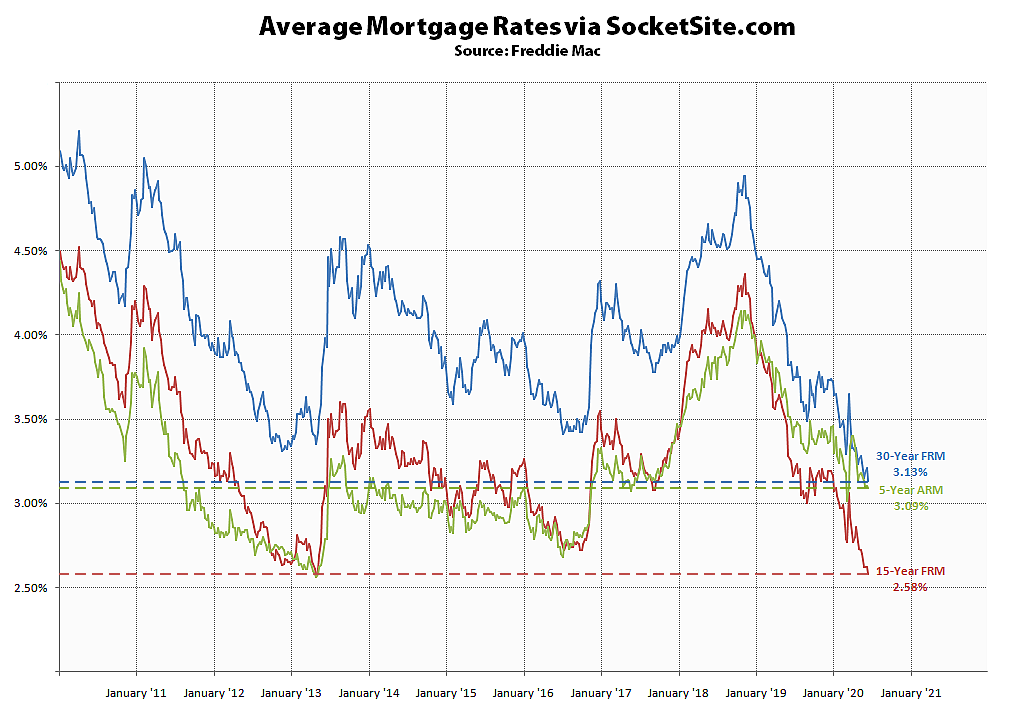

As we noted last week, while the average rate for a benchmark 30-year mortgage had inched up to 3.21 percent, there weren’t any hikes on the horizon. And in fact, the average 30-year rate has since dropped 8 basis points (0.08 percentage points) to 3.13 percent, which is 71 basis points below its mark at the same time last year and a new all-time low, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has shed 4 basis points to 2.58 percent, which is 67 basis points below its mark at the same time last year and within 2 basis points of its all-time low, while the average rate for a 5-year adjustable has inched down 1 basis point to 3.09 percent (which is 39 basis points below its mark at the same time last year but 53 basis points above its all-time low of 2.56 percent).

And in terms of mortgage market activity, applications to refinance, which continue to represent the majority of mortgage broker activity across the U.S. and in San Francisco, have ticked up 10 percent over the past week and are now running 106 percent higher versus the same time last year while purchase loan activity has inched up another 2 percent and is currently up 21 percent on a year-over-year basis, but down year-to-date, according to Mortgage Bankers Association data.