As we outlined yesterday, there is over 17 million square feet of vacant office space now spread across San Francisco, which is up from around 16 million square feet of vacant space three months ago and as compared to under 5 million square feet of vacant space at the start of last year.

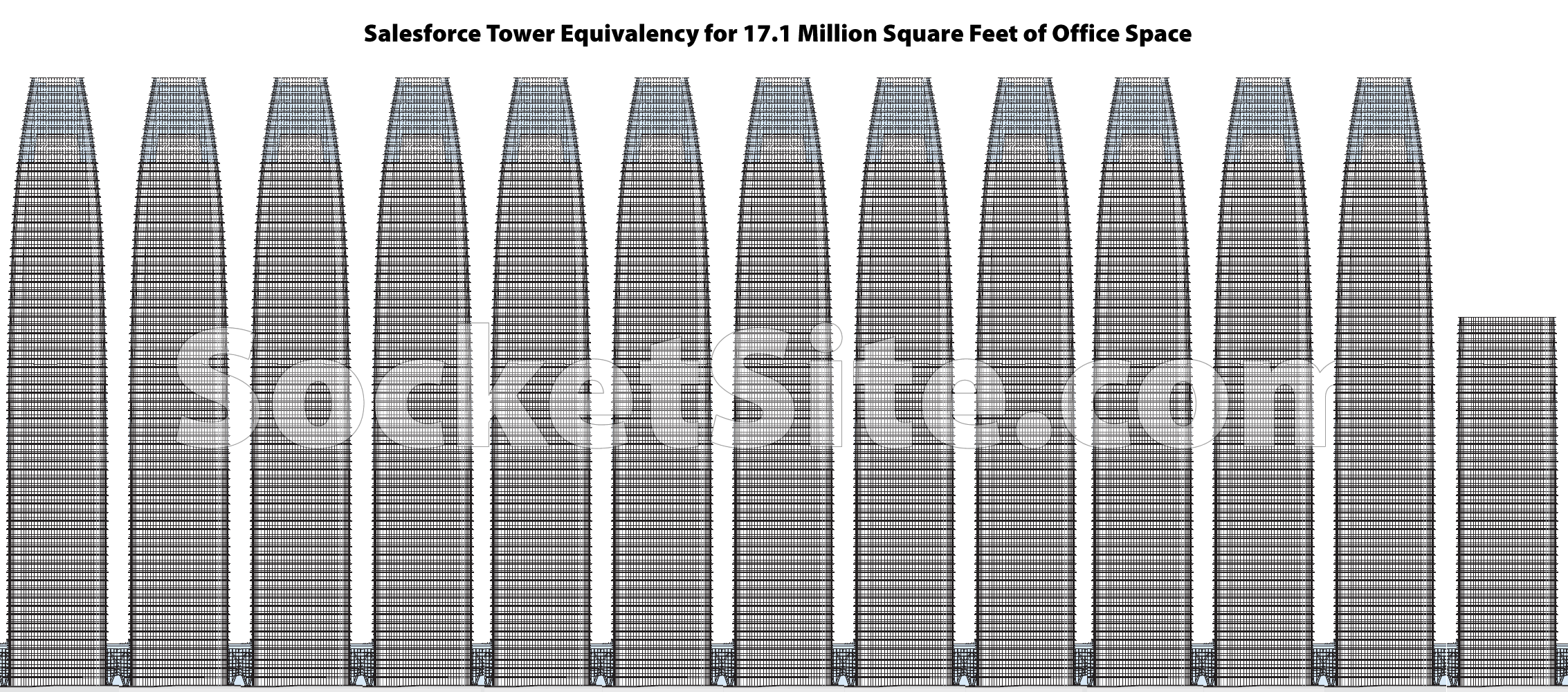

For context, the 1,070-foot-tall Salesforce/Transbay tower at First and Mission, which is the tallest building in San Francisco, contains 1.35 million square feet of office space spread across 59 floors.

And employing the framework we introduced last year, there is now 12.7 Salesforce Towers, or 747 Salesforce Tower floors, worth of empty office space spread across San Francisco, which is roughly enough space to accommodate between 98,000 (based on an average, pre-Covid, density) and 131,000 (a la twitter) worker bees.

That’s a lot of foosball tables.

This begs the question – what to do with all that empty office space. The average annual net absorption for the boom decade just ended was what? About 1.5 million feet? It would take 11 years at that absorption pace to fill the space. However, going forward it’s hard to see SF ever averaging that kind of net absorption again over a prolonged period. So it could take decades to fill the 17 million feet of empty space.

This does not bode well for the owners of these buildings – generally. Some of the space can be converted to life sciences or residential. But most of it cannot. Already the Oceanwide development has been abandoned as has 88 Bluxome – and the to follow second phase.

Mission Rock is going forward but it had already started construction and it was early enough to tweak the design and make that space aimed towards life-science tenants. Dropbox abandoned its SF headquarters but that building(s) had been designed to accommodate life science space and a small potion of DropBox’s sublease was picked up by a life science company. Life science may be the only option for major new SF “office” development Hence the Power Plant project is now planned/designed as life science space.

In terms of the life sciences and biotech SF is at a disadvantage both to SSF/the Peninsula and Berkeley/Emeryville/Oakland – the latter cities are making a big play to attract life science/biotech firms. SF needs to not only clean itself up but change its business tax policy if it hopes to capture even a small portion of the life science/biotech play.

The only office development that might pan out in SF is small, boutique projects. 50K or so Hence the Union Square condo conversion will include a small amount of said boutique office space.

As to large office developments (like the still empty 3M tower) not only is there not a need/demand for more space, there is no way to determine the potential price/square foot that future space might command. Today it’s $73.24 but how long before landlords losing significant amounts of money on these empty towers make large cuts in the asking price per square foot? Meaning future projects could actually be financially untenable if rents take a big hit.

In the meantime, SF may garner a new moniker – the city of see through towers.

This is why building booms can be such destructive events in the long-term: they shoehorn land into niches that may be obsolete for future generations. Smaller buildings are more easily repurposed or demolished to make way for new uses, but there’s not a lot of versatility in an office tower.

One easy and always-needed repurposing would be art studios. Most artists just need natural light, ventilation, and access to a utility sink. Thousands of art studios have been destroyed in this latest wave of uncreative destruction; maybe it’s time to bring them back.

Can art studios pay the rent for office tower space?

Not current “:asking” rent, of course not.

The demand for “creative” office space (no interior walls, but lotsa foosball tables and hot pink Jacobsen chairs) has collapsed now that the need for “work” stations for stylesheet coders of bagel delivery apps has dried up. No one is now going to pay the rent the landlords of those buildings have come to expect.. According to the myth of supply & demand, prices are supposed to drop until takers are found. We all know this is a lie, that there are price floors below which, 1) loan penalties are activated, and 2) current tenants demand rent reductions. The buildings will need to be sold at lower prices, the cap rates of which will allow for lower-cost rentals.

This will take years to play out.

You’ve lost your mind.

“According to the myth of supply & demand,”

Supply and demand is not a myth. These landlords do not recognize the forces that are distorting the market, namely the breakdown of the social order that continues apace in San Francisco in particular and all of the West Coast in general. They will continue to expect those rents in spite of the fact that what they offer has become undesirable. No one wants to do business in a sewer.

“According to the myth of supply & demand, … … The buildings will need to be sold at lower prices,”

It’s hilarious that you contradict your self in such a short space. Thanks for the hoots.

But, seriously, except for the use of the word “myth” where you should have used the word “principle,” you summarize the situation pretty well.

Once again for the latecomers, supply & demand is a theoretical model that looks nice on paper where you can control all the variables, but it often works counter-intuitively in the real world.

Before you even get to S&D theory in Econ 1 for Simpletons (which is as far as most members of the real estate industrial complex ever get), the ubiquitous neo-classical texts always first inform us that, 1) everything you’re about to learn is subject to ceteris paribus (but they somehow omit that once you leap off the paper into real world markets, nothing is ever ceteris paribus; and 2) homo economicus always acts in his or her rational self-interest.

if your theory requires these two conditions to be met, you have a fragile theory, and certainly no scientific “law.”

S&D is indisputably not a scientific law, but a theory. If it were a scientific “law,” there would be be such things as Veblen goods and Giffen goods. There would also be no asset bubbles in which additional supply increases speculation and therefore puts upward pressure on prices. These things empirically exist, therefore it’s ignorant and/or disingenuous to call S&D a “law.”

Physicists and chemists laugh their arses off at neo-classical economists, real estate cadres, and other scam artists who invoke market behavior theories as “laws.” Imagine the laws of thermodynamics with all kinds of arbitrary assumptions, conditions, exceptions, and omissions. You can’t, but this kind of hedging is status quo in neo-classical economics.

S&D is a nice theory that can provides insights into markets, but relying on it exclusively frequently provides an inaccurate explanation for market behavior. The only thing “simple” about supply and demand are the simpletons who invoke it mindlessly as a “law” that justifies their own business practices.

According to the “law” of supply & demand, a drop in demand is supposed to be reflected by a drop in prices in order to restore an illusory “equilibrium” which itself is just one more neo-classical tautology. If LLs sit on their prices because they “expect” higher rent, then somehow the “magic hand” has fallen asleep. Myth is it.

You mean a drop in demand like when lots of people move out of the city and then residential rents drop 25%? Like exactly what happened this past year? Do the Qanon guys over at zerohedge know that happened?

Yes, rents fell by around 25%, but that only made a dent in vacancy rates. The theory of S&D is based on a theoretical equilibrium. Thousands of vacant units on the east side say that we’re nowhere close to “equilibrium,” IOW, according to S&D theory, rents should have fallen by much, much more, perhaps 40%, 50%, or more, to achieve the “equilibrium” that underpins the whole damn theory. A marginal drop isn’t vindication of S&D…

By what economic theory do you believe that rents “should have” dropped 40-50%? They found a new equilibrium and they are now going back up. The population of The City is increasing again.

“They found a new equilibrium […]”

Thank you for demonstrating how S&D is often used as a magic tautology. Whatever the current vacancy rates and prices are, that is your new equilibrium! Hello see-through buildings, good-bye market-clearing prices. It’s obscuring, mystical nonsense, not science.

S8D is only one of a number factors that influence pricing. The real estate industrial complex doesn’t want the rubes to know that.

I have to admit, I’ve never heard “supply and demand” be referred to as a ‘myth’ before.

@two beers is right here. This article proves his point. Since there is so much vacant office space, office space prices in SF should be dropping until we find the new equilibrium. However, S&D theory requires open competition.

Surprise! Effectively, real estate and many other markets in the US are oligopolies and operate in a cartel-like fashion

You know this isn’t how city life works. The less desirable, industrial areas of a city are taken advantage of by artists and new entrepreneurs for their lower rents. I remember when Minna was a slum with wonderful art studios. But eventually the gritty areas find new life, ironically art museums, and creative public studios, and then Starbucks moves in, and rents rise and buildings are sold and raised and rebuilt, and artists move on as they always have.

Artists aren’t a part of a city because the city needs them, they are determined to been there and they find a way.

SOMA and the FiDI are currently, and for the foreseeable future, the least desirable areas of SF…

I guess it’s better – from capitalism’s POV – to just let the see-through buildings rot and deteriorate.

Now you’re just sounding emotional and unreasonable. FIDI which literally stands for FINANCIAL DISTRICT is the heart of capitalism, what are you expecting to happen there? This city was build by banks. If a city like San Francisco with all of its juxtapositions doesn’t thrill and inspire you, then you shouldn’t be living in a city. You should be living in an artist’s community in the desert. My guess is you are not an artist.

Easy tiger. Take a breath.

I agree so much art culture has been lost can a city funded program start the Art .

Ah yes. The standard answer of the modern educated left. We have all abandoned religion (thankfully) so we are replacing our priests and temples with “artists”. The modern, craft-free, politically-correct content narcissistic new “religion”. Well, there are plenty of human feces on the streets of San Francisco that our radical transgressive artists can use for their “paintings” “I call this Brown Study Number Nine”

No, this is the result of the “Service Economy” heaped upon us so we could get our cheap shiny objects made by slave labor in China.

Yes, but….One might argue that the development of China as THE industrial capital of the world helped raise hundreds of millions of people out of absolute penury. And it is not only American industry that has been hollowed. I like bicycling, and almost all of the legacy Italian brands are actually made, yes, in China. (“Chinarellos” LOL) Bianchi, etc. There are remnant hand building shops, but not very many. The Chinese will conquer the electric car industry next, so…. The cost of this rapid industrialization may be very, very high…and with climate change may be a sort of “last hurrah” for industrial civilization, but…

Yes, hundreds of millions of former rural subsistence farmers now have the opportunity to enjoy the modern luxury of jumping out of Apple vendor factory windows to their deaths in order escape the despair of industrial exploitation. They didn’t even have buildings big enough to jump from back on their farms. Progress!

Why can’t more of the commercial buildings be converted to residential use (as we’re seeing in Wall Street, for ex.). Structural reasons?

Because many of these office buildings have large floor plates not well suited for apartment conversion. Apartments need windows. You end up with really awkward floor plans in many of the units. Not to mention cost of conversion…

Yes. I’m guessing the conversions in NYC are older smaller towers with relatively small floorplates.

How can we comment at all – intelligently – when we don’t know which are “these buildings”??

Logic would dictate older/smaller buildings are the least desirable from an office POV, and if,

in fact the vacancies are really in the newer buildings you describe, then they should be becoming the

new class B…and people can move up from those smaller/older buildings into them.

Can class B rents service the debt when someone paid $1500/sf for a building built in 1980 ??

Probably not, but we have a mechanism to deal with that…I believe it’s known as bankruptcy

(and 3c/sf is 3c more than getting nothing)

The problem is, of course, that so far landlords are not dropping rents significantly. Even in the sublease market – the old hold and hope game. Of course they can only drop them so far as debt service becomes or would become an issue. Ultimately, given the massive amount of empty space, there probably will be bankruptcies.

I value your contribution to this conversation. I hope someone with influential power has similar thoughts as you.

Invented, the main problem is the plumbing. Picture yourself in an office tower and you need to use the restroom. You always end up walking out to some central area near the elevators, to a rest room with a dozen toilets. Now imagine breaking those spaces up into residential units. Where do you put a shower? And how do you connect all the drains? Another issue is the distribution of electrical panels. They are often centralized and massive, and not easily broken up into smaller units.

plumbing/electricity is not designed for home use. It would be a massive process to convert not just the floors to a different design, but the under the street hookup would need to be enlarged, and that might not be possible.

And what will these people do for work if there are no businesses?

There was never a need for this much office space in SF. It was just artificially hyped up to accommodate QE assisted economic pump during Obama and Trump years.

Even after several $trillion pump post March 2020, the economy hasn’t quite yet recovered — exposing the Fugazi.

Fed is seriously concerned about inflation in housing prices (even if they claim otherwise in popular press) and is currently considering curtailing/stopping MBS purchases as part of the planned taper.

Dude the fed stopped purchasing MBS years ago.

New York Federal Reserve Agency Mortgage-Backed Securities Operation Schedule

Lots of good points. But anything can be repositioned, anything. Office buildings actually convert quite easily to residential. The space is never as efficient as you would like it to be, and plumbing and water supply are expensive issues to address. But If you take San Francisco downtown, and your acquisition cost is $300 a sq ft, which is what liquidation prices are for older buildings in SF, & another $200per sq ft in Renovating will get you a very nice unit, maybe no balcony. 2200 gfa sold at $600 per is always gonna work in SFO..

—

OK and I admit this is not the end result for the salesforce tower

I remember when the AAA office was converted to Condos.

Didn’t we see that a decade or so ago in China?

An important point that is being left out of the conversation here is that there have been many companies who have given up their office spaces as leases have expired to take the “wait and see approach.” I have seen companies who have given up their offices in our buildings due to lease expirations that are now reaching out again to reoccupy their old spaces. Secondly, we are also seeing some of our tenants who have put up portions of their space on the sublease market drop fully negotiated subleases and plan to reoccupy. Lastly, and I think the most exciting is that tenants who have subleased their expansion space that they leased in anticipation of growing are now struggling to handle their growth projections. We are seeing tenants who are now approaching their subtenants to buy out their subleases or explore more direct space in the building! i’m very bullish that we will absorb vacant space much faster than the estimated decades long absorption hypothesis.

Yet the amount of sublet space available dropped only slightly from.

That sure seems like enough square footage to solve the SF homelessness problem and help the housing crisis.

great solution for homeless crisis. London Breed should implement right away instead of building tents for homeless.

Let’s say a highrise like salesforce tower sits empty. How is that destructive? It’s a small footprint in an area with enough foot traffic that few would notice lack of occupancy.

It’s the cumulative effect of the massive amount of empty office space in the FIDI and SOMA. 91K – 131K workers no longer there. That dampens the already struggling retail sector downtown and in SOMA. SF Business Times just reported that Oakland has the best retail occupancy in the Bay Area. A big jump in net space absorbed with many new leases signed or set to be signed. The reason – job growth in Oakland. PG&E signed a massive lease there early this year and Twitter did so just yesterday. Those two leases alone are close to the total lease activity in SF during the same period. And other leases have been signed in Oakland as companies move/expand there. The retail sector needs worker bees in downtown areas to thrive and the 17 million feet of empty space means that there will continue to be large amounts of empty retail space downtown for a long time to come.

Oakland did it right. Oakland has built a tremendous amount of new housing downtown while San Francisco was building office buildings. Now downtown Oakland is more vibrant than downtown SF.

It’s destructive because it’s a waste of land that the city has precious little of.

It’s destructive because it was a key driver in SOMA gentrification, and it’s very existence makes all nearby real estate more expensive.

So, now we have millions of square feet of empty, useless space, with no realistic plan for absorption at current rents. Meanwhile, PDR and actual creative spaces are still being “upgraded” and “improved” into “creative” office space with bespoke finishes, spaces destined to sit empty for years, while the former small businesses, skilled labor, artists, and other actual creative types who used these buildings are forced out of the city.

This might seem like an optimal economic model to you, but to those of us not in the real estate industrial complex, to people who do productive instead of extractive work for a living, it’s destructive.

I would think that an enormous, new, and empty tower with blinking neon “for rent” signs would make nearby real estate less expensive, rather than more, but then what do I know…

You’re assuming that increased inventory leads inexorably to lower prices, and that isn’t necessarily the case. Landlords can and often do keep the lease prices at their “wishing rate” for a long time after the property becomes vacant.

All you have to do to understand this real world phenomenon is look around S.F. at all of the retail space inventory and compare that to the price level over the recent past. Those models you had pounded into your head in Econ 101 only work (when they do), when everything else is held constant and equilibrium is reached in the long term.

What’s typically left out is that the price per square foot for commercial FAR exceeds the price for residential – the conversion costs notwithstanding, CRE would have to drop far more for the change of use to be worth it. It’s more than an order of magnitude difference – I saw some figures around $5/sf for apartments and $80/sf for offices. Makes sense to wait from a game theoretic standpoint.

The price per square foot figures you’re quoting would appear to be monthly figures for apartments versus annual figures for office space.

In other words, it’s not even close to being an order of magnitude difference. But the cost of conversion is typically underestimated, as is the practicality.

It is really a giant physical standard bearing flag — indicating to all far and wide that this area is not relevant anymore.

But more importantly, at the level of social and economic systems, it is a sign of destructive inequality in an area that has already had its fair share. As well as misguided investment and planning. SF and Bay Area were never going to have enough housing for all of the new and ongoing office developments. These were only being built thanks to fantastical, fleeting dreams fueled by easy, extractive money. Future generations will judge how wise this was … some can see it now.

Perhaps the lifetime of individual new silicon technologies has been overestimated?

Uber comes to mind — extractive as any, fancy new empty buildings, but no drivers or riders…

Also what happened to the eternal myth that SF, Bay, Sili Valley were the place to be for talent to beget talent?

FAANGs have grown so big, cash rich and matured to the extent they no longer need government investments. They also have deep pools of technological expertise that allows them to invest, train and develop skills pretty much anywhere in the world where they are permitted to operate.

Bio-tech on the other hand is somewhat dependent on Govt. funding. But San Mateo county will absorb the bulk of the related economic growth and benefits.

With expensive housing, over the top salaries and business unfriendly taxation, SF/Silicon Valley have ceased to be a desirable destination for sw tech.

I know of several companies that have offloaded large/significant in-house (silicon valley based) projects offshore on a permanent basis as part of pandemic reconfiguration.

It is simply no longer feasible to develop hardware or maintain sustaining software development in Silicon Valley.

“FAANG”?

Facebook, Apple, Amazon, [Netflix], Google

Incorrect shadow editing

Facebook, Apple, Amazon, NVidia, Google

Netflix has been replaced by NVidia

It has also evolved into FAAMG .. Microsoft.

No more destructive than the air space over a parking lot.

Indeed. These buildings are apparently destructive, and a waste, because they occupy so much space… but a similar-sized parking lot passes by without notice. I suppose they would claim that a parking lot offers a useful function that serves several hundred people’s cars, while a building with space for thousands is useless. I dunno.

Ultimately, the only real problem I can foresee is if the rents people are willing to pay for these buildings is less than the cost of maintaining them, in which case they may become an active problem. But as far as I know, we’re a long, long way from that. The only current problem is that some organizations have spent too much money, which is a problem for those organizations, and not really anyone else.

Liberal city. Liberal problem. Who cares?

Sell off the entire floor plates Of these large office towers. Watch housing prices fall once that starts happening.

I mean, this is all going to be utilized in 1-2 years. Even NYT finally admitted,(yesterday, google it) and wrote an article that everyone is returning back to the Bay. My corporate rentals have never been better.

Agreed. My ‘corporate’ rentals are also all rented for the next 6mths. (Q2 last yr we had 100% vacancies and loses were huge). Most of the other people I know in similar positions sold to new owners so there is now less inventory available. I’ve also heard from so many more people than usual who are returning Sept+ (Tech, start-ups, students, all kinds of professionals) who will be looking for long term housing in SF, most will likely be in the office 3-5days/wk. More to arrive in Jan 2022 to make downtown active again.

SF cases have shot up 600% in the last two weeks (name link), the fastest increase ever. If that continues, SF will have a record high number of cases within 3 weeks. This looks like it isn’t over by a long shot.

As I understand it, many CMBS financing vehicles do not reprice until rents are reduced; that’s a fancy way of saying that the people who manage these properties might make more $ allowing them to stand largely vacant than by filling them at lower rents.

Long and short, repricing these properties in order to clear the market might take a long long time. (That’s why the Fed agreeing to buy crappy CMBS actually hurts the recovery: it allows lots of dumb projects to continue because their managers can profit from the stupidity while investors can stick the Fed w/ much of the losses.)

Salesforce Tower is itself empty, right? So SFO has 12.7+1 SFDC Towers’ worth of empty office space.

back in the Dot.com bust days, about 2002 or so, SF had office vacancy rates about what they are now — a lot of the vacancies were in older office buildings; rents fell by 50% in many cases

once the social media and related boom began, the vacancies filled up pretty fast and by the time of the great recession of 2008-9, office space was getting tight

As a commercial Class A tenant in central Portland, we were first offered no rent decrease for a proposed 5-year renewal and no space available for a smaller suite, because they were focusing on a faded dream the anchor tenant would expand. We passed and downsized our Portland staff from 7 to 2.

After hearing our plan, the landlord offered a 50% rent reduction. Now my key staff person is moving to Bend and we have signed up for a $300 a month plan with a shared office place in Portland. The owners are now Florida-based (one just moved from Portland), so Oregon taxes will now go down by 80% or so.

Always nice to hear stories of greed biting people in the rear.

There is a move of Portland residents to Vancouver and close in parts of the Gorge after the issues of this past summer and in part fueled by income tax free Washington state. Home prices have been traditionally less in Vancouver and other cities across the river from Portland but they are surging now in part due to the Portland exodus.

The lesson for SF is, if it hopes to attract life science/biotech firms to occupy some of the empty office space, it needs to make the tax situation conducive to these companies which are mostly locating/expanding in SSF/the Peninsula and Emeryville/Berkeley/Oakland/Alameda.

They should give all the space to the homeless. This extra space represents hoarding and is wrong. Why don’t they let the homeless people live in these office towers and have the workers telecommute, and then the homeless should all be placed on the management boards of each worker group. This way, homeless people will have a say in how all the work is done in these corporations.. This is a much more equitable solution to systemic inequality, and give homeless people important experience so that they can take over these companies.

RE: “So it could take decades to fill the 17 million feet of empty space.”

It’s beyond ignorant to measure and report office space in units of “feet.”

“San Francisco is Dead”.

(Socketsite commentariat in 2002 and 2010)

Let’s revisit this thread in 2024.

It looks like there is more than enough space to house all the urban campers.

Sad S.F. has lost what was once vibrant downtown, created by a series of events, poor planing and misplaced euphoria. The City government filled with overpaid incompetent managers (and in some cases downright corrupt ones ) only adds to the misery. A walk down the Embarcadero (including Embarcadero shopping center) says it all, closed stores and restaurants including a major hotel, dirty streets filled with homeless folks and non- existent conventions, car break-ins. The question to be answered is office space really needed at levels prior to the pandemic? I think not, the workplace / setting has changed. The impact on the city coffers is being put off for now, given Federal aid. .. Not bright future.

The CITY PTB don’t get it. Lots of negative indicators that need to be addressed but likely won’t. Tourism is one – the SF Business Times reported that San Francisco has the worst hotel market in the county. Previously the SF Times reported that Oakland and San Jose will see stronger recoveries in their hotel industry than SF.

Give it to homeless for housing. Ask the mayor to help

By waving her magic wand and wishing three times?

The hubris of constructing a gargantuan glass vibrator in a way that no citizen of SF cannot see it from any point in the city is having its karmic return.

Have you seen Salesforce’s stock price? They don’t seem to be suffering.

That might be due to the software it rents that facilitates the shift to working from home.

There’s a somewhat crucial implication here, but I just can’t figure it out! ?

I do not know if you have used Salesforce for your job, but I promise you it’s precisely as useful at home as it is in the office.

The original point was that they were having some sort of karmic retribution for building the Salesforce Tower. I was just observing that karma doesn’t seem to be bothered too much.