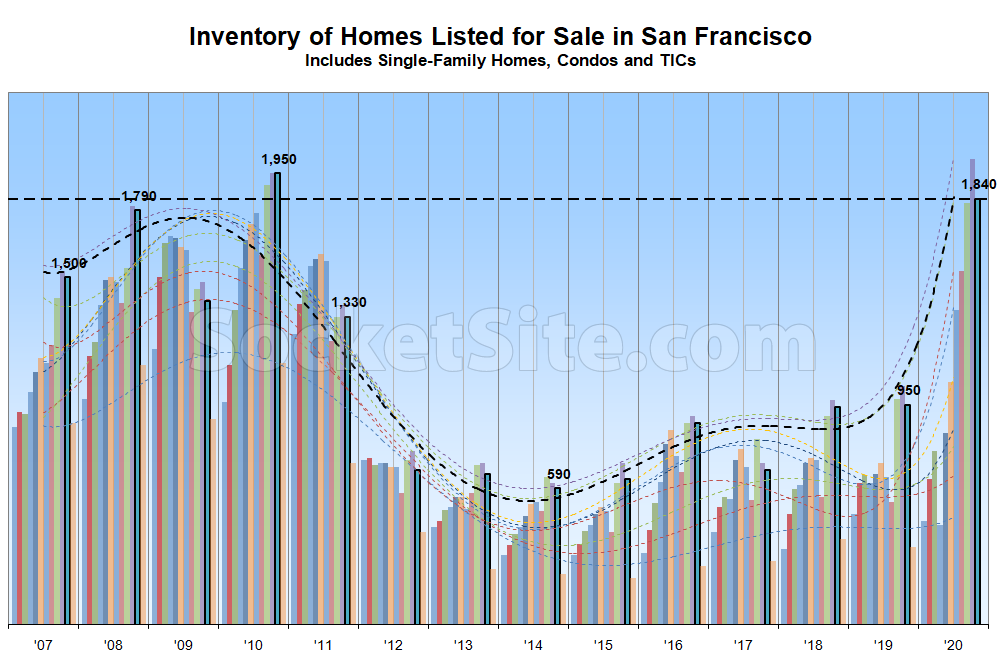

In a move that shouldn’t catch any plugged-in readers by surprise, the number of homes on the market in San Francisco, net of new sales and contract activity, both pending and closed, ticked down 6 percent over the past week to 1,840.

That being said, there are still twice as many homes on the market now than there were at the same time last year (versus nearly 20 percent lower nationwide), three times as many homes on the market as there were on the market at the start of November in 2015, and around 15 percent more, on average, than during the Great Recession, with the number of condos on the market (1,390) up 121 percent on a year-over-year basis and single-family home inventory, which hit a 9-year high last month, up 41 percent.

As we noted last month when inventory levels hit a two-decade high overall, and the month before, “listed inventory levels typically peak in October, at which point new listing activity typically slows and unsold homes are more likely to be withdrawn from the market (and then re-listed anew in the spring).” In other words, typical seasonality is in play versus a market surge.

And having hit a 10-year high in the absolute last month, the percentage of homes on the market which have been reduced at least once, which includes 29 percent of the single family homes, has held at 35 percent over the past week, which is the highest percentage of reduced listings since the first quarter of 2012 and 10 percentage points higher than at the same time last year.

We’ll keep you posted and plugged-in.

It’s just the beginning. This was the Covid effect. Next comes the tax exodus.

Depends on the outcome tomorrow. If Biden wins, SALT caps could be repealed — which could stem the tax exodus. A Trump win could manifest itself as a great deflationary force for rents along both coasts.

i doubt this happens. a tax decrease for high earners wont look great in a depression and pandemic

Anyone know where to get similar data for the East Bay (especially Contra Costa county)? I’m really wondering if the San Francisco exodus is really just people decamping from the city to the suburbs. The shift to hybrid or mostly remote work makes the East Bay suburbs a reasonable alternative for tech workers; it’ll be very interesting to see which direction those markets move in relation to the city. Anecdotally the Peninsula is continuing to do fine.

Strong theory. Look at sales in Berkeley in particular. Pretty steadily 30-40% over asking on turnkey-ish SFH throughout the pandemic. Very, very, few SFH listings < $1M that anyone would want to buy.

While Berkeley homes might be selling for “30-40% over asking,” keep in mind that single-family home values in Berkeley are only up around 5 percent, on average, over the past six months on a price per square foot basis, up 3 percent over the past year.

And in terms of sales volumes, it’s effectively unchanged over the past 12 months versus the 12 months prior (down 1 percent, in fact).

But there is a lot of bad industry analysis and reporting making the rounds.

Thanks. Under the circumstances, appreciation and steady sales volume would seem like an indicator of strength. That is, if bay area is reported to be in less demand.

@Mutal Kudi, why East Bay suburbs? Why not Central Valley? or Nevada? or beyond?

Some of the home pricing in East Bay and South Bay is supported by H1-B workers. A Trump win could put a dent into that price support since they’ve tightened up and are tightening up the H1-B process. Companies could also shift workforce to remote satellite offices and adjust wages accordingly. I don’t think H1-B will disappear. But I do think it will become more selective.

Without doubt H1-B offers a cost benefit to corporations. The only question is why should that H1B employed in Bay Area vs other places in California or US?

What evidence do you have that prices are being supported by H-1B employees? The program is important for tech but is not a large number of people on an absolute basis, and also, people who may have to leave the country after 6 years are probably not rushing into the market.

And I doubt tech industry employees are going to decamp to the Central Valley or beyond in large numbers. Highly educated people have clustered in urban areas forever; the pandemic isn’t going to change that. We certainly could see an increase in moves out of CA to other urban areas as has happened with Seattle, PDX, Denver, and Austin over the last couple of decades, but the pandemic might actually reverse that effect. A lot of tech workers who might have been considering moving to Boise aren’t going to move to a place where the lieutenant governor drives around waving a gun and spouting anti-mask slogans while their hospitals are overwhelmed.

H1-B people also need shelter. They pay rents or mortgages. In either case they are offering support to market prices. I don’t know where they or tech folks will move to.

But from a wages perspective, a company could easily relocate the job to a specific geographic area and adjust wages accordingly. I mean this is essentially the same logic behind outsourcing jobs to wherever, right? And if they can, moving it out of CA offers them the best value — isn’t this same reason behind moves to PDX, Denver and Austin?

I don’t think people care about political affiliation if it means saving or making more money. I certainly don’t. All those Indian & Chinese immigrants working in tech, operating laundromats, gas stations, motels etc., in the middle of nowhere might agree with me.

A lot of people, like myself, have a job here. My company has not decided to leave the bay area. I could leave to work remotely, but it would be a dead end career in tech. So while I need space, I need it within proximity of my commute when we inevitably return to offices.

I don’t think companies will remove themselves from the bay area completely. But I think they will optimize for space and staff where possible. A bio-tech might require scientists onsite. But a software company could restructure their QA/development dept for WFH for instance. It makes no economic sense to host headquarters in SF and pay $x in rent when you can pay $y in rent in South San Francisco where $y < $x, for instance. Stripe did this. The same logic could be extended to other places in the US.

I also think the job-to-specific_location will be phased out gradually rather than abruptly so as to minimize/control employee demoralization.

Sure. For what it’s worth, companies were doing this before the pandemic. I’d say the one benefit of startup in SF is creative energy and feedback. Same is true for any urban center, but it requires a high-enough concentration of like minds to have the same magic. This is why every other city on the planet has tried to brand itself as, “The Next Silicon Valley.”

Stripe had gotten so large that it had to leave SF and find a proper corporate campus because there wasn’t an SF space that worked.

Or Maybe SF was never the ideal place to be for a tech company. Either Stripe wasn’t thinking ahead or had gotten wildly successful which forced revaluation. Tell me, exactly why should a company pay such exorbitant rent when there is significantly cheaper RE to be found in San Jose or else where in the real Silicon Valley? Btw, SF is not Silicon Valley. It is a colorful city north of.

Silicon valley is a boring suburb and many talented people will only work in SF.

@CaveDweller – good points. SF’s tech industry is largely a spillover from the SV. Stripe moved for several reasons including the cost of doing business in SF – which, BTW, will go higher with the passage of one of the initiatives. As tech retrenches from SF look for some consolidation back to the SV – as well as moves out of the BA altogether.

Since Stripe is less than 1/10th the size of Salesforce and there are over 8 and a half Salesforce towers worth of vacant commercial RE in SF right now, I find it unlikely that Stripe just outgrew SF.

You folks clearly haven’t worked in Big Tech.

The new generation of tech companies lean young. Young people prefer SF, ergo the shift up to SF in the last boom. Now you end up with an employee base that lives mostly in SF, with a mix of East Bay, Peninsula and South Bay as well.

Up and moving your entire company 60-90 minutes commute south would piss off a huge number of employees. Many of them would leave.

South SF is the closest they could get to SF proper with a large campus size.

Feel free to read about the rationale. I’m sure taxes are a reason too, but the #1 reason was running out of room.

Wilson, yes, *now* there is a lot of SF office space available. When they made the decision to move to South SF, there wasn’t.

I don’t think y’all realize the morale hit to employees if you announced a move 60-90 minutes south. Just like where you live is not all about the lowest price (or we’d all live in Nebraska), moving your company isn’t that simple either. I’ve personally been involved with it multiple times at large Bay Area tech companies.

Stripe decided to decamp to SSF long before Covid and the subsequent 81/2 Salesforce towers worth of empty office space. Stripe’s move was mostly an economic decision though I’ve read they did want a more campus-like setting as they grew their workforce.

The speed and scale of people moving out of SF as soon as they had the chance seems to fly in the face of your theory that employees are demanding that companies locate here.

Wilson, you seem to be confusing “Pre-COVID” with “Post-COVID.”

Yes, now everything has changed. Stripe announced their own remote work package. They might regret signing the lease in South SF.

At the time, they had a rapidly growing employee headcount projections and were quickly running out of room in SF. All of their employees were centered around SF. There was also Prop C (a factor, I’m sure). They looked around and saw Oyster Point as their best bet to support headcount growth while not alienating their employee base.

@Panhandle Pro — take all the tech companies based out of SF (their HQ) and add up their market capitalization. Then take all the tech companies based in between Redwood City thru San Jose and add up their market cap. Then, please explain to me why all those companies haven’t decided to relocate to SF to attract super hot talent oozing out of god knows where!

@Panhandle Pro — the reason Silicon Valley exists is because they actually make Silicon which needs an ecosystem of software, integration with other silicon, testing, product integration etc etc. If you are running a company that runs on open source software (which is the case with bulk of companies based out of San Francisco) there is no real reason to set up shop in SF or Silicon Valley. Yes, they should and would really be better off setting up shop in Nebraska. I mean Linus developed his kernel in Finland. There are many software companies around the world. Microsoft is based out of Seattle etc.,

There is no eco-system in SF. Name one company from SF that developed *any* fundamental computer technology? How about a compiler? How about a micro-processor?

SF rides on the coat-tails of Silicon Valley. If you are spending exorbitant money on rent in SF, yes, its an absolute waste of shareholder value. But then it helps a lot of con men front run RE deals which feeds into fat tax to City. Its a party until the music stops.

That’s not how this is going to play out. Some Stripe employees have ties to the bay area so half of them will stay put.

BUT, the next Stripe won’t start here. The founder will realize there are ex Stripe employees to be poached from all over the US and he’ll start his next venture in Nebraska and save boatloads of money as his employees can work from home in cheaper locales around the country. And you’ll start seeing tech companies all over the US instead of mostly here. That’s how this will play out. Meanwhile, the VCs and lawyers and accountants who make silicon valley work have realized they don’t actually need to be close to their clients and THEY will leave too. And that will lessen the draw of being here for the tech companies.

Sure, Reddit just announced work from home permanently with NO pay differentials based on where you are (name link), and sure ALL companies will soon match that because they will have no choice because the market for tech talent is competitive and if your star programmer wants to move to the beach in Florida while paying ZERO income taxes you’ll pay him just the same and he’ll put $50,000 more in his pocket every year while living in a home that is twice the size as here with a pool, but that’s only half the work force, the other half will stay put for awhile. Then the next company will take it from there and grow only outside the bay area and other high cost areas. Soon, workforces will be dispersed, and bay area housing costs will just sink and sink.

The world just changed. This is as fundamental as the Internet itself. The world just proved to itself that you don’t need to be in the same building.

Two factors going on re: the exodus from San Francisco. It is both intra and inter. There is an exodus from SF to other Bay Area regions. The East Bay and North Bay in particular. There is also an exodus from SF and the Bay Area to other regions. Central Valley, Nevada, Tahoe, the Willamette Valley and parts of Washington State.

With climate change upon us, not sure decamping to the Central Valley or Nevada is a good idea. But if you insist, have fun there.

A/C costs are cheaper than paying for a site along the coast. Besides it has been getting pretty hot on the coast as well. Central Valley heat is no worse than Alameda/Contra Costa.

“A/C costs are cheaper than paying for a site along the coast.”

Today, yes. But energy costs are expected to rise over time as will the temperature differential between coastal and inland locations.

“Central Valley heat is no worse than Alameda/Contra Costa.”

Perhaps for the far eastern side of Alameda Co. But the Bay side of Alameda has significantly more stable temperatures, both in the winter and summer. It is common to have a 20 degree difference between the two sides of the Diablo Range,

People live in the Nejd Desert in Saudi Arabia, in Arizona, Utah, New Mexico, Sahara, Mojave, Sonoran Desert, the Great Taklamakan Desert etc. They’ve been living there for 1000s of years — where temperatures and conditions are far more extreme.

Central Valley is a relative paradise but for 3-4 hot months. Its not a big deal. I mean there are millions today who live in Central Valley and other Deserts I mentioned above.

It’s not a binary choice. Some folks are heading to the NW and especially smaller cities in the NW – Eugene for instance. And there are options outside the West Coast as well.

Proving the old adage “there’s no problem that price can’t fix,” even the construction-noise-challenged Millenium tower podium properties are selling. Case in point, 301 Mission #805. Bought for $2.9M in 2014, it just sold for $1.8M (name link). ~$1.2M down the tubes.

That ~$1.2M will likely be written off over several years. Sometimes better to take near term losses in view of long term benefits. Smart money usually cuts their losses quick. Often times liquid capital is worth more than hard asset values on paper.

But if someone actually did spend $2.9M on a condo without a grasp on how to limit the downside — then “a fool and his money .. so on”

Well I just looked at the RedFin listing that tipster provided and it’s not at all clear the seller will be able to write off that approx. $1.2 loss over several years. What makes you think it was an investment property? Just the HOA dues are $2,555.90 monthly and according to the listing, that’s about 50% of the median rent in the area alone.

If it was a residence for the person who sold, how was he or she supposed to “limit the downside” and avoid being a fool? Employ some exotic Nassim Nicholas Taleb-esque multi-family real estate property hedging technique? Please do tell, inquiring minds want to know.

One way is to maintain stake in a holding company. When the holding company sells the asset (condo) at a loss, it is recorded as a Capital loss which be used to offset Capital gains elsewhere. Can always structure the gains to be long term as well to further lower tax liability. But don’t take this advice from me. I am very often (always) wrong.

The only way to limit the downside on a primary residence if its not a structured holding is to not buy a condo with that kind of pricing and expense overhead. Don’t go to a Casino if you want to build wealth. What do I know, I am just a chump.

Well, you can always find someone who did even worse than you did in this market and #805 is the consolation price for #1002 (name link). Purchased in 2012 for 1.9M, sold last week for $1.4. Nearly $600,000 lost and they bought “at the bottom” in 2012. Think of how smug they felt for the last 8 years thinking they bought low and could sell high. Instead, they bought low and sold — even lower.

I had to do a spit take when I saw: HOA Dues $2,555/month

OK how about this one. HOA dues: $0. And their loss is about as bad.

Now listed for over a million dollar loss with commissions and taxes. 3020 Scott Street (name link). SFR purchased for 4.250, now listed for 3.380.

Yeah. These condos weren’t targeted for “common folk”. Upscale earners and the wealthy were the niche group they were marketed to. IIRC Joe Montana owns a place in the building. Given he spends much of his time in SoCal and at a Peninsula place he owns I’m guessing this was little more than a weekend getaway for him.

Maybe this was their mother-in-law unit. They’ve also got a pad on the penultimate floor of the main tower.