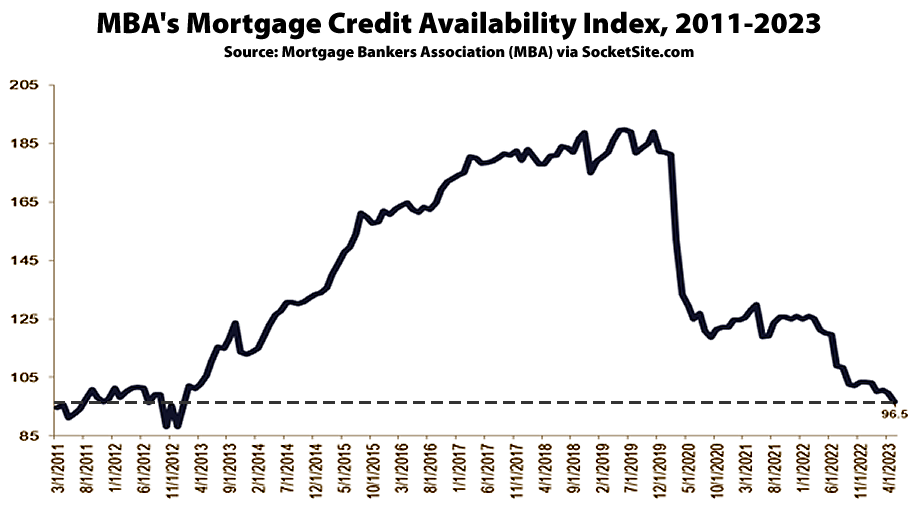

Having slipped 0.9 percent in April to a 10-year low, mortgage credit availability, as indexed by the Mortgage Bankers Association, dropped 3.1 percent last month to its lowest level since January of 2013, with a 3.9 percent drop in the index for conforming loan availability and a 1.5 percent drop in the index for Jumbo loans, the availability of which has dropped by around 25 percent over the past year and is 50 percent lower than prior to the pandemic at the end of 2019.

At the same time the spread between jumbo and conforming loans continues to narrow and their average rates nearly on par.

I was thinking we were heading for a seven handle on conforming 30 year mortgages because The Fed hasn’t yet controlled inflation (although the direction is correct) and so more Fed Funds Rate hikes were certain to come.

But anyone can check the CME FedWatch Tool, which as of this posting, is pricing in a 93 percent chance of no rate hike from the FOMC this week (i.e., tomorrow). I don’t mind admitting that I don’t have the cojones to put a meaningful amount of money on the other side of that in the futures market before tomorrow’s open.

My name’s Blurryface and I care what you think.

My name’s Blurryface and I care what you think.