Having inched up a percent last week, the net number of homes on the market in San Francisco has since dropped 5 percent driven by an uptick in contract activity.

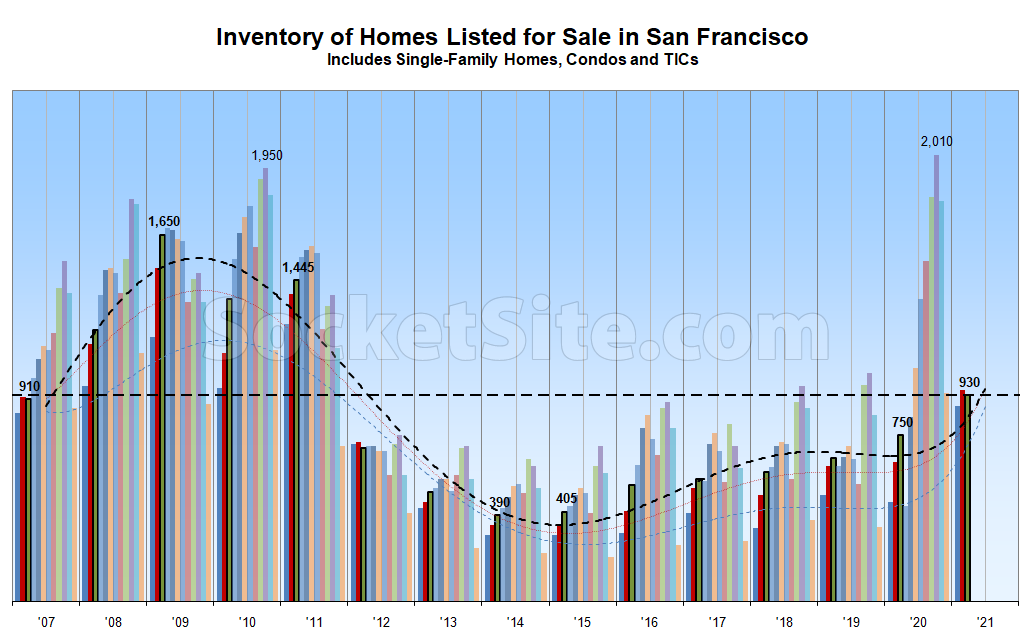

And in fact, while there are still 22 percent more homes on the market (930) than at the same time last year, versus nearly 30 percent fewer nationwide, single-family home inventory (230) is now down 11 percent, year-over-year, in San Francisco while the number of condos on the market (700) is still up 40 percent.

All that being said, the percentage of homes on the market with a reduced list price is still hovering around 20 percent, which is 3 percentage points higher than at the same time last year, with 40 percent more reduced listings in the absolute.

And the average list price per square foot of all the homes which are in contract actually ticked down a percent over the past week to $984,which is 4 percent lower than at the same time last year and 6 percent below the average list price per square foot of the homes which remain on the market.

Expect inventory levels to climb over the next quarter and through the middle of the year, with a big year-over-year jump next week driven by an exodus of listings last March.

“…with a big year-over-year jump next week driven by an exodus of listings last March.”

Bottom is way past, I am calling a surprise lack of inventory for 2021 given moratoriums and prices will rocket as everyone who was outbid in Fairfax and Oakland Hills swarm back into SF. Adding fuel to the fire? Federal Reserve Yield Curve Control(YCC). Just think… 20% Y/Y increases and the FED is still going to artificially keep real mortgage rates negative. Insanity

Free money, buy buy buy (if you can)