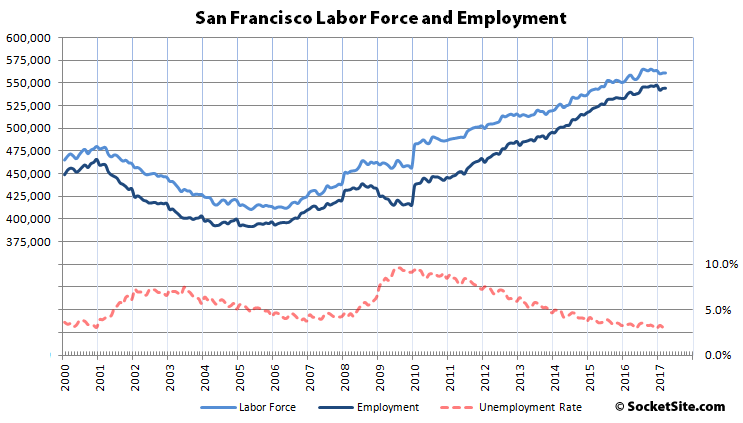

With the number of people living in San Francisco with a job pegged at 543,900 last month, a nominal 200 higher than the month before, employment in the city has dropped by 3,300 in the first quarter of the year versus gaining 6,900 in the first quarter of 2016, having gained 5,700 in the first quarter of 2015, and having gained 5,700 in the first quarter of 2014 as well. In fact, it was the weakest first quarter since 2009.

That being said, there are still 78,400 more people living in San Francisco with paychecks than there were at the end of 2000, an increase of 107,200 since January of 2010 and 4,300 more than at the same time last year, but the year-over-year gains have been trending down since the fourth quarter of 2014, with last month’s year-over-year gain of under a percent the smallest in eight years.

The unemployment rate in San Francisco, which hit 8.8 percent in 2010, having dropped to 2.4 percent in 1999, is holding at 3.0 percent.

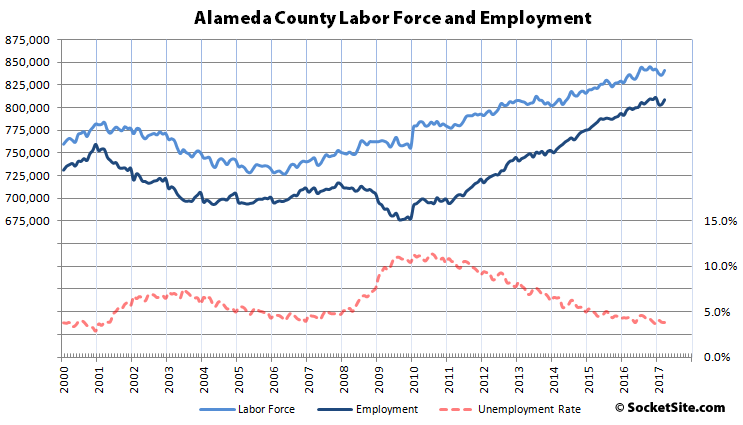

In Alameda County, which includes Oakland, employment increased by 5,200 in March to 808,400 and is running 9,100 higher versus the same time last year, with an unemployment rate of 3.9 percent and 116,400 more employed residents since the beginning of 2010.

Employment across the greater East Bay increased by 8,700 in March to 1,344,000 and the unemployment rate dropped to 3.9 percent as well.

Up north, the unemployment rate in Marin County held at 3.0 percent as employment inched up by 300 to 136,900.

And down in the valley, employment in San Mateo County was relatively unchanged (up by 100 to 436,900) but moved enough to drop the unemployment rate from 2.8 to 2.7 percent while employment in Santa Clara County ticked up by 3,800 to 990,000 and the unemployment rate dropped to 3.4 percent.

i really wonder when the recession at the end of this business cycle will hit. Might be opening a can of worms here but any guesses how bad the next recession will be and how it will hit sf/bay harder than elsewhere in the country?

It should hit harder here, because we didn’t get hit hard in the last bust. While the rest of the country crashed after the last bubble burst (and much of the country never really recovered), Fed QE and ZIRP programs fed new RE bubbles on top of the old one in a handful of the largest cities. Those cities that escaped the previous correction should get hit hardest precisely because they didn’t correct as they should have, so they are waa-aay overvalued with respect to historic trendlines and fundamentals.

Of course, just like last time (and the time before that), the Fed and USG will undoubtedly “innovate” to prop up certain asset classes and bail out those who live off unearned income. The success of these coming measures to once again bail out the wealthy will determine how hard the BA gets hit, because the current BA economy is largely a consequence of those measures enacted at the bottom of the last business cycle.

Your analysis of what happened after the last two crashes makes sense, but it suggests that the forces that mostly spared SF in the last two recessions will mostly do so again.

This can be true whether you think the Fed is an agent of the kleptocracy or whether you think that monetary stimulus is just too blunt an instrument to channel help to the people who actually need it.

Fiscal stimulus in the hands of social conservatives could be directed away from the Bay Area, but would the economic conservatives stand for it?

I think the Fed’s role as an agent of the kleptocracy speaks for itself. It will try to keep asset bubbles inflated; how successful it will be determines the fate of SF RE,

It isn’t a question of monetary policy being too blunt — it’s that it is the wrong solution for the problem. Basic Keynes: counter-cyclical monetary policy for supply-constrained recessions; counter-cyclical fiscal policy for demand-constrained recessions. Most recessions, such as the last (/current) one, are demand side, calling for fiscal policy.

By “economic conservatives,” are you referring to the Democrats? Obama had a Democratic Congress for his first two years, and pushed for meager fiscal stimulus, mostly in the form of tax cuts that economic conservatives covet. There was little direct stimulus. Where were the jobs programs? HAMP was a joke.The Obama admin blocked cram-down, and there were no prosecutions of any Wall St banks running the systemic fraud that fueled the housing bubble. Because he operated as a stooge for Wall St, Obama had a yuge hand in giving us President Trump. Credit where credit is due.Enlightened thinkers may perceive the causative link between the housing bubble and President Trump.

We saw a perfect correlation between GDP growth and the size of the stimulus as the stimulus wound down. This proves the stimulus worked well. Of course, a bigger stimulus would have been even better, but hey, there was just a tad of political opposition and just a couple of Democratic Senators who were pretty conservative. But oh, a magical persuader coulda done something! So you’re another one of those “obama could have cured psoriasis in addition to cancer and ebola, but he just didn’t try because he’s corrupt” folks.

Frank:

GDP growth is a disingenuous metric if the distribution of the gains to productivity aren’t graphed. 100% of the gains since the last crash have gone to 1% of the population. This isn’t even in dispute anymore. The “stimulus” worked _only_ for the 1% precisely because it was designed that way, i.e. ZIRP and QE welfare for the rich, instead of jobs programs, single payer healthcare, expanded worker benefits, etc. 1% of the population is doing better than ever, fabulously so. Maybe 10-20% are treading water. The rest are in free fall.

I’m sorry cognitive dissonance prevents you from seeing that Obama was a conservative wolf in liberal sheep’s clothing, but the failure of Democrat* voters to hold Obama’s feet to the fire (when he had an historic mandate, immense popularity, and a solid Democrat Congress for two years) is why we now have Trump.

*I’ll return the “ic” when they start acting democratic.

The economy “recovered” in spite of the stimulus, not because of it. In fact this has been the weakest post war “recovery” by far and it has taken doubling the national debt and tripling the Fed balance sheet to achieve that pathetic growth. And, the gains have been distributed very unevenly, and wage growth has been offset by increases in essential expenses like housing and health care. That’s because when interest rates are artificially low it encourages malinvestment (financial engineering vs productivity). Even Keynes himself said that monetary stimulus would not work as it came close to zero or negative.

Isn’t government spending a component of GDP? i.e. If the government institutes a $100B stimulus it’s a tautology that GDP gets a $100B boost.

A success would be a stimulus that enabled the real economy to do well even once the stimulus was removed.

i.e. If I give someone $100k/year for a few years to improve their life, it’s a given that their income will go up by $100k/year while they’re receiving this assistance. What’s crucial is if that extra money is simply wasted on excess consumption or invested in something that will produce results in the future. If their income returns to baseline post-assistance, then the assistance/stimulus was a failure not a success.

I agree with what twobeers says. And coincides with what all ‘real economists’ that predicted the last bubble, have been saying for years. (William Black, Michael Hudson, Nomi Prins, Pam Martens, and many others, not in the NY Times or WSJ of course)

“have been saying for years” – economic predictions are useless without time frames. Broken clocks twice a day and all that.

That’s not really true.

Does anyone have a model that can predict exactly how many cigarettes you can smoke until you get lung cancer?

If no one has such a model that can predict an exact time frame for the danger of lung cancer does that mean it’s a good idea to smoke every day?

You can keep piling on debt as long as you have someone to lend to you. And lenders can keep lending and relaxing lending standards as long as things are booming. Just because you can’t predict exactly when this virtuous cycle will turn down into a vicious cycle doesn’t ensure it won’t happen.

Are you suggesting that “cigarettes will kill you” is an economic prediction? Medical information should come from medical doctors, not economists.

As for your last paragraph: I did NOT say the prediction was _wrong_ without a time frame, I said it was useless. If I tell you that the economy will grow in the future, that’s clearly true, but not useful unless I tell you when it’ll happen. Same goes for predicting downturns. The fact that some economists “have been saying for years” that the economy will crash is actually an argument against their credibility at this point.

(If they’d said two years ago that “we’ll have a boom for three years, then a crash” I’d be more inclined to think that they were onto something).

“Are you suggesting that “cigarettes will kill you” is an economic prediction?”

No, the point of an analogy is to illustrate a common concept using an example with different subject matter.

Knowing that something has a high risk of failure without knowing exactly when it will fail is useful in that you can simply decide to do something else.

If you point out that a company is severely overvalued, sometimes people say, “If you’re so sure why don’t you short it?” But needing to go long or short is a false choice. You can simply invest (or work) elsewhere.

Similarly no one needs to buy or rent in any particular region. They can simply go elsewhere.

Not if you accept that predictions are about probability and not certainty. Since human nature never changes and we just keep repeating the same idiotic mistakes throughout the ages on a scale both small and large, some basic concepts like mean reversion and momentum can help us predict what is more likely to happen next, although never exactly when.

Sure. But zoom out, and look at the macro view: The economy has been growing for the last 2000+ years, so why would it stop now? Probability, mean reversion and momentum tells us that the economy will keep growing, not shrinking.

Certainly a down-turn will happen at some point. That’s obvious, and also useless. Tell me when you think it’ll happen, and If you’re right I may believe you next time.

In terms of the macro view, most people don’t have a 2000 year investment horizon, they need to figure out what asset prices are most likely to do in the near future. If you put your money in the Dow in 1928 then it would take you until 1955 to get back to even.

Besides, right now the economy is only “growing” because we are creating upwards of $3.50 in debt for every $1 of GDP. Between demographics, automation, and the debt overhang, growth in the developed world is not looking so great. Productivity growth in the US is hovering around 1% for the past decade, which is about half the historical average.

You just made NB’s point. To have predictive value, you need to provide some timing. It’s easy to say that some day the stock market will go down. (People have been talking about the impending crash since about 2013.) Without timing, it’s just predicting that the sun will set sometime in the next 24 hours.

We will have a downpour someday but I can’t say exactly when. So I’m going to walk around in a raincoat under an open umbrella all the time.

That’s a fine framework but poorly executed.

There are those who will only take an umbrella when it’s already raining. They frequently get soaked or pay a premium (for a new umbrella) every time it starts raining after they’ve left home.

Others might take a forecast into account, but only if it already looks like it’s likely to rain. They need “100 percent” certainty, because those foolish meteorologists are often wrong, but sometimes get soaked as well.

And yet others look at the forecast every day and proceed accordingly, perhaps even packing an umbrella when it’s not needed but rarely getting caught by surprise.

Nonsense. If you go into the desert with no water, I predict you will die of thirst, but I have no idea when.

In a similar fashion we can figure if assets are relatively cheap or expensive. There are plenty of indicators, for the broad stock market one basic example is Tobin’s Q ratio, for economic conditions you can look at durable good orders, etc.

If your theory were true then a speculator must attribute 100% of their performance to luck, but lots of people consistently outperform “buy and hold” strategies so there must be something to it, they are buying and selling based on certain indicators.

You cannot predict when you might crash your car, but I bet you still buckle your seatbelt every time.

Yeah, but 1.5 million people live in Phoenix and have been staving-off that parched death for a long time. Anyone who bought a swap that pays off when Phoenix-dwellers die of thirst would be way, way underwater now (pardon the pun). His bet may pay off if he can just hold out on their position until all the water disappears, as may eventually happen, but he will likely be bankrupt long before then. Timing is critical.

More nonsense. I bought my rental property maybe a year before the bottom, could have gotten it for around 20% cheaper, but it’s tripled since then. I wouldn’t go anywhere near a rental property today. Likewise I predict that this Big Fat Ugly Bubble is close to the top. You don’t need exact timing to know when something is a bargain or just plain stinks.

I think it will hit us less than elsewhere as long as we keep using Google, Facebook, and iphones.

No idea when. Neither Apple nor Google is particularly overvalued, but there’s no telling when [Trump] decides to kick off a war.

Those (Google, Facebook, and iphones) are all consumer driven business: ads, ads and conspicuous consumption. A broad US recession will hit them all. A broader global recession will hurt them worse.

Right. Everywhere would be damaged in a recession. The Bay Area would be damaged less, compared to a region more dependent on, say, auto manufacturing or gambling (Vegas)

depends on what kind of recession. A consumer lead recession is worse for the bay area than one due to manufacturing or gov’t or currency or commodities, etc. SV used to have a much larger mix of defense industry and corporate tech, now much more heavily weighted towards consumption, and much of the consumption revenue is from volatile sectors with heavy discrectionary component. Apple’s value depends very much on selling high margin phones to existing owners of iphones. The iphone is a fairly mature product with fat margins priced into Apple stock and Apple’s cost structure. What’s the next next ithing?

I don’t know. I’d say a consumer led recession would hit Vegas and the auto industry a lot more than here. Google is free, Facebook is free. We wouldn’t escape, but I bet it would be worse elsewhere.

Who will build the iphone killer? You would have said Samsung, but they have a few problems at the moment. Until that better phone comes out, Apple had record revenue last quarter.

Google and Facebook are not “free” to consumer product companies that reduce their ad spend during recessions. Google’s ad revenue was growing ~50%/year before the ~2008 recession hit. During the recovery to now it has been about one-third that growth rate. Which is good as long as they manage costs (cut back on money losing fiber deployment, etc) and don’t have another down bump that cuts their growth rate by another two-thirds.

No one has to build an iphone killer any more than anyone killed the mac. The iphone is stuck at around 20% market share. Smartphone unit sales growth has slowed. Apple’s huge profits are due to the huge margins they make on the iphone, which has much larger margins than most android phones.

The risk to Apple is that their customer’s have been increasingly delaying upgrading. The average age of a new iPhone buyer’s previous iPhone has increased by approximately one month per year for several years now.

This has happened in every previous generation of computer: mainframe, mini, pc; and has happened in the cell phone business before, and in cars, and tvs, and on and on. Natural market response to mature product category (10+ years of smartyphones) with slowing innovation. An adverse economic jolt can tip the balance, like a recession or just rapid inflation in non-discretionary expenses such as healthcare, education, housing, food, …..

Classically, product companies generate their greatest profit during these mature “conservative” periods of dominance, with customers lockedin, and R&D costs largely amortized; then the long decline.

Your own argument betrays you. Google’s ad revenue growth slowed during the last recession, but it was still growing. Consumer product companies keep reducing their spend on other categories and keep moving it online, which basically means Facebook or Google at this point.

And, conveniently for Bay Area real estate prices, the company best positioned to take smartphone revenue from Apple is….Google. From our real estate perspective, it doesn’t matter who wins that fight.

no, Google’s huge and persistent decline in revenue growth is a big issue, not a plus, not a good outcome. Google isn’t going away or at risk of collapse, but their margins may tighten and that will tighten their budgets.

FWIW, there are major CPG companies that have cut advertising with google and facebook. And many companies have recently completely eliminated advertising with youtube.google, including Johnson & Johnson, Verizon, AT&T, JP Morgan,…. Google, Facebook, and other content-based ad platforms are going to have to increase costs to clean up extremist and brand tarnishing content; lessening upside revenue and lowering margins.

Most smartphone revenue was taken away from Apple years ago. Apple does not have most of the smartphone revenue as it did 10 years ago and as Google still does for online advertising. What Apple does still have the majority of the net profit from smartphone sales. Many companies are targeting that with premium phones like the google pixel and the samsung s8.

The ‘killer’ competition for the smartphone is the replacement for the smartphone, as the smartphone was the replacement for the feature phone. Just ask Blackberry, Nokia, and Motorola how fast the times can change. Or ask Apple, they aren’t fumbling around with wearable gadgets and VR/AR widgetry for the love of the tech. As Andy Grove said, “Success breeds complacency. Complacency breeds failure. Only the paranoid survive.”

Yes of course some CPG companies have cut advertising on Google. Now compare them with the list that have cut advertising on TV, newspapers, and billboards. Which of those three industries is growing as quickly as Google?

I’m not saying Apple, Google, and Facebook will last forever. But as of now there is not indication yet that any of them are losing any market position. The US car companies, for instance, built crappy cars for decades while they were nominally the largest. That will happen with these three companies eventually, but there’s no sign of it now.

And GM and Ford are still around, large and profitable. And Detroit is … Detroit. You don’t need every single company in the region to collapse completely in order for a bubble to burst.

The iPhone was a massively massively successful product. It came out in 2007 and yet the last bubble still burst. Apple & Google’s center of gravity is in the south bay not SF, they don’t have all that many employees (non-retail) compared to the size of the BA and most of them probably already have housing.

Apple market cap: $750B

Google market cap: $600B

Facebook market cap: $420B

Ford market cap: $45B

GM market cap: $50B

Do you notice some different about those numbers? Do you think those numbers might be related to different real estate prices near their respective headquarters?

So when there’s a downturn, startups start imploding, larger companies trim staff and the federal government curbs immigration (which has been a major source of bay area population growth), your theory is what?

Apple & Google employees who have been huddling up in overstuffed Mountain View apartments suddenly discover SF and rush up to make up all the slack in demand? Right as many are starting to get to an age where they acquire families and don’t want to spend a few extra hours on a bus to and from work? A few thousand in a region of millions?

And this didn’t happen in 2007 when Apple was ramping up staff to build up the iPhone into a massive unprecedented success? But it will happen this time?

If you think that the market cap of local industry leaders directly correlates to housing prices and Detroit has homes that sell for $1 and our large companies have 10x the market cap, does that mean you expect houses here to sell for $10??

I didn’t say there’s a direct correlation. It doesn’t work that way. (Although it wouldn’t surprise me if comparable housing in the Bay Area is roughly 10x what it is in Detroit)

The point is that housing prices are set in large degree by the health of the local economy. If Microsoft (ha!) came out with a new phone tomorrow that was better than the iphone, Apple would lose market share and our real estate prices would drop. Same if Microsoft (ha!) came out with a superior search engine to Google.

“The point is that housing prices are set in large degree by the health of the local economy.”

During the last national boom-bust when national (and many international) prices rose sharply, plateaued and then dropped nearly in sync around the nation and parts of the world, was that because local economies all around the world were just coincidentally becoming more and less healthy at the same time?

Real estate values in different markets dropped, but not by the same amount. Nor have they recovered to the same degree. Compare SF with Vegas or Arizona.

Question: how does an unemployed person live in San Francisco? Unless they have super crazy rent control, I’d say with parents or on the street. So maybe this is not that great of an economic indicator.

The next recession is going to be a banger because the middle class (engine of the economy) is already stretched thin thanks to the skyrocketing cost of essentials like housing and healthcare in our Crony Capitalist Cartel system combined with the stagnant incomes thanks to Fed driven corporate malinvestment. The average household can’t afford a $500 emergency . There is a retail apocalypse with over 8,500 stores closing this year so far and you can’t blame it on Amazon when less than 11% of purchases are made ‘Not In Store’, this has been slow to increase only doubling since 1999, and part of that is simply snail mail catalog traffic moving online. Meanwhile consumer credit is up which suggests people are using credit cards to pay for everyday living expenses. Apple has hit a wall with innovation, now resorting to ripping people off with power cables and adapters. Google and Facebook are rife with fake accounts and falsified traffic and are furthermore shooting themselves in the foot with their spying and now censorship.

Google up 2% today. Apple and FB up 1% each. It appears that the market does not share your belief about their supposed weakness.

I think we agree on their importance to our real estate market, but there’s still no sign of them weakening.

“now resorting to ripping people off with cables….” – as if this wasn’t happening 10 years ago. As if Google and FB had some kind of imminent failure…he should short them. He’d be rich! But no, it’s nonsense. Classic Saddie post.

Actually, we agree that those companies are not “going away” but disagree on their importance to local real estate.

Although I do think in each case their core products are facing a decline, the fact is that those companies have more cash on hand than the US government, so they can just buy up whatever new company does actually show some innovation, Instagram being a prime example.

However, Apple has been around since 1976 and Google since 1998, and local real estate has seen some sharp declines in the meantime. Yes it has always rebounded eventually, but correlation does not equal causation. Real estate will always go up due to our banking system. But above and beyond that, on a local level this current bubble was further inflated largely by startup activity and foreign cash. Startup activity is seeing a sharp decline as WSJ reported yesterday: “Funding of technology firms plummets after 2014-15 boom, forcing many in Silicon Valley to fight for survival”. Foreign money unfortunately is still a major factor.

Regarding stocks, Intel and Cisco both had bigger market cap than these modern companies when adjusted for inflation. But look at them now, trading for about half of what they did in 2001. Of course some other companies like eBay have surpassed that peak, but the point is that size does not equate to stability.

‘Real estate will always go up due to our banking system’

Not true. Plenty of places in the Midwest have not seen real estate increase in price and they have the same banking system that we do.

The bigger factor is the local economy. The local economy is why our real estate prices are where they are and Detroit’s are where they are.

Correlation does not equal causation – you know of this, yet you still make assertions based on correlation every time one of your posts shows up. And “real estate will always go up due to our banking system.” Wow, “always”? And how do you get away with these broad hand-wavers…our “banking system”? Fun stuff. More! Intel, Cisco, FB, Google, eBay….all “tech” companies, therefore all the same! (Hint: each is in a totally different category, and lessons from one do not apply to the other.) You fly at 50,000 feet, and think you can see ants.

Then there’s the inconvenient truth that these companies are not the largest Bay Area employers by a long shot. Here’s the top 10: Kaiser Permanente, Safeway, Wells Fargo, Stanford University, United Airlines, PG&E, Genentech, UPS, Oracle, Gap. FB, Google, and Apple are only the biggest in terms of tech hype!

Wait, so these other big companies are more important than Apple and Google in setting housing prices because they have more employees?

I thought you said that real estate prices are set by startups, not by Apple and Google.

I don’t think any one or two companies “sets” housing prices. But I do think that startup employees skew towards younger, fewer family attachments and more prone to taking large risks (i.e. hoping against long odds for a stock option payout when most startups actually fail). And this demographic skews more towards SF proper where many startups are. And startups are very much prone to imploding completely overnight. And since these implosions are mostly related to an inability to secure further financing, these implosions tend to happen in packs.

we dont need anyone in their 20s to buy housing to keep prices high. with so few sales per year, we could just have people between the age of 45-55 buying and we would be golden

Not just up today, but goog, appl, and fb are at all time highs. One can always make a prediction “they will just fall that much further” because of the Fed or whatever zerohedge is writing about these days. But the evidence that local tech companies are a current drag on local real estate is non-existent. Maybe the current extremely high SF employment and record tech market will end someday, but that is the present state of things and does not provide any support for those arguing we are in a current decline.

And yet with Google, Apple and Facebook at all-time highs, new condo sales in San Francisco dropped 25 percent last year and recorded sales hit a five-year low in February, all despite an increase in inventory levels for both new and existing homes.

Which brings us back to the topic at hand, which is actual employment in San Francisco, which dropped in the first quarter versus a typical increase and was the weakest first quarter since 2009 (despite Google, Apple and Facebook being at all-time highs).

Looking at a more granular level, employment rose in Santa Clara County. SF seems to be the outlier in these numbers. Unfortunately, we don’t have granularity as to the job losses. Were they service jobs?. Tech jobs? One month’s data does not a story tell. Let’s see how things stack up in the coming months. It could be this signifies a shift of intra-regional jobs out of SF and to other Bay Area locales, or not. If such a shift develops, it’ll be due to quality of life issues – SF gridlock, long commutes and very high home prices. Many of my LinkedIn friends are hoping for an eventual move of their jobs out of SF and to the Northwest. For quality of life issues.

[Editor’s Note: Speaking of which, Demand Really Dropped in San Francisco but Not Around the Bay.]

“Which brings us back to the topic at hand”

Anecdotally — totally anecdotally — I’ve noticed an uptick in outgoing moving vans in my hood…

Not so anecdotal, SS had a piece in the past month about actual population loses in a number of BA counties – including Santa Clara and San Mateo. SF did not experience a loss, but the story qualified that by saying that a net in-migration of foreign residents kept SF’s numbers up.

Two things going on perhaps? At the local BA level could we see a shift of jobs out of SF to other BA counties?

At a more macro level, could we see a shift of jobs (in particular tech) out of the BA to other markets. Or, if not an outright relocation of jobs, then an expansion of companies in other metros rather than here?

Seattle is seeing a large influx of jobs and new residents. The builders can’t keep up with the demand there and available housing supply is near an historic low. It’s not just Seattle – Orlando, Jacksonville and Nashville, to name a few, are seeing big job growth and part of that is in tech. Add to that Denver and Portland which have been near the top of home price appreciation for about a year and a half now as demand soars in those cities.

So who knows, maybe the uptick in outgoing moving vans in your hood means something.

Californians have been moving to Oregon and Washington for cheaper land prices for decades. Here’s an article from 2003 discussing how many people were moving in the 1990s.

Yes, the “north to Seattle rush” predates the present time and even 2000. What is different in more recent years is the vibrant tech job bases that have emerged there (as the Redfin article notes), the worsening affordability and commute conditions in the Bay Area (hence a third of millennials are considering leaving the area per that poll SS posted) and more and more folks retiring without a defined pension plan and having to rely on their 401Ks and SS – which is hard to do in the Bay Area. On that and anecdotal, a worker at TJ’s told me recently they’re about to retire. No pension from the store and their spouse does not have a pension, but they own a home in Westlake worth a million. They will be “forced” to sell it to free up cash – moving to Texas once they retire.

I’m not one of those who sees a crash in home prices, but rather significantly greater appreciation in other markets like Seattle, Orlando and Nashville in the coming decade. As a SFH investor this seemed to be the trend back in 2014 when I purchased my first NW rental – and fell in love with the area.

The subsequent few years have only reinforced my feelings regarding Bay Area real estate vis a vis certain other metros.

The “north to Seattle” trend has been with us for some time, certainly before 2000. I moved from Oakland to Seattle in 1980 and within my first week in town, I received a note on my car informing me that I needed to “go back to California” as I was “making traffic worse”, “raising rents” and generally making life miserable for all the “native” Seattlites (many of whom had moved there from the Midwest).

It goes to show that fear of newcomers is not the sole province of SF progressives.

Based off searches out of area, which they claim is correlated to actual purchases, SF topped the list of people looking to outmigrate in Q1 2017 according to Redfin. And by state California was the state with the highest outmigration.

“At the state level, California had the largest net outflow of users last quarter. As the Bay Area residents of Northern California looked north to the booming tech hubs of Seattle and Portland, Southern Californians went east to the more affordable places in the Southwest, like Las Vegas and Phoenix—which saw their populations grow immensely in 2016. These and other southern metros took in large inflows of people from the East Coast as well.”

Maybe ‘Dave’ is onto something with all this talk of Seattle.