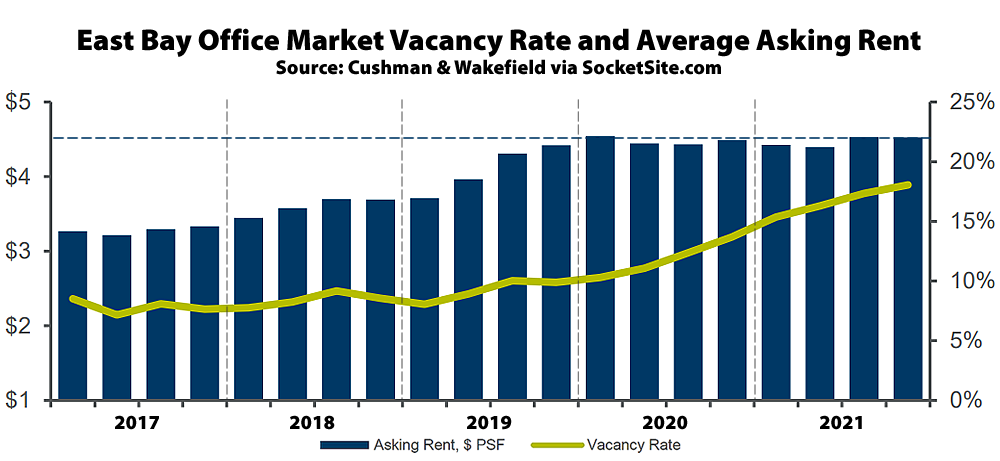

The office vacancy rate in the East Bay, not including Walnut Creek or further east, inched up from 17.9 percent at the end of September to 18.1 percent at the end of 2021, which includes 4.8 million square feet of un-leased space and 1.1 million square feet of space which has been leased but is sitting vacant and actively being offered for sublet, according to Cushman & Wakefield.

While East Bay landlords appear to have held firm in terms of rents despite the increase in vacant space over the past year, with the average asking rent having inched four cents ($0.04) to $4.53 per square foot per month, the average asking rent continues to be skewed by negative absorption in the region’s most expensive submarkets and landlords have been giving free rent and build out allowances rather than reduce their rack rents.

In fact, rents in Oakland’s Central Business District (CBD) have now dropped nearly 10 percent ($0.53) to $4.93 per square foot, with 3.1 million square feet of that aforementioned 5.9 million square feet of vacant space located in the CBD, up from 2.6 million square at the end of 2020.

At the same time, the effective office vacancy rate in San Francisco inched down to 19.9 percent at the end of 2021, but with 17.0 million square feet of still vacant space, 11.5 million square feet of which remains un-leased.

Lots of tenants in our building went into a pandemic induced hibernation and then simply disappeared when their lease expired.

1) What city is said building in ?

2) define “lots” (3 of 4…of10…of 75…)