As we noted last week, “the yield on the 10-year treasury [had] inched up around 3 basis points since the Fed’s [rate hike] announcement, indicating the near-certain hike was already priced-in and should moderate any significant jumps in mortgage rates over the next week.”

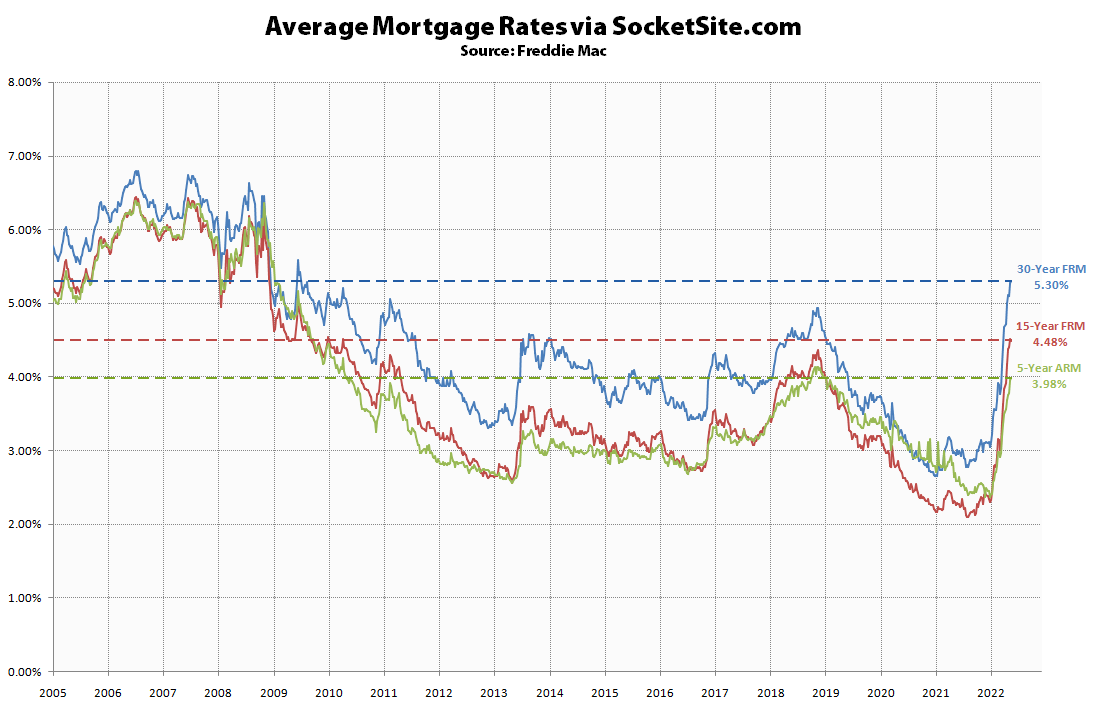

The average rate for a 30-year mortgage subsequently inched up exactly 3 basis points over the past week to 5.30 percent and is now 236 basis points or 80 percent higher than at the same time last year, representing the highest average 30-year rate since July of 2009, a trend that shouldn’t have caught any plugged-in readers by surprise.

At the same time, the average rate for a 5-year adjustable rate mortgage (ARM) inched up 2 basis points over the past week to 3.98 percent, which is 139 basis points or over 50 percent higher than at the same time last year as well as 50 percent higher than the average 30-year rate in January of 2021 and the highest average 5-year rate since the end of 2018 with the share of shorter duration ARM-funded purchases having nearly tripled over the past three months.

“ the share of shorter duration ARM-funded purchases having nearly tripled over the past three months.”

We’ve seen this before.

I know, “it’s different this time.”

11% is still very low share for ARMs historically speaking. It had never been that low prior to 2007. It makes sense that the ARM share is low when rates are low, and rates are still pretty low. ARM share will increase as rates increase and the probability of rates going down seems higher.

This isn’t a bubble, as much as people like to throw that word around. Rising interest rates will be a serious headwind for sales activity and prices but much improved loan underwriting following the Great Recession will prevent that same thing from recurring. In most cases, the income and equity cushion will be sufficient to keep people from walking away…as long as the FED doesn’t push us into a hard recession.

Sure it isn’t just like the 2007 bubble. But rates are going to go much higher and how are people going to afford the much higher payments if prices don’t drop?

Well, I guess I didn’t say so explicitly a few weeks ago when we were discussing this topic, so I’ll say it now: The Fed will push us into a recession, or a hard landing, because the causes of the currently high inflation are not addressable with the blunt axe of raising the federal funds rate.

Note that, according to the “advance” estimate released by the Bureau of Economic Analysis last month, real gross domestic product (GDP) decreased at an annual rate of 1.4 percent in the first quarter of 2022, so we’re well on our way.

I agree with you that we’re probably on our way to a recession. Not sure how hard. I still think that we will not get to the point that homes will have been significantly “overbought” in this cycle. I expect that some people will come to feel that they overpaid but I don’t think they will walk away in large numbers.