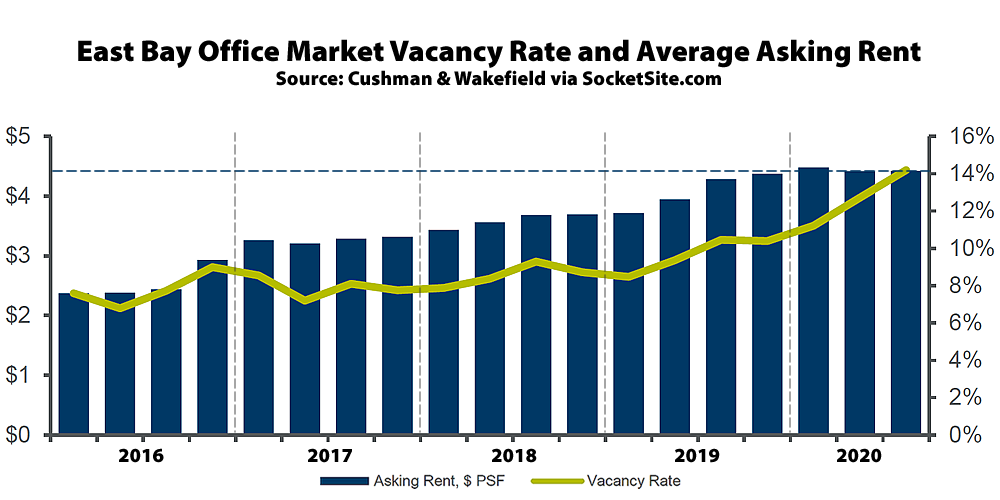

As in San Francisco, the vacancy rate for East Bay office space has just ticked back over 14 percent, which includes 3.6 million square feet of un-leased space along with nearly a million square feet which has been leased but is sitting vacant and actively seeking a subletter, which is the most sublettable space on offer across the East Bay in over 15 years, and over half of which is located in Oakland’s Central Business District, according to Cushman & Wakefield.

And while the average asking rent for held at $4.42 per square foot per month last quarter, which was unchanged from the second quarter and up 3 percent ($0.14) from the third quarter of 2019, said average was “propped up by several blocks of sublease space with top-of-the-market pricing” and asking rents are expected to follow in the footsteps of the San Francisco market and soon decline.

My poor landlord keeps calling me with a lower price, but can’t get through his head that office space is not only worth zero, but staying in California requires me to pay the ever increasing taxes, so California office space is actually worth less than zero. He would have to pay me to stay. So I haven’t even been returning his calls. 1/3 of his leases came up for renewal this year and none of his tenants renewed.

Most people don’t realize that the tenants of a building pay the property taxes unless the space is vacant. Prop 15 will sail to an easy victory, and so now my landlord will have to pay the increased taxes himself.

Until we see what the tax rates are, it’s going to be hard for any tenant to sign up for a lease. That, coupled with being shell shocked by having to pay rent for a space you couldn’t use made the tenants much more risk averse. Had the landlords all moved in to lower rents prior to the lease expirations, I think the tenants would be much less averse to signing a new one. The landlords shot themselves in the foot by refusing to budge and now my landlord is going to lose far more than if he had just cut my office rent in half when I couldn’t use it.

In the meantime, I’m enjoying not commuting and not having to maintain (and soon, not having to pay $35,000 a month for) an office and my employees unanimously want to keep working from home. Zoom is working fine for us. I wish the landlords a lot of luck. They are the travel agents of the 2020s: completely obsoleted by new technology. Adios forever.

So you’re staying put, continuing to pay the high lease that you signed up for, while complaining about San Francisco and not moving. Got it.

Many landlords’ hands are actually tied and are unable to lower rents to meet the reality of the current landscape because their loan covenants prevent them from doing so.

Other landlords who have refused to drastically lower their rents haven’t, mainly because with so little leasing volume the past 7 months, they haven’t been losing deals to the much lower priced and higher value subleases; but they will.

Tenants are touring for space again and many are planning a return in 2021. The 8M square feet of currently available sublease space will get absorbed first, which landlords should be terrified of.