Having hit a record high at the end of 2019, the number of apartments and condos now under development in San Francisco (i.e., the city’s housing pipeline) has since dropped 4.6 percent, primarily driven by a sharp decline in the pace of newly proposed projects.

That being said, there are still 9,500 units of housing which are already under construction across the city and should be ready for occupancy within the next year or two, which is down 2.3 percent on a year-over-year basis but roughly 50 percent higher than the average number of units which have been under construction across the city over the past decade.

At the same time, the number of housing units in projects have already been entitled and for which building permits have either been issued, approved or requested – but for which the ground has yet to be broken – has ticked up to nearly 18,000, which is the most in over a decade, while the number of units in projects that have already been approved but not yet permitted (which still includes the majority of the 10,500 units by Candlestick, 7,800 units on Treasure Island and 5,680 units at Parkmerced, projects which have overall timelines measured in decades, not years) has ticked up to 32,900 and is now 7.0 percent higher than at the same time last year.

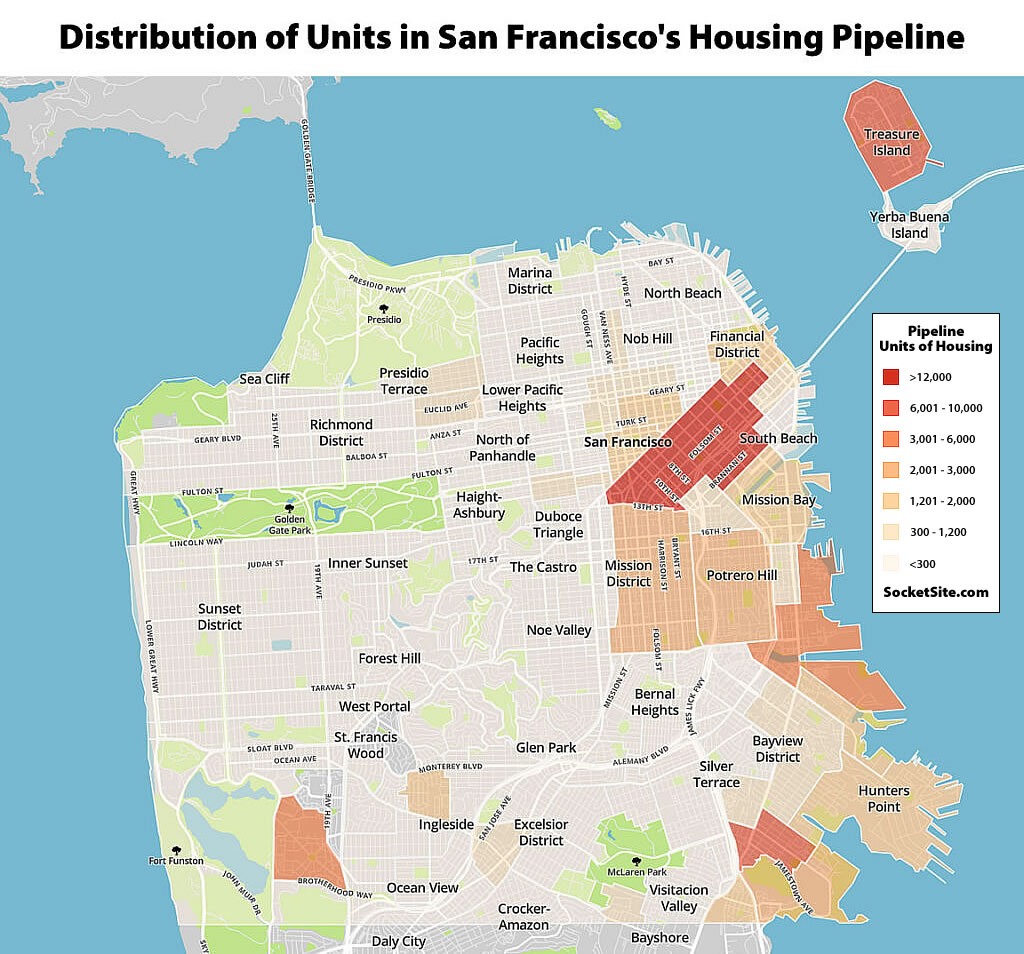

And with proposals for another 10,200 units of housing under review by the City’s Planning Department, which is the fewest since the fourth quarter of 2014 and down over 35 percent versus the same time last year, San Francisco’s overall Housing Pipeline now totals 70,418 units of housing, which is down 4.7 percent on a year-over-year basis and includes 13,900 units of affordable housing, according to our latest accounting of Planning’s databases as mapped and distributed above.

Those 9k units at Parkmerced will never be built. The location is terrible, frequently overcast and cold and has highly limited access to transit. The developer is a glorified value-add shop that hasn’t ever done ground up, let alone anything at this scale. No way they raise capital for any sort of vertical construction in the next 50 years.

My two cents

Agree 100% with dreamin…..

Muni M-line is washed up and no money

SFSU keeps building but which students are attending

And stonestown has plans but no transit solutions….

Parkmerced should be bought by the city and any density should be an infill on the existing parking lots as townhomes with granny and student units plenty of land to density and 11 unretrofitted towers

I feel like you’re talking about all of Daly city.

Candlesticks and Hunter’s Point are farther from transit and yet many more units are planned at those places than at Park Merced. Your core argument here disintegrates under a tiny amount of scrutiny.

Planned and capitalized are two VERY different things. I bet those two projects are having the same capital issues that Parkmerced is. Why do you think these enormous projects rarely break ground?

Can you point to actual evidence that the developers and/or city are reconsidering moving forward with development in either case? I haven’t seen anything yet that would indicate they are.

Developers plan to do all sorts of projects, but the point he was making is that they sometimes don’t break ground, and in many cases that is because they don’t have the capital to do so. Anyone reading socketsite for over a year read about many projects that get planned, approved and then sit around without a ground breaking for years on end.

If that’s a fair reading, then there wouldn’t be “actual evidence” of reconsideration to point to, and in fact there might be all kinds of press releases available on the web about the project and submissions to the planning commission leading an outside observer to believe that the project was moving forward when in fact it wasn’t.

Talk is cheap. The way to tell if a development is moving forward and financing is in place is if construction is proceeding.

About 10,000 people have already left S.F. and will never have a reason to return. The exodus shows no sign of slowing down, no matter what happens with covid. There’s really no reason to build any more housing. A bank would have to be crazy to lend any money to a developer looking to build here.

There’s still a housing shortage even with a probable short to medium term population decline.

I think everyone commenting here would agree with this statement.

However, the harsh reality is that lenders for real estate development probably prefer a housing shortage to an equilibrium or a surplus because the shortage, all other things being equal, tends to buoy housing prices. And they lend based on, among other things, what prices the completed units are expected to command in the marketplace once a project is completed.

What I think Joe is saying is that if there’s a meaningful population reduction, prices will either stagnate or decline and that will tend to reduce the funds available for housing construction because projects will cease to “pencil out” (that is, produce the desired level of profit) for the lender.

People leaving – that is the unknown. How much will SF’s population fall and where will it settle at. IMO there will be a 10% or so decline over the met few years – that includes what anecdotally appears to already be a large drop. If there is ultimately an 80k – 90k population decrease all the housing in the pipeline will not be needed. Not saying that more housing is not needed just not all that’s been proposed, Some of these projects looked dubious before Covid and now seem like little more than pipe dreams – the TI project for instance. Others like HP/Lennar have run into serious environmental issues that may limit the amount of new housing that can be built there. Others, like Hub 2.0, probably no longer pencil. A significant number of the 70,148 pipeline units will likely not get built. Socketsite – are the units for the abandoned Rizzo. Oceanwide residential and skinny Howard Street towers still being counted as part of the 70k pipeline?

Remember the dot com 1.0 bust after 2000? Plenty of people packed up and left after that. Yeah there are going to people that leave but there will be others to return or move in for the first time. SF isn’t just tech. We are not a monolith and hopefully tech’s endless hunger for real estate will be tempered a bit allowing for other things to thrive in it’s place. And rents have dropped but prices are still bonkers.

Remember that Detroit use to have almost 2 million people and Chicago had 3.6 million people before manufacturing moved away from the Midwest.

San Francisco depends on a lot of the money that tech brought in. Without that, it could dwindle. Historically, like your example, there is precedent, between 1950 and 1980, SF lost almost 100,000 people.

We are heading into unknown territory – will work-from-home reshape downtown areas, will tech companies spread their teams around, will companies make work-from-home permanent, will Americans re-shape their habits based on the lengthy stay-at-home, will Covid continue to plague us for another couple years, etc. The situation could constitute a re-alignment of de-centralization that will increase the population of the suburban areas and make downtowns ghost towns again.

Regardless, many of the businesses will not re-open, and I’m not sure how many people will rush in to fill the void (there were many vacancies before Covid, so I would not expect a return to pre-Covid times).

I think Covid was simply the precipitating event + catalyst. The reshaping of cities because of high-speed inter-networking was due anyway. Historically, the “city” (in human civilization parlance) was the place where information was concentrated which allowed for arbitrage opportunities of goods/services. The Internet just about took that advantage or the need away.

At least in the near term I expect there will be population dispersion to areas out of cities. But in the future I expect cities to (re)gain prominence again because of logistics related to resource distribution and services engagement. This is already evident in some cases where arbitrage opportunities are dependent on information latency. (For ex HFT).

I think the question is really how do we make cities affordable and livable as we progress into future. The approach (in SF and metropolitan California) is broken imo.

Population in the city over the next 4 years in the city will drop at least 20%. WFH /WFA is a game changer and in order to retain and attract talent, companies will be make this more permanent. If just 10% of the large tech employers in the city went full or even half WFH/WFA that would have significant impact on the employee base in the city. I’m talking about the city as a whole, not the bay area. This is happening and it’s a reality.

So half the large tech employers go full or half WFH that equates to a 20% drop in population?

How do you derive 20% from your tech WFH 10% metric?

Pretty fanciful stuff there. An effective vaccine happens, plus the cheaper rent that’s already happening? Right there people are thinking they like SF again. You’re talking about a swing of 200,000 people. Does SF even have 200,000 tech workers?

only 13% of SF workforce is tech, but there is a multiplier effect for businesses supported by tech employees.

OK. Now think about the quotient, meaning how many of those workers have SF resident families whom are tied to said workers movement. Then think of the overall population here, children, elderly, retired, non-working, etc. This 20 percent drop thing is one of the wildest takes I’ve read on Socketsite recently. And that’s saying something.

Only 100% telework would allow employees to move away from SF. How are you going to commute into the office 2 days a week from Montana?

montana is probably tough, but i’ve had friends in LA, SD, Lake Tahoe who’ve done either 2-3 days per week or every other week here. you could add salt lake, seattle, boise, portland and Denver to that list. If there is a direct 2 hr flight, then its possible

If I had to drive back and forth from Tahoe two or three times a week I don’t think I’d expect to live past the age of 55. That drive has gotten so miserable anymore with like 4, 5 choke points.

i dont think they are driving back and forth 2-3 x. they are staying in SF for 2 nights (3 work days) and driving back. so its a once/week drive. or that are driving every other week and staying 3 nights (4 work days)

2 days a week could also be re-framed as 5 days a month — at which point, commuting once a month from Montana is a fairly straight forward air-travel affair.

5 days/1 week a month also matches well with 25% occupancy. The weekend in between could ensure proper sanitization / re-arranging of furniture as needed.

I would wager a very large sum of money that San Francisco’s population will NOT drop by 20% (!) in the next 4 years. A very large sum.

i agree, but i do think 10% is a real possibility. there are a lot of sheep following the tech titans

Somebody brought up a guy who was in the paper recently who was always going to leave town. Of course. Social liberal fiscal conservative “libertarian” types get to a point where they think they are above the fray, right. And unless they’re willing to jump in the old school Schultz and Wilsey types what are they gonna do? Florida beckons. Don’t le the door hit you on the way out.

I think that a 15 percent drop-off in population in that time period is entirely possible, IIRC the exodus after the dot com implosion was about 10%.

People selling their condos and moving out of the area might be a bit sad for the flippers, penny ante landlords, real estate agents and the other hangers-on in the real estate “game”, but overall it will mean that San Francisco and the Bay Area in general will be returning to something healthier. If it holds post-pandemic, airport and freeway traffic will be lighter, and neighborhoods will be more livable.

We don’t have the infrastructure for accommodate the population we’ve had and we weren’t on our way to building it, either.

Brahma, it’s simply not moving that way. Condos are only down 270 sales in volume per the MLS from 2019, 2696/2426 despite the 2 month shutdown. Single family homes are only down 46 sales 2043/1997. This conventional wisdom on here which many posters seem to share is quite simply wrong.

People have left expensive rentals. That’s what has happened. Whether temporarily or not, that’s largely what this vaunted WFH exodus has been about.

*per the MLS subscription service numbers, that is

Unlike with the rental market, where an “exodus” would present as an increase in vacancy rates and resultant drop in rents, an “exodus” in the condo/SFH market would present as an increase in inventory levels, leading to price capitulation and a resultant increase in sales volumes as most people don’t move without a sale of their primary residence.

True about infrastructure. It has not been well maintained to begin with and certainly not given the population increase since 2010 or so. SF can’t accommodate 860k residents given its situation. I just drove past Font at Lake Merced Blvd and there were 26 large SUVs parked there. People living in them due to housing costs. It is a traffic nightmare with SF refusing to tag the vehicles – what they are doing is illegal – or to at least to force cyclists to ride on the sidewalk in that area. A major accident is waiting to happen there and SF does nothing.

I don’t see a 15% drop but definitely a 10% drop and that will have a real impact. 3 homes near me were rented out to unrelated individuals. 10 people, 3 homes and 14 cars. All the vehicles parked on the street. Now 8 of the 10 have moved out. Only 4 cars left and there are now actually street parking spaces open midday on the weekends. Something that didn’t happen before. Definitely as the population falls the quality of life will start to recover.

Not sure why you did that, bundling in on sentence price capitulation as seen by a one off anecdote, and a resultant increase in sales volumes. The “volumes” in question upon look nothing like sales capitulation price wise.

Ohlone Californio, point taken. Although I think that condo sales are not down further than that number you cited due to the fact that some people who may want to sell are assuming that sales prices will be depressed due to “Stay at home” orders, because if you can’t have traditional open houses, you probably won’t get multiple offers and so on. So some people that may be motivated to leave may not be selling right away because they don’t want to take a haircut or think the sales process will take longer in terms of duration than they want.

But even if people are just leaving overpriced rentals, that will still affect the population level because such a large proportion of S.F. households are renters.

one … upon examination …