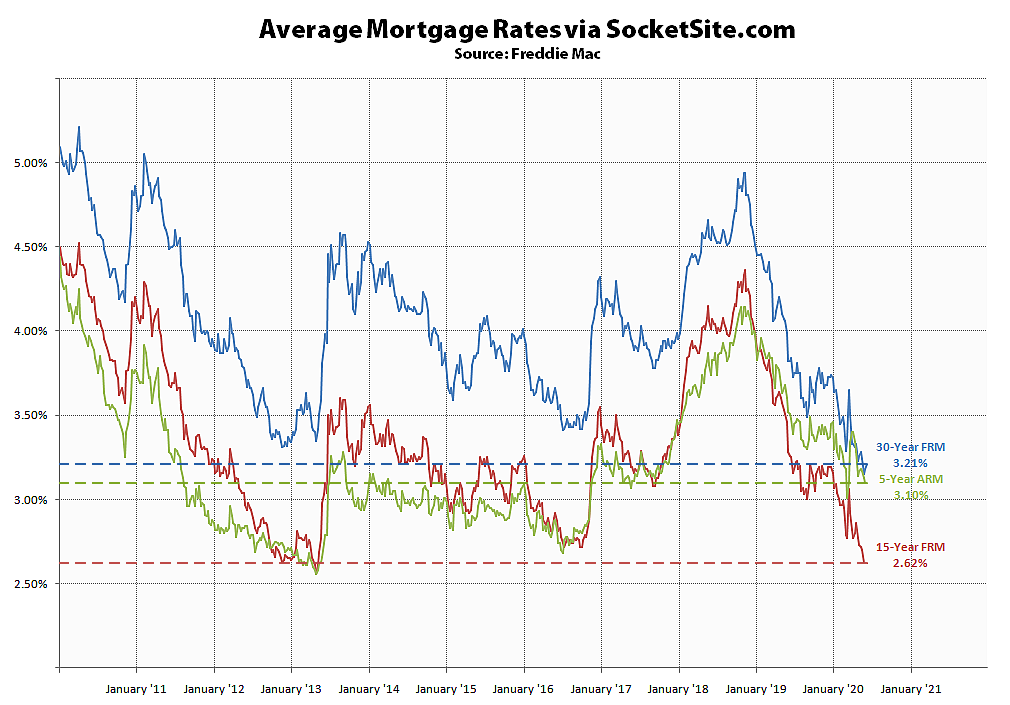

Having dropped to an all-time low of 3.15 percent two weeks ago, the average rate for a benchmark 30-year mortgage has since inched up 6 basis points (0.06 percentage points) to 3.21 percent but remains 61 basis points below its mark at the same time last year and nearly 50 percent below its long-term average, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has held at 2.62 percent (which is 64 basis points below its mark at the same time last year and within 6 basis points of its all-time low) while the average rate for a 5-year adjustable has inched down 3 basis points to 3.10 percent (which is 42 basis points below its mark at the same time last year but 54 basis points above its all-time low of 2.56 percent).

While applications to refinance, which are currently up 80 percent versus the same time last year, continue to represent the majority of mortgage broker activity across the U.S. (and in San Francisco), purchase loan activity increased 15 percent over the past week and is now running 13 percent higher on a year-over-year basis, according to the Mortgage Bankers Association.

And according to the latest survey of Federal Open Market Committee members, there’s not a single federal funds rate hike on the horizon for at least another two years. Or in the words of Fed Chairman Jerome Powell: “We’re not thinking about raising rates – we’re not even thinking about thinking about raising rates” right now.