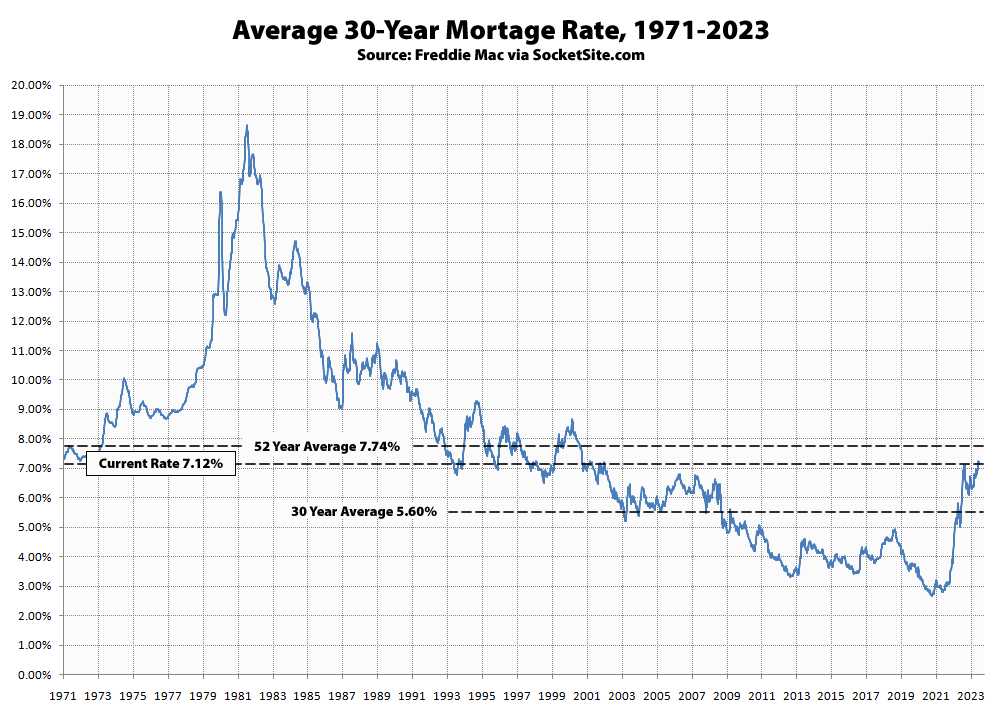

The average rate for a benchmark 30-year mortgage has inched down 11 basis points (0.11 percentage points) over the past two weeks, from a 22-year high of 7.23 percent to 7.12 percent as of yesterday.

At 7.12 percent, the current 30-year average rate is 123 basis points higher than at the same time last year and 447 basis points, or just under 170 percent, higher than its all-time low of 2.65 percent two years ago but still below its long-term average of 7.74 percent, with the probability of an easing by the Fed by the end of this year having dropped to 2 percent and the odds of another rate hike holding near even.

As we first outlined back in the fourth quarter of 2021, when the average 30-year rate was under 4 percent, higher mortgage rates would lead to less purchasing power for buyers and downward pressure on home values, not simply higher payments for buyers, none of which should catch any plugged-in readers, other than the most obstinate or easily mislead by others into thinking that rates “would soon be back into the fours,” by surprise.

One of the recent times we were discussing mortgage rates inching down around here, back during The Spring, one of the regular commenters mentioned that “SF biggest residential landlord Veritas facing $1B in mortgage defaults now”.

Everyone not closely following the machinations of the local landlord class will be interested to find out that a Buyer [has been] found for nearly $1 billion in mortgages tied to [Veritas Investments], S.F.’s largest [residential] landlord. From last week’s piece in The Chronicle:

It doesn’t say why Veritas’ holdings were still expanding at the same time their rents were contracting, necessitating the default. We can all sleep soundly knowing that Veritas’ lenders won’t be left holding the biggest bag of odorous excrement ever assembled in the post-2008 history of S.F. real estate.