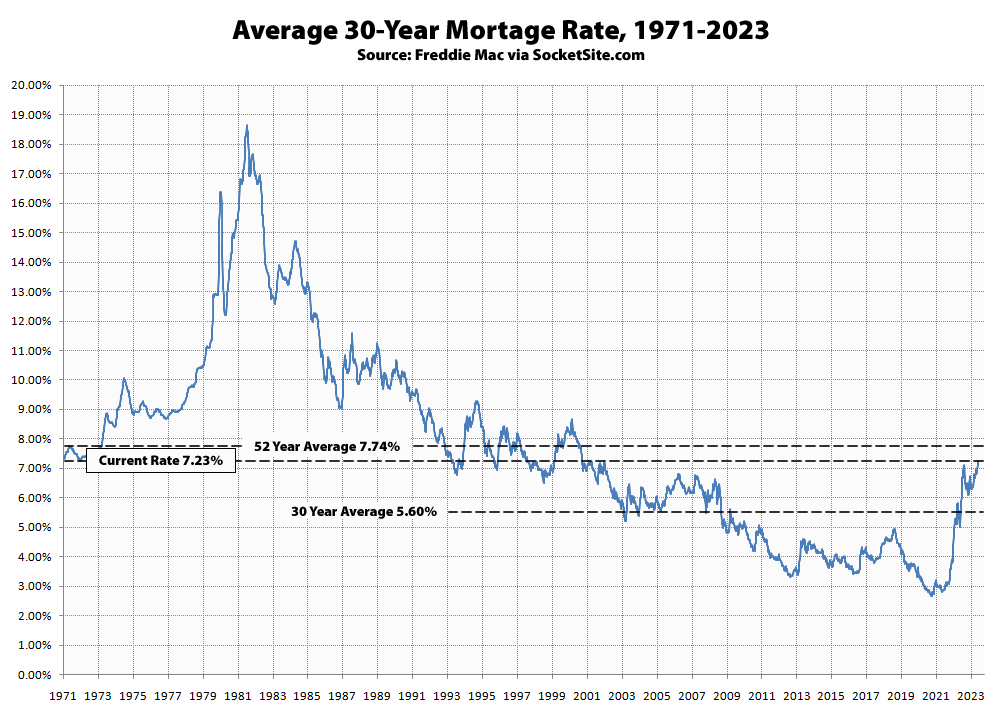

The average rate for a benchmark 30-year mortgage ticked up another 14 basis points (0.14 percentage points) over the past week to 7.23 percent, which is 168 basis points higher than at the same time last year, 458 basis points, or over 170 percent, higher than its all-time low of 2.65 percent two years ago, and the highest average rate since June of 2001.

That being said, the current 30-year rate is still below its long-term average of 7.74 percent, with the probability of an easing by the Fed by the end of this year having dropped to under 5 percent and the probability of another rate hike having ticked up to 45 percent.

Once again, as we first outlined back in the fourth quarter of 2021, when the average 30-year rate was under 4 percent, higher mortgage rates would lead to less purchasing power for buyers and downward pressure on home values, not simply higher payments for buyers, none of which should catch any plugged-in readers, other than the most obstinate or easily mislead by others into thinking that rates “would soon be back into the fours,” by surprise.

UPDATE: The average rate for a benchmark 30-year mortgage inched down 5 basis points (0.05 percentage points) over the past week to 7.18 percent, which is 152 basis points higher than at the same time last year and nearly 3 times higher than its all-time low of 2.65 percent two years ago, with the probability of an easing by the Fed by the end of this year now hovering around 7 percent versus a 43 percent probability of another rate hike and even odds of no change.