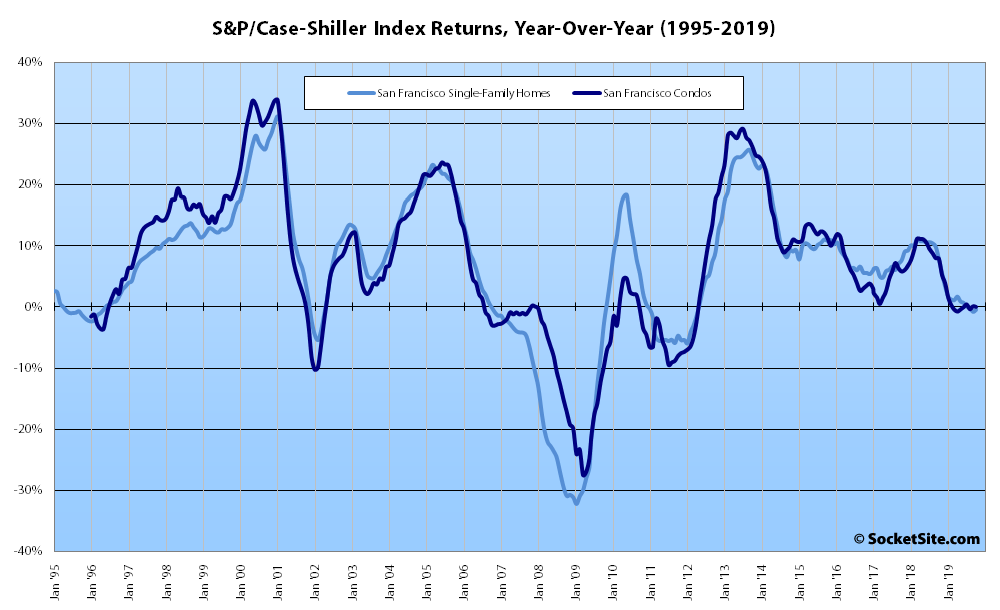

Having turned negative two months ago, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – has since shed 1.5 percent of its value, an outcome which shouldn’t catch any plugged-in readers by surprise.

As such, the index is currently down 0.4 percent on a year-over-year basis despite a dramatic drop in mortgage rates over the same period of time, plenty of IPO related hype from industry folks since the start of the year and a stock market which is still hovering near an all-time high. And that’s versus an indexed year-over-year gain of 7.9 percent at the same time last year.

At a more granular level, the index for the bottom, least expensive, third of the market shed 0.7 percent in October but remains 1.3 percent above its mark on a year-over-year basis (versus a year-over-year gain of 8.3 percent at the same time last year); the index for the middle third of the market, which peaked last year, slipped another 0.3 percent and is now down 0.8 percent on a year-over-year basis; and while the index for the top third of the market only slipped 0.1 percent in October, it is now down 1.2 percent on a year-over-year basis versus a year-over-year gain of 7.8 percent at the same time last year.

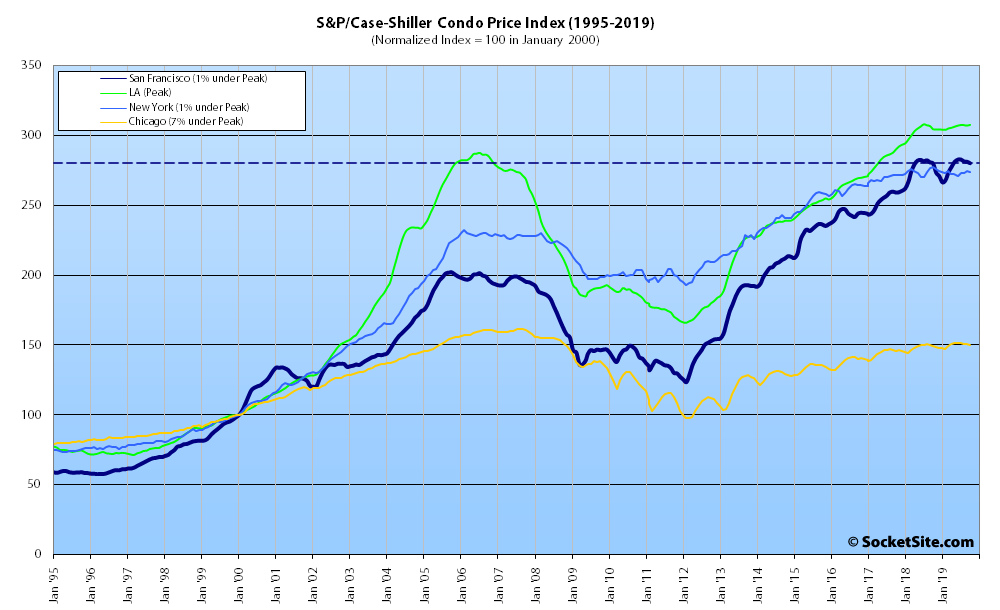

The index for Bay Area condo values, which peaked in July, slipped another 0.4 percent in October but managed to eke out a year-over-year gain of 0.1 percent.

Nationally, Phoenix is still leading the way in terms of home price gains, up 5.8 percent on a year-over-year basis, followed by Tampa (up 4.9 percent) and Charlotte (up 4.8 percent).

And for the third month in a row, San Francisco was the only top-20 metro area to record a year-over-year loss, with Chicago, which ranked second to last in terms of performance in October, managing to eke out a 0.5 percent gain and an average gain of 3.3 percent nationwide (which was actually up from a 2.1 percent gain in September).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

So IOW this has been the 10th Best Year this decade !!

But I’m sure things will be (even) better next year…we’ll all know by tomorrow

(Confucius say “foresight next year will be 20/20!!”)

Today, the FDA banned 65% of Juul’s products. All flavored products other than menthol and tobacco are banned as of the end of the month.

And what about those last two remaining flavors of theirs? Even worse news:

“On Thursday, researchers announced they’ve found a microbial toxin in Juul-made e-cigarettes. According to new study, researchers said about half of the 54 Juul pods they reviewed contained “detectable levels” of the toxin glucan.

Research suggested chronic exposure to the toxin can cause airway inflammation, which could [lead] to long-term lung damage. Tobacco and menthol flavored pods were reportedly more contaminated than the other sweet or fruit flavored pods.”

Last year’s big driver of SF real estate bites the dust, hard.