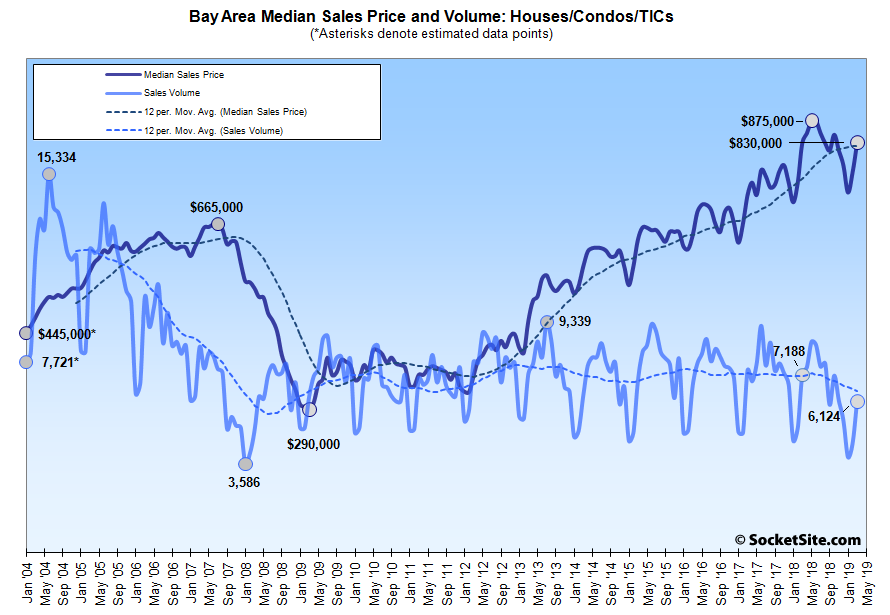

Following a trend which shouldn’t catch any plugged-in readers by surprise, while the number of single-family homes and condos that traded hands across the greater Bay Area increased a seasonally driven 39.4 percent from February to March, total sales (6,124) were down 14.8 percent on a year-over-year basis. And for the first time since the first quarter of 2012, the median sale price ($830,000) declined on a year-over-year basis, albeit by a nominal 0.1 percent, according to recorded sales data from CoreLogic.

In San Francisco, recorded sales totaled 455 last month, down 12.0 percent on a year-over-year basis and the lowest March sales volume since 2009, which is another trend and outcome which shouldn’t catch any plugged-in readers by surprise.

On the eastern side of the Bay, homes sales totaled 1,284 in Alameda County last month, down 14.7 percent on a year-over-year basis. Sales in Contra Costa County totaled 1,187 (down 16.6 percent). And sales in Solano County totaled 525 in March, down 6.9 percent versus the same time last year.

Down south, home sales in Santa Clara County totaled 1,430 in March, down 13.6 percent on a year-over-year basis, while sales in San Mateo totaled 490, down 17.2 percent versus the same time last year.

And up north, home sales in Napa totaled 96 in March, down 3.0 percent versus the same time last year. Sales in Sonoma totaled 434, down 26.6 percent. And sales in Marin totaled 223, down 5.9 percent, year-over-year.

With more expensive homes on the market in San Francisco, the median price paid for home last month was $1,380,000, matching last year’s peak and 5.3 percent above the median sale price at the same time last year.

The median sale price in Alameda County was $822,000 last month, 1.5 percent above its mark at the same time last year; the median sale price in Contra Costa County $603,000, 2.0 percent above its mark at the same time last year; and the median sale price in Solano County was $426,500, up 0.4 percent versus March of 2018.

The median sale price in Santa Clara County was $1,080,000 last month, down 10.0 percent versus the same time last year, while the median sale price in San Mateo County was $1,308,500, which was unchanged on a year-over-year basis.

The median sale price in Marin was $1,090,000 last month, 4.7 percent below its mark at the time last year while the median sale price in Napa ($630,000) was 3.3 percent above its mark at the same time last year and the median sale price in Sonoma ($575,000) was down 2.5 percent, year-over-year.

And as such, the median home sale price across the greater Bay Area was $830,000 in March, which was 7.8 percent above its mark in February but 0.1 percent below its mark at the same time last year with a year-over-year trend that has been on the decline since last May.

But as always, keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, especially as sales volumes drop, as opposed to movements in the Case-Shiller Index.

Sales down almost 15% YOY. These are huge numbers; I wonder what’s up. Also interesting is that prices really are not declining. Is inventory building up again?

“What’s up” is what is called a “slowdown.” A “slowdown” always precedes what is known as a “price drop.”

Real estate is the most illiquid of all assets, and properties are not fungible, so RE is not a commodity, which means most economic theory — supply & demand, equilibria, elasticity, yadayada — is more complicated than in the simplistic graphs they told you explained everything in Econ 1. On the way up, prices change at the margins. On the way down, prices are sticky. Downward price movement is like an oil tanker changing direction: it occurs slowly, but inexorably.

The interest of the landlord is always opposed to the interests of every other class in the community. – David Ricardo

A “slowdown” occurs when a combination of the following occur: the central bank raises interest rates; the central bank stops buying up lenders’ failed assets at full price; foreign countries clamp down on flight capital; newly-public unicorn stock plummets, because of fraudulent business models; & etc.

A “slowdown” never occurs because some magical supply number has suddenly hit the market, although a surge of new housing does apply downward pressure on prices that are already in decline…

This thread is anchored by data displaying SF median is up, and tied with an all time high. I think most people would hesitate to call MLS data currently displaying 525 versus 514 (and climbing, as more data is entered throughout this week) sales a slowdown. We also saw that CS showed a slight gain, regionally.

So I went back in and looked. As of now there have been more April 2019 (526, and climbing) sales than April 2018(525) sales. So that puts the most recent SF median YoY up, tied with an all time high. The most recent CS slightly higher. And sales volume is Yoy higher.

An uptick in April sales shouldn’t catch any plugged-in readers by surprise. But total sales in the first quarter were still down nearly 13 percent on a year-over-year basis and the fewest since the first quarter of 2009.

At the same time, while the Case-Shiller index for single-family home values inched up 0.6 percent in February, it’s still down 3.7 percent since the third quarter of 2018 and the index for condos is down 5.1 percent versus the second quarter of last year.

Now YoY April YoY sales are up over 5%, 554 vs 525 and $sqft is up as well, way up for SFRs, 945 vs 871, and even condos are up 1103 vs 1063. And April 2018 was strong. Meanwhile there are 743 properties for sale on the MLS. Looks like peak market conditions IMO.

Or as we first pointed out three weeks ago: “In fact, for the first time in nearly a year, the number of homes in contract to be sold is now higher on a year-over-year basis, up 8 percent versus the same time last year.” (And with respect to the price per square foot, and inventory levels, in April: More Expensive Homes for Sale in San Francisco.)

Is 5+% coupled with more price per foot in both SFRs and condos merely an uptick? Because that’s what you said in this thread earlier. As you also pointed to several trailing indicators that depict months in the first quarter. You were told that the market had shifted during the end of that quarter, actually, and you hedged, and pointed to trailing indicators at that point in time as well. Here you’re hedging once more.

Socket: Are you calling housing price deflation or not? Just state your call. Will the purple line catch down to the blue line or vise versa?