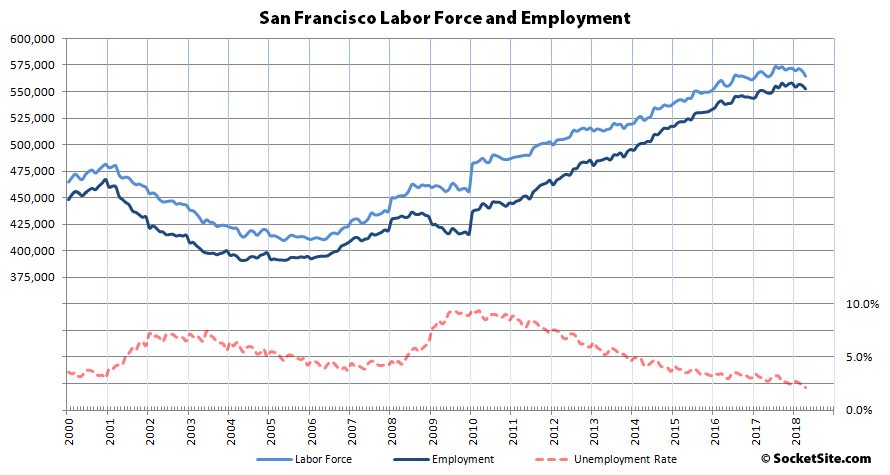

While the unemployment rate in San Francisco has just dropped to a record low 2.1 percent, the number of people living in the city with job has actually dropped by 5,400 to 552,400 since the beginning of the year, having dropped by 3,200 last month alone. But with the labor force having also contracted by 7,300 to 564,300, the unemployment rate has been driven down.

That being said, there are still 2,700 more people living in San Francisco with paychecks than there were at the same time last year and 115,700 more since the start of 2010. But the year-over-year growth rate of 0.49 percent last month was the lowest since 2009 (which was the last year in which there was a net decrease in San Francisco employment across its first four months).

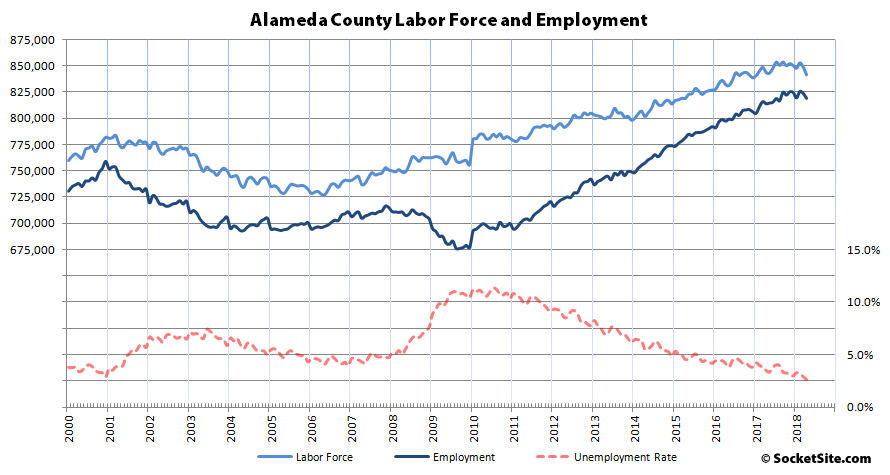

In Alameda County, which includes the City of Oakland, the estimated number of people living in the county with a paycheck has dropped by 5,700 since the beginning of the year to 819,300, including a drop of 4,500 last month, but remains 5,300 higher on a year-over-year basis with a gain of 126,500 since January of 2010. And the unemployment rate in Alameda county has dropped to a record low 2.7 percent as the labor force contracted by 8,900 over the past four months.

Across the greater East Bay, employment has slipped by 9,200 to 1,363,000 since the beginning of the year but remains 9,000 above its mark at the same time last year and the unemployment rate has dropped to a record low 2.7 percent.

Up in Marin, the number of employed residents has dropped by 1,500 to 136,200, which is 400 lower on a year-over-year basis, while the unemployment rate has dropped to 2.2 percent.

And down in the valley, employment in San Mateo County has dropped by 4,100 over the past four months to 440,400 but remains 2,400 higher on a year-over-year basis, with a record low unemployment rate of 2.0 percent, while the number of employed residents in Santa Clara County has slipped by 2,200 since the beginning of the year to 1,018,500, which is 20,000 more than at the same time last year with an unemployment rate of 2.4 percent which matches the record low set in December of 2000.

The labor force contraction across the Bay Area is something to keep an eye on. The graph shows a flattening the past few months with perhaps a downtward trend starting. Unfortunately, we don’t have granularity numbers – are tech jobs a significant portion of the labor force jobs lost?

While the labor force loss is not specified for SM, SC or Marin counties, between Alameda and San Francisco County it is 16,200. Larger presumably if one includes the other counties. For comparison’s sake, Washington State, about the same population as the Bay Area, added 7100 jobs to the labor pool in April. Mostly in the PG area. If the Bay Area is seeing the start of a slow decline or flattening of its labor pool it could have impacts, positive ones, on the housing crisis in the region. It definitely would exert downward pressure on price points.

Yeah I don’t think any jobs have been “lost”, the unemployment rate keeps dropping, there are probably still plenty of jobs on offer. What you’re probably seeing is people fleeing the Bay Area, because even with these salaries it’s not worth the hassle anymore.

Agreed. I think there are plenty of jobs. But the cost of living here has long been rising faster than wages.

Just saw the U-Haul data for April, San Francisco had the largest out-migration in the country based on truck rentals.

That UHaul data was so bad. It was based on price. And all these articles coupled a flawed Redfin study with that UHaul thing. Meanwhile, population increased in SF.

“the number of people living in the city with job has actually dropped by 5,400 to 552,400 since the beginning of the year, having dropped by 3,200 last month alone”

Do you think they are taking some time off to hobnob with the homeless while paying the highest rents in the nation? Back in the day we called in “funenployment” but now it’s called “30 day notice to vacate”. The main question is are they moving to Austin, Seattle, or Denver?

Oops, looks like I was wrong in that last comment. The latest Redfin data now shows outflows from the second tier cities like Denver and Seattle to even cheaper areas.

I don’t know where that quote comes from, and I don’t know what your riff (comedy attempt? unfunny, to me) about the homeless, or your fake quotes have to do with anything.

[Editor’s Note: As reported above, in the first sentence of the piece upon which you’re commenting.]

My fault, there. Probably not taking time to hobnob with the homeless. Probably mix: seasonal jobs, independently wealthy, office relocations, gig economy, is the answer …

You’re probably not working a seasonal job or gig while paying $1,500 for a room. People are commuting in from Antioch for those. Not sure why you keep denying that the cost of living in SF is prohibitively expensive for anyone but the top earners nationwide, lotto winner beneficiaries of various government schemes, or those willing to bunk up third world style. It’s basic math and out there for anyone to see. That’s before taking into account the extra hassles of living in SF, which I can summarize for you if you really need me to.

You’re probably not working a seasonal job while paying $1500 for a room, true. No, you probably have pretty good rent control if you live here, and have lived here, working seasonal jobs. Gig jobs? that can vary greatly. Did someone deny somewhere that it’s expensive to live in SF?

You are telling me that various data I have posted showing out migration from SF is flawed. Meanwhile SF County has birth projections of around 9,350 babies annually per the State Demographic Research Unit, which would account for nearly all of the 9,995 population growth you linked. Well guess what, newborn babies don’t typically use UHaul and Redfin. Yep, replacing workers with babies is about the best SF can muster right now.

And the data showing that people are now leaving Seattle and Denver too speaks to my other point, that the millennial cohort is finally reaching that age where they are starting to prefer the burbs to the big city.

The Redfin data is people looking at other areas. Of course tech savvy people here look at other areas and go, “huh, look what X amount gets in [insert location].” The Uhaul “data” is price based. Not sure what your births take has to do with a net increase in SF.

I am one of the people messing up Redfin data – I watch Property Brothers and similar shows and go online to check if houses in that area really cost $xxx to compare to what they have on the show 🙂 Not likely that I will move to any of those areas.

The “births take” along with the blue squiggly line up top shows that SF is no longer growing in terms of working people, and since traditionally it has been people with a paycheck who buy houses, that does not bode well for demand. Combine this with new supply and rising interest rates. Demand and supply and interest rates are a big part of what drive home prices.

Now some might argue that are other sources of demand out there besides people with a paycheck, but that argument has often drawn fierce opposition here and even accusations of racism.

It doesn’t though, the blue line. It shows a recent, small, turn down amid an 8 year climb. And never mind population growth in general. Now you’re talking supply? As if there’s a lot of supply coming? Sorry, no way. You’re bringing multiple conclusions to this discussion that you can’t support. You’re trying to use reads of data, and bad data to do so, but you can’t.

I said the working population is no longer growing at this time. This is facts and math. It’s right there in this very article in black and white. “The number of people living in the city with job has actually dropped by 5,400… since the beginning of the year, having dropped by 3,200 last month alone… the labor force having also contracted by 7,300”. I don’t care about overall population growth because babies don’t buy houses.

On the supply side, there are indeed some new residential units being built in San Francisco right now sorry. According to this very website, there are 6,300 units that have already broken ground, another 15,000 in the permitting process, and another 29,000 approved but not permitted. If you don’t believe these reports, then you could take a walk around town and are certain to see a few of these buildings going up with your very own eyes.

I don’t know why you guys are complaining. Rents have been slightly down or flat for 2 years now. Anyone making $80k+ can easily get a private bedroom in a house with roommates. NBD.

Not complaining. Like I said this will have positive impacts on the region. Coupled with slow population growth a downward pressure will continue on rents and home prices. Slower appreciation and flattening rents are a good thing for everyone in the BA – well, almost everyone as investors won’t see it as good..

Yes, yes, except that won’t happen. Rents will start increasing, as well as general home prices as the economy, and tech, continue to perform well. Unless we hit a national recession, the softening we have seen In the last 2 years will pretty much be the “low point.” And even that was hardly a low point, more like a pause on the growth curve. SF investors will do very well in the next 5-10 years. Seattle, OTOH, is already susceptible to overbuilding. Plus it doesn’t have nearly the same powerhouse economic size, nor overall desirability of the Bay Area. So Seattle may very well suffer a bust, as many boom and bust areas in the West have experienced before like Phoenix, Vegas, Colorado, etc. Prime is prime. And secondary is secondary. And if you can afford to play in prime, you’ll reap the long term rewards as well as the stability.

“are tech jobs a significant portion of the labor force jobs lost? ” I think you’re confusing supply and demand: what’s being measured here is people having/looking for jobs – i.e. supply (of workers) – what you’re asking about is demand (of various industries for people to fill various positions). Although one could, of course, take changes in employment in various sectors as being the same as “lost”, it fails to take account of unfilled positions…sometimes from people taking their options and retiring at age thirty-five to a cushy condo (twisty shaped building or not).

Again, who really thinks people will hang out here without a job at the top of a cycle?

Rents are still high and the price to income ratio is elevated. People without jobs are going to eventually leave. And even for those with jobs, rising home prices provided a tailwind so that people with incomes just sufficient to ‘get a foot on the property ladder’ could make it. Those same jobs just won’t cut it in an era of flat prices, and forget about it when prices start to decline in earnest.

Though this irks the ‘endless summer’ crew, it is one of the reasons that our region doesn’t fall into the all too common tailspin when a RE cycle ends. Think about what happens in areas where there is *not* out-migration when economic stress hits. People sit around unemployed, providing a drain on local government just at a time when the tax base is shrinking. The reality of SF’s situation lies between the hyper-bullish banter of the endless summer crew and the very serious problems that many low end areas face.

“when prices start to decline in earnest”

And when do you reckon that will take place?

A forest can be full of dry brush, but nobody can tell you where it will ignite.

Meteorologists can easily identify a tornado setup, but have no idea what time and where.

Robert Shiller can develop indices that predict long term returns, but say nothing about the near term price trajectory.

If you are seriously asking this question, you should read Shiller’s _Irrational Exuberance_.

Or like how The Big One will hit San Francisco sooner or later.

In other words, a random event. There’s not much value in predicting that an earthquake will happen here some day. The sun will set at some point today. The value is being able to predict when that will happen.

The sun will set around 8:18 today 😉

The whole point of statistics is that there is a difference between “random” and “unpredictable”.

There’s $X billion of illiquid stock waiting to be released onto the SF housing market over the next few years so it’s hard to see where a downturn could come from. But cycles are real and the metrics support anon2’s belief that we at the very least past the inflection point.

It’s not clear what your are trying to accomplish by aggressively pointing out the obvious uncertainties. The editor here is scrupulous about explaining why they choose the data they do, we should be able to talk about it like adults. Even the sports fans use statistics now!

So if you have actual data, let’s hear it. If not, mindlessly contradicting the people who are trying to discern actual trends really lowers the level of dialogue here. At least one extremely smart and well-informed commenter seems to have left rather than deal with an unending stream of ignorant challengers. Please stop.

I’m not sure who you are responding to, but my argument is that there’s no indication that prices are about to decline in earnest. Our economy (demand) is still strong, and it seems that SF will be building fewer units in the coming couple of years (supply). Strong demand and low supply means that prices won’t drop.

People have been predicting the impending collapse of the SF RE market here for at least five years. It’s always right around the corner, but it never happens.

I’m replying to you. Prices have a significant psychological component: a simple supply/demand model does not explain market cycles, yet these cycles are obvious if you look at graphs. This is covered in great detail in _Irrational Exuberance_. You don’t have to be in a “bubble” – even in normal times, the irrational component of the price can be very significant.

A simple way to think about cycles is to add some kind of momentum term to your mental model. When you’re driving, you can have the brakes on and be slowing down but still moving forward. There is often a bit of a hitch before you shift into reverse (“downward price stickiness”) but history shows that prices often overshoot.

What anon2 and others are trying to say is that according to the available data, the brakes have been on for a while. According to a fairly simple momentum model based on longer term history, and given the degree of deceleration, it is not unreasonable to think things could go into reverse. Prices are certainly less robust against an unpredictable external shock. We can argue endlessly about IPOs and building restrictions and whether the market has actually responded to losing the mortgage interest deduction. But if you restrict yourself to data and history, it looks like a party that’s is going to turn ugly at some point.

So it’s really very complicated and hard to understand what’s going on, and the editor here is doing a great job of collecting the relevant data so this is a natural place to have a careful discussion about it. Hopefully you can see why it’s frustrating to have that conversation keep returning to “so if brakes are so important how come the car is still moving forward, huh smart guy?”

You’re the one with the brakes analogy.

I’m looking at the chart at the top of the page. We have a record low unemployment rate around here. Shockingly low. That means a healthy economy (demand).

Also, SS has highlighted the slowing of new housing construction in SF. That’s a limit on supply. Those are my bases.

It appears that the counter argument is that eventually, something will happen and housing prices will drop. My question is why now? The same argument has been made for years. Why is 2018 different than 2015?

Another important question is how much will they come down when they come down? Are you expecting a 5% price decrease or a 50% crash?

“We have a record low unemployment rate around here. Shockingly low. That means a healthy economy.” But…”the number of people living in the city with job has actually dropped by 5,400 to 552,400 since the beginning of the year, having dropped by 3,200 last month alone.”

Back to my original point, the number of people with jobs actually dropped with the rate of this drop having markedly increased. Combine this with the net negative domestic out-migration numbers.

And while you seem to fixate on the unpredictable, I’ll point out that I’ve pointed out this issue with unemployment rate vs jobs number here previously. As recently as last week.

“And I don’t really expect people to hang out in SF unemployed during this downslope. My expectation is that any economic stress we do see will have people transitioning into gig economy jobs for a brief period and then quickly become part of the domestic out-migration that we’ve been seeing.”

Unemployment rate can be reduced by people either leaving or being underemployed (gig-economy jobs).

And as far as what is going on right now, look at my comment here.

You and others have tried to argue that something fundamental needs to happen in order for housing prices to decline (Drop in phone market, big-tech shakeup, mass unemployment,…) But implicit in this line of argument is that it was fundamentals that caused the rise in the first place and thus a fall in fundamentals is required for prices to slow or fall.

In the last cycle, the drop in home price expectations and subsequent drops in prices, preceded and caused the later economic distress. In particular, the labor market *followed* the drop in housing prices.

“It is now well established that the U.S. housing market crisis preceded the labor market crisis and “In early 2007, the most recent U.S. housing bubble burst. The bust was followed by the onset of the Great Recession and the deepest employment decline that the United States has experienced since the end of World War II.”

And the fact that we are seeing housing price weakness “bad apples” or a “plateau” as you’ve called it, without and correspondingly large drop in fundamentals is highly consistent with a momentum based cycle. (As is the fact that just as in 2007, price/income ratios rose up. An increase in valuation above fundamentals)

If a doctor sees a patient who is bleeding from their chest and they say they have been shot, that leads to one diagnosis. If they are merely bleeding from their chest with no apparent trauma, that leads you to a completely different diagnosis.

“when prices start to decline in earnest”…And when do you reckon that will take place?”

I think that ‘heynonnynonny’ did a very good job of covering the when.

But as far as what constitutes a serious decline, there have been two apples here recently with sales around 20% below 2015 prices. That’s generally going to wipe out people’s down payments, in fact with selling costs even around -15% puts people effectively near/underwater. And this is from three years ago.

Now, as they say: “Once is happenstance, twice is coincidence and three times is enemy action” So I’m happy to consider one or two under -15% apples as just potential leading indicators. But once we get 6-7 of these comp setting apples that essential wipe out 20% DPs, I think this will cause some earnest consternation among some folks.

Thats why it’s important to consider aggregate numbers instead of individual apples. The aggregate numbers published on this site show a price plateau over the last couple of years.

Other than that index for new construction pricing in San Francisco (which peaked in 2015), to which aggregate numbers for San Francisco (versus Bay Area) home values (versus median prices or even rents) are you referring? And of course, one could consider our individual apples in the aggregate as well.

I was thinking of this.

Which is a Bay Area index, the market components of which are not currently moving in lockstep.

Oh, sure. It’s an imperfect measure, but maybe the best one there is. It’s rising, though slowly. Also, the mix in SF is changing as we build more condos than sfh’s.

It’s certainly the best measure for Bay Area home values as a whole, and even individual market segments when they’re moving in lockstep (unlike right now).

And the funny thing about new condos, they tend to be more expensive, not less, than the median existing home in San Francisco.

Also keep in mind that people and institutions have various degrees of risk tolerance/loss aversion. For a lender lending you money, the best case scenario is that they get their money back with interest. If the house does exceptionally well, the lender gets none of the upside. But if the house does exceptionally poorly, then their capital and/or profits are at risk.

Similarly, is there any limit to how large a check you can deposit in your bank account? No. But there is a limit to how much you can withdraw. There’s a big penalty (bankruptcy) for going below zero with respect to your personal finances.

So if you have a situation with a flat average, with some +20% positive outliers and some -20% negative outliers, many people will be affected by the potential downside risk. If you look how long some people are taking to save up a down payment, a non-trivial chance of losing is will be a large factor for them even if they don’t on average lose their down payment.

I’m not arguing with any of that. Just pointing out that demand (Bay Area economy) remains strong, supply is increasing at a slower rate, so it’s not surprising that prices have been in a plateau.

It wouldn’t surprise me if they start dropping, as deficits grow in DC and there’s uncertainty in Korea, but that’s a macro trend.

Plateau? According to the (Bay Area) index to which you appear to have hitched your cart, home values in “San Francisco” are up nearly 20 percent since the end of 2015 and 10 percent over the past year alone! That’s not only a multiple of the average annual appreciation for San Francisco proper but nearly twice the current rate of appreciation for the US market as a whole!

If that’s the best measure of Bay Area home prices, I might as well trust it. I’m calling it a plateau, though, as different segments are moving differently. Individual units, of course, will be up or down.

Our apologies, we thought you were talking about San Francisco proper, not the Bay Area as a whole (and wouldn’t have characterized an average 10 percent gain over the past year, or 20 percent since the end of 2015, as a “plateau”). But you’re right, different segments of the Bay Area market are moving differently, which brings us right back to where we started.

Well then I guess that means we’re all in agreement. I think. Great!

Uber going public will unleash enough multi-millionaires to soak up the whole supply for 18 months alone

This isn’t about what you (“SFRealist”) believe, or even that you keep repeating it over and over. It’s about your habit of attacking people who believe something else. Your comment that I originally replied to was stupid and aggressive.

I don’t actually care except that I was really enjoying “Jake”‘s contributions to the site, I saw him get increasingly frustrated with the constant attacks and at this point I haven’t seen him post in a while. I don’t blame him. Please cut it out.

Hey it’s just my opinion, man. I’m not personally insulting anyone and we don’t have to agree on everything.

Maybe I’m wrong and the economy is about to collapse after all. Time will tell!

Yeah, I miss Jake too – tho I wouldn’t be surprised to learn that he’s still contributing under another pseudonym – but that’s b/c of his ability to source material – often obscure, but always relevant – in support of his arguments. I certainly don’t miss his (almost self-parodying) San Francentric attitude and ‘ad hominem’ attacks…which make “SFR” seem like Mr. Manners in comparison.

He really didn’t have any sense for real estate future values. Sure, he used lots of census data and liked to portray himself as a “smart guy”, but data analysis can only take you so far. His obstinance and lack of understanding that on the ground experience and social/cultural trends effect housing (sometimes more than census stats), lead him into the inevitable cubby hole of- those that can do, those that can’t teach (or preach). I doubt he owned any real estate (at best his own home.) Meh.